Is LS MARKETS safe?

Business

License

Is LS Markets Safe or a Scam?

Introduction

LS Markets is a forex broker that has emerged in the financial trading landscape, primarily targeting the Chinese market and offering a variety of trading instruments, including forex, commodities, and CFDs. As the forex market continues to grow, the importance of selecting a reputable broker cannot be overstated. Traders must exercise caution and conduct thorough evaluations of any broker they consider to ensure their investments are secure and their trading experience is positive. This article aims to provide an objective assessment of LS Markets, examining its regulatory status, company background, trading conditions, customer safety, and user experiences to determine if LS Markets is safe or a potential scam.

To conduct this investigation, we analyzed multiple sources, including regulatory databases, user reviews, and expert assessments, focusing on key factors such as regulation, company history, trading conditions, and customer feedback. By employing a structured evaluation framework, we aim to present a comprehensive overview of LS Markets and help traders make informed decisions.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in assessing its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict standards of conduct and financial practices. In the case of LS Markets, the broker claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the National Futures Association (NFA). However, upon further investigation, it has been revealed that LS Markets is not currently registered with these regulatory bodies, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001281499 | Australia | Deregistered |

| NFA | N/A | USA | Not a member |

| BVI FSC | N/A | British Virgin Islands | Not registered |

The above table highlights the lack of valid regulation for LS Markets. The deregistration with ASIC indicates that the broker does not meet the necessary compliance standards, while the absence of NFA membership further emphasizes the lack of oversight. This absence of regulatory authority raises red flags, as it implies that clients' funds may not be protected under any legal framework. As such, it is prudent for traders to consider the implications of trading with an unregulated broker.

Company Background Investigation

LS Markets operates under the name LS Markets Pty Ltd, a company that claims to be registered in the British Virgin Islands. However, the details surrounding its establishment and ownership structure remain vague. The broker was founded in 2020, and its relatively short history raises questions about its stability and reliability in the highly competitive forex market.

The management team of LS Markets has not been publicly disclosed, leading to concerns about transparency and accountability. A lack of information about the individuals behind the company can make it challenging for traders to assess the broker's credibility. Furthermore, the broker's website offers limited insights into its operational practices and mission, which is often a warning sign for potential investors.

Transparency is vital in the financial sector, as it fosters trust between brokers and their clients. In the case of LS Markets, the insufficient information available regarding its ownership and management does not inspire confidence. As such, traders should approach this broker with caution, considering the potential risks associated with engaging with a company that lacks a clear and transparent operational framework.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. LS Markets claims to offer competitive spreads and a range of trading instruments. However, several reports indicate that the broker's fee structure may not be as favorable as advertised. Traders have reported unexpected charges and withdrawal issues, which can significantly impact their trading experience.

| Fee Type | LS Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | Variable | 0.5% - 2.0% |

The above table illustrates the discrepancies in trading costs associated with LS Markets. While the broker may advertise low spreads, the variability and lack of transparency regarding commissions and overnight interest can lead to unexpected costs for traders. Such practices are often indicative of brokers that may not prioritize their clients' best interests, raising further concerns about whether LS Markets is safe for trading.

Customer Funds Security

The security of customer funds is paramount in the forex trading environment. LS Markets claims to implement various measures to protect client funds; however, the absence of regulatory oversight significantly undermines these assertions. The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies.

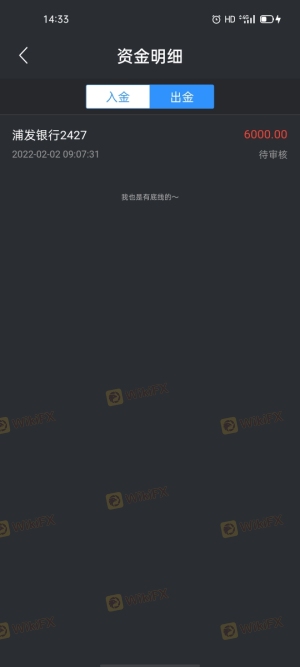

In regulated environments, brokers are typically required to maintain client funds in segregated accounts and participate in compensation schemes to protect investors. The lack of such measures at LS Markets raises concerns about the safety of traders' investments. Additionally, historical complaints from users regarding difficulties in withdrawing funds further exacerbate these concerns, suggesting that the broker may not be adhering to best practices in fund management.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reputation. Numerous reviews and testimonials from users indicate a pattern of complaints related to withdrawal issues, lack of responsive customer support, and unfulfilled promises regarding trading conditions.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Inconsistent |

| Misleading Promotions | High | No response |

The table above summarizes the primary complaints associated with LS Markets. The severity of withdrawal issues is particularly concerning, as it directly impacts traders' access to their funds. Many users have reported difficulties in processing withdrawals, often citing excuses from customer support or prolonged waiting periods. Such experiences can lead to significant financial distress for traders and indicate a lack of accountability on the broker's part.

Platform and Execution

The trading platform's performance and execution quality are essential for a successful trading experience. LS Markets offers access to popular platforms such as MetaTrader 5; however, user experiences suggest that there may be issues with execution quality, including slippage and order rejections.

Traders have reported instances of orders not being executed at the desired prices, which can lead to significant losses. Moreover, the potential for platform manipulation has been raised by users who have experienced sudden changes in spreads or execution delays during volatile market conditions. Such practices are concerning and warrant careful consideration when evaluating whether LS Markets is safe for trading.

Risk Assessment

Engaging with LS Markets presents several risks that traders should be aware of. The lack of regulatory oversight, combined with reports of withdrawal issues and platform execution problems, creates a high-risk environment for investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Withdrawal Risk | High | Reports of difficulties in accessing funds. |

| Execution Risk | Medium | Issues with order execution and slippage. |

The above risk assessment highlights the critical areas of concern for traders considering LS Markets. To mitigate these risks, it is advisable for potential investors to conduct thorough research, seek alternative brokers with established reputations, and consider starting with smaller investments until they gain confidence in the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding the safety and legitimacy of LS Markets. The lack of valid regulation, coupled with numerous user complaints and issues related to fund withdrawals, suggests that LS Markets may not be a trustworthy broker. Traders are advised to exercise extreme caution when dealing with this broker and consider the potential risks involved.

For those seeking reliable alternatives, it is recommended to explore brokers that are regulated by reputable authorities such as ASIC, FCA, or NFA. These brokers typically offer better protection for client funds, transparent trading conditions, and responsive customer support. Always prioritize safety and conduct thorough due diligence before committing to any forex broker.

Is LS MARKETS a scam, or is it legit?

The latest exposure and evaluation content of LS MARKETS brokers.

LS MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LS MARKETS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.