PRCBroker 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive prcbroker review examines one of the notable players in the forex brokerage industry. PRCBroker shows strong performance metrics with an impressive 5/5 user rating based on available information from multiple sources. The broker operates under dual regulatory oversight from CySEC and VFSC, providing traders with robust investor protection frameworks that ensure safety and compliance.

Two key features distinguish PRCBroker in the competitive landscape. The broker provides both MT4 and MT5 trading platforms, catering to diverse trading preferences across different skill levels. Its comprehensive regulatory compliance across multiple jurisdictions also sets it apart from many competitors in the market.

The broker's technological infrastructure supports various trading strategies while maintaining regulatory standards. PRCBroker primarily targets middle to high-net-worth investors, evidenced by its substantial minimum deposit requirement of $10,000. This positioning strategy attracts serious traders seeking professional-grade services and advanced trading capabilities. However, it may limit accessibility for retail investors with smaller capital bases who want to start trading.

Important Notice

While PRCBroker operates across multiple regions, traders should note that regulatory requirements and investor protection levels may vary significantly between different jurisdictions. The broker's CySEC and VFSC authorizations provide different protection frameworks depending on your location. Clients should understand which regulatory umbrella covers their specific trading relationship before opening an account.

This evaluation incorporates data from various independent sources and user feedback platforms to ensure objective analysis. All information presented reflects publicly available data and user testimonials as of the review date. Individual experiences may vary based on account types and trading activities, so results cannot be guaranteed for all users.

Rating Framework

Broker Overview

PRCBroker established operations in 2014, positioning itself as a relatively young yet ambitious forex brokerage firm. The company is headquartered in Cyprus, building its foundation within one of Europe's prominent financial services hubs. Cyprus provides an established regulatory framework and strategic geographical location that benefits international brokers. The broker's decade-long market presence demonstrates sustained business viability and gradual market penetration over time.

The company's business model focuses on providing institutional-grade trading services to serious investors. This approach is evidenced by its substantial minimum deposit requirements that target professional traders. This strategic positioning differentiates PRCBroker from retail-focused competitors who cater to smaller account holders. The broker targets clients who prioritize service quality over low entry barriers and minimal fees.

PRCBroker's technological infrastructure centers on industry-standard MT4 and MT5 platforms. These platforms ensure compatibility with widely-used trading tools and expert advisors that most traders prefer. The dual-platform approach accommodates both traditional forex traders preferring MT4's familiar interface and advanced traders seeking MT5's enhanced capabilities. Operating under CySEC and VFSC regulatory frameworks, the broker maintains compliance across multiple jurisdictions while providing clients with regulatory protection and operational transparency.

Regulatory Jurisdictions: PRCBroker operates under Performance Ronnaru Company Ltd authorization from CySEC (Cyprus) under license number 253/14. The broker also holds VFSC (Vanuatu) license number 14788, ensuring comprehensive regulatory compliance and investor protection across multiple jurisdictions.

