Is LiMarkets safe?

Business

License

Is LiMarkets Safe or Scam?

Introduction

LiMarkets is a forex broker that positions itself as a provider of ECN (Electronic Communication Network) trading services. Established in 2019 and based in St. Vincent and the Grenadines, the broker claims to offer a wide range of trading instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting a broker to ensure that their investments are secure and that they can trade with confidence.

In this article, we will conduct a thorough investigation into the safety and legitimacy of LiMarkets. We will analyze its regulatory status, company background, trading conditions, customer fund security measures, customer experiences, platform performance, and overall risk assessment. Our evaluation will be based on data gathered from various reputable sources, including user reviews, regulatory filings, and industry reports.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and the safety of its clients' funds. LiMarkets is registered with the Financial Services Authority (FSA) of St. Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. This raises questions about the broker's accountability and the level of investor protection it can offer.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA SVG | 151 LLC 2019 | St. Vincent and the Grenadines | Not regulated by a major authority |

The lack of stringent regulation is a significant concern for potential clients. While LiMarkets claims to provide negative balance protection, the absence of oversight from reputable regulatory bodies such as the FCA, ASIC, or CySEC means that traders may have limited recourse in the event of disputes or financial mishaps. Furthermore, offshore brokers often lack transparency, which can lead to potential issues with fund withdrawals and overall trustworthiness.

Company Background Investigation

LiMarkets operates under the ownership of Li Capital Markets LLC. Despite its relatively recent establishment, the broker has garnered attention for its aggressive marketing strategies and promises of high leverage trading. However, the company's history and ownership structure raise several red flags.

The management team's background is not readily available, and the lack of transparency regarding the individuals behind the company is concerning. A reputable broker typically provides detailed information about its management team, including their qualifications and industry experience. The absence of this information may indicate a lack of accountability and raises questions about the broker's operational integrity.

Clients should be wary of investing with a broker that does not clearly disclose its ownership and management structure, as this can be indicative of potential scams or fraudulent activities.

Trading Conditions Analysis

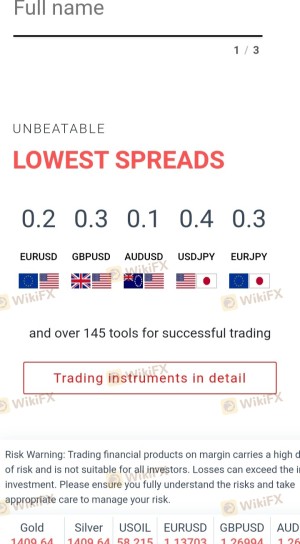

LiMarkets offers various account types with different trading conditions, including high leverage of up to 1:500 and low minimum deposits starting at $1. However, the overall fee structure and trading conditions warrant careful examination.

| Fee Type | LiMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0-1.5 pips |

| Commission Model | $0 - $4 per lot | $5 - $10 per lot |

| Overnight Interest Range | High | Moderate |

While the broker promotes attractive trading conditions, the spreads are higher than the industry average, which could significantly impact profitability. Additionally, the commission structure appears to vary widely, with some accounts incurring substantial fees. Traders should carefully assess whether these costs align with their trading strategies and risk management practices.

Client Fund Security

An essential aspect of evaluating whether "LiMarkets is safe" revolves around its client fund security measures. The broker claims to use segregated accounts for client funds, which is a positive sign. However, the lack of investor protection schemes raises concerns about the safety of deposits.

LiMarkets does not provide any information regarding compensation schemes for clients in the event of insolvency or bankruptcy. This lack of financial security measures can expose traders to significant risks, especially in the volatile forex market. Furthermore, the absence of negative balance protection in certain trading conditions may lead to substantial losses beyond the initial investment.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of LiMarkets reveal a mixed bag of experiences, with many clients expressing frustration over withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal delays | High | Poor |

| Lack of communication | Medium | Poor |

| Account verification issues | Medium | Average |

Common complaints include difficulties in withdrawing funds, lack of timely responses from customer support, and issues with account verification. These problems can significantly impact a trader's experience and raise doubts about the broker's legitimacy.

One notable case involves a trader who reported being unable to withdraw their funds after repeated attempts to contact customer support. This kind of feedback is concerning, especially for those considering investing their money with LiMarkets.

Platform and Trade Execution

The trading platform offered by LiMarkets is based on MetaTrader 5, a widely used trading software known for its user-friendly interface and robust features. However, the overall performance of the platform, including order execution quality and slippage rates, is critical for traders.

Users have reported mixed experiences regarding order execution, with some noting instances of slippage during high-volatility periods. While slippage is common in forex trading, excessive slippage or frequent rejections of orders could indicate underlying issues with the broker's liquidity or execution policies.

Risk Assessment

When evaluating the overall risk of trading with LiMarkets, several factors come into play, including regulatory status, customer feedback, and trading conditions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated offshore broker |

| Fund Security Risk | High | Lack of investor protection |

| Customer Service Risk | Medium | Poor response to complaints |

Given the high-risk levels associated with LiMarkets, traders should approach this broker with caution. It is advisable to implement risk mitigation strategies, such as limiting the amount of capital allocated to this broker and ensuring adequate diversification across different trading accounts.

Conclusion and Recommendations

In conclusion, the investigation into LiMarkets raises several concerns regarding its safety and legitimacy. The lack of robust regulation, transparency in ownership, and poor customer feedback suggest that traders should proceed with caution when considering this broker.

While LiMarkets offers attractive trading conditions, the potential risks outweigh the benefits, particularly for inexperienced traders. It is essential to conduct thorough research and consider alternative brokers with strong regulatory oversight and positive customer experiences.

If you are looking for reliable forex brokers, consider options such as OANDA, IG, or Forex.com, which are known for their regulatory compliance and solid reputations in the industry. Always prioritize safety and transparency when choosing a forex broker to protect your investments and ensure a positive trading experience.

Ultimately, the question "Is LiMarkets safe?" leans towards a cautious "no," and potential clients should be aware of the risks involved.

Is LiMarkets a scam, or is it legit?

The latest exposure and evaluation content of LiMarkets brokers.

LiMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LiMarkets latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.