Jumper 2025 Review: Everything You Need to Know

Executive Summary

Jumper Capital presents itself as a forex broker that entered the market in 2020. The company targets traders who want to enter foreign exchange markets with easy terms. However, this jumper review shows serious concerns that potential investors must think about carefully before putting money in.

The broker works without any oversight from recognized financial authorities, which raises red flags about investor protection and fund security right away. Jumper Capital offers a competitive minimum deposit of $100 and claims to provide multiple forex trading options. But the lack of regulatory supervision seriously hurts its credibility in the highly regulated forex industry.

The platform seems to focus mainly on new traders who like low entry barriers. However, the lack of complete information about trading conditions, platform details, and customer support suggests limited transparency. Our analysis shows that while the low minimum deposit may look appealing, traders should weigh this against the big risks of dealing with an unregulated company.

Based on available information, Jumper Capital's offerings stay mostly unclear, with not enough details about spreads, leverage ratios, trading platforms, and customer service abilities. This jumper review stresses how important it is to do thorough research before working with this broker.

Important Disclaimer

This evaluation looks specifically at Jumper Capital as an unregulated forex broker. Traders should know that regulatory requirements and operational standards change a lot across different areas, and the absence of regulatory oversight presents higher risks compared to licensed alternatives.

Our assessment method relies on publicly available information and market research data. This review does not include user ratings or detailed customer feedback because there are limited testimonials and reviews from verified users. All information presented reflects the current state of available data and should be added to with independent research before making investment decisions.

Rating Framework

Broker Overview

Jumper Capital appeared in the forex trading world in 2020. The company positions itself as a broker focused on providing foreign exchange trading services to retail investors.

The broker works as an unregulated forex broker, which means it functions without oversight from established financial regulatory bodies such as the FCA, CySEC, or ASIC. Jumper Capital's business model centers around helping clients trade currency pairs for those seeking exposure to forex markets. The broker markets itself toward traders looking for easy entry points into forex trading, especially those attracted by lower minimum deposit requirements compared to some established competitors.

Despite its recent establishment, the broker claims to offer multiple trading options within the forex space. However, the lack of detailed information about specific trading instruments, platform abilities, and operational infrastructure raises questions about the depth and quality of services provided. The absence of regulatory oversight means that typical investor protections, such as separated client funds and compensation schemes, may not be available.

This jumper review notes that the company's operational transparency stays limited, with not enough public disclosure about management, financial backing, or operational procedures that would typically be required under regulatory frameworks.

Regulatory Status and Jurisdiction

Jumper Capital operates as an unregulated forex broker. This means it lacks authorization from recognized financial regulatory authorities. This status presents serious concerns for trader protection and fund security, as unregulated brokers are not subject to capital adequacy requirements, client fund separation rules, or operational oversight that regulated entities must maintain.