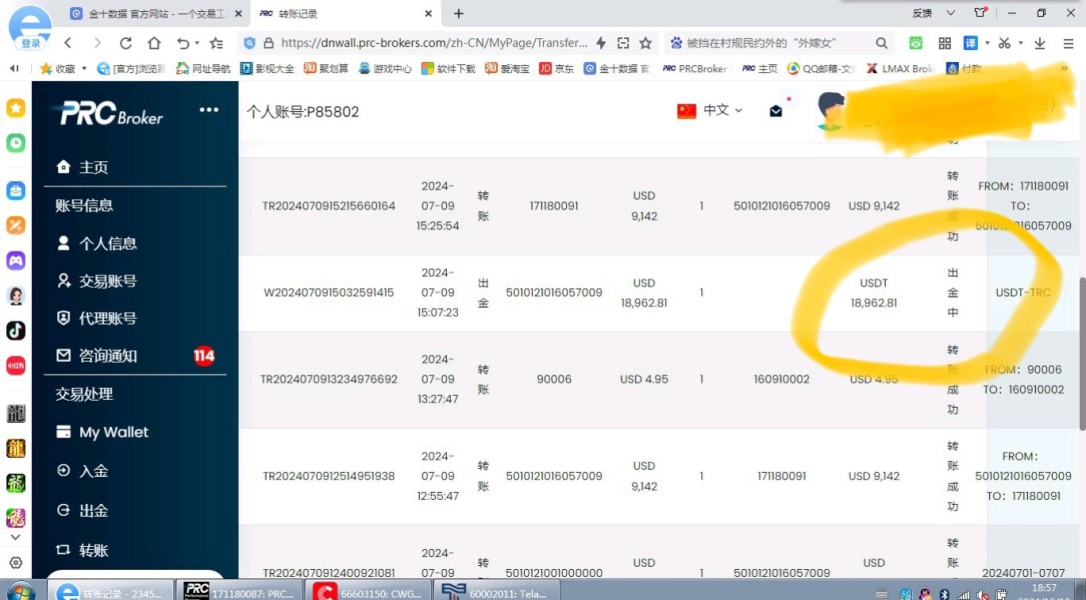

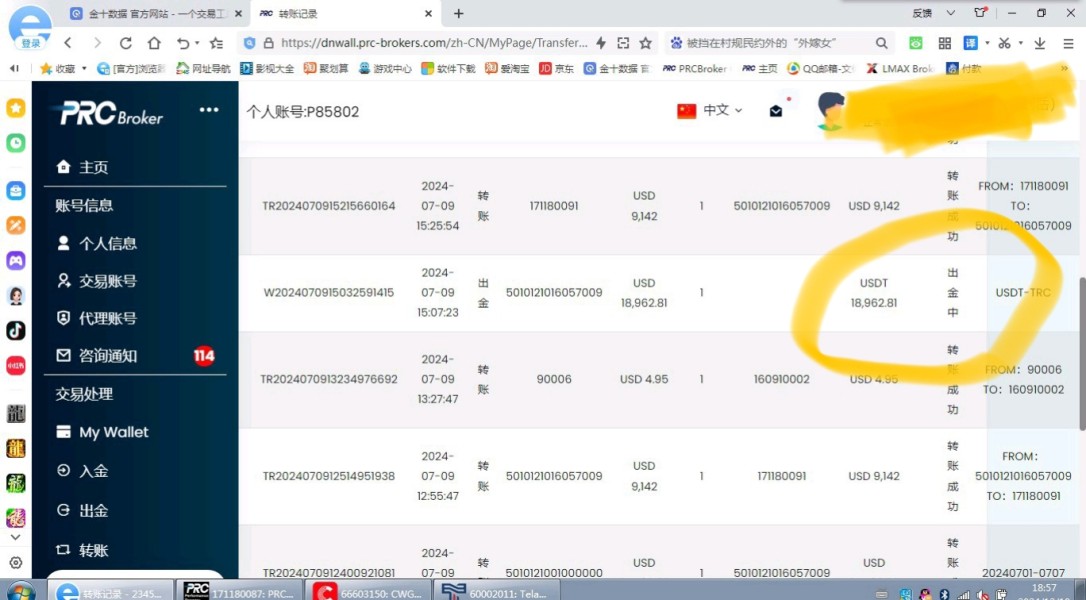

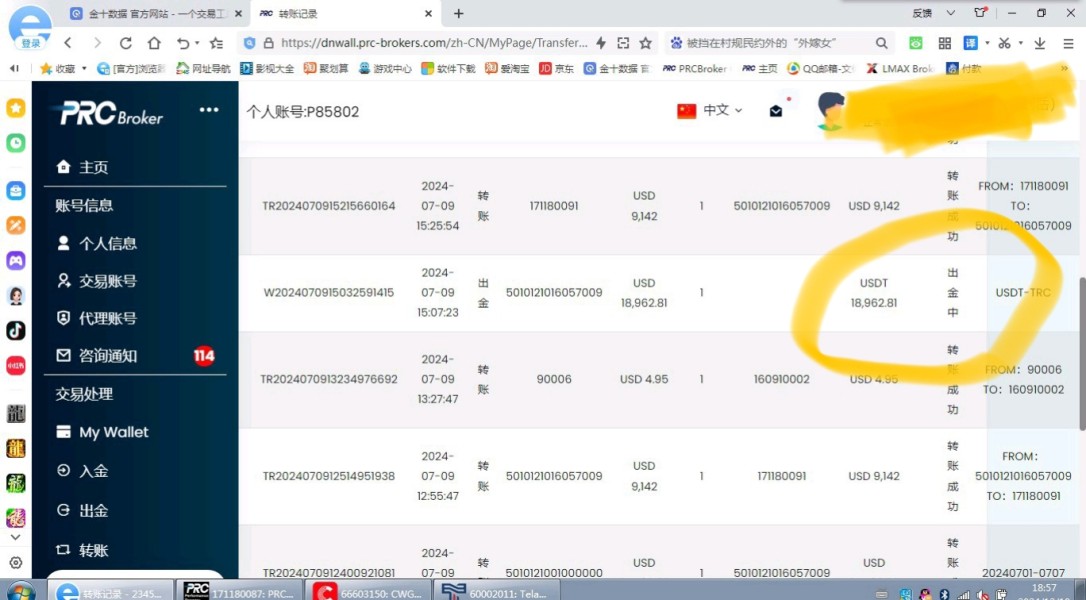

Deposit and Withdrawal Methods: Specific deposit and withdrawal mechanisms are not detailed in available source materials. Traders need direct broker consultation for payment processing information and available banking options.

Minimum Deposit Requirements: The broker maintains a $10,000 minimum deposit threshold. This positioning places it firmly in the premium brokerage segment of the market.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in accessible information sources. Potential clients should contact the broker directly for current offers.

Tradeable Assets: Available trading instruments and asset classes require direct verification with the broker. Specific details are not elaborated in source materials about forex pairs, commodities, or other instruments.

Cost Structure: Spread configurations, commission rates, and fee structures need clarification through direct broker communication. Pricing details are not comprehensively covered in available sources for this review.

Leverage Ratios: PRCBroker offers leverage options of 1:30 and 1:100. These ratios accommodate different risk management preferences and regulatory requirements across various jurisdictions.

Platform Options: The broker provides both MT4 and MT5 trading platforms. These platforms support diverse trading styles and technical analysis requirements for different trader preferences.

Geographic Restrictions: Specific regional limitations and service availability constraints are not detailed in current information sources. Traders should verify availability in their jurisdiction before applying.

Customer Service Languages: Supported communication languages for customer service are not specified in available materials. This prcbroker review continues with detailed analysis of each operational aspect based on available information and user feedback.

Account Conditions Analysis

PRCBroker's account structure reflects its premium market positioning. Specific account tier details are not comprehensively outlined in available source materials, however. The broker's approach appears focused on serving serious traders rather than accommodating entry-level participants. This focus is evidenced by its substantial capital requirements that exceed industry standards.

The $10,000 minimum deposit requirement significantly exceeds industry averages. This threshold potentially limits accessibility for novice traders while attracting clients with substantial trading capital. This requirement suggests the broker targets experienced traders who value professional services over low-cost entry points. For high-net-worth individuals, this requirement may actually provide confidence in the broker's commitment to serious trading relationships rather than serving as a barrier.

