Is NUMERA International safe?

Business

License

Is Numera International A Scam?

Introduction

Numera International is an online forex broker that positions itself as a gateway for traders to access a variety of financial markets, including foreign exchange, commodities, and cryptocurrencies. Established in 2022, the broker claims to offer competitive trading conditions, including high leverage and a user-friendly trading platform. However, the influx of new brokers in the forex market necessitates a careful evaluation by traders to ensure their safety and the legitimacy of the services offered. The rise of scams and unregulated entities in the financial industry has made it increasingly important for traders to conduct thorough due diligence before committing their funds.

This article aims to provide a comprehensive analysis of Numera International based on various factors, including regulatory status, company background, trading conditions, customer safety, and user experiences. The evaluation is based on a review of multiple sources, including user reviews, regulatory databases, and expert analyses, to present a balanced view of whether Numera International is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors for traders when assessing safety and legitimacy. Regulation serves as a form of oversight that ensures a broker adheres to strict standards designed to protect clients. In the case of Numera International, the broker operates as an unregulated entity, raising significant red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Numera International is based in Saint Vincent and the Grenadines (SVG), a jurisdiction notorious for its lax regulatory framework. The local financial services authority does not regulate forex trading, meaning that Numera International does not have a valid trading license. This lack of regulatory oversight poses a significant risk to traders, as they have no recourse in the event of a dispute or financial loss. The absence of a regulatory license is a critical factor that should deter potential clients from investing with this broker.

Moreover, while Numera International claims to have an office in the UK, reports indicate that this entity is in the process of dissolution, further undermining its credibility. Without proper regulation, clients are left vulnerable to potential fraud and mismanagement, making it imperative for traders to seek licensed brokers that operate under the supervision of reputable financial authorities.

Company Background Investigation

Numera International Limited, the entity behind the broker, was established in early 2022. Despite its relatively new presence in the market, the company has already garnered a reputation that raises concerns among potential clients. Information regarding the ownership structure and management team is sparse, which is often a red flag in the financial services industry. A transparent company typically provides detailed information about its leadership and operational history, but Numera International falls short in this regard.

The lack of transparency regarding the management team and their qualifications is concerning. A competent management team with relevant experience is essential for the success and integrity of a brokerage. In the case of Numera International, the absence of publicly available information about its executives makes it challenging for traders to assess the broker's reliability and expertise.

Furthermore, the company's website does not provide comprehensive information about its operations, which contributes to a perception of opacity. As a result, potential traders may find it difficult to trust the broker, given the lack of clarity surrounding its business practices and ownership.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for traders looking to maximize their potential profits and minimize their risks. Numera International claims to provide competitive trading conditions, but a closer examination reveals several concerning aspects regarding its fee structure and trading policies.

| Fee Type | Numera International | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.2 pips | 0.5 - 1.0 pips |

| Commission Structure | None disclosed | Varies (typically low) |

| Overnight Interest Range | Not specified | Varies (typically 0.5% - 2%) |

The spread for major currency pairs at Numera International starts at 1.2 pips, which is higher than the industry average, indicating that traders may incur higher costs when executing trades. Additionally, the broker does not clearly disclose its commission structure, leaving potential clients in the dark about any additional fees they may encounter.

Another critical aspect is the lack of information regarding overnight interest rates, which can significantly impact trading costs, especially for those holding positions overnight. The absence of transparency in these areas raises questions about the broker's commitment to fair trading practices.

Moreover, traders should be cautious of any unusual fees or hidden costs that may not be explicitly stated. Such practices are often indicative of less reputable brokers looking to maximize their profits at the expense of their clients.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Numera International's lack of regulation raises significant questions about its ability to protect client assets. The broker's website does not provide detailed information regarding its security measures, which is a critical factor for potential clients to consider.

A reputable broker typically employs measures such as segregated accounts, negative balance protection, and investor compensation schemes to safeguard client funds. However, Numera International does not appear to offer any of these protections, leaving traders vulnerable to potential financial loss.

In historical contexts, unregulated brokers have been known to misappropriate client funds, leading to significant losses for investors. The absence of a regulatory framework means that clients have little to no recourse in recovering lost funds. Therefore, it is crucial for traders to prioritize brokers that provide robust security measures and adhere to regulatory standards aimed at protecting client investments.

Customer Experience and Complaints

User feedback is invaluable when assessing the reliability of a broker. A review of customer experiences with Numera International reveals a pattern of negative feedback, with many users reporting issues related to withdrawals and overall service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High-Pressure Sales Tactics | Medium | Inconsistent |

| Lack of Customer Support | High | Unresponsive |

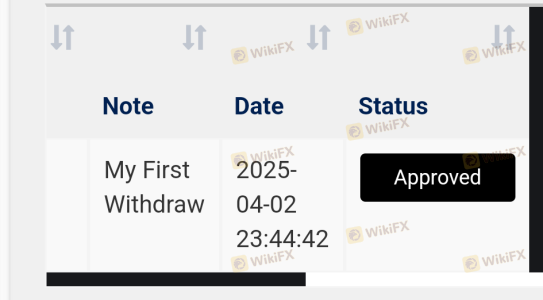

Common complaints include difficulties in withdrawing funds, with many users claiming that their requests were ignored or met with unreasonable delays. Additionally, there are reports of high-pressure sales tactics employed by the broker's representatives, attempting to persuade clients to deposit more funds under the guise of potential profits.

One notable case involves a trader who reported being pressured to deposit additional funds after initially investing, only to face challenges when attempting to withdraw their capital. Such experiences are indicative of a broker that may prioritize profit over client satisfaction, further raising concerns about its legitimacy.

Platform and Trade Execution

The trading platform is a critical component of any trading experience, and Numera International claims to offer the widely recognized MetaTrader 5 (MT5) platform. However, user experiences suggest that the platform may not perform as expected.

Traders have reported issues related to order execution quality, including instances of slippage and rejected orders. Such problems can significantly impact trading performance, especially for those employing strategies that rely on precise execution. The presence of any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, would further exacerbate concerns regarding the broker's integrity.

The overall user experience on the platform, including ease of navigation and access to trading tools, is also essential. Unfortunately, feedback indicates that users have encountered difficulties when using the platform, raising questions about its reliability and stability.

Risk Assessment

Engaging with Numera International presents several risks that potential traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of investor protection and fund segregation. |

| Withdrawal Risk | High | Reports of withdrawal issues and delays. |

| Platform Risk | Medium | User complaints regarding execution quality. |

The high level of regulatory risk associated with Numera International cannot be overstated. The absence of oversight means that traders are at risk of losing their entire investment without any means of recovery. Additionally, the lack of fund security measures compounds these risks, as clients have no assurance that their assets will be protected.

To mitigate these risks, traders should consider using well-regulated brokers with a proven track record of compliance and client protection. Additionally, employing risk management strategies, such as setting stop-loss orders and diversifying investments, can help safeguard against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Numera International exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, combined with negative user experiences and transparency issues, raises significant concerns about the broker's legitimacy.

Potential traders should exercise extreme caution when considering an investment with Numera International. It is advisable to seek out regulated brokers that provide robust security measures, transparent fee structures, and a positive track record of customer service. For those looking for reliable alternatives, brokers such as FXTM, IG, or OANDA offer well-regulated environments with comprehensive client protections.

Ultimately, ensuring the safety of your investment should be the top priority, and working with a reputable broker is essential for achieving long-term trading success.

Is NUMERA International a scam, or is it legit?

The latest exposure and evaluation content of NUMERA International brokers.

NUMERA International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NUMERA International latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.