Regarding the legitimacy of FRX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is FRX safe?

Pros

Cons

Is FRX markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

Noor Capital UK Limited

Effective Date:

2015-03-09Email Address of Licensed Institution:

wahb@noorcapital.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.noorcapital.co.ukExpiration Time:

--Address of Licensed Institution:

Second Floor Berkeley Square House London W1J 6BD UNITED KINGDOMPhone Number of Licensed Institution:

+442033277001Licensed Institution Certified Documents:

Is FRX Safe or Scam?

Introduction

FRX Markets is a forex broker that has emerged in the competitive landscape of foreign exchange trading, offering a variety of financial instruments and trading options to clients globally. As the forex market continues to grow, the need for traders to exercise caution when selecting brokers has never been more critical. With the potential for significant profits comes the risk of scams and fraudulent activities, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide a comprehensive analysis of FRX Markets, examining its regulatory status, company background, trading conditions, customer experiences, and associated risks. Our investigation is based on a review of various online sources, regulatory databases, and customer feedback, ensuring a balanced perspective on whether FRX is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and safety for traders. In the case of FRX Markets, there are significant concerns over its lack of regulation. The absence of oversight from recognized financial authorities raises red flags about the broker's operational integrity and the protection of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

FRX Markets does not hold a license from any level of regulatory authority, which is a critical indicator of its legitimacy. The lack of regulation means that there are no legal frameworks in place to protect investors in the event of disputes or financial mismanagement. Additionally, the absence of a verified online presence further complicates the assessment of FRX's credibility. Regulatory bodies such as the FCA, ASIC, and CFTC enforce stringent requirements for brokers, including maintaining a minimum capital reserve, ensuring transparency in operations, and providing investor protection schemes. The absence of such regulatory oversight in the case of FRX Markets suggests a higher risk for traders, reinforcing the need for caution when dealing with this broker.

Company Background Investigation

FRX Markets (UK) Ltd. was founded in 2019 and claims to offer a wide range of trading instruments, including forex, commodities, and cryptocurrencies. However, there is limited information regarding the companys history, ownership structure, and management team. The lack of transparency in these areas is concerning for potential investors.

The company's registered address is located in Ruislip, London, but there are no verifiable details about its operational history or the qualifications of its management team. A well-established broker typically provides information about its founders and key personnel, including their professional backgrounds and expertise in the financial markets. In contrast, FRX Markets appears to lack this level of transparency, which raises questions about its operational integrity and commitment to customer service.

Moreover, the absence of a clear ownership structure and management information may indicate potential risks associated with investing with FRX Markets. As traders seek to understand the legitimacy of a broker, it is essential to evaluate the transparency of information provided and the company's willingness to disclose relevant details to its clients.

Trading Conditions Analysis

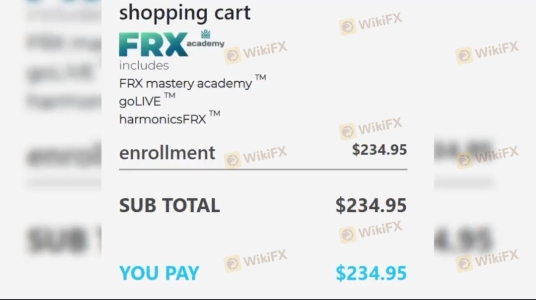

When assessing a broker, understanding its trading conditions, including fees and commissions, is vital. FRX Markets offers various account types, including standard, VIP, and ECN accounts. However, the overall fee structure and trading conditions warrant careful scrutiny.

| Fee Type | FRX Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 1.4 pips | From 1.0 pips |

| Commission Structure | No commission | Varies |

| Overnight Interest Range | Varies | Varies |

While FRX Markets advertises competitive spreads, the actual costs may be higher than industry averages, particularly for less popular currency pairs. Furthermore, the absence of a clear commission structure raises concerns about hidden fees that could impact profitability. Traders should be wary of brokers that do not clearly communicate their fee structures, as this can lead to unexpected costs that eat into trading profits.

Additionally, the lack of transparency regarding overnight interest rates and other trading fees can create an unfavorable trading environment. Traders are encouraged to compare the costs associated with FRX Markets against those of reputable brokers to make informed decisions about their trading options.

Customer Funds Security

The security of customer funds is paramount when evaluating a broker. FRX Markets has been criticized for its lack of adequate measures to protect client funds. The absence of regulatory oversight means that there are no requirements for the segregation of client accounts, putting traders' funds at risk in the event of financial instability or mismanagement by the broker.

Moreover, the lack of investor protection schemes, such as those offered by regulatory bodies, increases the likelihood of financial loss for clients. Traders should be particularly cautious with brokers that do not provide clear information about their fund security measures, as this can indicate potential risks to their investments.

Historically, unregulated brokers have been associated with numerous cases of fund mismanagement, withdrawal issues, and even outright fraud. As such, the absence of a robust framework for managing and safeguarding client funds at FRX Markets raises significant concerns about the overall safety of trading with this broker.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. In the case of FRX Markets, numerous online reviews highlight a range of negative experiences, including difficulties with withdrawals, poor customer service, and unresponsive support teams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misinformation | High | Poor |

Common complaints from users include issues with accessing funds, unfulfilled promises regarding bonuses, and a general lack of support when problems arise. These complaints paint a troubling picture of FRX Markets' customer service and operational practices.

For example, several users have reported being unable to withdraw their funds, with some claiming that their requests were ignored or met with unnecessary delays. Such experiences can significantly undermine traders' confidence in the broker and highlight the potential risks associated with trading on an unregulated platform.

Platform and Execution

The performance of a trading platform is a crucial aspect of the trading experience. FRX Markets offers its services through the MetaTrader 5 (MT5) platform, which is widely regarded for its robust features and user-friendly interface. However, the quality of order execution, including slippage and rejection rates, is essential for assessing the platform's reliability.

While MT5 is known for its stability, user reports indicate potential issues with order execution at FRX Markets. Traders have expressed concerns about high slippage during volatile market conditions, which can lead to significant losses. Additionally, instances of order rejections have been reported, raising questions about the broker's execution quality and reliability.

Overall, while the MT5 platform itself is reputable, the execution quality at FRX Markets may not meet the expectations of traders, particularly those who require precise execution in fast-moving markets.

Risk Assessment

Using FRX Markets presents several risks that potential traders should consider. The lack of regulation and oversight, combined with poor customer feedback, raises significant concerns about the safety and reliability of trading with this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Issues with withdrawal and customer service |

To mitigate these risks, traders are advised to conduct thorough research before engaging with FRX Markets. Seeking out regulated and reputable brokers with a proven track record of customer satisfaction can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

In conclusion, the evidence suggests that FRX Markets raises several red flags regarding its legitimacy and safety. The lack of regulatory oversight, combined with numerous customer complaints and issues related to fund security, indicates that traders should exercise extreme caution when considering this broker.

For those seeking to engage in forex trading, it is advisable to explore alternatives that are properly regulated and have a positive reputation in the trading community. Brokers with established regulatory frameworks offer greater protection for client funds and a more reliable trading experience.

In summary, while FRX Markets may present itself as a viable trading option, the associated risks and concerns indicate that it is not a safe choice for traders. It is crucial to prioritize safety and choose brokers that provide transparency, regulatory oversight, and positive customer experiences.

Is FRX a scam, or is it legit?

The latest exposure and evaluation content of FRX brokers.

FRX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FRX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.