Is MorsPrime safe?

Business

License

Is MorsPrime Safe or a Scam?

Introduction

MorsPrime is an emerging player in the forex market, claiming to provide a wide range of trading services, including access to over 120 currency pairs. As with any financial service, particularly in the volatile realm of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex landscape is rife with unregulated entities, making it essential for traders to evaluate the legitimacy and reliability of brokers like MorsPrime carefully. This article employs a comprehensive investigative approach, analyzing regulatory status, company background, trading conditions, customer safety measures, and user experiences to determine whether MorsPrime is safe or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of safe trading practices. A broker's regulatory status not only indicates its legitimacy but also provides a safety net for traders' funds. MorsPrime claims to operate from Seychelles; however, it has not provided any verifiable information regarding its regulatory status. This lack of transparency is a significant red flag. Below is a summary of the core regulatory information regarding MorsPrime:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unverified |

The absence of any valid regulatory information raises serious concerns about the quality of oversight MorsPrime is subjected to. In many jurisdictions, trading with unregulated brokers can be illegal and inherently risky, as these entities may engage in practices that could lead to significant financial losses for traders. The failure to publish live spreads and other trading conditions further compounds the uncertainty surrounding MorsPrime's operations. Without a regulatory body to enforce compliance, traders must question the safety of their investments.

Company Background Investigation

MorsPrime's company history and ownership structure are critical in assessing its credibility. Established only recently, MorsPrime appears to be a relatively new entrant in the forex market. Information regarding its management team, including their qualifications and experience, is sparse, which raises questions about the broker's transparency. A lack of detailed company information can indicate potential risks for traders, as established brokers typically provide insight into their leadership and operational practices.

Moreover, MorsPrime has not disclosed any physical office locations or comprehensive contact information, which is often a hallmark of fraudulent brokers. The companys website does not offer sufficient information about its operations or history, making it difficult for potential clients to gauge the broker's reliability. This opacity in operations is concerning, as it suggests that MorsPrime may not be forthcoming about its business practices, potentially leading traders to question whether MorsPrime is safe for their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by MorsPrime is essential for evaluating its overall value proposition. The broker claims to provide competitive spreads and flexible account types, including ECN accounts. However, the lack of transparency regarding its fee structure raises concerns. Below is a comparison of MorsPrime's core trading costs against industry averages:

| Fee Type | MorsPrime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | Not disclosed | $5 per lot |

| Overnight Interest Range | Not disclosed | Varies widely |

While MorsPrime advertises low spreads, the absence of clear information about commissions and other fees suggests that traders may encounter unexpected costs. This uncertainty can lead to dissatisfaction and financial losses, particularly for those new to trading. Moreover, the broker's minimum deposit requirement of just $10 may entice inexperienced traders, but it could also serve as a tactic to lure them into upgrading to higher-tier accounts, often leading to larger investments without guaranteed returns. This raises the question of whether MorsPrime is safe or simply a vehicle for higher-risk trading.

Customer Funds Security

The safety of client funds is paramount when considering a forex broker. MorsPrime's claims regarding fund security are vague, and there is no detailed information available about its measures for safeguarding client deposits. Key aspects such as fund segregation, investor protection schemes, and negative balance protection are crucial for assessing a broker's reliability.

Without established protocols for fund security, traders may find themselves vulnerable to potential losses. Historical issues related to fund safety, such as delayed withdrawals or unprocessed requests, have not been disclosed by MorsPrime, leaving potential clients in the dark about the broker's track record. This lack of transparency raises critical concerns about whether MorsPrime is safe for traders looking to invest their hard-earned money.

Customer Experience and Complaints

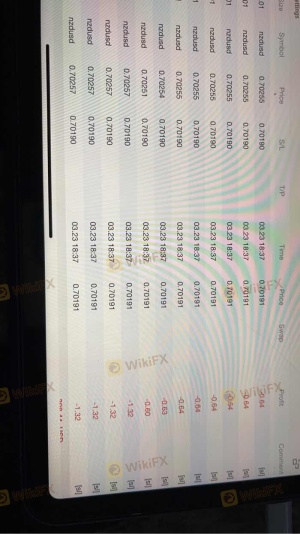

Analyzing customer feedback provides valuable insights into the operational quality of MorsPrime. A review of online forums reveals a mixed bag of experiences, with several users expressing dissatisfaction regarding customer service and withdrawal processes. Common complaints include delays in fund withdrawals and unresponsive customer support, which can significantly impact a trader's experience. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Unresolved issues |

| Lack of Transparency | High | No clear response |

Two notable cases involve users reporting difficulties in accessing their funds after multiple withdrawal requests. In both instances, the traders experienced significant delays, leading to frustration and distrust in MorsPrime's operations. Such complaints are alarming and suggest that potential clients should approach MorsPrime with caution, questioning whether MorsPrime is safe given these reported experiences.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for successful trading experiences. MorsPrime claims to offer a user-friendly platform with advanced trading tools; however, reviews indicate mixed performance regarding stability and execution quality. Traders have reported issues with slippage and order rejections, which can adversely affect trading outcomes.

Furthermore, there are no indications of any manipulative practices, but the lack of transparency regarding execution policies raises questions about the broker's operational integrity. Traders should be aware of the potential risks associated with using MorsPrime's platform, as any inefficiencies in trade execution can lead to considerable financial implications. This leads to further skepticism about whether MorsPrime is safe for trading.

Risk Assessment

Assessing the overall risk associated with trading with MorsPrime is vital for potential clients. The following risk scorecard summarizes the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security Risk | High | Lack of information on fund protection |

| Customer Service Risk | Medium | Numerous complaints regarding support |

| Trading Execution Risk | Medium | Reports of slippage and order issues |

To mitigate these risks, potential traders should consider starting with a minimal investment, conducting regular withdrawals, and maintaining a close watch on account activity. Engaging with well-regulated brokers with transparent practices could also provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the investigation into MorsPrime raises significant concerns regarding its legitimacy and safety for traders. The absence of regulatory oversight, coupled with a lack of transparency in trading conditions and customer service issues, suggests that MorsPrime may not be a safe choice for forex trading. While some traders may be tempted by the low minimum deposit and promised trading conditions, the potential risks far outweigh the benefits.

For traders seeking safer alternatives, it is advisable to consider well-regulated brokers with established reputations and transparent practices. Brokers regulated by top-tier authorities such as the FCA or ASIC offer a higher level of security for client funds and better overall trading experiences. In light of the findings, it is prudent to approach MorsPrime with caution and consider whether MorsPrime is safe for your trading needs.

Is MorsPrime a scam, or is it legit?

The latest exposure and evaluation content of MorsPrime brokers.

MorsPrime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MorsPrime latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.