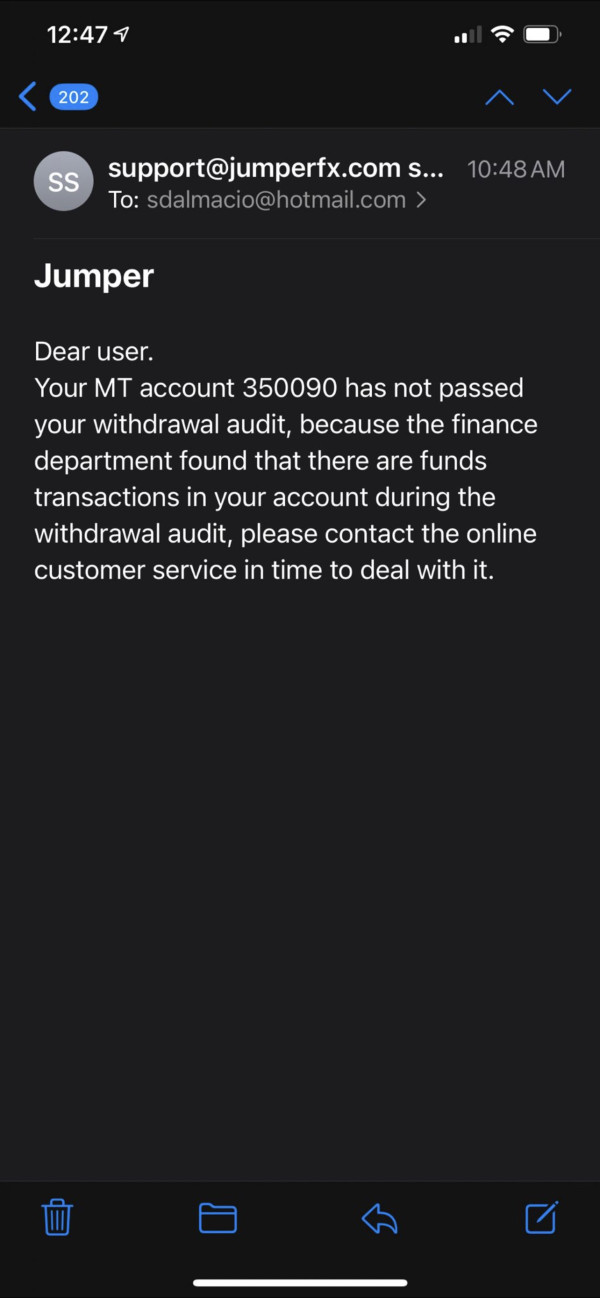

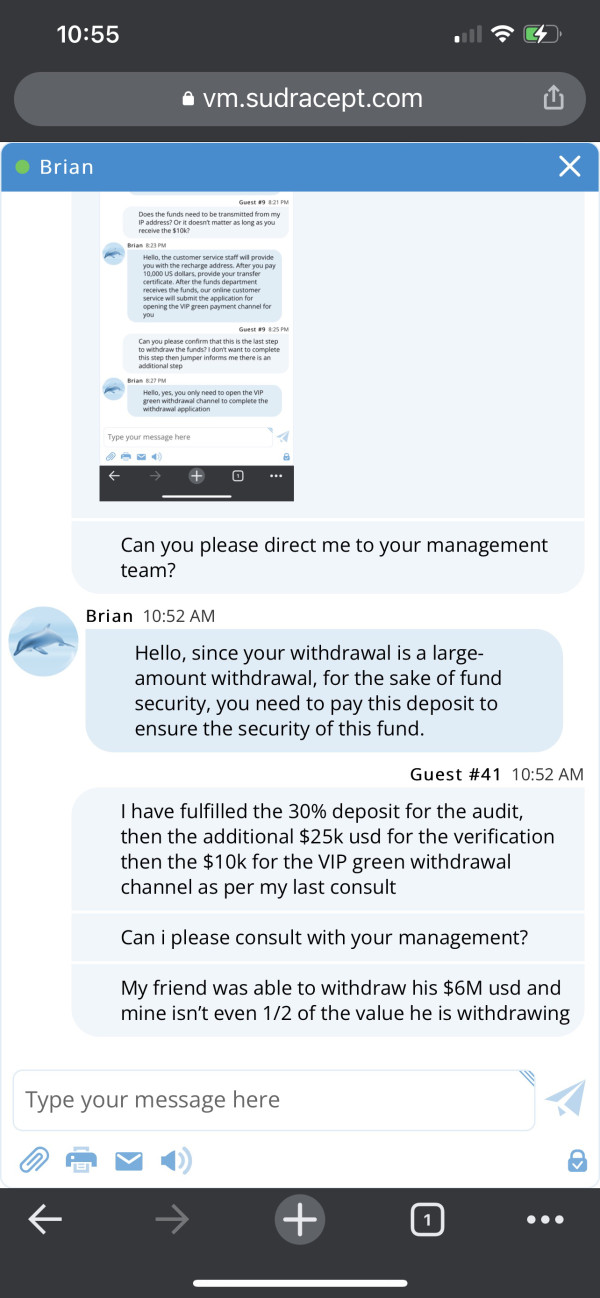

Deposit and Withdrawal Methods

Available information does not specify the payment methods supported by Jumper Capital. Details about processing times, fees, and minimum withdrawal amounts stay undisclosed, which is concerning for traders planning their fund management strategies.