Account opening procedures and verification processes are not detailed in current source materials. Traders need direct consultation with the broker for specific requirements and timeframes. The absence of information regarding Islamic accounts or other specialized account features indicates potential gaps in service diversity. This may reflect the broker's focused approach rather than service limitations, though it limits options for some traders.

The regulatory framework provided by CySEC and VFSC oversight ensures account holder protection through established investor compensation schemes. Specific protection amounts and conditions vary between jurisdictions, so traders should understand their coverage. This prcbroker review notes that while the high minimum deposit may deter smaller traders, it aligns with the broker's premium service positioning and target market focus.

PRCBroker's technological foundation rests on the industry-standard MT4 and MT5 platforms. These platforms provide traders with robust analytical capabilities and execution tools. The dual-platform approach demonstrates the broker's commitment to accommodating diverse trading preferences. Traders can choose from traditional forex strategies to advanced algorithmic trading systems.

MetaTrader 4 offers the familiar interface and extensive expert advisor library that many experienced traders prefer. MetaTrader 5 provides enhanced analytical tools, additional timeframes, and improved order management capabilities for more advanced users. This platform diversity ensures compatibility with various trading strategies and technical analysis approaches. Both platforms support automated trading and custom indicators that professional traders often require.

However, specific information regarding proprietary research resources, market analysis publications, and educational materials is not detailed in available sources. The absence of information about economic calendars, trading signals, or analytical reports suggests potential areas for service enhancement. These resources may be available but not prominently featured in public materials.

Automated trading support through expert advisors is inherently available via the MetaTrader platforms. Specific broker policies regarding algorithmic trading, VPS services, or trading restrictions are not elaborated in current source materials. The regulatory oversight from CySEC and VFSC provides framework assurance for trading activities. Specific platform performance metrics and uptime statistics require direct verification with the broker.

