Regarding the legitimacy of Limestone FX forex brokers, it provides ASIC and WikiBit, .

Is Limestone FX safe?

Business

License

Is Limestone FX markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

BaileyHenry Capital Group Pty Ltd

Effective Date:

2016-11-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-01-25Address of Licensed Institution:

GARY WARNER, Suite 204 Level 2, 185 Elizabeth Street SYDNEY NSW 2000, Suite 204, Level 2, 185 Elizabeth Street, Sydney, NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

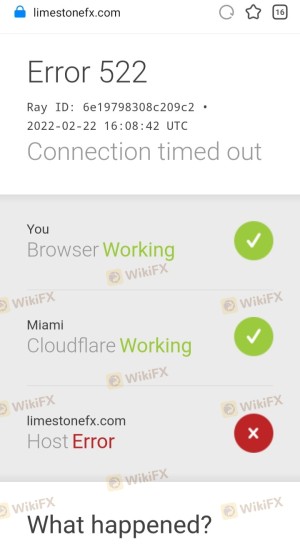

Is Limestone FX A Scam?

Introduction

Limestone FX is a relatively new player in the forex market, having been established in 2019. With a focus on providing online trading services, it positions itself as a broker catering to various trading instruments, including forex, commodities, and cryptocurrencies. As traders increasingly navigate the complex landscape of online trading, it becomes crucial to assess the legitimacy and safety of the brokers they choose to work with. The potential for scams and fraudulent practices in the forex market necessitates a thorough evaluation of trading platforms. This article examines the regulatory framework, company background, trading conditions, customer experiences, and overall safety of Limestone FX to determine if it is a reliable trading partner or a scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect traders' interests. Limestone FX claims to be regulated by the Australian Securities and Investments Commission (ASIC); however, there are concerns regarding the authenticity of this claim. Below is a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 488340 | Australia | Suspicious |

The lack of a valid regulatory license raises significant concerns about the operational integrity of Limestone FX. Regulatory bodies like ASIC are known for their stringent requirements, and any indication of a broker being a "clone" or unregulated should be treated with caution. The absence of genuine oversight can expose traders to substantial risks, including the potential loss of funds without recourse.

Company Background Investigation

Limestone FX was founded in 2019, and its operational history is relatively short compared to more established brokers. The company claims to offer various trading services, including forex and CFDs, but details about its ownership structure and management team are scant. A transparent company should provide clear information about its founders, management, and operational history, which is essential for building trust with potential clients.

The management teams experience in the financial industry is a critical factor in determining the broker's reliability. If the management lacks experience or a solid track record, it could lead to poor decision-making and operational issues. Furthermore, the company's transparency in disclosing its operational practices and financial health is vital. Traders should be wary of any broker that does not provide easily accessible information about its background and regulatory compliance.

Trading Conditions Analysis

Limestone FX presents a variety of trading conditions, including various account types and fee structures. The overall cost structure is essential for traders to understand, as it directly impacts profitability. Below is a comparison of core trading costs associated with Limestone FX:

| Fee Type | Limestone FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 pips |

| Commission Model | None | $5 per trade |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 2.0% |

While Limestone FX offers competitive spreads, the absence of a transparent commission structure can be a red flag. Traders should be cautious of hidden fees that may not be clearly outlined. Additionally, the overnight interest rates charged can significantly affect trading costs, especially for those who hold positions overnight. Understanding these costs is crucial for traders looking to maximize their returns.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Limestone FX claims to implement various security measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures remains questionable given the broker's regulatory status.

Traders should assess whether their funds are held in segregated accounts at reputable banks, as this practice ensures that client funds are protected in the event of the broker's insolvency. Additionally, the presence of negative balance protection policies is essential, as it prevents traders from losing more than their initial investment. Historical issues related to fund security or any unresolved disputes can further indicate the broker's reliability.

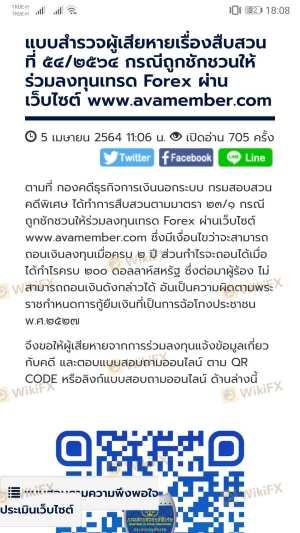

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the trustworthiness of a broker. Limestone FX has received mixed reviews from users, with several complaints regarding withdrawal times and customer service quality. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent help |

| Account Management Issues | Low | Limited assistance |

Common complaints revolve around the slow processing of withdrawals, which can be a significant concern for traders wanting quick access to their funds. The quality of customer support plays a crucial role in resolving issues, and a lack of responsiveness can lead to frustration and mistrust among clients. Typical cases of complaints highlight the importance of efficient communication and timely resolutions, which are essential for maintaining a positive client relationship.

Platform and Trade Execution

The performance of the trading platform used by Limestone FX is another critical factor to consider. A reliable platform should provide stability, speed, and a user-friendly interface. Traders expect quick order execution, minimal slippage, and a low rejection rate. Any signs of platform manipulation or technical issues can severely impact trading performance.

Traders should also evaluate the availability of trading tools and resources that enhance their trading experience. The presence of technical indicators, charting tools, and educational resources can significantly benefit traders, especially those new to the market.

Risk Assessment

Using Limestone FX comes with inherent risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of genuine regulation |

| Fund Safety Risk | Medium | Concerns about fund protection |

| Customer Service Risk | Medium | Complaints about support responsiveness |

Traders should be prudent when engaging with Limestone FX, particularly due to the high regulatory risk associated with its operations. To mitigate these risks, traders should conduct thorough research, utilize demo accounts, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Limestone FX raises several red flags regarding its legitimacy and safety. While it offers various trading instruments and competitive spreads, the lack of genuine regulatory oversight, mixed customer feedback, and potential issues with fund security warrant caution.

Traders should be vigilant and consider alternative brokers with a proven track record of reliability and regulatory compliance. If you are a novice trader or someone looking for a safe trading environment, it may be wise to explore options with well-established brokers that prioritize client protection and offer transparent trading conditions.

In summary, is Limestone FX safe? The answer remains uncertain, and potential traders are advised to conduct their due diligence before engaging with this broker.

Is Limestone FX a scam, or is it legit?

The latest exposure and evaluation content of Limestone FX brokers.

Limestone FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Limestone FX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.