Is Jinlong safe?

Pros

Cons

Is Jinlong Safe or Scam?

Introduction

Jinlong, a forex brokerage firm, has come under scrutiny in recent years due to numerous allegations of fraudulent activities and scams. As a participant in the forex market, Jinlong positions itself as a platform for traders looking to invest in various currency pairs and commodities. However, the importance of thorough due diligence when selecting a forex broker cannot be overstated. Traders must be vigilant and assess the legitimacy of brokers like Jinlong to avoid potential financial losses. This article employs a comprehensive evaluation framework, analyzing Jinlong through various lenses, including regulatory compliance, company background, trading conditions, customer safety, and user experiences. By synthesizing these elements, we aim to answer the critical question: Is Jinlong safe or a scam?

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of any legitimate brokerage operation. It ensures that brokers adhere to industry standards and protect client funds. Unfortunately, Jinlong operates without any significant regulatory oversight, raising serious concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Jinlong is not subject to any external audits or compliance checks, which are essential for safeguarding investor interests. This lack of oversight is a significant red flag, as unregulated brokers often engage in practices that can jeopardize client funds, such as misappropriation or refusal to honor withdrawal requests. Historically, many unregulated brokers have faced allegations of fraud, which further emphasizes the risks associated with trading through platforms like Jinlong. Thus, the regulatory landscape surrounding Jinlong suggests a high level of risk for potential investors.

Company Background Investigation

Jinlong's history and ownership structure are crucial factors in assessing its credibility. The company appears to lack transparency regarding its operational history, ownership, and management team. This opacity is concerning, as reputable brokers typically provide detailed information about their founding, development, and leadership.

The management teams background is particularly important; experienced professionals with a solid track record in finance can instill confidence in traders. However, Jinlong does not offer clear information about its key personnel or their qualifications. This lack of transparency can be indicative of a broader issue regarding the broker's commitment to ethical practices and customer service.

Furthermore, the company's information disclosure level is alarmingly low. Potential clients are often left in the dark about critical operational details, which is a common tactic employed by scam brokers to avoid accountability. This significant lack of transparency raises further doubts about whether Jinlong is safe for traders to engage with.

Trading Conditions Analysis

A thorough understanding of the trading conditions offered by Jinlong is essential for evaluating its legitimacy. The broker's fee structure and trading policies have been criticized for being opaque and potentially predatory.

| Fee Type | Jinlong | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Hidden Fees | Transparent |

| Overnight Interest Range | Unclear | Standard |

The spread on major currency pairs is reportedly higher than the industry average, which can significantly impact trading profitability. Additionally, traders have reported encountering hidden fees that were not disclosed upfront, a common tactic used by fraudulent brokers to extract additional funds from clients. This lack of clarity in fee structures raises serious questions about the overall cost of trading with Jinlong and whether traders can trust the broker to provide fair and transparent conditions.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any forex broker. Jinlong's approach to fund security is questionable. The brokerage has not provided sufficient information regarding its fund segregation practices, investor protection measures, or negative balance protection policies.

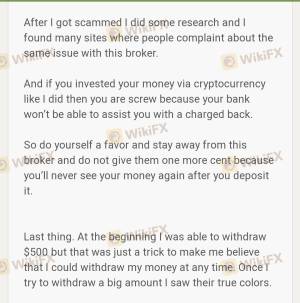

Many traders have reported issues with fund withdrawals, claiming that their requests were either denied or met with excessive delays. This pattern of behavior is a hallmark of scam brokers, who often use various tactics to retain client funds, such as imposing unreasonable withdrawal conditions or claiming that funds are tied up in compliance checks.

The absence of robust safety measures and the history of client complaints related to fund access create a concerning picture regarding Jinlong's commitment to safeguarding client investments. Therefore, it is reasonable to conclude that Jinlong is not safe for traders who prioritize the security of their funds.

Customer Experience and Complaints

Customer feedback is a critical component in assessing a broker's reliability. Reviews and testimonials from users of Jinlong reveal a troubling pattern of complaints. Many users have reported negative experiences, particularly regarding the broker's customer service and responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Communication Gaps | Medium | Inadequate |

| Hidden Fees | High | Non-responsive |

Common complaints include difficulties in withdrawing funds, poor communication from customer support, and the presence of hidden fees. Users have expressed frustration at the lack of timely responses to their inquiries and the evasive nature of the broker's representatives.

Several case studies illustrate these issues. For instance, one user reported being unable to withdraw their funds after repeated attempts, only to be told that they needed to pay additional fees to process the withdrawal. This tactic is often employed by scam brokers to extract more money from their victims. Such experiences leave potential clients questioning whether Jinlong is a scam and whether they should invest their hard-earned money with the broker.

Platform and Execution

The performance and reliability of a trading platform are essential for a positive trading experience. Jinlong claims to offer a robust trading platform; however, user reviews suggest otherwise. Many traders have reported issues with platform stability, order execution quality, and instances of slippage.

The execution quality has been called into question, with some users alleging that their orders were not filled at the expected prices, leading to significant financial losses. Additionally, reports of rejected orders and platform crashes during critical trading times further exacerbate concerns regarding Jinlongs operational integrity.

Without a reliable and efficient trading platform, traders cannot effectively manage their investments, leading to frustration and potential losses. This raises further doubts about whether Jinlong is safe for traders seeking a dependable trading environment.

Risk Assessment

Engaging with Jinlong comes with a variety of risks that potential traders must consider. The lack of regulation, combined with poor customer feedback and questionable trading conditions, paints a concerning picture.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud potential. |

| Financial Risk | High | Hidden fees and high spreads can lead to losses. |

| Operational Risk | Medium | Platform issues and order execution problems. |

To mitigate these risks, potential clients should conduct thorough research before engaging with Jinlong. Consider starting with a small investment or opting for a demo account to assess the platform's reliability. Additionally, traders should remain vigilant and be prepared to switch to a more reputable broker if issues arise.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Jinlong is not a safe broker for traders. The lack of regulatory oversight, combined with numerous customer complaints regarding fund withdrawals and hidden fees, points to a high risk of fraudulent activity.

For traders seeking reliable and trustworthy forex brokers, it is advisable to consider alternatives with a proven track record and strong regulatory backing. Brokers such as Forex.com, IG, or OANDA offer more transparent trading conditions and better customer service.

Ultimately, potential investors should exercise caution and conduct due diligence before engaging with any broker, especially those with troubling histories like Jinlong. The question remains: Is Jinlong safe or a scam? Based on the available evidence, it leans heavily towards the latter.

Is Jinlong a scam, or is it legit?

The latest exposure and evaluation content of Jinlong brokers.

Jinlong Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Jinlong latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.