INGFX 2025 Review: Everything You Need to Know

Executive Summary

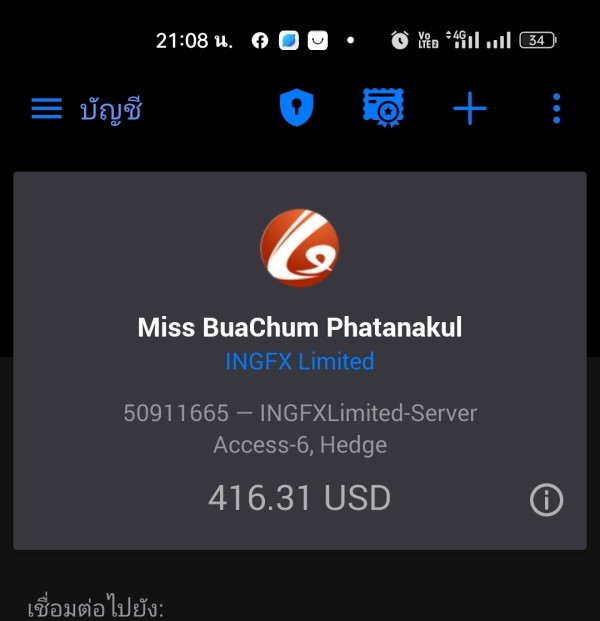

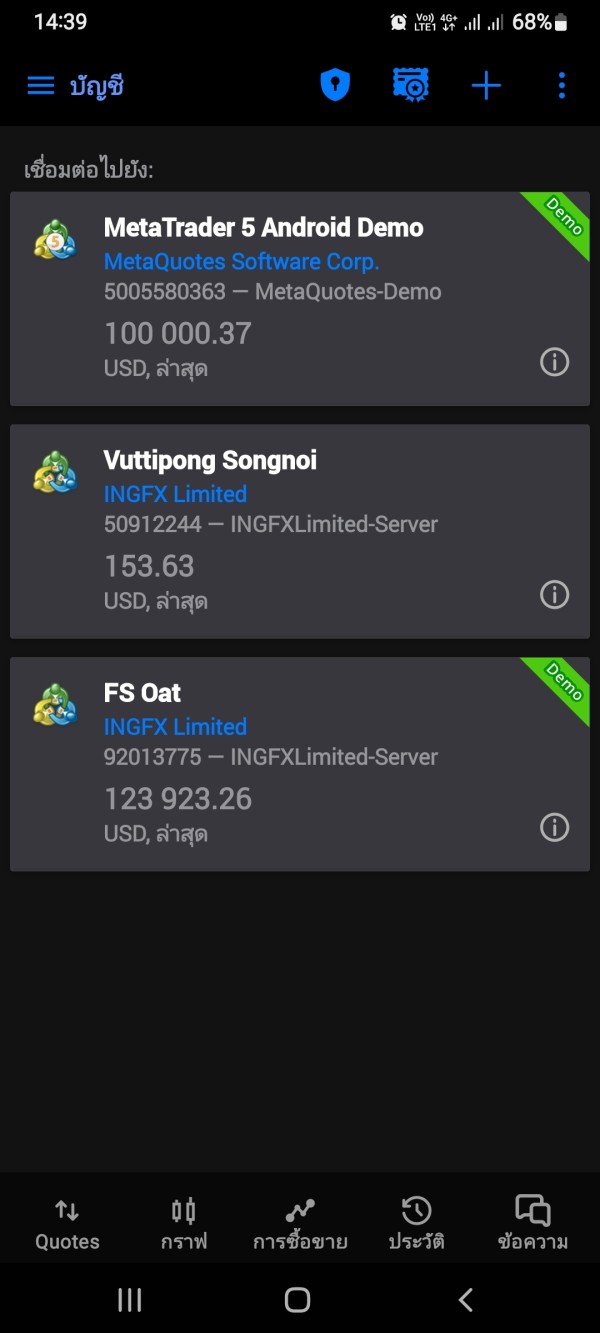

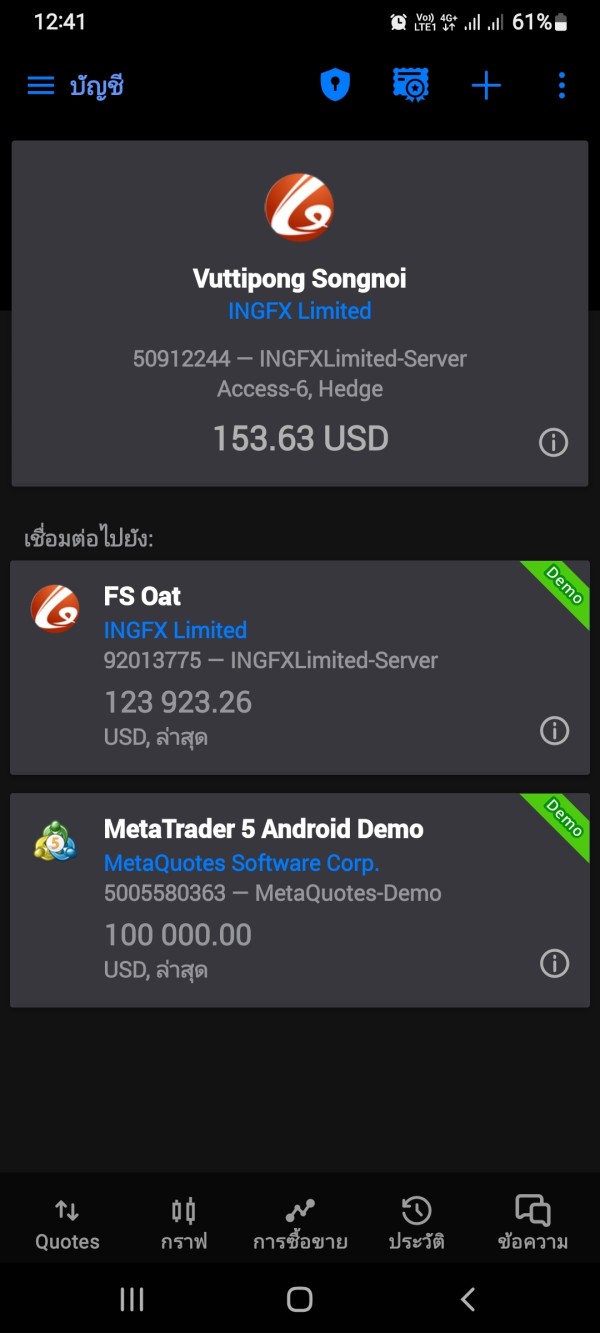

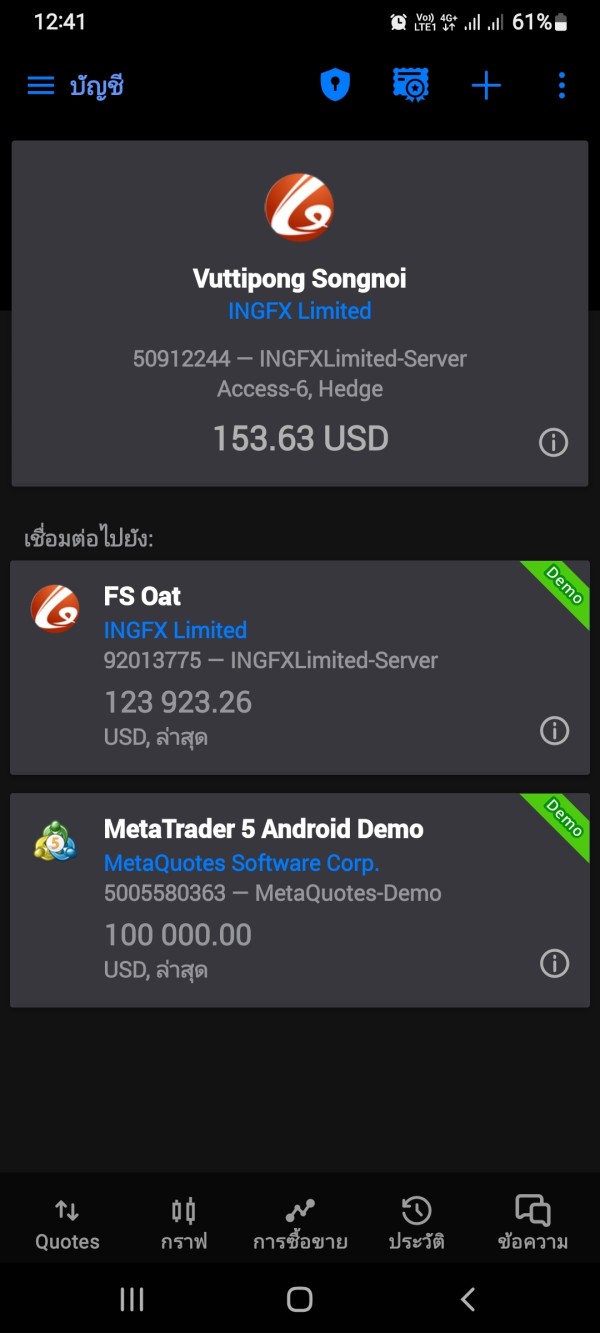

This comprehensive ingfx review reveals significant concerns about the broker's credibility and regulatory status that potential traders must carefully consider. INGFX presents itself as a forex and CFD trading platform offering high leverage up to 400:1 and utilizing the widely recognized MetaTrader 5 trading platform. However, our investigation uncovers substantial red flags regarding the broker's regulatory claims and overall trustworthiness.

The broker claims to be regulated by ASIC. Our verification attempts have yielded no matching results in official regulatory databases. This discrepancy raises serious questions about INGFX's legitimacy and regulatory compliance. User feedback presents a mixed picture, with some positive comments about trading tools and platform functionality, but concerning negative reviews highlighting potential safety issues and poor customer service experiences.

