Is MLC safe?

Pros

Cons

Is MLC Safe or a Scam?

Introduction

MLC is a trading platform that has garnered attention in the forex market, offering various financial services to traders. As the forex market continues to grow, traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities is significant, making it crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen platforms. This article aims to provide an objective assessment of MLC's safety, exploring its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The investigation is based on multiple credible sources, including customer reviews, regulatory data, and industry analyses, to create a comprehensive evaluation framework.

Regulatory and Legality

The regulatory status of a trading platform is a vital indicator of its legitimacy. MLC claims to operate under specific regulatory authorities; however, its licensing history raises concerns. Below is a summary of MLC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 230702 | Australia | Revoked |

MLC was previously regulated by the Australian Securities and Investments Commission (ASIC), but its license was revoked due to non-compliance with regulatory standards. This revocation is alarming, as it suggests that MLC may not be adhering to the necessary legal frameworks that protect traders' interests. The importance of regulation cannot be overstated; it ensures that brokers operate transparently and uphold high standards of conduct. The lack of a valid license raises serious questions about MLC's operations and its commitment to safeguarding its clients' funds. Given this context, the question remains: Is MLC safe? The evidence points towards a concerning lack of regulatory oversight.

Company Background Investigation

MLC has a complex history, having undergone various ownership changes and structural transformations. Originally established as a reputable financial service provider, MLC has faced numerous challenges over the years. It is essential to understand the company's evolution, including its ownership structure and management team.

The management team at MLC comprises individuals with varying degrees of experience in the financial sector. However, the lack of transparency regarding their backgrounds raises concerns about the company's governance. A reliable trading platform should provide clear information about its leadership, enabling traders to assess the expertise and credibility of those at the helm. Moreover, the company's commitment to transparency and information disclosure is crucial in building trust with clients. Unfortunately, MLC's history of regulatory issues and opaque operations does not inspire confidence.

Trading Conditions Analysis

Understanding the trading conditions offered by MLC is essential for evaluating its overall safety. The broker's fee structure and trading costs can significantly impact a trader's profitability. MLC's trading conditions are characterized by a lack of transparency, with several users reporting unexpected fees and charges. Below is a comparison of MLC's core trading costs:

| Fee Type | MLC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (high) | Competitive |

| Commission Structure | Hidden fees | Standard fees |

| Overnight Interest Range | High | Moderate |

Traders have reported that MLC's spreads are often higher than the industry average, which can erode potential profits. Additionally, the presence of hidden fees can lead to unexpected costs, raising further questions about the broker's trustworthiness. This lack of clarity in trading conditions is a significant red flag when considering whether MLC is safe for trading.

Customer Fund Security

The security of customer funds is paramount when assessing a trading platform's safety. MLC claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory history.

The absence of a valid regulatory license means that MLC may not be subject to the same stringent oversight as other brokers. This raises concerns about the security of funds held with MLC, particularly in the event of financial difficulties or insolvency. Furthermore, any historical issues related to fund security can significantly impact a trader's decision to engage with the broker. In light of these factors, the question of whether MLC is safe remains unresolved.

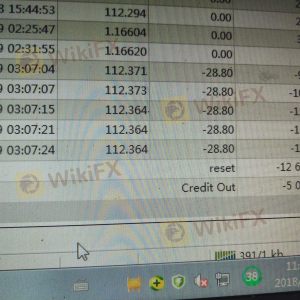

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating the reliability of a trading platform. MLC has received mixed reviews from users, with many reporting negative experiences related to customer service, withdrawal issues, and overall satisfaction. Below is a summary of common complaints and their severity ratings:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Inconsistent support |

| Hidden Fees | High | Lack of transparency |

Typical case studies reveal a pattern of complaints, with customers expressing frustration over delayed withdrawals and unresponsive customer service. Such issues can lead to significant stress for traders, particularly when they are unable to access their funds. The prevalence of these complaints raises serious concerns about whether MLC is safe for traders seeking a reliable platform.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors in ensuring a positive trading experience. MLC's platform has been described as unstable, with reports of slow execution times and frequent outages. These issues can hinder a trader's ability to make timely decisions and execute trades effectively.

Additionally, the quality of order execution, including slippage and rejection rates, is crucial for evaluating the broker's overall performance. Traders have reported instances of significant slippage during volatile market conditions, which can negatively impact trading outcomes. The combination of these factors raises further doubts about the reliability of MLC's trading platform, prompting the question: Is MLC safe for traders?

Risk Assessment

Using MLC as a trading platform presents several risks that traders must consider. Below is a summary of key risk categories and their corresponding levels:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of active regulation |

| Fund Security | High | No investor protection |

| Trading Costs | Medium | Hidden fees and high spreads |

The high-risk levels associated with regulatory compliance and fund security are particularly concerning. Traders should be aware of these risks and take appropriate measures to mitigate them, such as conducting thorough due diligence and considering alternative platforms with better safety records.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the safety and legitimacy of MLC as a trading platform. The lack of regulatory oversight, combined with negative customer feedback and questionable trading conditions, suggests that traders should approach MLC with caution.

While some traders may still consider using MLC, it is crucial to weigh the risks and potential drawbacks. For those seeking a safer trading environment, it may be advisable to explore alternative platforms with robust regulatory frameworks and positive customer experiences. Ultimately, the question of whether MLC is safe remains contentious, and potential users should proceed with caution.

Is MLC a scam, or is it legit?

The latest exposure and evaluation content of MLC brokers.

MLC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MLC latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.