Customer Service and Support Analysis

Customer service quality metrics and support infrastructure details are not comprehensively covered in available source materials. This creates an information gap in this critical service area. The absence of specific information regarding support channels, response times, and service quality indicators prevents detailed assessment of customer service capabilities.

Available communication methods are not specified in current sources. These might include live chat, telephone support, email assistance, or ticket systems. This lack of transparency regarding customer service accessibility may concern potential clients who prioritize responsive support services. The concern is particularly relevant given the broker's premium positioning and substantial minimum deposit requirements.

Response time expectations, issue resolution procedures, and escalation processes remain unspecified. This makes it difficult for potential clients to assess service level expectations. The broker's regulatory standing with CySEC and VFSC provides some assurance of professional standards. Specific customer service protocols are not detailed, however.

Multilingual support capabilities, crucial for international brokers, are not outlined in available information. Given the broker's Cyprus headquarters and international regulatory framework, support in multiple languages would be expected. Confirmation requires direct broker consultation for specific language availability. The absence of customer service information in this prcbroker review highlights the need for improved transparency in service offerings.

Trading Experience Analysis

Trading experience assessment faces limitations due to insufficient specific feedback and performance data in available source materials. The broker's provision of MT4 and MT5 platforms suggests standard trading functionality. Platform stability, execution speed, and order processing quality require user verification through direct experience or additional research.

MetaTrader platforms generally provide comprehensive analytical tools, charting capabilities, and indicator libraries. These features support various trading strategies from scalping to long-term position trading. The platforms' built-in features include multiple order types, pending orders, and risk management tools. Specific broker implementation and any customizations are not detailed in available sources.

Order execution quality, including fill rates, slippage characteristics, and requote frequency, lacks specific documentation in current sources. These factors critically impact trading profitability and user satisfaction. They remain unverified in available materials despite their importance. The regulatory oversight from CySEC and VFSC provides some execution standards assurance. Specific performance metrics are not published, however.

Mobile trading capabilities through MetaTrader mobile applications are standard features. Broker-specific mobile experience enhancements or limitations are not specified in current materials. Trading environment factors such as spread stability, liquidity provision, and market hours coverage require direct verification. This prcbroker review notes the need for more comprehensive trading experience documentation to support informed broker selection decisions.

Trust Factor Analysis

PRCBroker demonstrates strong regulatory credentials through its dual authorization from CySEC and VFSC. These authorizations establish credible oversight frameworks for client protection. The CySEC license number 253/14 under Performance Ronnaru Company Ltd provides European Union regulatory standards. VFSC license 14788 offers additional jurisdictional coverage for international clients.

CySEC regulation ensures compliance with MiFID II requirements. These include segregated client fund protection, investor compensation scheme participation, and operational transparency standards. This regulatory framework provides substantial client protection measures and establishes professional conduct requirements for broker operations.

However, specific fund safety measures beyond regulatory requirements are not elaborated in available sources. These might include additional insurance coverage, bank partnerships, or segregated account details. The absence of detailed transparency information regarding company financial statements, ownership structure, or operational audits represents potential areas for enhanced disclosure.

Industry reputation factors, including awards, recognition, or third-party assessments, are not documented in current materials. Similarly, negative incident handling, regulatory actions, or dispute resolution track records lack specific documentation. The broker's 5/5 user rating suggests positive client experiences. The sample size and verification methods for these ratings are not specified in available sources, however.

User Experience Analysis

User satisfaction indicators show promising results with a 5/5 rating from available feedback. This rating suggests high levels of client satisfaction with broker services. This indicates that users who meet the broker's minimum deposit requirements generally experience positive service levels and operational satisfaction.

However, specific interface design elements, platform customization options, and usability features are not detailed in current source materials. The reliance on standard MetaTrader platforms provides familiar functionality for experienced traders. Broker-specific enhancements or limitations are not documented in available information.

Registration and account verification processes lack detailed description. This makes it difficult to assess onboarding efficiency and user-friendliness. Given the substantial minimum deposit requirement, streamlined verification procedures would be particularly important for target clientele expectations.