INGFX appears to target experienced traders seeking high-leverage opportunities. The platform offers over 150 tradable assets with spreads starting from 0 pips. The broker boasts an average execution speed of 0ms, suggesting efficient order processing. However, the lack of transparency regarding minimum deposits, commission structures, and withdrawal procedures creates additional uncertainty for potential clients.

Given the unverified regulatory status and negative user feedback patterns, traders should exercise extreme caution when considering INGFX as their trading platform. While the technical features may appear attractive, the fundamental trust and safety concerns significantly outweigh any potential benefits.

Important Notice

This ingfx review is based on available public information, user feedback, and regulatory database searches as of 2025. INGFX claims ASIC regulation but verification attempts have not confirmed this regulatory status, suggesting potential differences in regional oversight or possible misrepresentation. Traders should be aware that regulatory protection may vary significantly across different jurisdictions.

Our evaluation methodology incorporates multiple data sources including user reviews, regulatory databases, company disclosures, and industry reports. However, the limited availability of verified information about INGFX necessitates a cautious approach to this assessment. Potential clients are strongly advised to conduct independent verification of all regulatory claims and thoroughly research any broker before committing funds.

Overall Rating Framework

Broker Overview

INGFX operates as a forex and CFD trading broker in the competitive online trading market. The company's establishment date and corporate background remain unclear from available sources, which immediately raises transparency concerns for potential clients. This lack of fundamental company information is particularly troubling in an industry where regulatory compliance and corporate accountability are paramount.

