Regarding the legitimacy of Lmgmarket forex brokers, it provides CYSEC and WikiBit, .

Is Lmgmarket safe?

Business

License

Is Lmgmarket markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

AFX Capital Markets Ltd

Effective Date:

2010-07-09Email Address of Licensed Institution:

info@afxgroup.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.afxcapital.com/, http://www.stofs.com, http://www.stoaffiliates.com, http://www.afxaffiliates.com, http://www.market-technologies.com, http://www.quanticaffiliates.com, http://www.quantic-am.com, http://www.afxgroup.com, https://www.afxgroup.com/Expiration Time:

--Address of Licensed Institution:

Ascot House 2 Woodberry Grove London N12 0FB United KingdomPhone Number of Licensed Institution:

35725262710Licensed Institution Certified Documents:

Is LMGMarket Safe or a Scam?

Introduction

LMGMarket is a forex broker that has garnered attention in the trading community, primarily for its offerings in the foreign exchange market. As with any trading platform, it is crucial for traders to conduct thorough due diligence before investing their hard-earned money. The forex market is notorious for its volatility and the presence of unscrupulous brokers, making it essential for traders to evaluate the legitimacy and safety of their chosen brokers carefully. In this article, we will analyze whether LMGMarket is a safe trading platform or if it exhibits characteristics of a scam. Our investigation will rely on a comprehensive review of regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and legitimacy. LMGMarket operates without any significant regulatory oversight, which raises red flags for potential investors. Below is a summary of the regulatory information we have found:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

As indicated in the table, LMGMarket lacks any valid regulatory licenses, which is a significant concern for traders. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) enforce strict guidelines to protect traders. The absence of regulation means that traders have limited recourse in case of disputes or financial losses. Furthermore, the broker's claims of having a suspicious regulatory license have been flagged by multiple sources, indicating a lack of transparency and potential compliance issues.

The importance of regulation cannot be overstated; it serves as a safeguard for traders, ensuring that brokers adhere to certain operational standards and provide a level of investor protection. In the case of LMGMarket, the lack of oversight suggests that traders may be exposing themselves to unnecessary risks. Therefore, the question remains: Is LMGMarket safe? The evidence points towards a negative response.

Company Background Investigation

LMGMarket's history and ownership structure are vital aspects to consider when assessing its reliability. The broker is reported to have been operating for approximately 2 to 5 years, but concrete information about its founders or management team is scarce. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their leadership and corporate structure.

The absence of a well-documented history raises questions about the broker's intentions and operational practices. Furthermore, the management teams background, including their professional experience and qualifications, is not readily available, which is another indicator of a potential scam. A trustworthy broker would generally highlight the expertise of its team to instill confidence among potential clients.

In terms of transparency, LMGMarket appears to fall short. The brokers website does not provide sufficient information regarding its operations, leading to speculation about its legitimacy. This lack of disclosure can be a significant warning sign for traders. Therefore, when asking, Is LMGMarket safe?, the answer leans towards skepticism due to the opaque nature of its operations.

Trading Conditions Analysis

Evaluating the trading conditions offered by LMGMarket is essential in determining whether it operates fairly. The broker claims to provide competitive spreads and various trading instruments; however, the actual trading costs can significantly affect a trader's profitability. Below is a comparison of the core trading costs associated with LMGMarket and industry averages:

| Fee Type | LMGMarket | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 pips |

| Commission Model | TBD | $5 per lot |

| Overnight Interest Range | TBD | Varies |

While specific figures for LMGMarket are currently unavailable, it is crucial to note that many brokers often have hidden fees or unfavorable conditions that can impact a trader's bottom line. The existence of unexpected charges, such as withdrawal fees or inactivity fees, can also add to the overall cost of trading.

Furthermore, the broker's policies regarding bonuses and promotions should be scrutinized, as these can sometimes come with stringent withdrawal conditions that may trap traders' funds. In light of these concerns, traders should carefully consider whether the trading conditions offered by LMGMarket align with their trading strategies and risk tolerance. Thus, the question of Is LMGMarket safe? remains pertinent, especially concerning its trading conditions.

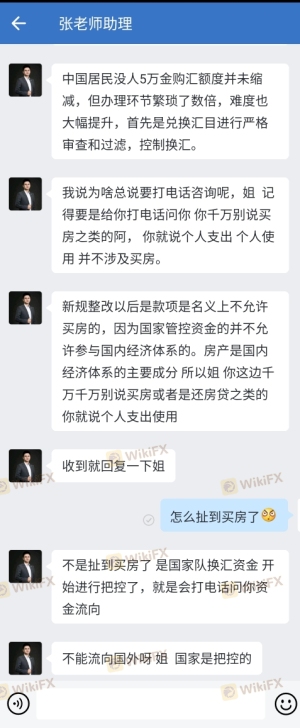

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. LMGMarket's practices regarding fund security are particularly alarming due to the lack of regulatory oversight. Typically, reputable brokers implement measures such as segregated accounts to ensure that client funds are kept separate from the company's operational funds. This practice protects traders' investments in case of the broker's insolvency.

