Is Natural Seven Limited safe?

Business

License

Is Natural Seven Limited A Scam?

Introduction

Natural Seven Limited (NSL) is an online forex broker that has recently emerged in the crowded foreign exchange market. Positioned as an offshore broker, it claims to provide a platform for trading various financial instruments. However, the increasing number of unregulated brokers has made traders cautious about where they invest their money. The potential for scams in the forex industry necessitates a thorough evaluation of any broker before committing funds. This article aims to assess the safety and legitimacy of Natural Seven Limited by analyzing its regulatory status, company background, trading conditions, customer experience, and overall risk factors. The information presented is derived from multiple sources, including reviews, regulatory databases, and user feedback, ensuring a comprehensive evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for determining its legitimacy and safety. A licensed broker is more likely to adhere to industry standards and protect traders' interests. In the case of Natural Seven Limited, it is important to note that the broker is not regulated by any recognized financial authorities. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0548297 | United States | Unauthorized |

Natural Seven Limited claims to be regulated by the National Futures Association (NFA); however, investigations reveal that its license number is flagged as unauthorized. This lack of regulation poses significant risks for traders, as unregulated brokers are not held accountable for their actions. The absence of oversight means that traders have limited recourse in the event of disputes or financial losses. Therefore, the question of is Natural Seven Limited safe becomes increasingly concerning, as investing with an unregulated broker can lead to potential scams and financial loss.

Company Background Investigation

Understanding the background of a broker is essential in assessing its reliability. Natural Seven Limited was established recently, and its registered address is located in Hong Kong. However, the company's website lacks comprehensive information about its history, ownership structure, and management team. This absence of transparency raises red flags about its legitimacy.

The management teams background is crucial for evaluating the broker's credibility. Unfortunately, there is little information available regarding the qualifications and experience of the individuals running Natural Seven Limited. A lack of transparency in this regard can be indicative of a broker that may not have the best interests of its clients at heart. Furthermore, the quality of the information disclosed on the website is subpar, which can further contribute to the skepticism surrounding the broker's reliability. In summary, the limited information available regarding Natural Seven Limited's background raises concerns about its legitimacy and the safety of trading with this broker.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can provide insight into their operational practices. Natural Seven Limited advertises leverage of up to 1:500 and claims to offer spreads starting from 0 pips. However, the specifics of its fee structure remain unclear, which is a common tactic among potentially unscrupulous brokers.

| Fee Type | Natural Seven Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | Unspecified | Varies |

The lack of clarity regarding spreads, commissions, and overnight interest rates is concerning. Brokers that operate transparently typically provide detailed information about their fees, which allows traders to make informed decisions. The absence of this information may indicate that Natural Seven Limited could impose hidden fees or unfavorable trading conditions, further raising the question of is Natural Seven Limited safe for traders.

Client Funds Safety

Ensuring the safety of client funds is paramount for any reputable broker. Natural Seven Limited does not provide clear information on its fund safety measures, which is a significant concern. The broker does not appear to offer segregated accounts for client funds, meaning that traders' money could be co-mingled with the broker's operational funds. This lack of segregation increases the risk of losing funds, especially in the event of financial instability or bankruptcy.

Additionally, there is no mention of investor protection schemes or negative balance protection policies. These features are essential for safeguarding traders from losing more than their initial investment. The absence of such measures raises serious questions about the safety of funds deposited with Natural Seven Limited. Given these factors, it is reasonable to conclude that trading with this broker poses a high risk to client capital, making one wonder, is Natural Seven Limited safe to trade with?

Customer Experience and Complaints

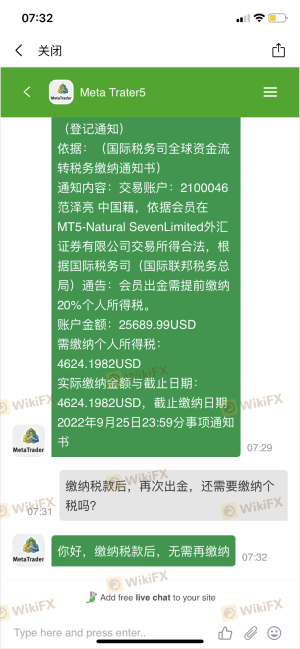

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Reviews of Natural Seven Limited reveal a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, poor customer service responses, and a lack of transparency regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Poor |

| Transparency Concerns | High | Unaddressed |

For instance, several users have reported that their withdrawal requests were either delayed or denied without explanation. This raises significant concerns about the broker's integrity and ability to honor its financial obligations to clients. The poor quality of customer service, characterized by slow response times and inadequate support, further compounds these issues. Such patterns of complaints lead to a strong conclusion that is Natural Seven Limited safe is a question worth serious consideration.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Natural Seven Limited claims to offer the MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. However, reports indicate that the platform may not perform reliably, with users experiencing issues such as slippage and order rejections.

The quality of order execution is a vital aspect of trading, and any signs of manipulation or poor performance can significantly impact traders' experiences. The lack of transparency regarding the platform's operational integrity raises concerns about whether trades are executed fairly and whether clients can trust the broker to handle their orders competently. Given these factors, potential traders should carefully consider whether is Natural Seven Limited safe before proceeding.

Risk Assessment

Trading with Natural Seven Limited presents several risks that traders should be aware of. The absence of regulation, combined with opaque trading conditions, raises significant concerns about the broker's reliability and the potential for financial loss.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Potential issues with trade execution. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Natural Seven Limited. It is advisable to consider alternative brokers with robust regulatory oversight, transparent fee structures, and positive customer feedback.

Conclusion and Recommendations

In conclusion, the investigation into Natural Seven Limited raises significant concerns regarding its legitimacy and safety. The lack of regulation, transparency issues, and negative customer experiences suggest that this broker may not be a safe option for traders. The question of is Natural Seven Limited safe is answered with considerable skepticism.

For traders seeking reliable and secure trading environments, it is recommended to consider alternative brokers that are well-regulated and have a proven track record of positive client experiences. Trusted options may include brokers regulated by recognized authorities such as the FCA, ASIC, or CySEC. Ultimately, traders should prioritize their financial safety and choose brokers that provide clear information, robust protections, and responsive customer support.

Is Natural Seven Limited a scam, or is it legit?

The latest exposure and evaluation content of Natural Seven Limited brokers.

Natural Seven Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Natural Seven Limited latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.