Is UKG safe?

Pros

Cons

Is UKG Safe or a Scam?

Introduction

UKG, also known as UKG Finance or UKG Forex, positions itself as a player in the forex trading market, offering a range of trading services that include forex, cryptocurrencies, and CFDs. However, as the forex market is rife with potential pitfalls, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy of brokers before committing their funds. This article aims to provide an objective analysis of UKG's credibility, utilizing a structured framework that encompasses regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, risk assessment, and ultimately, a conclusion regarding its safety.

Regulation and Legitimacy

The regulatory landscape is a cornerstone of any broker's credibility. A regulated broker is typically subject to oversight by a recognized authority, which helps ensure that it adheres to industry standards and protects client funds. UKG claims to be based in New Zealand and mentions being regulated by the Financial Service Providers Register (FSP). However, the FSP is not a regulatory body but rather a registration service, which raises significant concerns regarding the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSP | N/A | New Zealand | Unverified |

Despite UKG's claims, a thorough examination reveals that it is not listed on the Financial Markets Authority (FMA) of New Zealand's register, which is the actual regulatory body in that region. Furthermore, the absence of any verifiable licensing information suggests that UKG operates without the necessary oversight, making it a potential risk for traders.

The quality of regulation is paramount. Brokers that are unregulated or operate under dubious claims can pose significant risks to investors, especially in terms of fund safety and dispute resolution. Given the lack of credible regulatory oversight for UKG, it is prudent to approach this broker with caution.

Company Background Investigation

UKG's history and ownership structure are vital components in assessing its reliability. Established in 2019, UKG Capital Ltd claims to operate under the UKG brand. However, there is a conspicuous lack of transparency regarding the company's ownership and management team. Many sources indicate that the true location and ownership details of UKG remain undisclosed, which further complicates the assessment of its credibility.

The management teams credentials and experience play a crucial role in the broker's operations. Unfortunately, there is little information available about the individuals behind UKG. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their management team to build trust with potential clients.

In terms of information disclosure, UKGs website offers minimal insight into its operations, which is a red flag for potential investors. A trustworthy broker should provide comprehensive details about its services, policies, and operational practices. In this case, the absence of such information raises questions about UKG's overall transparency and reliability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for any trader. UKG claims to provide various account types with different minimum deposit requirements, but the overall cost structure appears to be high compared to industry standards.

| Fee Type | UKG | Industry Average |

|---|---|---|

| Spread for Major Pairs | 2 pips | 1.5 - 2 pips |

| Commission Structure | None disclosed | Varies (typically low) |

| Overnight Interest Range | Not specified | Typically 0.5% - 1% |

The spread for major currency pairs is notably high, which can significantly impact trading profitability. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises concerns about hidden fees that could further erode traders' capital.

Moreover, the absence of a free demo account limits traders' ability to test the platform before committing real funds. This lack of flexibility in trading conditions is a significant drawback for those considering UKG as their trading partner. Overall, the trading conditions at UKG do not align with what is typically expected from reputable brokers, which warrants further scrutiny.

Customer Funds Safety

The safety of customer funds is a critical aspect of any broker's operations. UKG claims to implement measures to protect client funds, but the specifics of these measures are vague and not well-documented.

Key safety measures to consider include fund segregation, investor protection schemes, and negative balance protection policies. Unfortunately, UKG does not provide clear information regarding these practices, which raises concerns about the safety of client funds.

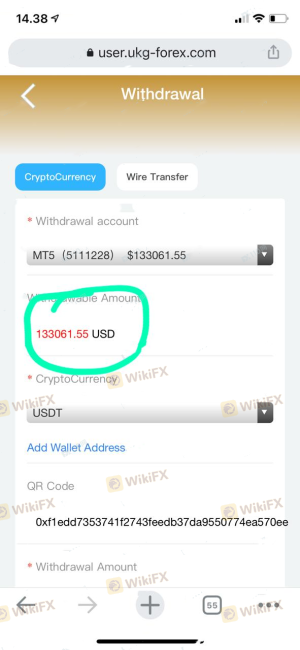

Historically, there have been reports of UKG users experiencing difficulties when attempting to withdraw funds. Such issues are often indicative of underlying problems with a broker's financial practices. If a broker discourages withdrawals or imposes excessive fees, it could signal a lack of financial integrity.

In light of these considerations, traders should be wary of investing with UKG, as the lack of transparent safety measures and historical complaints regarding fund withdrawals suggest potential risks to their capital.

Customer Experience and Complaints

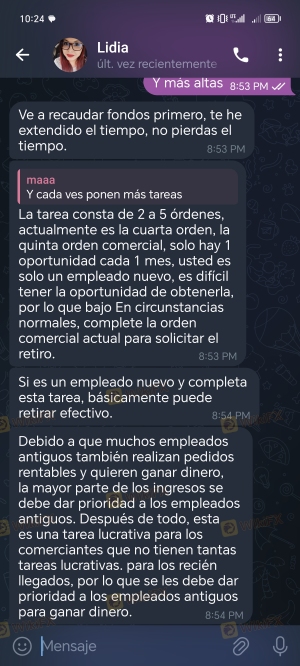

Customer feedback is a crucial indicator of a broker's reliability. Reviews of UKG paint a largely negative picture, with numerous complaints highlighting issues related to fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor response, delays |

| Lack of Customer Support | Medium | Limited communication |

| Misleading Promotions | High | No clear response |

Common complaints include difficulties in accessing funds, unresponsive customer support, and claims of misleading promotional offers. For instance, one user reported losing a significant amount of money after being unable to withdraw their funds, which suggests a pattern of behavior that could be classified as fraudulent.

These complaints raise serious concerns about UKG's commitment to customer service and ethical trading practices. The quality of a broker's customer support is critical, especially when clients encounter issues that require immediate resolution. The lack of effective communication and support from UKG further compounds the risks associated with trading through this broker.

Platform and Trade Execution

The trading platform is the primary interface through which traders interact with the market. UKG claims to offer a proprietary trading platform, but reviews indicate that users have experienced performance issues, including frequent outages and slow execution speeds.

Order execution quality is another critical factor. Delays, slippage, and order rejections can significantly impact trading outcomes. Reports from users suggest that UKG may exhibit problematic execution practices, which could compromise traders' strategies and lead to financial losses.

Given these concerns, the platform's performance raises red flags, indicating that traders may face challenges in executing their trades effectively.

Risk Assessment

Trading with any broker carries inherent risks, and UKG is no exception. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Financial Risk | High | Historical withdrawal issues reported |

| Operational Risk | Medium | Platform performance issues noted |

| Customer Service Risk | High | Poor responsiveness to complaints |

To mitigate these risks, traders should conduct thorough due diligence before engaging with UKG. It is advisable to start with smaller investments and consider using alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that UKG is not a safe broker for trading activities. The lack of credible regulation, combined with numerous customer complaints and concerns regarding fund safety, raises significant red flags.

For traders seeking reliable forex trading options, it is crucial to consider well-regulated brokers with transparent practices and positive customer feedback. Recommended alternatives include brokers that are regulated by reputable authorities such as the FCA or ASIC, which offer robust investor protection measures and a commitment to ethical trading practices.

In summary, traders should exercise extreme caution when considering UKG and prioritize their financial safety by opting for more reputable trading platforms.

Is UKG a scam, or is it legit?

The latest exposure and evaluation content of UKG brokers.

UKG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UKG latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.