Minimum Deposit Requirements

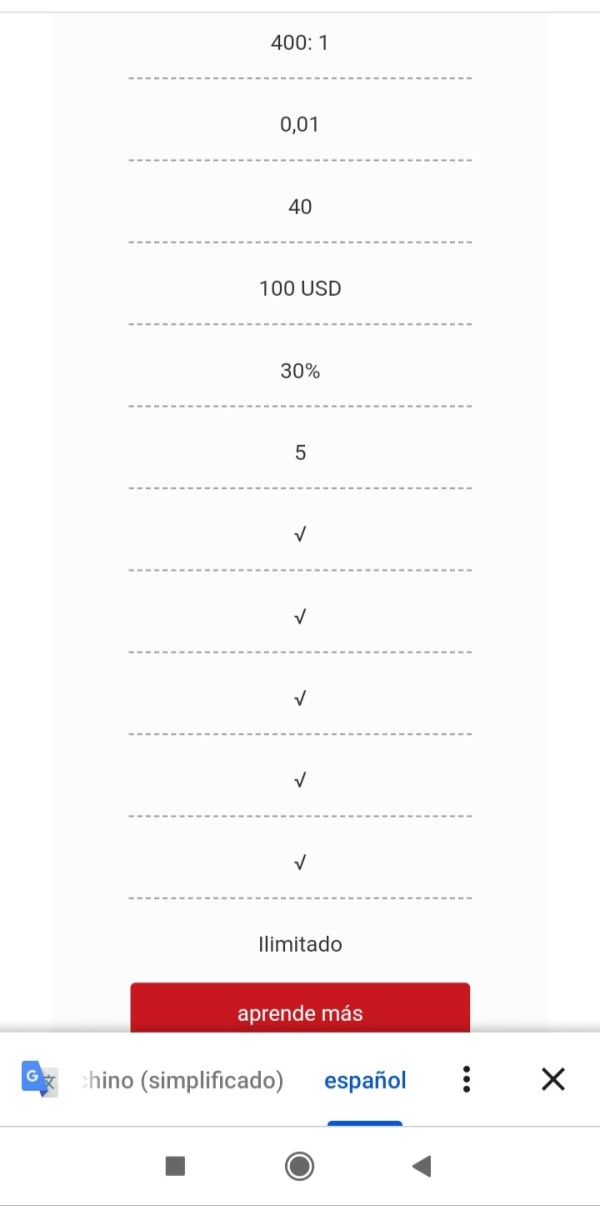

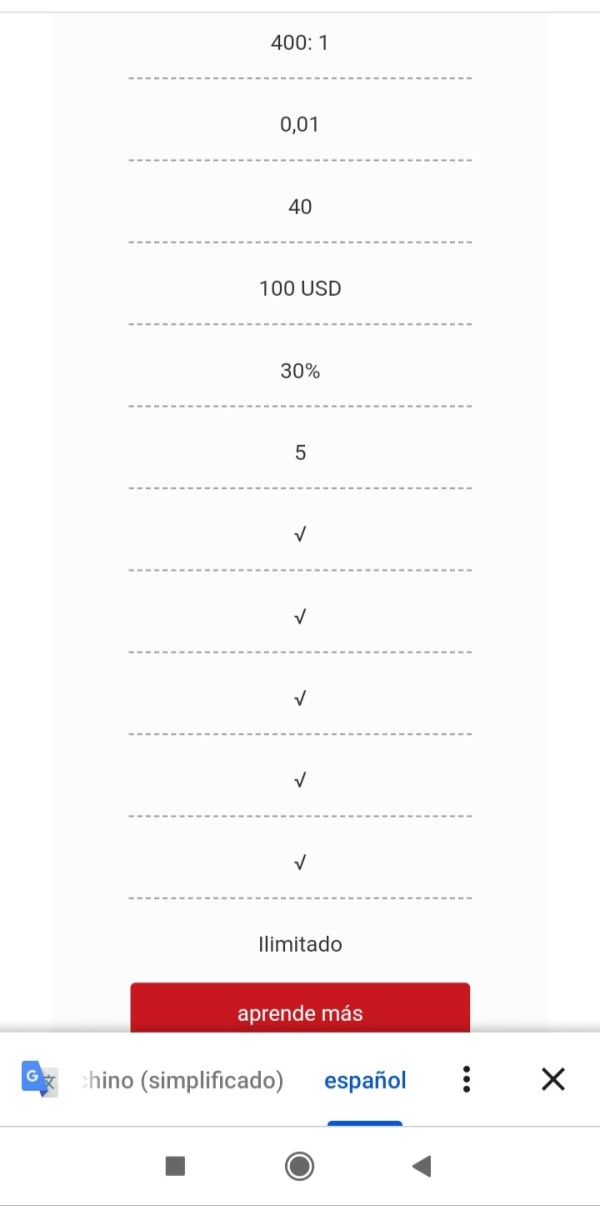

Jumper Capital sets its minimum deposit requirement at $100. This positions it competitively within the retail forex market. This relatively low threshold may attract new traders, but the lack of information about different account tiers or enhanced features for higher deposits limits understanding of the broker's account structure.