The broker positions itself as a provider of leveraged trading services. It focuses primarily on forex pairs and contracts for difference across various asset classes. INGFX's business model appears to center on offering high-leverage trading opportunities to attract experienced traders seeking amplified market exposure. However, the absence of clear information about the company's ownership structure, management team, and operational history creates significant gaps in due diligence assessment.

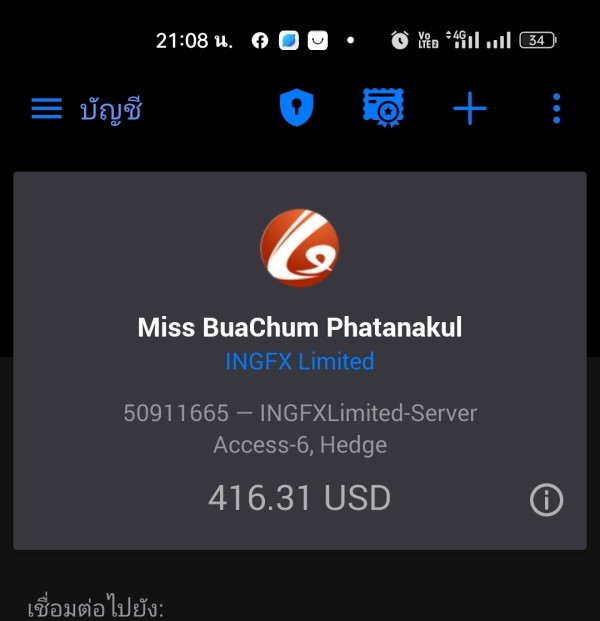

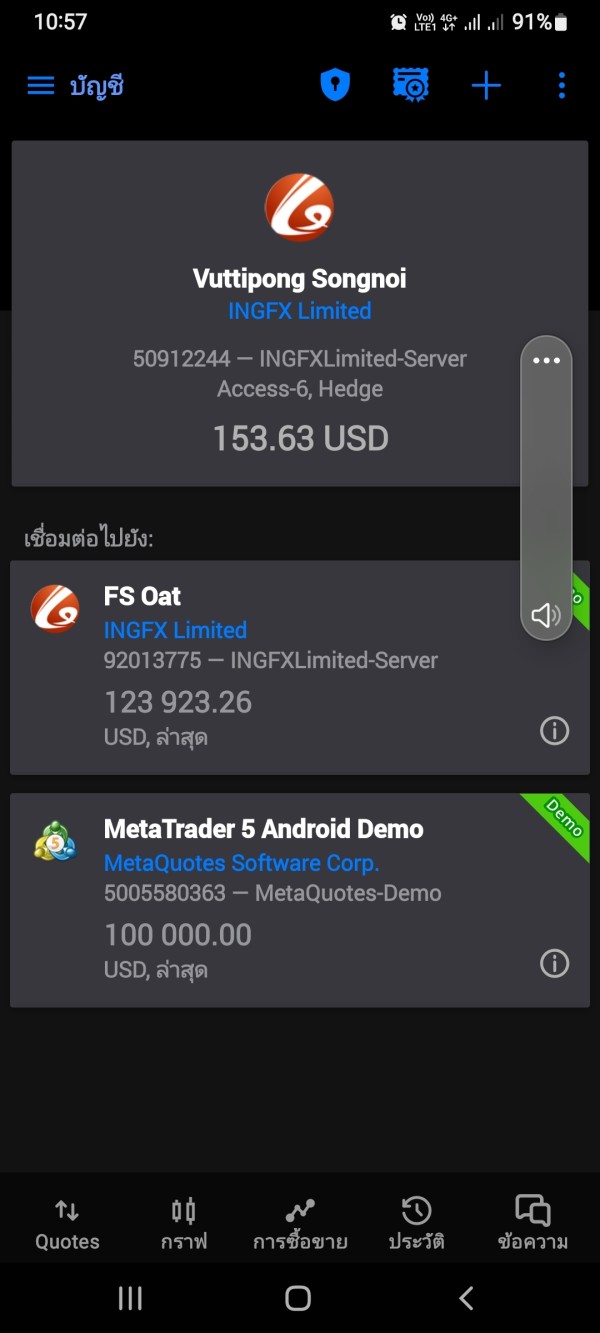

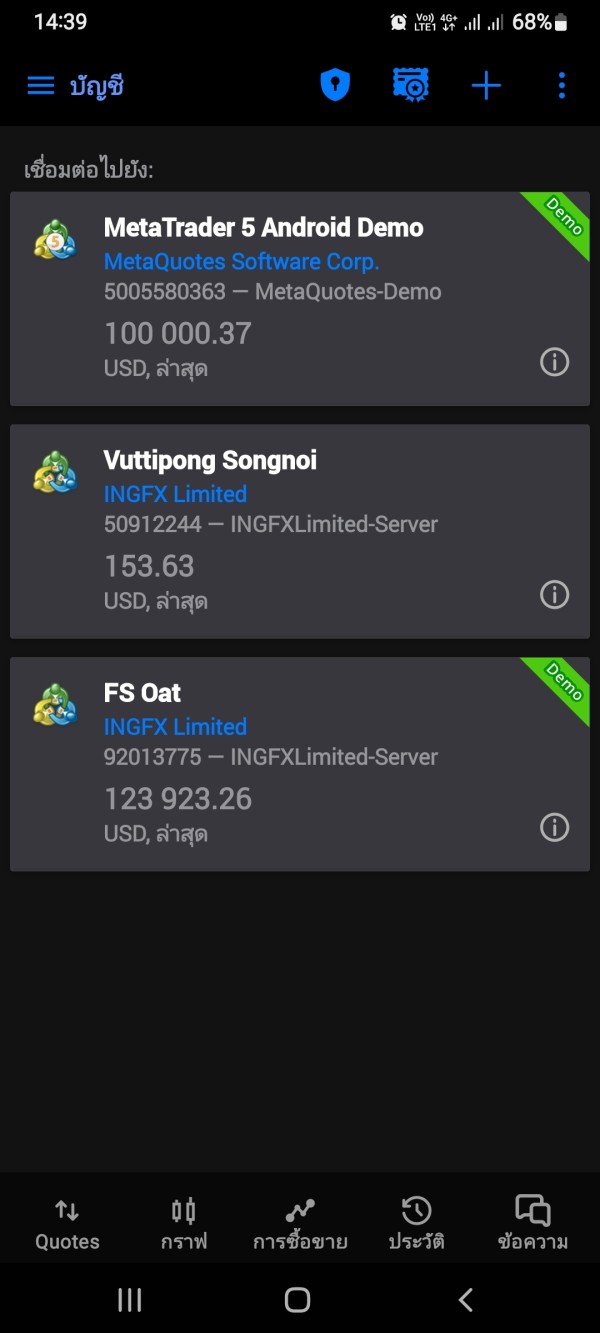

Regarding trading infrastructure, INGFX utilizes the globally recognized MetaTrader 5 platform. This provides traders with advanced charting capabilities, automated trading support, and comprehensive technical analysis tools. The broker claims to offer over 150 tradable instruments across multiple asset categories, suggesting a diverse trading environment. However, specific details about asset categorization, contract specifications, and trading conditions remain insufficiently documented in available materials.

The regulatory situation presents the most significant concern in this ingfx review. While INGFX claims ASIC regulation, independent verification through official regulatory databases has failed to confirm this status, raising serious questions about the broker's legal compliance and operational legitimacy.

Regulatory Status: INGFX claims regulation under ASIC. Verification attempts through official regulatory databases have not yielded matching results. This discrepancy raises significant concerns about the broker's actual regulatory compliance and legal operating status.

