PHY 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive phy review examines PHY Capital Investments Limited. The broker has raised significant concerns within the trading community. Based on available information from regulatory databases and user feedback, PHY broker's legitimacy and safety are highly questionable, resulting in an overall negative assessment. The company claims to provide forex and CFD trading services including indices and precious metals. However, the lack of clear regulatory oversight presents substantial risks for potential clients.

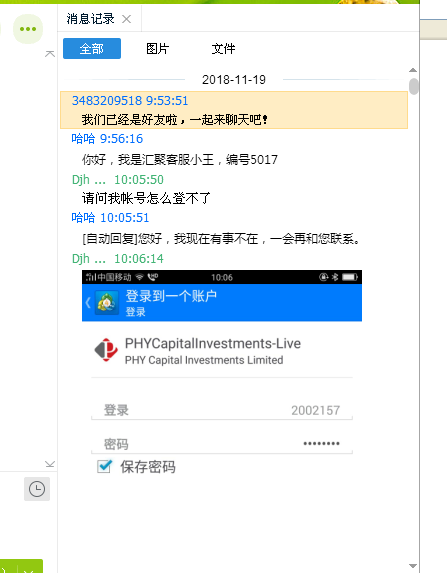

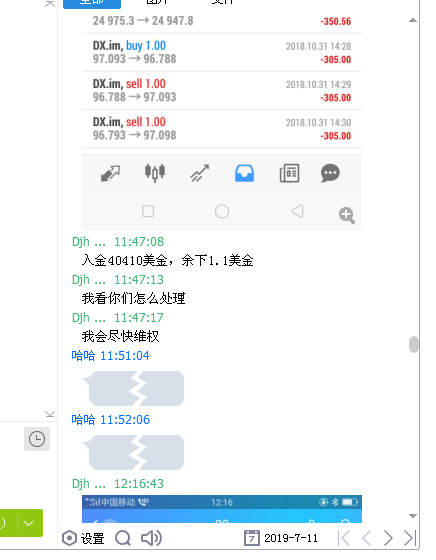

The broker appears to target investors seeking forex and CFD trading opportunities. The absence of transparent regulatory information and user reviews makes it unsuitable for traders who prioritize safety and regulatory compliance. Key concerns include the widespread belief among users that PHY Capital Investments Limited operates as a clone company. The company lacks proper licensing and regulatory authorization. The company's credibility is further undermined by the absence of user ratings and detailed operational information typically expected from legitimate brokers.

Important Notice

This PHY broker review is based on publicly available information and user feedback accessible through various financial databases and regulatory sources. Readers should note that PHY broker may operate under different regulatory frameworks across various jurisdictions. The information presented here reflects the current understanding of the company's operations. The evaluation methodology employed in this review relies on standard industry assessment criteria including regulatory compliance, user feedback analysis, and operational transparency measures. Given the limited verified information available about PHY broker's operations, potential clients are strongly advised to conduct additional due diligence before engaging with this broker.

Rating Framework

Broker Overview

PHY Capital Investments Limited presents itself as a modern insurance brokerage company. They offer what they describe as "21st-century proactive insurance services." However, the company's actual focus appears to be on forex and CFD trading services rather than traditional insurance products. The specific establishment date and headquarters location remain unclear from available sources, which raises immediate concerns about the company's transparency and operational legitimacy.

The broker's business model centers around providing access to foreign exchange markets and contracts for difference trading. Despite claims of offering comprehensive trading services, the lack of detailed information about the company's background, leadership team, and operational history creates significant uncertainty for potential clients. This phy review finds that the absence of basic corporate information is particularly concerning in an industry where transparency is crucial for client confidence.

Regarding trading platforms and technology infrastructure, PHY broker has not disclosed specific information about whether they utilize industry-standard platforms such as MetaTrader 4 or MetaTrader 5. The available asset classes reportedly include forex pairs, CFDs, stock indices, and precious metals trading. However, the absence of clear regulatory oversight from recognized financial authorities significantly undermines the credibility of these service offerings. This makes it a critical consideration in any comprehensive phy review.