No specific information about promotional campaigns, welcome bonuses, or loyalty programs is available in current materials. This absence of promotional details may indicate either a conservative marketing approach or limited marketing infrastructure.

Available Trading Assets

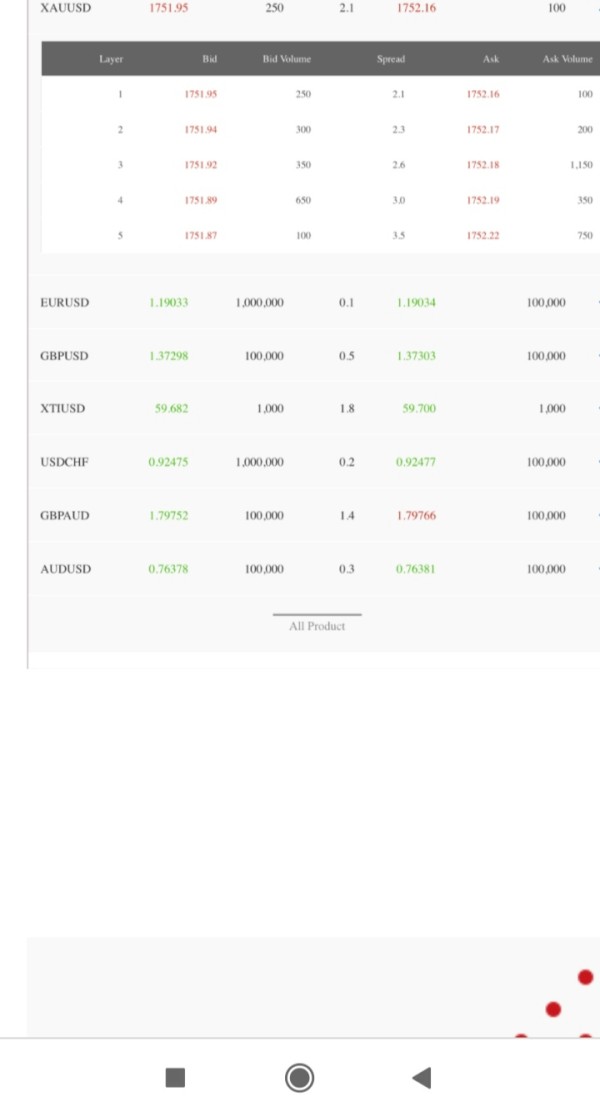

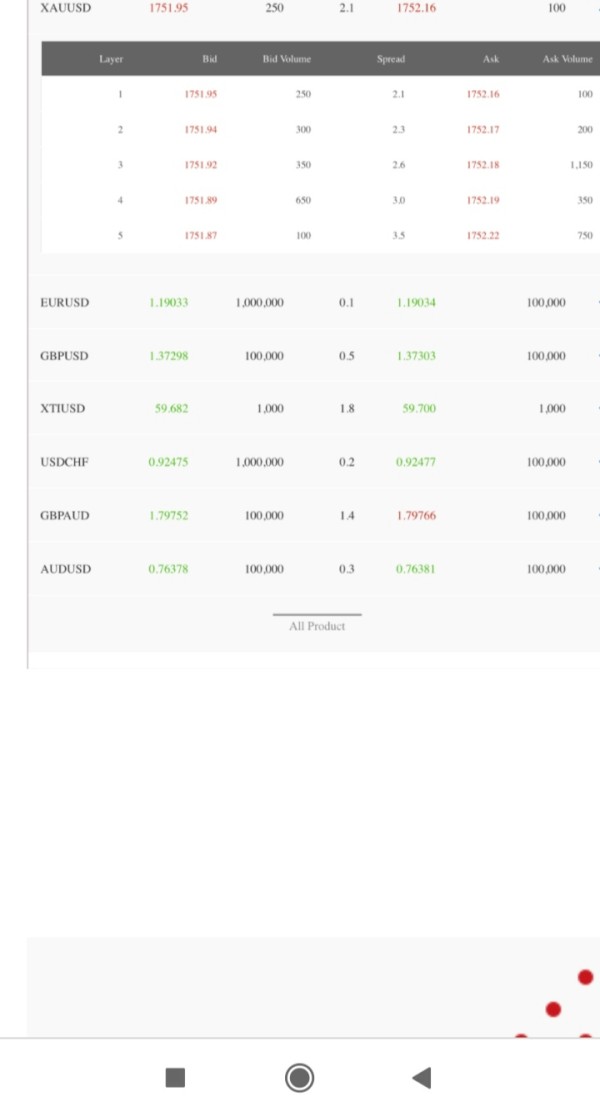

The broker focuses on forex trading and offers multiple currency pairs for trading. However, specific details about major, minor, and exotic pairs availability, or potential expansion into other asset classes like commodities or indices, stay unspecified.