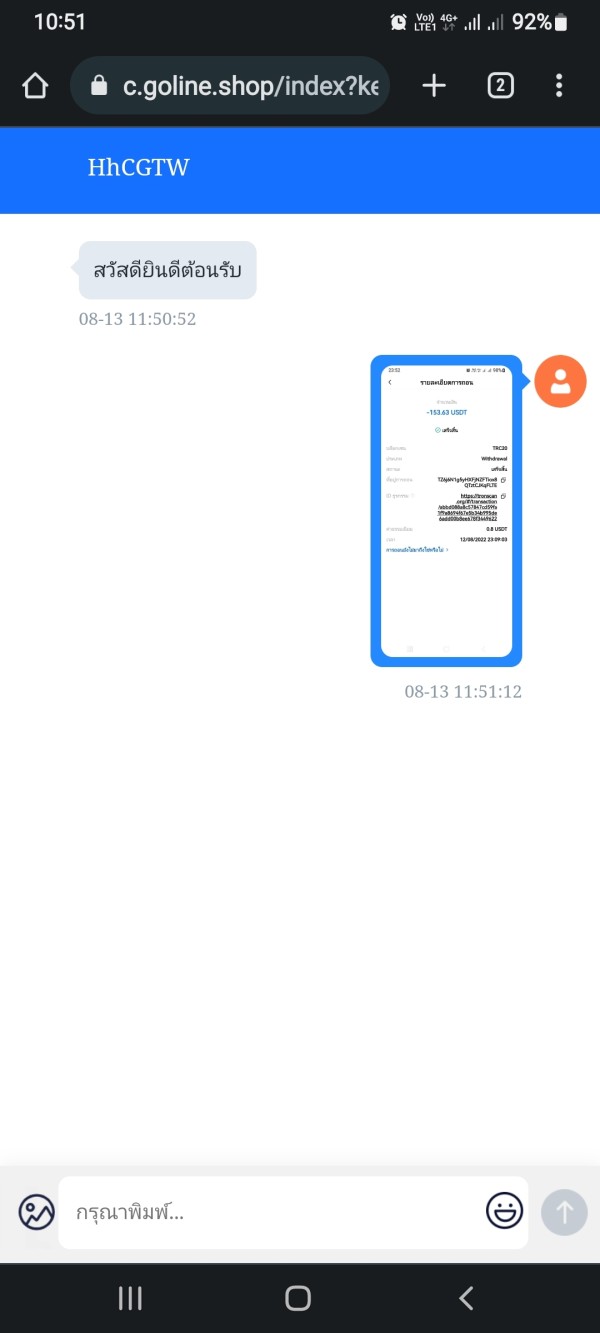

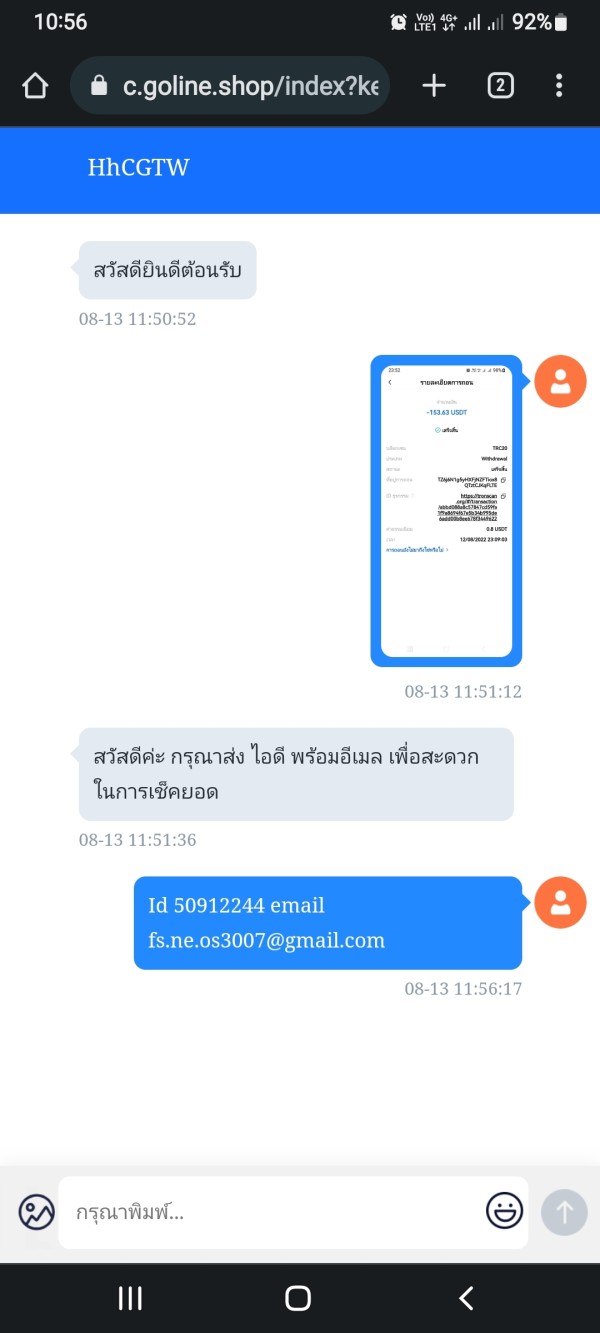

