Is Omega Pro safe?

Pros

Cons

Is Omega Pro A Scam?

Introduction

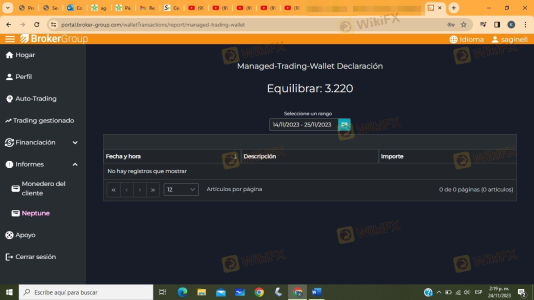

Omega Pro is a forex broker that emerged in 2019, claiming to provide a range of trading services, including forex and cryptocurrency trading. Positioned as a platform for both retail and institutional traders, it has attracted significant attention in the financial markets. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with unregulated brokers and scams, making it imperative for traders to assess the legitimacy and safety of their chosen platforms. This article employs a structured approach to evaluate Omega Pro's regulatory status, company background, trading conditions, customer experiences, and overall risk factors, ultimately determining whether it is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor that influences its legitimacy and the safety of traders' funds. Omega Pro claims to operate in the United Kingdom but lacks regulation from any recognized financial authority. This absence of oversight raises significant concerns regarding its operational practices and the protection of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Omega Pro is not subject to the stringent requirements imposed by reputable authorities like the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Such regulations typically ensure that brokers adhere to high standards of transparency, client fund protection, and operational integrity. Furthermore, multiple financial regulators, including the Spanish CNMV and the Belgian FSMA, have issued warnings against Omega Pro, categorizing it as a potential scam. This history of regulatory non-compliance and warnings from financial authorities significantly undermines the credibility of Omega Pro as a legitimate trading platform.

Company Background Investigation

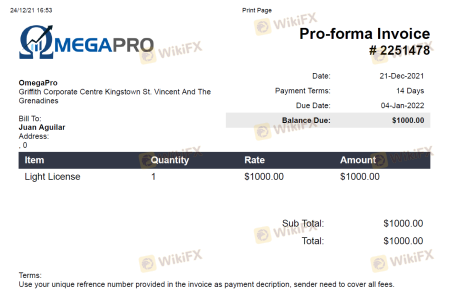

Omega Pro was founded in 2019 and claims to be headquartered in Beachmont, Kingstown, Saint Vincent and the Grenadines. However, the company has faced scrutiny regarding its ownership structure and transparency. The CEO, Dilawar Singh, is often mentioned in discussions about the broker, but there is limited verifiable information about his professional background or qualifications in the financial industry.

The company's website lacks detailed disclosures about its corporate structure, regulatory registrations, and operational history. This opacity raises red flags about its legitimacy and operational practices. Furthermore, the fact that Omega Pro operates without a valid physical office or regulatory oversight adds to the suspicion surrounding its operations. Transparency is a hallmark of a trustworthy broker, and the lack of it in Omega Pro's case indicates a potential risk for investors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential for assessing the overall cost of trading. Omega Pro offers various trading instruments, including forex, commodities, and cryptocurrencies, but the specifics regarding spreads, commissions, and fees are often vague and uncommunicative.

| Fee Type | Omega Pro | Industry Average |

|---|---|---|

| Spread (Major Pairs) | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Rate | N/A | Varies |

The spread for major currency pairs at Omega Pro is reported to be around 1.8 pips, which is higher than the industry average. Additionally, the absence of a clear commission structure raises questions about hidden fees or costs that traders may encounter. The lack of transparency regarding overnight interest rates and other potential charges further complicates the evaluation of Omega Pro's trading conditions.

Traders should be wary of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs that may erode trading profits. Overall, the trading conditions at Omega Pro appear to be less favorable compared to more established, regulated brokers.

Customer Funds Security

The security of customer funds is paramount when choosing a trading platform. Omega Pro's lack of regulation raises concerns about its ability to safeguard client funds effectively. The broker has not provided clear information regarding the segregation of client accounts, investor protection mechanisms, or negative balance protection policies.

Without regulatory oversight, there is no assurance that client funds are held in separate accounts or that they are protected by compensation schemes in the event of the broker's insolvency. This lack of transparency about fund security measures poses a significant risk for traders, as they may be unable to recover their investments if the broker were to default or disappear.

Historically, there have been no documented cases of fund security breaches reported by Omega Pro, but the absence of a regulatory framework means that any issues that arise could leave traders without recourse. Therefore, potential clients should be cautious and consider the implications of trading with an unregulated broker like Omega Pro.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the reliability and trustworthiness of a broker. Reports from users of Omega Pro indicate a range of experiences, with many expressing dissatisfaction regarding the platform's performance and customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Slow |

| Misleading Information | High | Non-responsive |

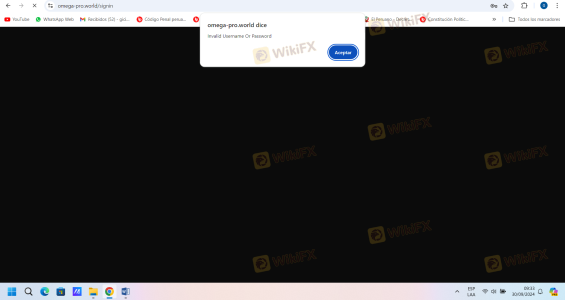

Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and perceived misleading information about trading opportunities. Users have reported long wait times for withdrawals, with some claiming that their requests were ignored or delayed indefinitely.

Two notable cases highlight these issues: one user reported being unable to access their account after making a deposit, while another expressed frustration over the lack of communication from customer support regarding withdrawal requests. These experiences suggest a pattern of poor customer service and operational inefficiencies that could negatively impact traders' experiences.

Platform and Trade Execution

A broker's trading platform is critical for executing trades efficiently and effectively. Omega Pro offers a web-based platform, but user reviews suggest that it may not be stable or reliable. Traders have reported issues with order execution, including slippage and rejections, which can significantly impact trading performance.

The absence of industry-standard platforms like MetaTrader 4 or 5 raises concerns about the platform's capabilities and user experience. Furthermore, the lack of transparency regarding the execution model used by Omega Pro leaves traders uncertain about how their orders are processed and whether they are receiving fair pricing.

Risk Assessment

Using Omega Pro presents various risks that traders should carefully consider. The absence of regulation, coupled with reports of poor customer service and operational inefficiencies, creates a high-risk environment for potential investors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | Lack of transparency regarding fees and trading conditions. |

| Operational Risk | Medium | Reports of poor customer service and withdrawal issues. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with small amounts, and be prepared for the possibility of losing their investment. It is advisable to explore alternative brokers that are regulated and have a proven track record of reliability and customer satisfaction.

Conclusion and Recommendations

In conclusion, Omega Pro exhibits several characteristics that raise significant concerns about its legitimacy and safety as a trading platform. The absence of regulatory oversight, coupled with a lack of transparency regarding trading conditions and customer fund security, suggests that traders should exercise extreme caution when considering this broker.

Given the potential risks associated with Omega Pro, it is not recommended for traders, especially those who are new to the forex market. Instead, traders are encouraged to explore regulated alternatives that offer better protection for their investments and a more transparent trading environment. Brokers such as Pepperstone, IG, and eToro provide robust regulatory oversight, competitive trading conditions, and comprehensive customer support, making them safer options for forex trading.

Is Omega Pro a scam, or is it legit?

The latest exposure and evaluation content of Omega Pro brokers.

Omega Pro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Omega Pro latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.