Cost Structure and Fees

Critical information about spreads, commission structures, overnight financing rates, and other trading costs is not detailed in available materials. This lack of cost transparency makes it difficult for traders to assess the true expense of trading with Jumper Capital compared to competitors.

Leverage Ratios

Leverage offerings and maximum ratios available to traders are not specified in current information. Given the unregulated status, leverage limits may differ significantly from regulated broker standards, potentially exposing traders to higher risk levels.

Specific trading platform information is not detailed in available materials. This includes whether the broker offers MetaTrader 4, MetaTrader 5, or proprietary platforms. Platform abilities significantly impact trading experience and strategy implementation.

This comprehensive jumper review analysis reveals substantial information gaps that potential clients should address through direct broker communication before account opening.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Jumper Capital present a mixed picture for potential traders. The broker's $100 minimum deposit requirement shows competitiveness in attracting retail traders, particularly those new to forex markets or operating with limited initial capital.

This threshold aligns with industry standards for entry-level accounts and removes significant barriers to market participation. However, the lack of detailed information about different account types represents a notable weakness in Jumper Capital's offering transparency. Established brokers typically provide tiered account structures with varying features, spreads, and service levels based on deposit amounts.

The absence of such information makes it difficult for traders to understand potential upgrade paths or enhanced features available with larger deposits. Account opening procedures and verification requirements stay unspecified, which could indicate either streamlined processes or lack of proper due diligence procedures. Without regulatory oversight, standard know-your-customer and anti-money laundering procedures may not follow industry best practices.

Special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, are not mentioned in available materials. This omission may limit the broker's appeal to specific trader demographics and suggests limited accommodation for diverse trading requirements.

The evaluation in this jumper review indicates that while the low minimum deposit provides accessibility, the lack of comprehensive account condition details raises concerns about service depth and operational sophistication.

Jumper Capital's tools and resources offering appears limited based on available information. While the broker claims to provide multiple forex trading options, the specific quality and range of trading tools stay unclear.

Professional traders typically require advanced charting abilities, technical analysis tools, economic calendars, and market research to make informed trading decisions. The absence of detailed information about research and analysis resources represents a significant gap in the broker's value proposition. Established brokers often provide daily market analysis, economic commentary, trading signals, and educational content to support trader development and decision-making processes.

Educational resources, which are crucial for new traders, are not specified in current materials. Quality educational programs, including webinars, tutorials, trading guides, and demo accounts, are standard offerings from reputable brokers seeking to support client success and retention.

Automated trading support, including expert advisor compatibility and algorithmic trading abilities, stays unaddressed. Modern traders increasingly rely on automated strategies, and the lack of information about such support may limit the platform's appeal to sophisticated users.

The overall assessment suggests that Jumper Capital may offer basic trading functionality but lacks the comprehensive tool suite expected from full-service forex brokers, potentially limiting its suitability for serious traders.