Regulatory Status: The regulatory information for PHY broker remains unclear and concerning. While references to NFA and WikiBit appear in available materials, no specific regulatory license numbers or authorizing bodies have been verified. This lack of transparent regulatory compliance represents a significant red flag for potential clients.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been disclosed in available materials. The absence of clear banking partnerships and payment processing information further contributes to concerns about the broker's operational legitimacy.

Minimum Deposit Requirements: The minimum deposit requirements for opening accounts with PHY broker are not specified in available documentation. This makes it impossible for potential clients to properly evaluate account accessibility.

Promotional Offers: No information about bonus structures, promotional campaigns, or special offers has been identified in available materials. This suggests either a lack of competitive incentives or insufficient marketing transparency.

Tradeable Assets: According to available information, PHY broker offers trading in forex currencies, contracts for difference, stock indices, and precious metals. However, the specific number of available instruments and market coverage details remain undisclosed.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available materials. This prevents accurate assessment of the broker's competitiveness in terms of pricing.

Leverage Ratios: The maximum leverage ratios offered by PHY broker for different asset classes have not been disclosed. This is essential information for traders evaluating risk management capabilities.

Platform Options: Specific trading platform options and technological infrastructure details are not provided in available materials. This raises questions about the quality and reliability of the trading environment.

Geographic Restrictions: Information about jurisdictional limitations and restricted countries is not available in current documentation.

Customer Support Languages: The availability of multilingual customer support services has not been specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by PHY broker receive a poor rating. This is due to the complete absence of essential information typically required for informed decision-making. Available materials do not specify different account types, their respective features, or the criteria for accessing various service levels. This lack of transparency makes it impossible for potential clients to understand what they would be signing up for. Such opacity is unacceptable in professional trading environments.

The minimum deposit requirements remain undisclosed. This prevents traders from assessing whether the broker's services align with their available capital. Additionally, no information about account opening procedures, required documentation, or verification timelines has been provided. The absence of details about special account features such as Islamic accounts for Muslim traders further demonstrates the broker's lack of comprehensive service planning.

Most concerning is the complete absence of information about account protection measures, segregated fund storage, or investor compensation schemes. These elements are fundamental to legitimate brokerage operations. Their omission significantly undermines confidence in the broker's commitment to client welfare. This phy review finds that the lack of transparent account condition information alone should deter potential clients from considering PHY broker as a viable trading partner.

PHY broker's tools and resources receive a below-average rating. This is primarily due to insufficient information about available trading tools and analytical resources. While the broker claims to offer trading in multiple asset classes including forex, CFDs, indices, and precious metals, no specific details about trading tools, charting capabilities, or analytical resources have been disclosed in available materials.

The absence of information about research and analysis resources is particularly concerning. This matters for traders who rely on fundamental and technical analysis for decision-making. Educational resources, which are crucial for trader development and skill enhancement, appear to be non-existent or undisclosed. The lack of automated trading support information also limits the broker's appeal to traders who utilize algorithmic strategies.

Without specific details about platform capabilities, third-party tool integrations, or proprietary analytical resources, it becomes impossible to assess whether PHY broker provides the technological infrastructure necessary for effective trading. The limited information available suggests a basic service offering. This may not meet the expectations of serious traders seeking comprehensive market analysis and trading support tools.

Customer Service and Support Analysis (Score: 2/10)

The customer service and support capabilities of PHY broker receive a poor rating. This is due to the complete absence of information about support channels, availability, and service quality. No details about customer service contact methods, response times, or support team qualifications have been provided in available materials. This raises serious concerns about the broker's commitment to client service.

The availability of multilingual support, which is essential for international brokers, remains unspecified. Additionally, no information about customer service hours or timezone coverage has been disclosed. This makes it impossible for potential clients to understand when assistance would be available. The absence of documented customer service policies or service level agreements further undermines confidence in the broker's support capabilities.

