Is IUBO safe?

Pros

Cons

Is Iubo Safe or Scam?

Introduction

Iubo is a forex broker that has recently gained attention in the trading community. Operating under the name Iubo Investment Management Co., Ltd., the broker positions itself as a platform for traders looking to engage in foreign exchange and other financial markets. However, the influx of new brokers in the forex industry has raised concerns about safety and reliability. Traders must exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to investigate whether Iubo is a safe trading option or a potential scam, using various sources and a structured assessment framework that considers regulation, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a broker is one of the most crucial factors for traders when determining whether a broker is safe. Iubo claims to operate under a financial services license; however, the broker is not regulated by any major financial authority. The absence of regulation raises significant red flags, as it means that Iubo is not subject to the stringent oversight that protects traders' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The lack of a credible regulatory framework is concerning, especially since traders typically seek brokers overseen by top-tier regulators like the FCA (UK), ASIC (Australia), or SEC (US). These regulators enforce strict compliance standards that help ensure fair trading practices and protect client funds. The absence of regulation for Iubo suggests a higher risk for traders, as the broker may not adhere to industry standards or provide necessary investor protections. Therefore, it is essential to question, Is Iubo safe? Given its unregulated status, potential investors should approach with caution.

Company Background Investigation

Iubo Investment Management Co., Ltd. appears to have a limited online presence, which is often a warning sign for potential investors. The company is registered in the British Virgin Islands, a jurisdiction known for its lax regulatory environment. This lack of transparency can make it difficult for traders to ascertain the broker's legitimacy and operational history.

The management team behind Iubo has not been prominently featured in available resources, making it challenging to evaluate their professional backgrounds and experience in the financial markets. A lack of information about the company's ownership and management can lead to concerns regarding accountability and trustworthiness. Transparency is vital in the financial industry, and the absence of such information raises the question: Is Iubo safe? Without a clear understanding of the company's structure and leadership, traders may find it difficult to trust Iubo as a reliable broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Iubo's fee structure is critical in determining whether the broker is a viable option for traders. Reports indicate that Iubo has a complex fee structure that may include hidden costs, which can significantly impact traders' profitability.

| Fee Type | Iubo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of clarity around fees can lead to unexpected expenses for traders, making it imperative to ask, Is Iubo safe? If traders are not fully aware of the costs associated with trading on Iubo, they could potentially face financial losses that could have been avoided with a more transparent fee structure. Furthermore, any unusual or excessive fees may indicate that the broker is not operating in the best interest of its clients.

Customer Funds Security

The security of customer funds is paramount when assessing a broker's safety. Iubo's measures for safeguarding client funds are unclear, raising concerns about whether traders' money is adequately protected. Typically, reputable brokers implement strict measures such as segregating client funds from their operational funds and providing negative balance protection.

However, without specific information regarding Iubo's policies on fund security, it is challenging to determine if they adhere to these best practices. The absence of such information leads to further skepticism about whether Iubo is safe. If the broker does not prioritize the security of customer funds, traders may be at risk of losing their investments without any recourse.

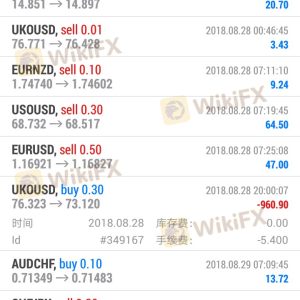

Customer Experience and Complaints

Analyzing customer feedback is crucial in evaluating a broker's reliability. Reviews of Iubo indicate a mixed bag of experiences, with some users expressing concerns about withdrawal issues and poor customer service. The frequency and nature of complaints can often provide insight into a broker's operational practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow to Respond |

| Unclear Fee Structure | High | No Clarification |

Common complaints about Iubo include delays in processing withdrawals and a lack of responsiveness from customer support. These issues can significantly impact a trader's experience, and if left unresolved, may lead to frustration and financial loss. Therefore, it is essential to consider whether Iubo is safe based on the experiences of existing clients.

Platform and Execution

The performance of a trading platform is another critical aspect to consider. Iubo's trading platform has received mixed reviews regarding its reliability and execution quality. Traders have reported instances of slippage and order rejections, which can hinder trading performance.

If a broker's platform is prone to technical issues, it raises further questions about whether Iubo is safe. Traders rely on their platforms for timely execution and accurate pricing; any shortcomings in this area could lead to significant losses, especially in a fast-moving market.

Risk Assessment

When considering whether to trade with Iubo, it is essential to evaluate the overall risk involved. The following risk assessment summarizes the key risk areas associated with using Iubo as a forex broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation by a credible authority. |

| Fund Security Risk | High | Lack of clarity on fund protection. |

| Customer Service Risk | Medium | Reports of poor customer support. |

| Trading Condition Risk | High | Unclear fee structure and execution issues. |

Given these risks, it is crucial for potential traders to approach Iubo with caution. To mitigate these risks, traders should consider diversifying their investments and thoroughly researching alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the safety and legitimacy of Iubo as a forex broker. The lack of regulation, unclear fee structures, and troubling customer experiences suggest that traders should exercise caution. Therefore, it is reasonable to conclude that Iubo is not a safe option for forex trading.

For those considering trading in the forex market, it is advisable to look for brokers with robust regulatory oversight, transparent fee structures, and positive customer reviews. Some reliable alternatives include brokers regulated by top-tier authorities, which provide a safer trading environment. Ultimately, traders must prioritize their financial security and due diligence when selecting a broker.

Is IUBO a scam, or is it legit?

The latest exposure and evaluation content of IUBO brokers.

IUBO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IUBO latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.