Customer Service and Support Analysis

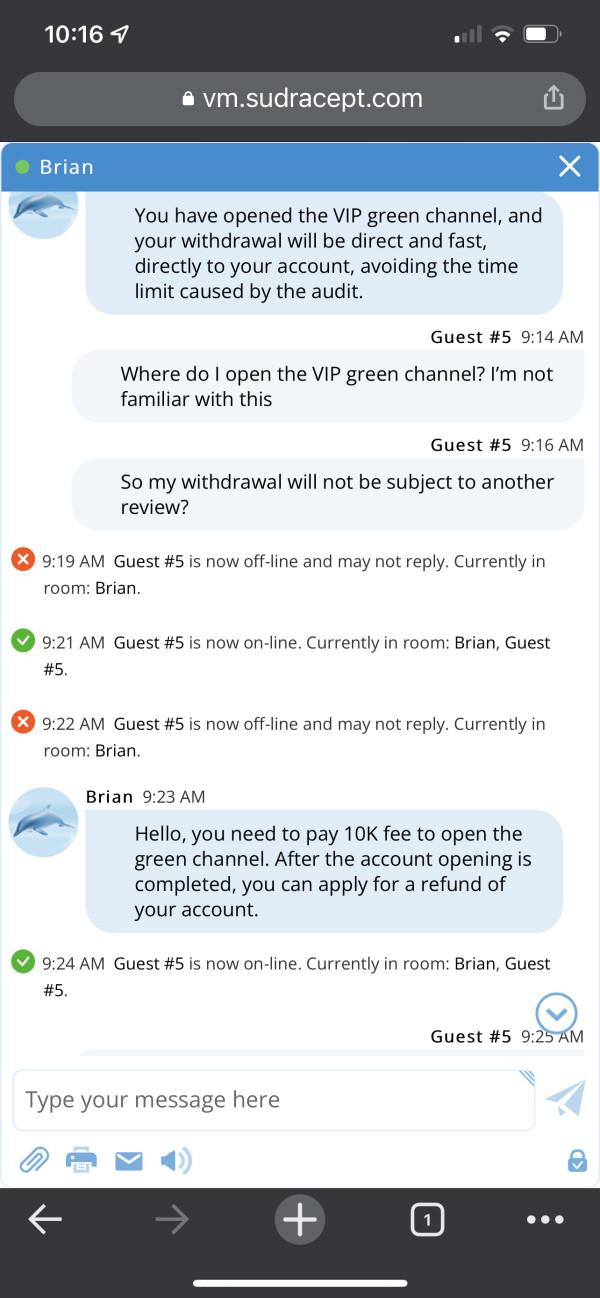

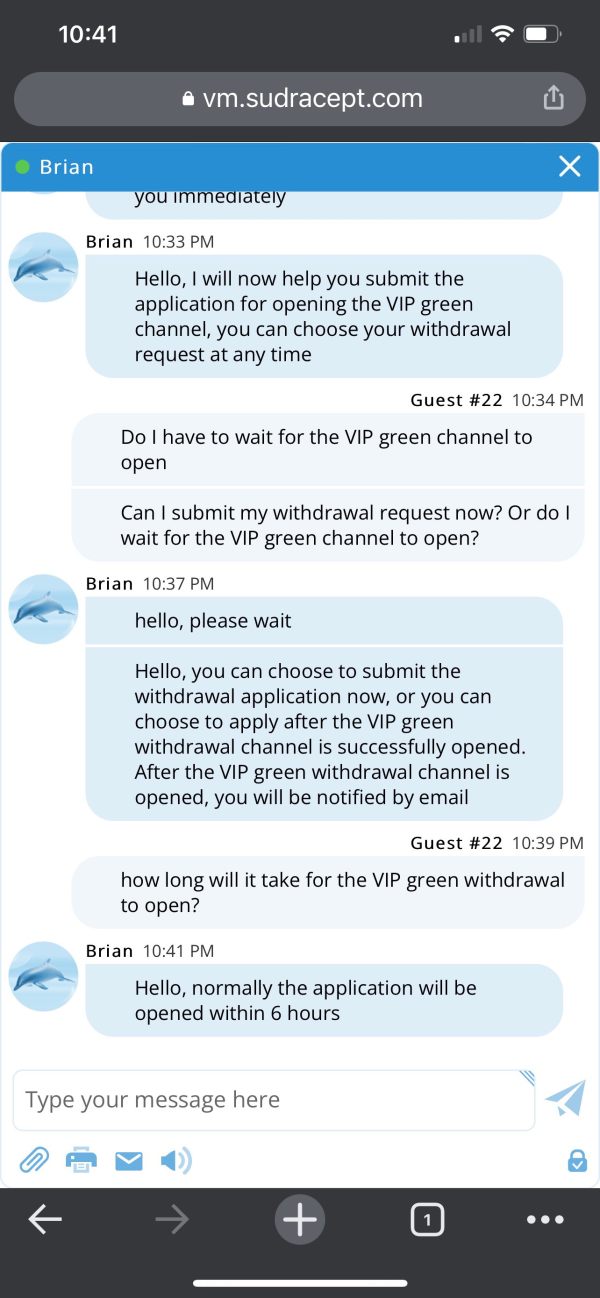

Customer service abilities represent a critical weakness in Jumper Capital's offering. There is virtually no information available about support infrastructure, contact methods, or service quality standards. Professional forex brokers typically maintain multiple communication channels, including live chat, email support, and telephone assistance to address client needs promptly.

