Is Ajman Bank safe?

Pros

Cons

Is Ajman Bank Safe or a Scam?

Introduction

Ajman Bank is a prominent financial institution in the United Arab Emirates, primarily offering Islamic banking services. Established in 2008, it aims to provide a range of banking products, including personal finance, corporate banking, and investment services. As the forex market continues to grow, traders must exercise caution when evaluating brokers and financial institutions like Ajman Bank. The legitimacy and safety of such entities can significantly impact traders' investments and overall trading experience. This article aims to provide an objective analysis of Ajman Bank, addressing its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. The findings are based on a thorough review of available online resources, including user reviews, regulatory information, and industry standards.

Regulation and Legitimacy

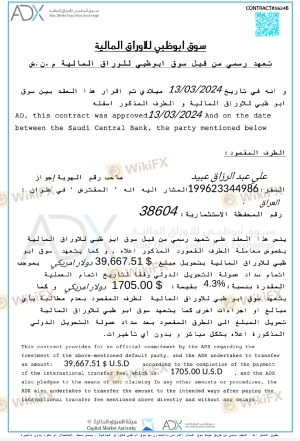

Regulation plays a crucial role in determining the safety of any financial institution. Regulatory bodies enforce standards that protect investors and ensure fair trading practices. Ajman Bank operates under the jurisdiction of the UAE, but it is essential to assess its regulatory status to understand its credibility.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Central Bank of UAE | Not specified | United Arab Emirates | Verified |

Ajman Bank is regulated by the Central Bank of the UAE, which provides a level of oversight that is essential for safeguarding customer funds and ensuring compliance with financial regulations. However, some sources indicate that Ajman Bank lacks specific licensing information, raising concerns about its transparency and adherence to regulatory standards. The importance of regulatory compliance cannot be overstated, as it serves as a safety net for traders and investors. While the Central Bank of the UAE is a reputable authority, the absence of detailed licensing information suggests that traders should exercise caution when considering Ajman Bank as a trading partner.

Company Background Investigation

Ajman Bank has a relatively short history compared to other financial institutions, having been founded in 2008. Despite its youth, the bank has made significant strides in establishing itself within the UAE's banking landscape. The ownership structure is predominantly held by the Emirate of Ajman, which adds a layer of governmental oversight.

The management team comprises experienced professionals with backgrounds in finance, banking, and Islamic finance. This expertise is crucial in navigating the complexities of the financial sector. However, the bank has faced criticism regarding its transparency and information disclosure practices. While the bank provides basic information about its services, a lack of detailed disclosures can lead to mistrust among potential clients.

Ajman Bank's commitment to transparency is vital for building customer confidence. Traders need to be assured that they are dealing with a credible institution that prioritizes ethical practices and customer welfare. In this context, the question arises: Is Ajman Bank safe? The answer lies in the institution's ability to provide clear and comprehensive information about its operations, management, and financial health.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Ajman Bank offers various financial products, including forex trading, but it is crucial to analyze its fee structures and trading conditions to determine whether they are competitive and fair.

| Fee Type | Ajman Bank | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not disclosed | 1.0 - 3.0 pips |

| Commission Structure | Not specified | Varies by broker |

| Overnight Interest Range | Not specified | 0.5% - 2.0% |

The lack of transparency regarding fees and spreads raises questions about Ajman Bank's commitment to providing a fair trading environment. Traders often rely on clear fee structures to gauge the overall cost of trading, and the absence of such information can be a red flag. Moreover, without specified commissions or overnight interest rates, traders may face unexpected costs that could impact their profitability.

In summary, the trading conditions at Ajman Bank warrant careful consideration. The question remains: Is Ajman Bank safe? The answer is nuanced, as the lack of clarity in fee structures may indicate potential risks for traders.

Customer Funds Security

The security of customer funds is paramount in the financial industry. Ajman Bank claims to implement various measures to protect client assets, including fund segregation and adherence to Shariah-compliant investment practices. However, it is essential to assess the effectiveness of these measures.

Ajman Bank reportedly utilizes secure banking protocols and systems to safeguard client information and transactions. The bank's commitment to fund segregation means that customer funds are kept separate from the bank's operational funds, minimizing the risk of loss in case of financial difficulties. Additionally, the bank adheres to investor protection regulations, which can provide further assurance to clients.

Despite these measures, historical incidents involving financial institutions can raise concerns. There have been no significant reports of fund security breaches associated with Ajman Bank, which may indicate a relatively stable operational environment. However, potential clients should remain vigilant and inquire about the bank's practices regarding fund security and any past incidents that may have occurred.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of any financial institution. Ajman Bank has received mixed reviews from customers, with some praising its services while others express dissatisfaction, particularly regarding customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Poor Customer Service | High | Slow response time |

| Account Issues | Medium | Inadequate resolution |

| Fee Transparency | High | Lack of clarity |

Common complaints include poor customer service, slow response times, and a lack of transparency regarding fees. Many users report frustration with the bank's handling of account issues, which can significantly impact the overall customer experience.

For instance, one user reported difficulties in canceling a credit card, with multiple follow-ups yielding little progress. Another user expressed frustration over the lack of communication regarding their account status, leading to a sense of distrust in the bank's operations. These complaints highlight the need for Ajman Bank to improve its customer service and responsiveness to enhance overall client satisfaction.

Platform and Trade Execution

The trading platform offered by Ajman Bank is a critical component of the trading experience. A reliable platform should provide stability, ease of use, and efficient order execution. User experiences with Ajman Bank's trading platform have been mixed, with some users reporting satisfactory performance while others encountered issues.

Order execution quality is vital for traders, as delays or slippage can impact trading outcomes. Reports of slippage and rejected orders have surfaced, which raises questions about the platform's reliability. Traders need assurance that their orders will be executed promptly and accurately, without manipulation.

The question of Is Ajman Bank safe? becomes pertinent in this context, as a stable and efficient trading platform is essential for a trustworthy trading environment.

Risk Assessment

Evaluating the risks associated with using Ajman Bank is crucial for potential clients. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Lack of detailed licensing information |

| Customer Service | High | Frequent complaints about service quality |

| Trading Conditions | Medium | Lack of transparency in fees |

Overall, the risks associated with Ajman Bank are moderate to high. Potential clients should be aware of the bank's regulatory compliance status and customer service issues. To mitigate risks, it is advisable to conduct thorough research, seek clarification on any unclear policies, and consider alternative banking options if concerns persist.

Conclusion and Recommendations

In conclusion, the evidence suggests that while Ajman Bank operates under a regulated framework, there are significant concerns regarding its transparency, customer service, and trading conditions. The question of Is Ajman Bank safe? remains complex, as potential risks exist that may impact traders' experiences.

For traders seeking reliable and transparent banking options, it may be prudent to explore alternative institutions with a proven track record of customer satisfaction and regulatory compliance. Some recommended alternatives include established banks with robust regulatory frameworks and positive customer feedback.

In summary, while Ajman Bank offers various banking services, potential clients should exercise caution and perform due diligence before engaging with the institution.

Is Ajman Bank a scam, or is it legit?

The latest exposure and evaluation content of Ajman Bank brokers.

Ajman Bank Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ajman Bank latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.