Is KadoCapital safe?

Business

License

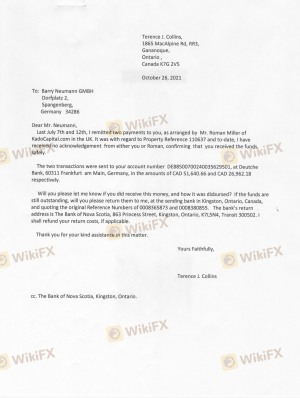

Is Kadocapital A Scam?

Introduction

Kadocapital has emerged in the forex market as a trading platform that claims to offer a wide range of assets, including cryptocurrencies, commodities, and forex pairs. As the trading environment becomes increasingly crowded, traders must exercise caution and conduct thorough assessments of brokerage firms before making financial commitments. The importance of regulatory oversight, company transparency, and user experiences cannot be overstated when determining whether a broker is trustworthy. This article investigates Kadocapital's legitimacy by examining its regulatory status, company background, trading conditions, customer safety measures, and user feedback.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in assessing its safety and reliability. Kadocapital has been flagged by the UK's Financial Conduct Authority (FCA) for operating without proper authorization. This lack of regulation raises serious concerns about the safety of client funds and the overall legitimacy of the broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Blacklisted |

The FCA's warning indicates that Kadocapital does not meet the necessary regulatory requirements to operate legally in the financial markets. Without a credible regulatory framework, clients are not afforded the protections that regulated brokers provide, such as segregated accounts and compensation schemes. The absence of regulatory oversight is a significant red flag, suggesting that traders should be cautious when dealing with this broker.

Company Background Investigation

Kadocapital's background is shrouded in mystery, with little information available about its ownership and management structure. The company claims to operate from the Commonwealth of Dominica, an offshore jurisdiction known for lax regulatory environments. The lack of transparency regarding its ownership and operational history poses additional risks for potential clients.

The management team behind Kadocapital remains largely anonymous, which raises further questions about their qualifications and experience in the financial sector. A reputable broker typically provides detailed information about its management team and their professional backgrounds, which is absent in this case. The overall lack of transparency and information disclosure is concerning and undermines any claims of credibility.

Trading Conditions Analysis

When evaluating a broker, it's essential to analyze their trading conditions, including fees and spreads. Kadocapital's fee structure appears to be competitive at first glance, but traders should be wary of any hidden costs that may arise.

| Fee Type | Kadocapital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable from 0.1 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate to High |

While Kadocapital advertises variable spreads that start at 0.1 pips, traders should be cautious as these rates may not apply to all account types. Additionally, the absence of a clear commission structure may indicate potential hidden fees that could impact trading profitability. Traders should carefully read the terms and conditions to understand the full scope of costs associated with trading on this platform.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Kadocapital claims to prioritize the security of client funds, but the lack of regulatory oversight raises questions about the effectiveness of these measures.

Kadocapital does not provide clear information regarding fund segregation or investor protection policies. In regulated environments, brokers are required to keep client funds in segregated accounts to ensure that they are protected in the event of insolvency. However, Kadocapital's offshore status and lack of regulation mean that clients may not have the same level of protection.

Historical issues surrounding fund safety have been reported, with several users expressing concerns about withdrawal delays and difficulties in accessing their funds. These issues further exacerbate the risks associated with trading with Kadocapital.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. A review of user experiences with Kadocapital reveals a mixed bag of opinions, with many users expressing frustration over withdrawal processes and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include withdrawal delays, where clients report waiting weeks or even months to access their funds. Additionally, the quality of customer support has been criticized, with many users stating that their inquiries go unanswered or are met with vague responses. These issues highlight potential systemic problems within the brokerage.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for successful trading. Kadocapital offers a web-based platform that is designed to be user-friendly and accessible. However, concerns have been raised regarding order execution quality, including slippage and rejection rates.

Users have reported experiencing slippage on trades, which can significantly impact profitability. Furthermore, there have been allegations of price manipulation, with some traders claiming that their orders are executed at unfavorable rates. Such practices, if true, would indicate a lack of integrity in the trading process.

Risk Assessment

Engaging with Kadocapital poses several risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of fund segregation and protection. |

| Customer Service Risk | Medium | Poor support can lead to unresolved issues. |

| Trading Execution Risk | High | Reports of slippage and manipulation. |

To mitigate these risks, traders should exercise extreme caution and consider using regulated brokers with established reputations. It's advisable to conduct thorough research and to only invest funds that one can afford to lose.

Conclusion and Recommendations

In summary, Kadocapital presents several alarming signals that suggest it may not be a safe trading environment. The lack of regulatory oversight, coupled with a history of customer complaints and issues related to fund safety, raises significant concerns.

For traders seeking a reliable and secure trading experience, it is recommended to consider alternative brokers that are regulated and have a proven track record of customer satisfaction. By doing so, traders can better protect their investments and avoid the potential pitfalls associated with unregulated brokers like Kadocapital.

In light of the findings, it is clear that Kadocapital is not safe for trading, and potential clients should be wary of engaging with this broker.

Is KadoCapital a scam, or is it legit?

The latest exposure and evaluation content of KadoCapital brokers.

KadoCapital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KadoCapital latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.