Response time standards and service availability hours are not specified, which raises concerns about support accessibility during critical trading periods. Forex markets operate 24/5, and traders require reliable support access, particularly during volatile market conditions or when experiencing technical difficulties.

Service quality indicators, such as multilingual support abilities, dedicated account management, or specialized technical assistance, are not detailed in available materials. These services are standard expectations for retail forex brokers serving international client bases.

The absence of user feedback about customer service experiences makes it impossible to assess actual service delivery quality. Established brokers typically showcase client testimonials and service quality metrics to demonstrate their commitment to customer satisfaction.

Without regulatory oversight, complaint resolution procedures and escalation mechanisms may not follow industry standards, potentially leaving traders with limited recourse in case of service disputes or operational issues.

Trading Experience Analysis

The trading experience offered by Jumper Capital stays largely undefined due to limited available information about platform abilities, execution quality, and user interface design. Platform stability and execution speed are critical factors for forex trading success, yet no specific data about these performance metrics is available.

Order execution quality, including slippage rates, requote frequency, and fill rates during high volatility periods, represents crucial information that traders require for strategy planning. The absence of such data makes it difficult to assess the broker's technical abilities and execution reliability.

Platform functionality completeness, including advanced order types, one-click trading, and risk management tools, is not detailed in current materials. Modern traders expect sophisticated platform features that support complex trading strategies and efficient position management.

Mobile trading experience, which is increasingly important for active traders, is not addressed in available information. Mobile platform quality and feature parity with desktop versions significantly impact trader flexibility and market access abilities.

The overall trading environment assessment in this jumper review suggests potential limitations in platform sophistication and execution quality, though definitive conclusions require direct platform testing and user experience data.

Trust and Safety Analysis

Trust and safety represent the most significant concerns regarding Jumper Capital, primarily due to its unregulated status. The absence of regulatory oversight from recognized authorities such as the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or Australian Securities and Investments Commission eliminates standard investor protections.

Fund security measures, including client money separation and deposit protection schemes, are not specified and may not exist without regulatory requirements. Regulated brokers must maintain client funds in separated accounts and often participate in compensation schemes that protect investor deposits up to specified limits.

Company transparency regarding management, financial statements, and operational procedures stays limited. Regulatory oversight typically requires regular financial reporting and operational audits that provide investors with confidence about broker stability and operational integrity.

Industry reputation and track record information is minimal given the broker's recent establishment and limited market presence. Established brokers build reputation through consistent service delivery, regulatory compliance, and positive client outcomes over extended periods.

The absence of information about negative event handling or dispute resolution procedures raises additional concerns about operational maturity and client protection abilities.

User Experience Analysis

User experience assessment for Jumper Capital is significantly hampered by the lack of available user feedback and satisfaction metrics. Without substantial user testimonials or independent reviews, it becomes challenging to evaluate actual client experiences and satisfaction levels.

Interface design and platform usability cannot be assessed without direct platform access or detailed user feedback. Modern trading platforms require intuitive design, efficient navigation, and responsive performance to support effective trading activities.

Registration and verification processes are not detailed in available materials, making it unclear whether account opening procedures are streamlined and user-friendly or potentially cumbersome and time-consuming. Fund operation experiences, including deposit and withdrawal processes, processing times, and potential complications, stay unspecified. Smooth fund operations are crucial for trader satisfaction and operational efficiency.

Common user complaints or satisfaction indicators are not available, preventing assessment of typical client experiences and potential operational issues that traders might encounter.

Conclusion

This comprehensive jumper review reveals that Jumper Capital presents significant risks for potential traders, primarily due to its unregulated status and limited operational transparency. While the broker offers an accessible $100 minimum deposit requirement, the absence of regulatory oversight, comprehensive service information, and user feedback creates substantial uncertainty about service quality and fund security.

The broker may suit traders seeking low-barrier market entry, but the risks associated with unregulated entities far outweigh the benefits of reduced deposit requirements. Traders are strongly advised to consider regulated alternatives that provide investor protections, transparent operations, and established track records.

Key advantages include competitive minimum deposits, while major disadvantages include lack of regulation, limited transparency, and insufficient user feedback. Potential clients should conduct thorough due diligence and consider whether the risks align with their investment objectives and risk tolerance levels.