Unfortunately, there is no evidence that LMGMarket employs such security measures. The absence of investor protection policies, such as negative balance protection, further exacerbates the risks associated with trading on this platform. Traders may find themselves liable for losses exceeding their deposits, a scenario that is unacceptable in a regulated environment.

Additionally, historical complaints regarding difficulties in withdrawing funds from LMGMarket have surfaced, indicating potential issues with the broker's financial practices. Such complaints raise serious concerns about the safety of customer funds. When evaluating whether Is LMGMarket safe?, it is evident that the broker's practices do not inspire confidence in the protection of traders' investments.

Customer Experience and Complaints

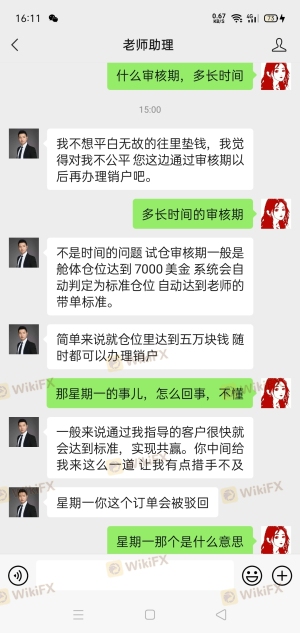

Customer feedback provides valuable insights into a broker's reliability and operational integrity. A review of customer experiences with LMGMarket reveals a pattern of dissatisfaction, particularly regarding withdrawal issues and customer support responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Ineffective |

| Account Management | High | Unresponsive |

Several traders have reported being unable to withdraw their funds, with some citing various excuses provided by the broker. Such complaints are alarming and suggest that LMGMarket may be employing tactics to delay or deny withdrawals. This behavior is often characteristic of scam brokers, who aim to retain clients' funds for as long as possible.

Moreover, the quality of customer support is another critical factor. Traders have expressed frustration over long wait times and unhelpful responses from the support team. A reliable broker should prioritize customer service and provide timely assistance to its clients. Given these issues, it is reasonable to question Is LMGMarket safe? The evidence indicates that customer experience is far from satisfactory, raising concerns about the broker's legitimacy.

Platform and Execution Quality

The performance of a trading platform can significantly impact a trader's experience. LMGMarket claims to offer a user-friendly platform with reliable execution, but the reality may differ. An in-depth evaluation of the platform's stability, order execution quality, and any signs of manipulation is necessary.

Traders have reported instances of slippage and rejected orders, which can be detrimental in fast-moving markets. If a broker frequently experiences technical issues or fails to execute trades promptly, it can lead to significant losses for traders. Furthermore, any signs of platform manipulation, such as artificially widening spreads during high volatility, should be scrutinized.

Given these factors, traders must consider the overall reliability of LMGMarket's trading platform. When pondering Is LMGMarket safe?, the potential for execution issues and technical instability raises further doubts about the broker's trustworthiness.

Risk Assessment

Understanding the risks associated with trading on a particular platform is essential for any trader. LMGMarket presents several risk factors that should be carefully evaluated. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Financial Risk | High | Potential withdrawal issues. |

| Operational Risk | Medium | Platform stability concerns. |

The absence of regulatory oversight is a significant risk factor, as traders have little recourse in the event of disputes. Additionally, the potential for financial loss due to withdrawal issues further exacerbates the situation. Traders should be aware of these risks and consider implementing strategies to mitigate them, such as limiting their initial investments and diversifying their trading portfolios.

In conclusion, the overall risk profile of LMGMarket suggests that it may not be a safe choice for traders. Therefore, it is imperative for potential clients to weigh these risks carefully before proceeding.

Conclusion and Recommendations

After a comprehensive analysis of LMGMarket, it is evident that the broker exhibits several concerning characteristics that warrant caution. The lack of regulatory oversight, transparency in operations, and numerous complaints regarding customer experiences all point towards the possibility of LMGMarket being a scam.

In response to the question, Is LMGMarket safe?, the evidence suggests that traders should exercise extreme caution. For those seeking reliable trading options, it is advisable to consider brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction.

If you are considering entering the forex market, look for established brokers with robust regulatory frameworks and positive customer reviews. Some reputable alternatives include brokers regulated by the FCA, ASIC, or CySEC, which have demonstrated their commitment to client safety and transparent operations. Always prioritize safety and diligence in your trading endeavors.

Is Lmgmarket a scam, or is it legit?

The latest exposure and evaluation content of Lmgmarket brokers.

Lmgmarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lmgmarket latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.