Is UNISON CORPORATION safe?

Pros

Cons

Is Unison Corporation Safe or Scam?

Introduction

Unison Corporation is a forex broker that has made its mark in the financial trading landscape, particularly focusing on the forex and CFD markets. However, as the trading environment becomes increasingly complex and competitive, traders must approach their choice of brokers with caution. The importance of due diligence cannot be overstated, especially in an industry where regulatory oversight can vary significantly, and reports of scams are not uncommon. In this article, we will conduct an in-depth analysis of Unison Corporation to determine whether it is a safe trading option or if it raises red flags that potential investors should be aware of. Our investigation will utilize information from various credible sources, including regulatory records, customer feedback, and expert reviews, to provide a comprehensive evaluation framework.

Regulation and Legitimacy

When assessing whether Unison Corporation is safe, the first aspect to consider is its regulatory status. Regulation plays a crucial role in ensuring that brokers adhere to specific standards designed to protect traders. A broker's regulatory status can significantly impact its credibility and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Labuan Financial Services Authority | Not specified | Labuan, Malaysia | Unverified |

Unison Corporation claims to be regulated by the Labuan Financial Services Authority (LFSA). However, it is important to note that the LFSA is known for its relatively lax regulatory framework compared to more stringent authorities like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). Furthermore, there are concerns regarding the authenticity of the licenses claimed by Unison Corporation, particularly allegations that it lacks valid regulatory licenses. This raises significant questions about the broker's legitimacy. The absence of robust regulatory oversight means that traders have limited recourse in the event of disputes or financial issues, which is a critical consideration when evaluating if Unison Corporation is safe.

Company Background Investigation

Unison Corporation was established in 2012 and has since positioned itself as a global brokerage firm primarily catering to forex traders. The company operates out of Labuan, Malaysia, which is known as an offshore financial center. The ownership structure of Unison Corporation is somewhat opaque, with limited information available regarding its parent company or major stakeholders. This lack of transparency can be a warning sign for potential investors, as a well-structured company typically provides clear information about its ownership and management.

The management team behind Unison Corporation also raises concerns regarding their qualifications and experience in the financial industry. A strong management team with a proven track record is essential for ensuring that a brokerage operates effectively and ethically. However, the absence of detailed information about the team members at Unison Corporation makes it difficult to assess their expertise and reliability. Overall, the company's transparency and information disclosure levels appear to be lacking, which is another factor that may lead traders to question whether Unison Corporation is safe.

Trading Conditions Analysis

Understanding the trading conditions offered by Unison Corporation is vital for evaluating its overall safety. The broker provides a range of financial instruments, including forex pairs, commodities, and CFDs. However, it is essential to delve deeper into the cost structure associated with trading on their platform.

| Cost Type | Unison Corporation | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 0.5 - 1.0 pips |

| Commission Structure | Not specified | Varies by broker |

| Overnight Interest Range | Not specified | Varies by broker |

The spreads offered by Unison Corporation start from 1.5 pips, which is significantly higher than the industry average. This could indicate that traders may face higher costs when trading, which can erode potential profits. Furthermore, the lack of clarity regarding commissions and overnight interest rates raises concerns about hidden fees that traders may encounter. These factors contribute to the overall perception that Unison Corporation may not provide competitive trading conditions, further complicating the question of whether it is safe for traders.

Client Fund Safety

Client fund safety is a paramount concern when evaluating any broker, and Unison Corporation is no exception. The broker's measures for safeguarding client funds are critical in determining if it is a trustworthy option.

Unison Corporation claims to implement measures such as segregating client funds from its operational funds. This is a standard practice that helps protect client investments in the event of financial difficulties faced by the broker. However, the effectiveness of these measures is contingent upon the regulatory framework under which the broker operates. Given that Unison Corporation is not regulated by a major authority, the risk of fund mismanagement or loss increases.

Additionally, there are no indications that Unison Corporation offers negative balance protection or any form of investor compensation scheme, which are essential safety nets for traders. The absence of these protections raises significant concerns about the safety of funds held with Unison Corporation, suggesting that traders should exercise caution before committing their capital.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Unison Corporation, reviews and testimonials from current and former clients present a mixed picture.

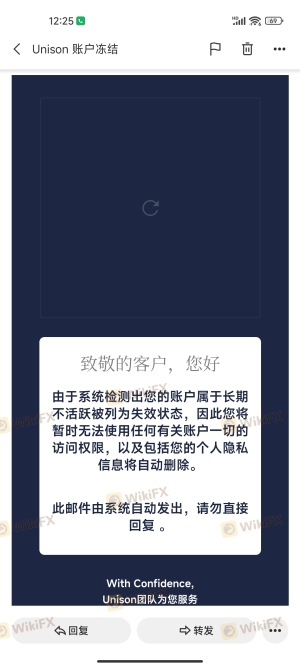

Common complaints include issues related to withdrawal difficulties and lack of responsive customer support. Many users have reported being unable to withdraw their funds, which is a significant red flag in evaluating if Unison Corporation is safe. Additionally, the quality of customer service has been criticized, with reports of long response times and unhelpful support staff.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresolved for many clients |

| Customer Support | Medium | Slow and unhelpful |

One notable case involved a trader who reported being unable to withdraw their funds for several months, leading to frustration and a sense of being scammed. Such experiences highlight the potential risks associated with trading through Unison Corporation, suggesting that traders should be wary of the broker's practices.

Platform and Trade Execution

The trading platform offered by Unison Corporation is based on MetaTrader 5 (MT5), which is widely regarded for its advanced features and user-friendly interface. However, the performance and reliability of the platform are crucial factors in assessing whether Unison Corporation is safe.

Users have reported mixed experiences regarding order execution quality, with some noting instances of slippage and delayed order processing. These issues can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Furthermore, there are concerns about potential signs of platform manipulation, which could further erode trust in the broker's operations.

Risk Assessment

When evaluating the overall risk associated with trading through Unison Corporation, several key areas require attention.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases risk of fraud and mismanagement. |

| Fund Safety Risk | High | Absence of investor protections raises concerns about fund security. |

| Customer Service Risk | Medium | Reports of slow and unhelpful support may hinder problem resolution. |

Given these risk factors, traders should approach Unison Corporation with caution. It is advisable to implement risk mitigation strategies, such as limiting the amount of capital invested with the broker and thoroughly researching any potential trading strategies.

Conclusion and Recommendations

In conclusion, the evidence suggests that Unison Corporation raises several red flags that potential traders should carefully consider. The lack of robust regulatory oversight, combined with reports of withdrawal issues and inadequate customer support, points to significant concerns regarding the safety of trading with this broker.

For those considering engaging with Unison Corporation, it is crucial to weigh the risks against the potential benefits and to remain vigilant. Traders may want to explore alternative brokers that offer more transparency, better regulatory oversight, and a proven track record of reliability. Some reputable alternatives include brokers that are regulated by major financial authorities, such as the FCA or ASIC, which provide a higher level of investor protection and trustworthiness.

Ultimately, while Unison Corporation may offer a range of trading options, the question of whether it is safe remains unresolved, and potential traders should proceed with caution.

Is UNISON CORPORATION a scam, or is it legit?

The latest exposure and evaluation content of UNISON CORPORATION brokers.

UNISON CORPORATION Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UNISON CORPORATION latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.