Is O-MARKETS safe?

Business

License

Is O Markets Safe or a Scam?

Introduction

O Markets is a forex broker that has attracted attention in the trading community, primarily for its claims of offering lucrative trading opportunities. However, the need for traders to exercise caution when evaluating forex brokers cannot be overstated. The forex market is rife with unregulated entities that can exploit inexperienced traders, making it essential to thoroughly investigate any broker before committing funds. This article aims to assess the safety and legitimacy of O Markets through a comprehensive evaluation framework, focusing on regulatory compliance, company background, trading conditions, customer fund security, user experiences, and overall risk assessment.

Regulation and Legitimacy

Regulatory oversight is a crucial factor in determining the safety of any trading platform. A brokers regulatory status can significantly influence its operational practices and the level of investor protection offered. O Markets claims to operate from London, UK; however, it does not appear on the Financial Conduct Authority (FCA) register, indicating a lack of proper licensing.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Verified |

The absence of a valid license from a recognized authority such as the FCA raises significant red flags. Regulatory agencies impose strict guidelines to protect traders, including requirements for segregated accounts and transparency in operations. O Markets unregulated status means it is not subject to these standards, increasing the risk for traders. Without regulatory oversight, there is little recourse for investors should issues arise, making it essential for potential clients to consider these factors when asking, "Is O Markets safe?"

Company Background Investigation

O Markets presents itself as a reputable trading platform, but its background raises concerns. The companys website lacks detailed information regarding its history, ownership structure, and management team. This opacity is problematic, as transparency is a hallmark of reputable brokers. A thorough investigation reveals that O Markets has not provided sufficient information about its operational history, which is a significant indicator of potential risk.

The management teams expertise is also an essential factor in assessing a broker's credibility. Unfortunately, O Markets does not disclose any information about its executive team or their qualifications, which further complicates the transparency issue. Traders should be wary of companies that do not clearly communicate their organizational structure, as this lack of clarity can be indicative of deeper issues within the organization. So, when evaluating whether "Is O Markets safe?" the answer leans toward caution due to its unclear company background.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for assessing its reliability. O Markets has set a minimum deposit requirement of $500, which is significantly higher than the industry average. Most reputable brokers maintain minimum deposits around $50 or even lower to attract a broader audience. This high entry barrier can be a tactic used by unscrupulous brokers to secure substantial initial funds.

| Fee Type | O Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Additionally, O Markets fails to provide clear information about its spreads, commissions, and overnight interest rates. This lack of transparency can lead to hidden fees, which are often utilized by fraudulent brokers to siphon funds from traders. Without a clear understanding of the cost structure, traders may find themselves at a disadvantage. Therefore, the absence of transparent trading conditions raises further doubts about the question, "Is O Markets safe?"

Customer Fund Security

The safety of customer funds is paramount when choosing a forex broker. O Markets does not provide adequate information about its fund security measures, including whether it maintains segregated accounts or offers negative balance protection. These are essential features that protect traders in the event of a broker's insolvency.

Historically, unregulated brokers like O Markets have been known to mishandle client funds, leading to significant losses for traders. The lack of investor protection mechanisms, such as compensation schemes, further exacerbates this risk. Therefore, the question of whether "Is O Markets safe?" must be answered with skepticism, given the broker's insufficient safeguards for client funds.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability. Reviews and testimonials about O Markets reveal a pattern of dissatisfaction among users. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

Several traders have reported being unable to access their funds, with some alleging that their accounts were frozen without explanation. Such complaints are alarming and suggest that O Markets may engage in practices that are not in the best interest of its clients. The overall negative sentiment surrounding user experiences strongly suggests that potential clients should approach O Markets with caution when considering, "Is O Markets safe?"

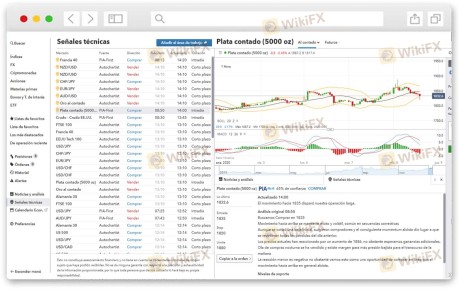

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a successful trading experience. O Markets claims to offer a sophisticated trading platform, yet user reviews indicate that the platform may not deliver on this promise. Reports of slippage, delayed executions, and frequent outages have surfaced, raising concerns about the platform's overall reliability.

The quality of trade execution is another vital aspect to consider. If a broker frequently experiences slippage or rejections of orders, it can significantly impact a trader's profitability. Such issues can be indicative of deeper problems within the broker's operational framework. Therefore, when asking, "Is O Markets safe?" the answer appears to be negative, given the concerning reports regarding platform performance.

Risk Assessment

Using O Markets comes with a range of risks that potential traders should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases exposure to fraud. |

| Fund Security Risk | High | Lack of fund protection mechanisms. |

| Customer Support Risk | Medium | Poor response to complaints and issues. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers that offer better security and transparency. Engaging with a broker like O Markets without proper due diligence can lead to significant financial losses.

Conclusion and Recommendations

In conclusion, the evidence gathered in this investigation strongly indicates that O Markets presents significant risks for potential traders. The lack of regulation, transparency issues, and negative customer experiences collectively suggest that O Markets may not be a safe trading environment. For traders seeking to enter the forex market, it is advisable to consider regulated alternatives that provide robust investor protections and transparent trading conditions.

Ultimately, the question "Is O Markets safe?" can be answered with caution. Prospective clients should prioritize their financial security and consider brokers with established regulatory oversight and positive user experiences.

Is O-MARKETS a scam, or is it legit?

The latest exposure and evaluation content of O-MARKETS brokers.

O-MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

O-MARKETS latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.