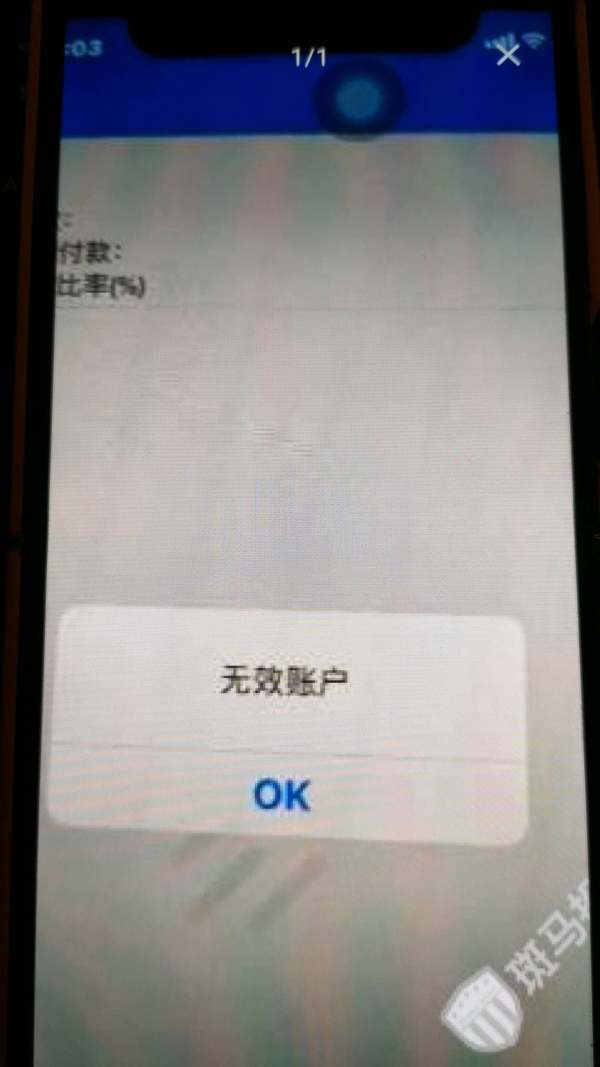

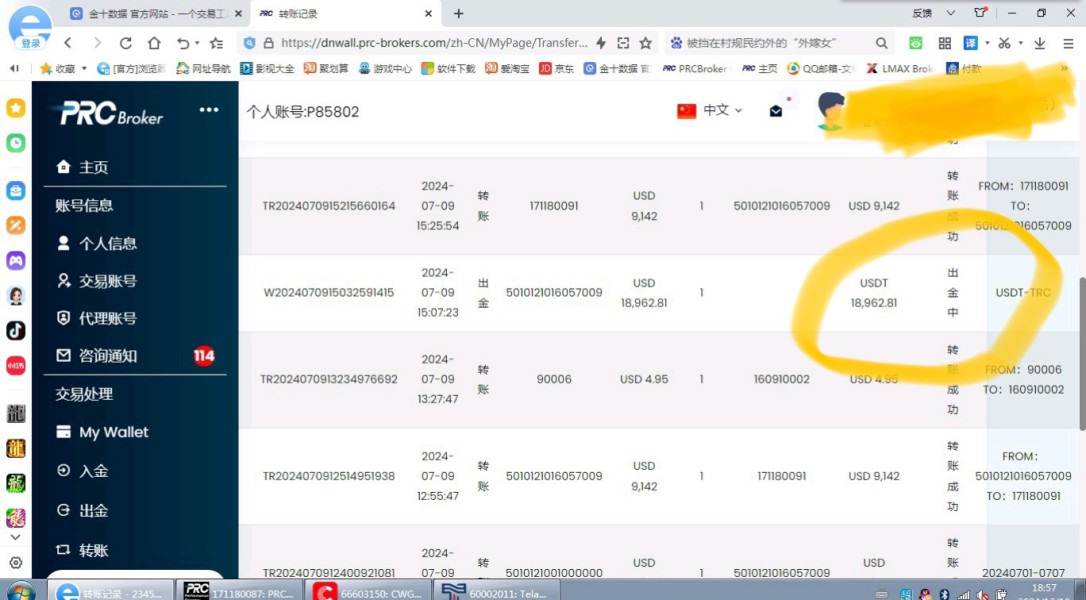

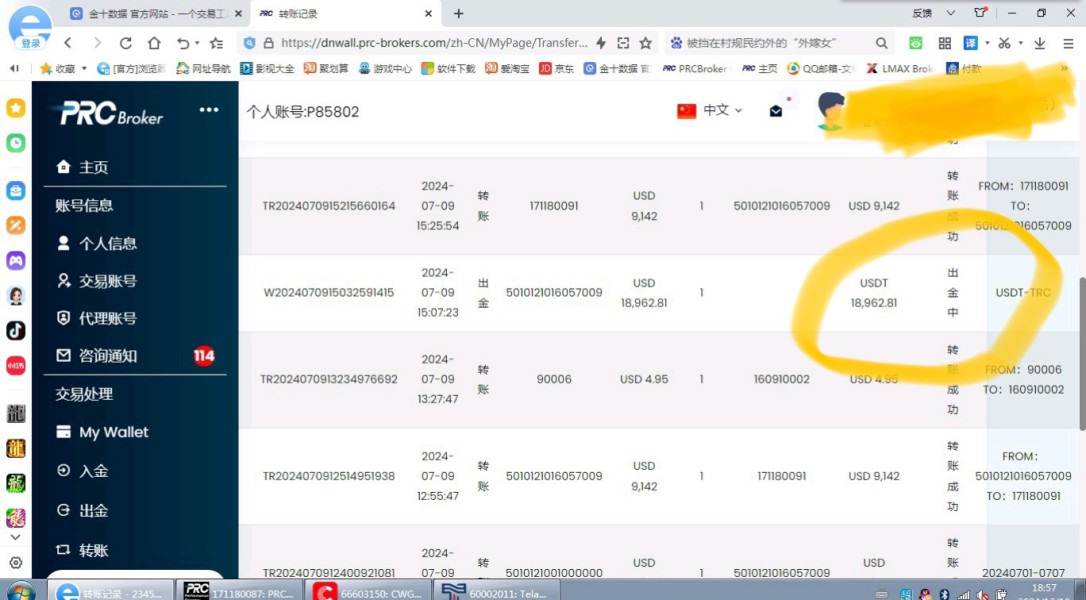

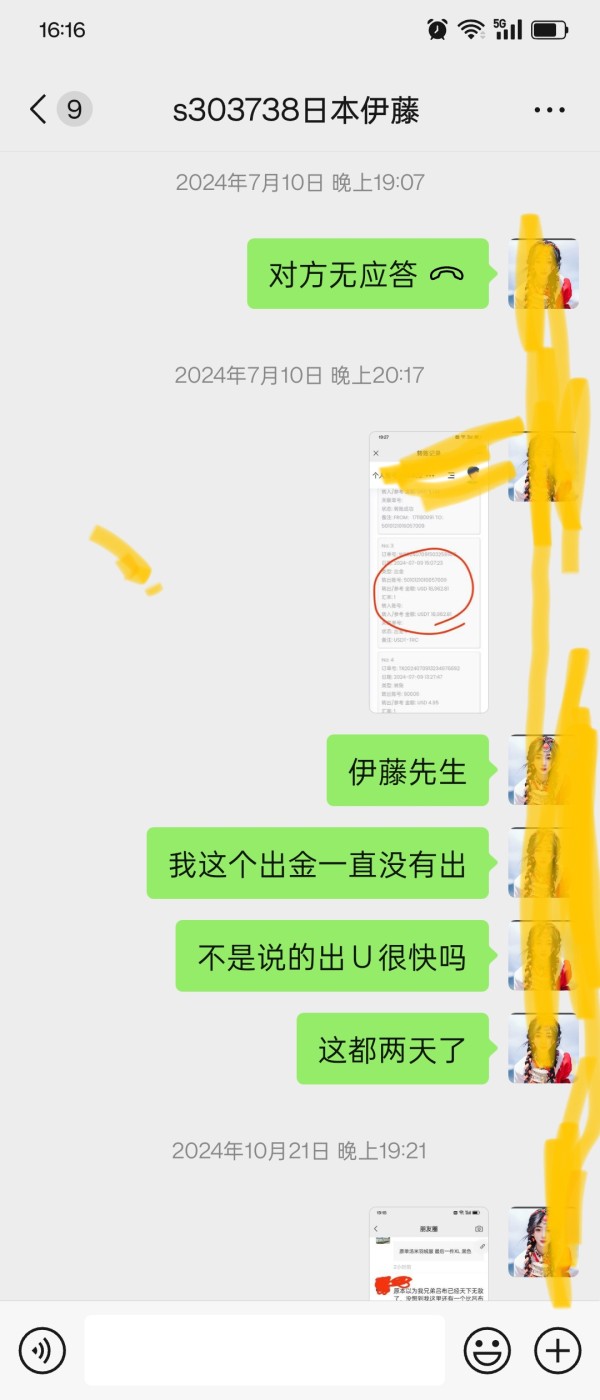

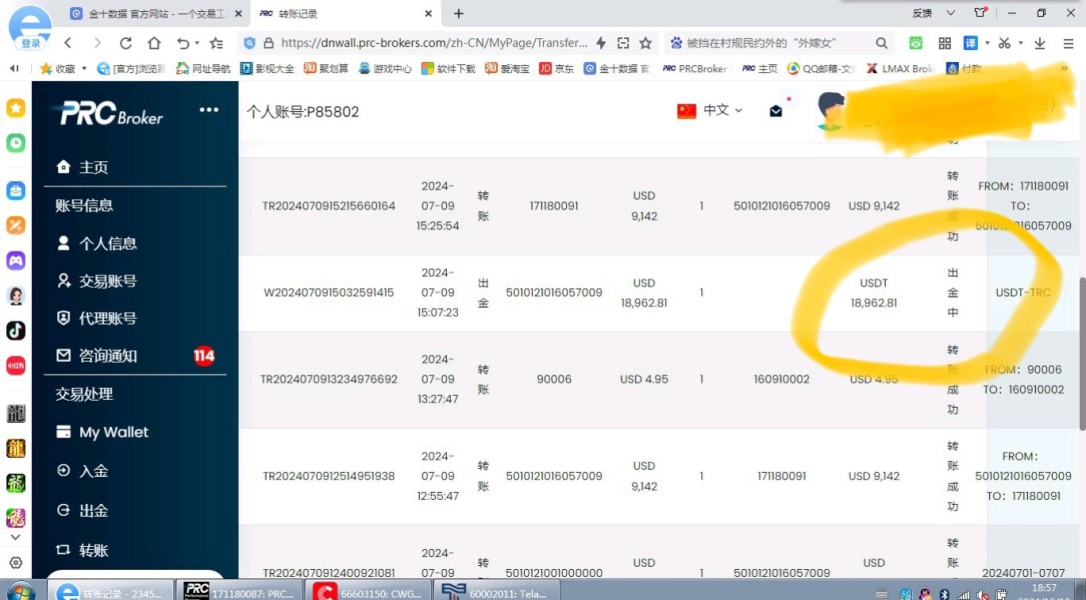

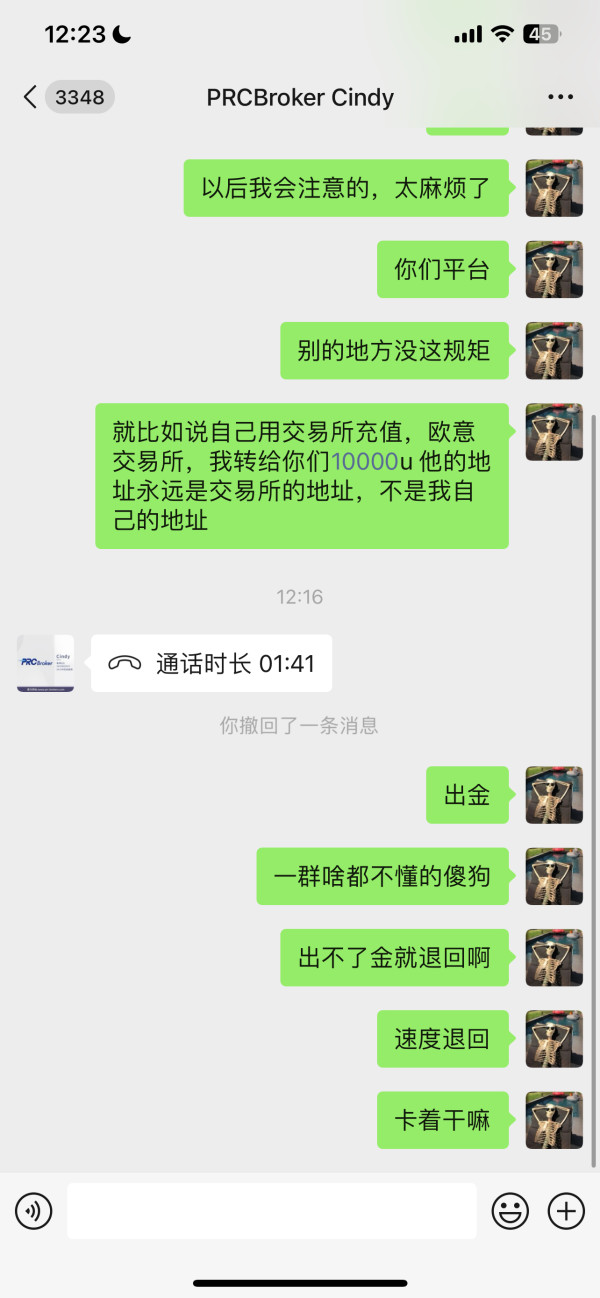

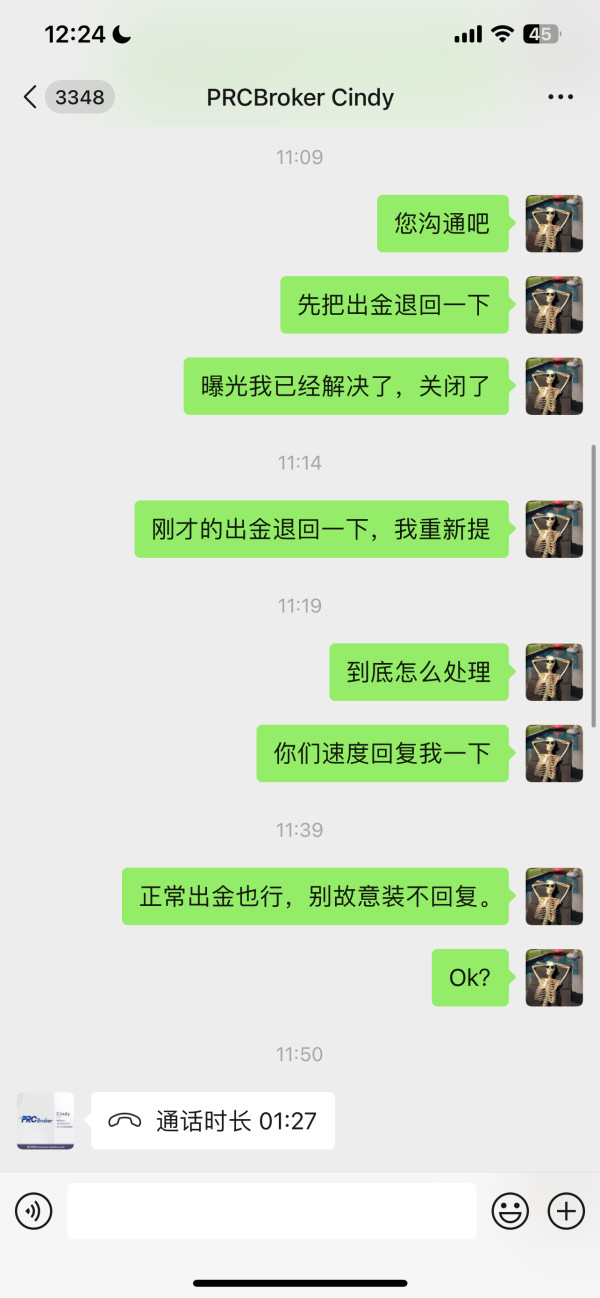

Fund management experiences, including deposit processing times, withdrawal procedures, and transaction efficiency, are not specifically documented in available sources. User demographic analysis suggests the broker successfully serves middle to high-net-worth investors. Specific client testimonials or case studies are not provided, however. Common user complaints or areas for improvement are not identified in current materials. This represents an opportunity for enhanced feedback transparency.

Conclusion

PRCBroker presents itself as a regulated forex broker with strong credentials through CySEC and VFSC oversight. The broker earns impressive 5/5 user ratings that indicate quality service delivery. The broker's dual-platform approach with MT4 and MT5 provides technological flexibility for diverse trading strategies. Regulatory compliance offers client protection frameworks that ensure safety and professional standards.

The broker appears most suitable for experienced traders and high-net-worth individuals. These clients can meet the $10,000 minimum deposit requirement and value regulatory protection over low-cost entry points. Professional traders seeking established platform technology and regulatory oversight may find PRCBroker's offerings aligned with their requirements.

Primary advantages include strong regulatory standing, positive user feedback, and standard professional trading platforms. The main limitation centers on the substantial minimum deposit requirement, which restricts accessibility for smaller traders and newcomers to forex markets. Potential clients should verify specific service details directly with the broker. Several operational aspects require clarification beyond available public information.