Is PHY safe?

Pros

Cons

Is Phy Safe or a Scam?

Introduction

Phy Capital Investments Limited, often referred to simply as "Phy," positions itself as a foreign exchange broker offering a variety of trading services, including forex, CFDs, indices, and metals. In an increasingly complex and sometimes deceptive financial landscape, traders must exercise caution when selecting a broker. The importance of thorough due diligence cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to evaluate the safety and legitimacy of Phy by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of available information, including user feedback, regulatory alerts, and expert analyses.

Regulation and Legitimacy

One of the primary factors to consider when evaluating a broker is its regulatory status. Regulatory oversight serves as a safeguard for investors, ensuring that brokers adhere to specific operational standards and ethical practices. Unfortunately, Phy Capital Investments Limited operates without any valid regulatory licenses, raising serious concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory license means that Phy is not held accountable by any financial authority, leaving traders vulnerable. Reports indicate that Phy has been blacklisted by the Securities & Futures Commission of Hong Kong due to its lack of compliance and use of misleading information regarding its regulatory status. The implications of this are significant, as engaging with an unregulated broker like Phy can expose traders to high risks, including the potential for fraud and loss of funds.

Company Background Investigation

Phy Capital Investments Limited claims to be based in Hong Kong and has been operational for approximately 5 to 10 years. However, the companys background raises red flags. It has been reported that Phy uses the address of a secretarial company, a common tactic employed by fraudulent entities to create an illusion of legitimacy. The ownership structure of Phy remains opaque, with little information available about its management team or their qualifications. This lack of transparency is concerning, as it suggests that the broker may not operate with the best interests of its clients in mind.

Without a clear understanding of who is behind the brokerage, traders are left in the dark regarding the potential risks associated with entrusting their funds to Phy. The absence of a well-defined management team and the lack of professional experience further exacerbate concerns about the broker's reliability and operational integrity.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's overall experience and profitability. Phy presents a range of trading options, but the specifics of its fee structure and trading conditions are not well-documented.

| Fee Type | Phy Capital Investments | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.5 - 3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Rate | N/A | Varies |

Reports suggest that traders have encountered unexpected fees and difficult withdrawal processes, which are common indicators of potential scams. The lack of transparent information regarding spreads, commissions, and overnight interest rates raises further concerns about the broker's practices. Traders should be wary of any broker that does not provide clear and accessible information about trading costs, as this could be a sign of hidden fees or unfair practices.

Customer Fund Security

The security of customer funds is paramount when assessing the trustworthiness of a broker. Phy Capital Investments has not provided adequate information regarding its fund security measures. Reports indicate that clients have experienced issues with fund withdrawals, with many alleging that their requests were ignored or unjustly delayed.

In terms of fund protection, Phy does not appear to offer features such as segregated accounts or negative balance protection, which are essential for safeguarding trader investments. The absence of these protective measures significantly heightens the risk of financial loss for clients. Historical complaints about difficulty in retrieving funds add to the concerns surrounding Phy's safety, making it imperative for traders to consider these factors seriously.

Customer Experience and Complaints

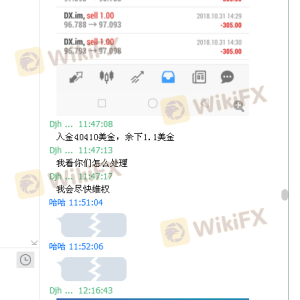

Customer feedback is a critical element in assessing the reliability of any broker. A review of user experiences with Phy reveals a pattern of negative reviews, with many clients reporting issues related to fund withdrawals and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Information | High | Poor |

| Customer Service Quality | Medium | Poor |

Many users have expressed frustration over the lack of communication from the company, particularly when attempting to resolve issues related to their accounts. For instance, one user reported being blacklisted after raising concerns about trading losses, indicating a troubling attitude towards customer feedback. Such patterns of complaints are significant red flags, suggesting that Phy may not be committed to maintaining a positive relationship with its clients.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Phy Capital Investments offers a trading platform, but user reviews indicate that it may suffer from stability issues, including frequent outages and slow execution times.

Traders have reported instances of slippage and order rejections, which can severely impact trading results. Additionally, there are concerns about potential market manipulation, as some users have alleged that the platform's operations appear to favor the broker over the trader. The overall user experience is essential for ensuring that traders can execute their strategies effectively, and the reported issues with Phys platform raise serious questions about its reliability.

Risk Assessment

Engaging with Phy Capital Investments carries significant risks, primarily due to its lack of regulation, poor customer feedback, and questionable operational practices.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid licenses or oversight |

| Fund Security | High | Reports of withdrawal issues |

| Customer Service | Medium | Poor response to complaints |

| Platform Reliability | High | Frequent outages and execution issues |

To mitigate these risks, traders should consider avoiding Phy Capital Investments altogether. Instead, they should seek out brokers that are well-regulated and have a proven track record of reliability and customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Phy Capital Investments Limited is not a safe choice for traders. The absence of regulatory oversight, combined with a history of customer complaints and questionable trading practices, paints a concerning picture. Traders should exercise extreme caution and consider alternative options that offer better security and transparency.

For those looking for reliable trading options, consider regulated brokers such as Interactive Brokers, City Index, or AvaTrade, which provide a more secure trading environment. In light of the analysis presented, it is clear that Phy is not safe for trading, and potential clients should be wary of engaging with this broker.

Is PHY a scam, or is it legit?

The latest exposure and evaluation content of PHY brokers.

PHY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PHY latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.