Is JUMPER safe?

Business

License

Is Jumper Safe or a Scam?

Introduction

Jumper, a forex broker that has recently gained attention in the trading community, positions itself as an international platform offering a range of financial services. However, as with any investment opportunity, it's crucial for traders to approach Jumper with a discerning eye. The forex market is notorious for its lack of regulation and the presence of fraudulent brokers, making it essential for potential investors to thoroughly evaluate any broker before committing their funds. This article aims to investigate the legitimacy of Jumper by analyzing its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a review of multiple online sources, including user feedback and expert analyses, ensuring a comprehensive assessment of whether Jumper is safe or a scam.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy. Regulatory bodies enforce standards that protect traders and ensure fair practices. Jumper claims to operate under strict regulations; however, investigations reveal that it lacks proper licensing.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a valid regulatory license raises significant concerns about the safety of traders' funds. Jumper has been reported to make misleading claims regarding its compliance with regulations, such as those set by the Financial Conduct Authority (FCA) in the UK. However, investigations into these claims show no evidence of registration with any recognized regulatory authority. This lack of oversight means that traders using Jumper may have no legal recourse in the event of disputes or financial losses, making the question of "Is Jumper safe?" increasingly pertinent.

Company Background Investigation

Understanding the company behind a broker is essential for assessing its reliability. Jumper appears to be an offshore entity with limited transparency regarding its ownership and operational history. The companys website lacks comprehensive information about its founding, management team, or physical location, which is often a red flag for potential scams.

The management team behind Jumper has not been publicly disclosed, further complicating the assessment of its credibility. A lack of transparency can indicate that the broker may not be operating in good faith. Moreover, the absence of a verifiable corporate structure raises questions about accountability and governance. In a market where trust is paramount, the opacity surrounding Jumper's operations is concerning, leading many to question, "Is Jumper safe?"

Trading Conditions Analysis

Jumper's trading conditions, including fees and spreads, are critical components of its appeal to traders. However, the broker's overall fee structure is not only uncompetitive but also shrouded in ambiguity.

| Fee Type | Jumper | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (often zero) |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of clear information regarding spreads, commissions, and other trading costs creates an opaque environment for traders. Many users have reported unexpected fees and charges, which could indicate a potential scam. The absence of competitive trading conditions further suggests that Jumper may not be a viable option for serious traders. Therefore, when considering whether Jumper is safe, the unclear trading conditions become a significant factor.

Client Funds Safety

The safety of client funds is paramount in the forex trading environment. Jumper's policies regarding fund security are questionable at best. Reports indicate that the broker does not maintain segregated accounts for client funds, which is a standard practice among reputable brokers. This means that traders' funds could be at risk in the event of the broker's insolvency.

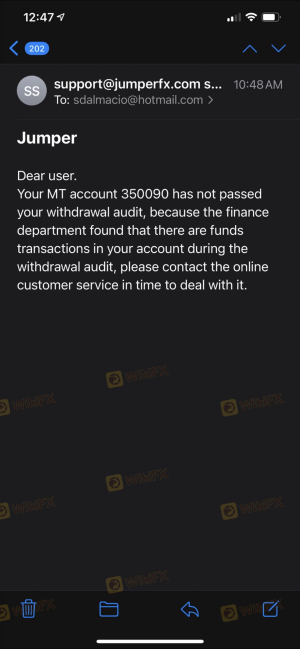

Additionally, Jumper does not appear to offer any investor protection schemes, which are critical for safeguarding traders' investments. Historical complaints from clients suggest that there have been difficulties in withdrawing funds, raising further doubts about the broker's reliability. The lack of robust security measures leads to the conclusion that, in terms of fund safety, Jumper does not meet the necessary standards, prompting the question, "Is Jumper safe?"

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reputation. Jumper has garnered a significant number of complaints from users, primarily centered around withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inadequate |

| Poor Customer Support | Medium | No Resolution |

| Misleading Information | High | Ignored |

Many users have reported that their withdrawal requests were either delayed or denied without sufficient explanation. Furthermore, the company's customer service has been criticized for being unresponsive and unhelpful. These patterns of complaints suggest that Jumper may not prioritize customer satisfaction, raising serious concerns about its legitimacy. The consistent negative feedback from users reinforces the notion that potential investors should be cautious and consider whether Jumper is safe for their trading activities.

Platform and Trade Execution

The performance of the trading platform is a crucial element for traders. Jumper's platform has been reported to experience frequent outages and slow execution speeds, which can significantly impact trading outcomes. Users have noted issues with slippage and rejected orders, further complicating the trading experience.

The lack of transparency regarding the platform's technology and execution methods raises additional red flags. If a broker cannot ensure reliable trade execution, it undermines the trustworthiness of its services. Therefore, the question of "Is Jumper safe?" becomes increasingly relevant when considering the potential risks associated with poor platform performance.

Risk Assessment

Assessing the overall risk of using Jumper is essential for potential investors. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Lack of fund protection and withdrawal issues. |

| Operational Risk | Medium | Poor platform performance and execution issues. |

| Customer Service Risk | High | Numerous complaints and inadequate support. |

Given these risks, it is evident that trading with Jumper carries significant potential for loss and frustration. To mitigate these risks, traders should approach Jumper with extreme caution and consider alternative, regulated brokers that offer better protection and service.

Conclusion and Recommendations

In conclusion, the investigation into Jumper reveals numerous red flags that suggest it may not be a safe trading option. The lack of regulation, transparency, and poor customer feedback all point to a broker that could potentially be a scam. While Jumper presents itself as a legitimate trading platform, the evidence indicates that traders should be wary.

For those seeking reliable forex trading options, it is advisable to consider regulated brokers with a proven track record of customer satisfaction and fund security. Brokers such as FP Markets and XM are recommended alternatives that offer robust regulatory protection and competitive trading conditions. Ultimately, the question remains: "Is Jumper safe?" The overwhelming evidence suggests that it is not, and traders should proceed with caution.

Is JUMPER a scam, or is it legit?

The latest exposure and evaluation content of JUMPER brokers.

JUMPER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JUMPER latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.