Is INGFX safe?

Pros

Cons

Is INGFX A Scam?

Introduction

INGFX is a forex and CFD broker that has recently gained attention in the trading community. Operating under the domain ingfxgroup.com, the broker claims to offer a wide range of trading instruments and competitive trading conditions. However, as with any financial service, it is crucial for traders to carefully evaluate the credibility and safety of the broker before investing their hard-earned money. The forex market is rife with unregulated entities and potential scams, making thorough due diligence essential for traders seeking to safeguard their investments. This article seeks to provide a comprehensive assessment of INGFX, utilizing a mix of narrative analysis and structured information to determine whether INGFX is safe or a potential scam.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation ensures that brokers adhere to specific standards and provides a level of protection for traders. Unfortunately, INGFX does not appear to be regulated by any recognized financial authority. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is a significant red flag. Regulated brokers are required to maintain certain capital reserves, segregate client funds, and provide transparency in their operations. In contrast, INGFX has been reported to make false claims about being regulated by ASIC (Australian Securities and Investments Commission), which has been disproven. This lack of legitimate oversight raises serious concerns about the safety of funds and the overall integrity of the broker.

Company Background Investigation

The history and ownership structure of a broker can provide valuable insights into its legitimacy. Unfortunately, there is limited publicly available information regarding INGFX's history or ownership. The broker claims to be based in Australia, but this assertion lacks corroborating evidence. Additionally, the identities of the individuals behind INGFX remain undisclosed, which contributes to a lack of transparency.

The management teams background is another critical factor. A reputable broker typically has a team with extensive experience in finance and trading. However, the lack of disclosed information about INGFX's management raises concerns about their expertise and the broker's overall credibility. Given these factors, it is challenging to ascertain whether INGFX operates with the necessary transparency and professionalism expected from a reputable broker.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer, including fees and spreads. INGFX promotes low initial deposits and attractive trading spreads, but the lack of transparency regarding their fee structure is concerning.

| Fee Type | INGFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information about commissions and overnight interest rates is problematic. Traders may encounter unexpected fees that could significantly impact their profitability. Moreover, the broker's claims of spreads as low as 0.0 pips should be approached with caution, as such offers are often associated with hidden costs or unfavorable trading conditions. This lack of clarity raises questions about whether INGFX is genuinely committed to providing fair trading conditions or if it is a tactic to lure inexperienced traders.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. INGFX's website does not provide specific information regarding its client fund protection measures. A reliable broker typically segregates client funds from its operational funds, ensuring that traders' money is safe even in the event of financial difficulties.

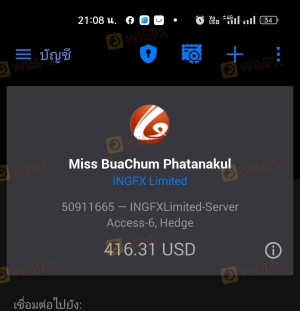

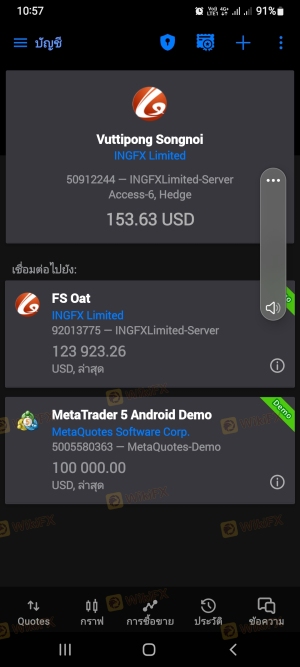

Furthermore, investor protection schemes are crucial in safeguarding traders against broker insolvency. However, INGFX has not disclosed any such measures, leaving clients vulnerable. Reports from users indicate significant issues with withdrawals, with many claiming they were unable to access their funds. This pattern of behavior is characteristic of fraudulent operations, further suggesting that INGFX may not be a safe broker.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Unfortunately, reviews of INGFX paint a troubling picture. Many users have reported negative experiences, particularly regarding withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

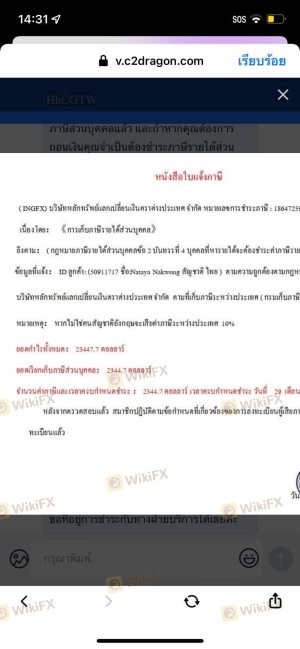

Common complaints include users being unable to withdraw their funds or facing unexpected fees during the withdrawal process. In some cases, traders reported being asked to pay additional taxes or fees before they could access their money. This practice is often indicative of a scam, where brokers create barriers to prevent clients from withdrawing their funds. Such complaints raise serious concerns about whether INGFX is a trustworthy broker or merely a facade for fraudulent activities.

Platform and Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. INGFX claims to use the widely recognized MetaTrader 5 platform, known for its stability and user-friendly interface. However, the overall user experience reported by traders has been inconsistent.

Many users have expressed concerns about order execution quality, including issues with slippage and rejected orders. These problems can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Furthermore, any signs of platform manipulation, such as frequent disconnections or unauthorized trades, could indicate a lack of integrity on the part of the broker.

Risk Assessment

Engaging with an unregulated broker like INGFX carries inherent risks. Traders must be aware of the potential pitfalls associated with using such platforms. Below is a summary of the key risk areas associated with INGFX:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud. |

| Fund Safety Risk | High | Lack of fund segregation and protection measures. |

| Withdrawal Risk | High | Numerous complaints regarding fund access. |

To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers with a proven track record of reliability and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that INGFX may not be a safe broker for traders. The lack of regulation, transparency, and numerous complaints regarding withdrawal issues indicate that traders should exercise extreme caution. There are significant red flags that suggest INGFX operates in a manner that could be detrimental to traders' financial well-being.

For those seeking to engage in forex trading, it is advisable to consider regulated alternatives that provide a safer trading environment. Brokers with established reputations, transparent fee structures, and robust customer support systems are preferable choices. Ultimately, if you are considering trading with INGFX, it is crucial to weigh the risks carefully and prioritize the safety of your investments.

Is INGFX a scam, or is it legit?

The latest exposure and evaluation content of INGFX brokers.

INGFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INGFX latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.