Is AVIC safe?

Pros

Cons

Is AVIC Safe or Scam?

Introduction

AVIC, an online trading broker, positions itself within the forex market as a facilitator for trading various financial instruments, including foreign exchange and cryptocurrencies. With its claims of being headquartered in London and operating under the auspices of AVIC Intl Group Holdings Ltd, it seeks to attract traders looking for a reliable platform. However, the necessity for traders to carefully evaluate forex brokers cannot be overstated. The forex market is rife with potential scams, and traders can easily fall victim to unscrupulous practices if they do not conduct thorough due diligence. This article investigates the legitimacy of AVIC by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors, providing a comprehensive assessment of whether AVIC is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is a crucial indicator of its legitimacy. Brokers that operate under strict regulations are generally considered safer, as they are required to adhere to specific standards that protect investors. AVIC claims to be regulated by the National Futures Association (NFA), but investigations reveal that it is not recognized by this regulatory body. Furthermore, checks with other major regulatory authorities, such as the Financial Conduct Authority (FCA) in the UK and the Monetary Authority of Singapore (MAS), show no record of AVIC being registered or licensed.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | N/A | USA | Not Approved |

| Financial Conduct Authority (FCA) | N/A | UK | Not Registered |

| Monetary Authority of Singapore (MAS) | N/A | Singapore | Not Registered |

The lack of a legitimate regulatory license raises significant concerns about the safety of funds deposited with AVIC. The absence of oversight implies that traders may not have recourse in the event of disputes or fraudulent activities. Given these findings, it is reasonable to conclude that AVIC is not safe for traders seeking a regulated trading environment.

Company Background Investigation

AVIC's history and ownership structure are essential factors in assessing its credibility. Established under the banner of AVIC Intl Group Holdings Ltd, the broker claims to have a foundation in London, with additional offices purportedly located in Hong Kong and Singapore. However, the veracity of these claims is questionable, as no substantial evidence supports the existence of such offices or any historical milestones that would establish credibility.

The management team behind AVIC is not well-documented, and there is a lack of transparency regarding their qualifications and professional experiences. This opacity raises further red flags; a reputable broker typically provides detailed information about its leadership team to instill confidence in potential clients. Without this transparency, traders are left in the dark about who is managing their investments, which is a crucial aspect of determining whether AVIC is safe.

Trading Conditions Analysis

An in-depth examination of AVIC‘s trading conditions is vital for understanding the costs associated with using its platform. Traders should be aware of all fees and commissions that may affect their profitability. AVIC’s website outlines various deposit methods, including credit cards and wire transfers, but it lacks clarity regarding withdrawal processes and associated fees. This lack of transparency can be problematic for traders.

| Fee Type | AVIC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies (typically $0 - $10 per lot) |

| Overnight Interest Range | N/A | Varies (typically 2% - 5%) |

The absence of clear information on spreads and commissions is concerning. Traders often rely on this data to compare brokers and make informed decisions. If AVIC does not provide transparent trading costs, it may indicate a lack of commitment to fair trading practices. Consequently, traders should approach AVIC with caution, as the unclear fee structure may suggest that AVIC is not safe.

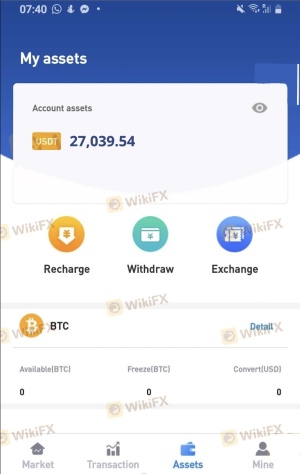

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. AVIC claims to implement various security measures to protect client investments, but the specifics of these measures remain vague. The absence of information regarding segregated accounts, investor protection schemes, or negative balance protection raises concerns about the safety of funds held with AVIC.

Historically, brokers that lack proper regulatory oversight often encounter issues related to fund safety. If a broker experiences financial difficulties, clients may find it challenging to recover their investments. Therefore, it is crucial for traders to understand the implications of trading with a broker like AVIC, which appears to lack robust protections for client funds. This situation further underscores the notion that AVIC is not safe for traders.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. Unfortunately, reviews of AVIC are predominantly negative, with many users reporting issues related to withdrawals, customer service responsiveness, and overall trustworthiness. Common complaints include difficulties in withdrawing funds and a lack of adequate support when issues arise.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Service | Medium | Inconsistent support |

| Account Management | High | Unresolved disputes |

For instance, one user reported being unable to withdraw funds after multiple attempts, leading to frustration and a feeling of being scammed. The lack of proactive communication from AVIC regarding these issues only exacerbates customer dissatisfaction. Such patterns of complaints suggest that traders may face significant challenges when dealing with AVIC, raising further concerns about whether AVIC is safe.

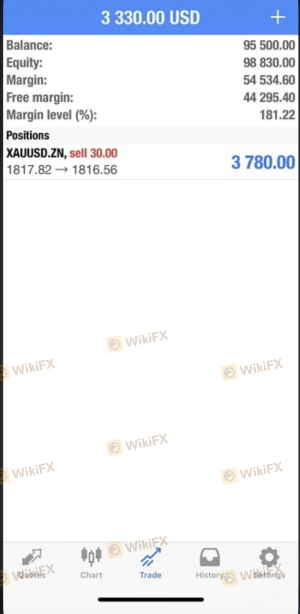

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. AVIC claims to offer a user-friendly interface, but user reviews indicate that the platform may suffer from instability and execution issues. Traders have reported experiencing slippage, delayed order executions, and instances where trades were rejected altogether.

A reliable platform should provide fast and accurate order execution, as any delays can negatively impact trading outcomes. If AVIC's platform fails to deliver on these fronts, it could lead to significant financial losses for traders. The reported issues suggest that traders may be at risk of poor execution quality, which raises further doubts about whether AVIC is safe.

Risk Assessment

Using AVIC as a trading platform presents several risks that traders must consider. The lack of regulation, unclear trading conditions, and negative customer feedback contribute to a high-risk environment. Furthermore, the absence of transparency regarding the company's operations and management adds an additional layer of uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No legitimate regulatory oversight |

| Financial Risk | High | Lack of transparency and unclear fees |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, traders should conduct thorough research before engaging with AVIC. It is advisable to consider alternative brokers with established regulatory frameworks and positive customer feedback. This approach can help safeguard investments and enhance the overall trading experience.

Conclusion and Recommendations

In conclusion, the evidence presented in this analysis strongly suggests that AVIC is not safe for traders. The lack of regulatory oversight, unclear trading conditions, negative customer experiences, and operational risks all point to a potentially fraudulent environment. Traders should exercise extreme caution and consider alternative options that offer robust regulatory protection and positive reputations.

For those seeking reliable forex trading platforms, it is recommended to explore brokers that are regulated by top-tier authorities such as the FCA or ASIC. These brokers typically provide better protections for client funds, transparent trading conditions, and more reliable customer service. By prioritizing safety and due diligence, traders can make informed decisions that enhance their trading experience and protect their investments.

Is AVIC a scam, or is it legit?

The latest exposure and evaluation content of AVIC brokers.

AVIC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AVIC latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.