Is Liqutek safe?

Business

License

Is Liqutek Safe or a Scam?

Introduction

Liqutek is a forex broker that has emerged in the competitive landscape of online trading, positioning itself as a provider of various financial instruments, including forex, commodities, and indices. The rise of online trading platforms has made it easier for individuals to access global markets, but it has also led to an increase in fraudulent activities. Therefore, it is crucial for traders to thoroughly evaluate the legitimacy and safety of any broker before entrusting them with their funds. This article aims to investigate whether Liqutek is a safe trading platform or a potential scam. Our evaluation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, client feedback, and risk assessment.

Regulation and Legitimacy

Understanding the regulatory status of a forex broker is vital for assessing its credibility. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect investors. Unfortunately, Liqutek operates under a suspicious regulatory framework, with no significant licenses from major financial authorities. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unverified |

Liqutek is registered in Seychelles, a jurisdiction known for its lenient regulatory environment. This raises concerns regarding the quality of oversight and the potential risks associated with trading on this platform. The lack of regulation from a reputable financial authority means that traders have limited recourse in the event of disputes or issues. Furthermore, several online reviews and reports indicate that traders have faced withdrawal issues, with claims that their accounts were blocked or that they were unable to access their funds. This history of complaints suggests a pattern of behavior that is concerning for potential clients. Thus, when asking "Is Liqutek safe?", the answer leans towards caution.

Company Background Investigation

Liqutek Global Ltd, the parent company of Liqutek, has a relatively obscure history. There is limited information available regarding its founding, ownership structure, and operational history. This lack of transparency can be a red flag for potential investors. The management team behind Liqutek is also not well-documented, which raises questions about their qualifications and experience in the financial sector.

A transparent company typically provides detailed information about its leadership, including professional backgrounds and previous roles in the industry. In Liqutek's case, such information is either absent or difficult to verify, which can lead to skepticism among traders. The absence of a clear history and management transparency further complicates the assessment of whether "Is Liqutek safe?" Ultimately, the lack of credible information can deter potential clients from engaging with the broker.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are a critical factor. Liqutek claims to offer competitive spreads and leverage options, but the reality may differ significantly. The overall fee structure can impact a trader's profitability and should be analyzed carefully. Below is a comparison of core trading costs:

| Fee Type | Liqutek | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0-2.0 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | 0.5-1.5% |

While the specifics are not fully disclosed, many traders have reported hidden fees and unexpected charges. Such practices are often indicative of less reputable brokers. Traders should be wary of any broker that does not provide clear and transparent information about their fee structures, as this can lead to significant financial losses. Therefore, when considering "Is Liqutek safe?", one must factor in the potential for hidden costs that could affect overall trading performance.

Client Fund Security

The safety of client funds is paramount when evaluating any forex broker. Liqutek's measures for securing client funds are unclear. A reputable broker typically segregates client funds from their own operational funds and offers investor protection schemes. However, there is no evidence that Liqutek implements such practices.

Additionally, the absence of any insurance or compensation schemes leaves clients vulnerable in the event of financial distress. Reports of users being unable to withdraw their funds raise serious concerns about the broker's financial stability and commitment to protecting clients investments. Therefore, the question of "Is Liqutek safe?" becomes more pressing, as the lack of robust security measures could expose traders to significant risks.

Customer Experience and Complaints

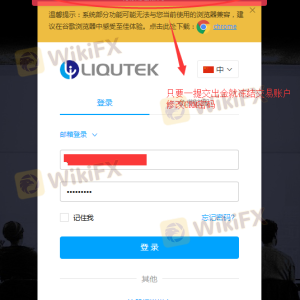

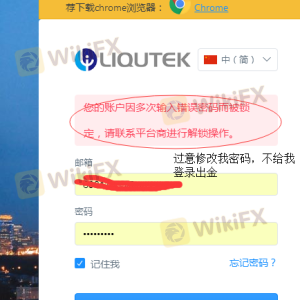

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Liqutek reveal a mixed bag of experiences, with many users expressing dissatisfaction with the service. Common complaints include difficulty in withdrawing funds, unresponsive customer service, and issues with account management. Below is a summary of major complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Fair |

| Account Management Issues | High | Poor |

Several users have reported that their accounts were blocked without explanation, and attempts to contact customer service were met with delays or no response at all. Such experiences are concerning and indicate a lack of professionalism and accountability. For potential clients, these issues raise a significant question about the safety and reliability of trading with Liqutek.

Platform and Execution

The trading platform's performance is a crucial factor in a trader's experience. Liqutek offers the popular MetaTrader 4 and 5 platforms, which are known for their user-friendly interfaces and robust trading tools. However, there have been reports of execution issues, including slippage and order rejections. These problems can severely impact a trader's ability to execute strategies effectively.

Additionally, any signs of platform manipulation should be taken seriously. Traders have expressed concerns about the reliability of order execution on Liqutek's platform, which adds to the growing list of reasons to question whether "Is Liqutek safe?". A broker that cannot guarantee stable and efficient trade execution poses a risk to traders' investments.

Risk Assessment

When considering the overall risk of using Liqutek, several factors must be assessed. Below is a risk summary card that highlights key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No significant regulation |

| Fund Security | High | Lack of investor protection |

| Customer Service | Medium | Poor response to complaints |

| Trading Conditions | High | Unclear fee structure |

Given these assessments, the risks associated with trading on Liqutek are substantial. Traders should exercise extreme caution and consider alternative brokers with better regulatory oversight and customer service.

Conclusion and Recommendations

In conclusion, the investigation into Liqutek raises significant concerns regarding its safety and legitimacy. The lack of regulation, poor customer feedback, and issues with fund security all point to a broker that may not be trustworthy. Therefore, potential traders should be wary and consider the risks involved.

For those seeking reliable trading options, it may be prudent to explore brokers that are regulated by top-tier authorities, offer transparent fee structures, and provide robust customer support. Some reputable alternatives include brokers regulated by the FCA, ASIC, or NFA, which can offer a more secure trading environment. Ultimately, the question "Is Liqutek safe?" leans towards a cautious "no," and traders are advised to proceed with care.

Is Liqutek a scam, or is it legit?

The latest exposure and evaluation content of Liqutek brokers.

Liqutek Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Liqutek latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.