Most troubling is the lack of user feedback or testimonials about customer service experiences with PHY broker. In an industry where responsive and knowledgeable customer support is crucial for resolving trading issues and account problems, the absence of any verifiable information about support quality represents a significant risk. This matters for potential clients considering this broker for their trading activities.

Trading Experience Analysis (Score: 2/10)

The trading experience offered by PHY broker receives a poor rating. This is due to insufficient information about platform stability, execution quality, and overall trading environment. No user feedback about platform performance, order execution speeds, or system reliability has been identified in available materials. This makes it impossible to assess the actual trading experience clients might expect.

Platform functionality details, including charting capabilities, order types, and mobile trading options, remain undisclosed. The absence of information about execution models, whether the broker operates as a market maker or uses straight-through processing, raises questions about potential conflicts of interest and execution quality. Without transparency about trading conditions and platform capabilities, traders cannot make informed decisions about whether the broker meets their operational requirements.

The lack of performance data, such as execution speeds, slippage statistics, or uptime records, further contributes to uncertainty about the trading experience quality. This phy review finds that the absence of verifiable information about trading conditions and platform performance makes PHY broker unsuitable. This applies to traders who require reliable and transparent trading environments for their investment activities.

Trust and Safety Analysis (Score: 1/10)

PHY broker receives the lowest possible rating for trust and safety. This is due to fundamental concerns about regulatory compliance and operational legitimacy. The widespread perception among users that PHY Capital Investments Limited operates as a clone company raises serious questions about the broker's authenticity and legal standing in the financial services industry.

The absence of verifiable regulatory licenses from recognized financial authorities represents a critical safety concern for potential clients. While references to NFA and WikiBit appear in available materials, no specific regulatory authorization numbers or compliance documentation has been verified. This lack of regulatory oversight means that clients would have limited recourse in case of disputes or operational problems.

Fund security measures, including client money segregation, deposit protection schemes, and operational risk management procedures, remain completely undisclosed. The absence of transparency about corporate governance, ownership structure, and operational controls further undermines trust in the broker's ability to safely handle client funds and provide reliable services. These fundamental trust and safety deficiencies make PHY broker unsuitable for any serious trading consideration.

User Experience Analysis (Score: 2/10)

The user experience rating for PHY broker is poor. This is due to the notable absence of user ratings, reviews, and feedback about the broker's services. This lack of user-generated content suggests either a very limited client base or potential issues with the broker's operational legitimacy that prevent normal user engagement and feedback generation.

Interface design and platform usability information is not available in current materials. This makes it impossible to assess whether the broker provides an intuitive and efficient trading environment. The registration and account verification process details remain undisclosed. This prevents potential clients from understanding the complexity and timeline involved in becoming active traders with this broker.

Fund operation experiences, including deposit and withdrawal processes, processing times, and associated fees, are not documented in available user feedback. The absence of common user complaints or positive testimonials creates an information vacuum that makes it impossible to identify potential issues or advantages of choosing PHY broker. This lack of user experience data represents a significant red flag in an industry where peer feedback and user reviews are crucial for evaluating broker quality and reliability.

Conclusion

This comprehensive phy review reveals significant concerns about PHY broker's legitimacy, regulatory compliance, and operational transparency. These issues make it unsuitable for traders seeking reliable and safe trading environments. The widespread perception of PHY Capital Investments Limited as a clone company, combined with the absence of verifiable regulatory authorization, creates unacceptable risks for potential clients.

The broker is not recommended for any trader category. This particularly applies to those who prioritize safety, regulatory compliance, and transparent operations. The complete absence of essential information about trading conditions, costs, platform capabilities, and customer support makes it impossible to properly evaluate the broker's services against industry standards.

The primary disadvantages include lack of regulatory oversight, absence of user feedback, unclear operational structure, and insufficient transparency about basic service offerings. While some traders might be attracted to unregulated environments for perceived flexibility, the risks associated with PHY broker far outweigh any potential benefits. This makes it advisable for traders to seek regulated alternatives with proven track records and transparent operations.