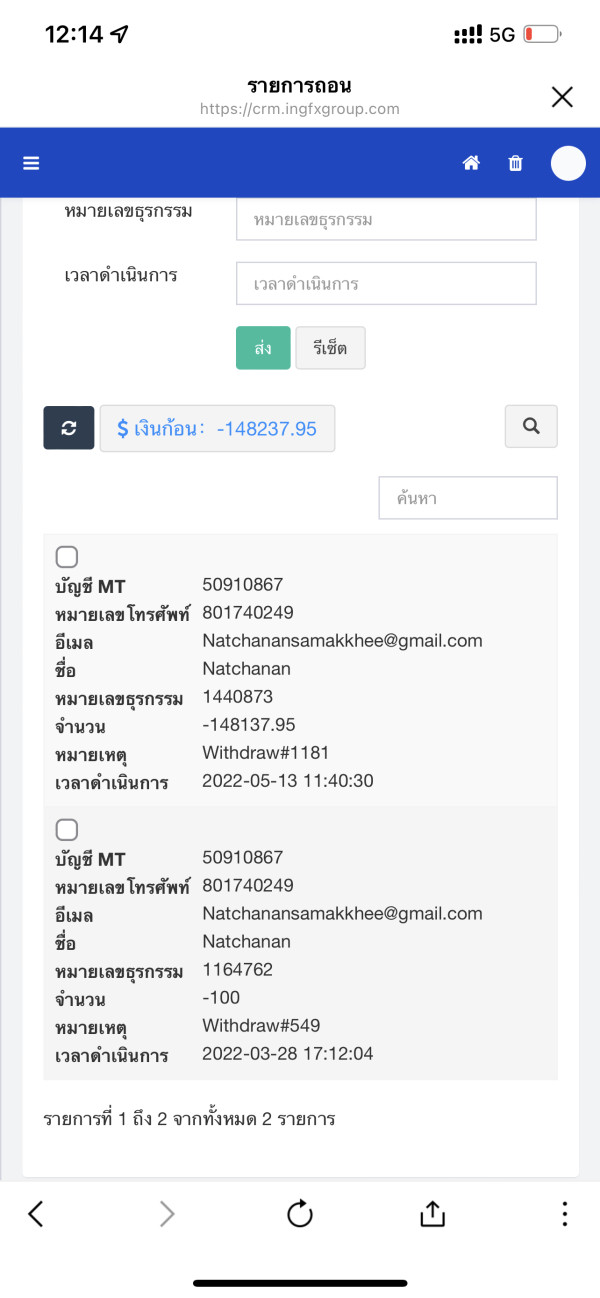

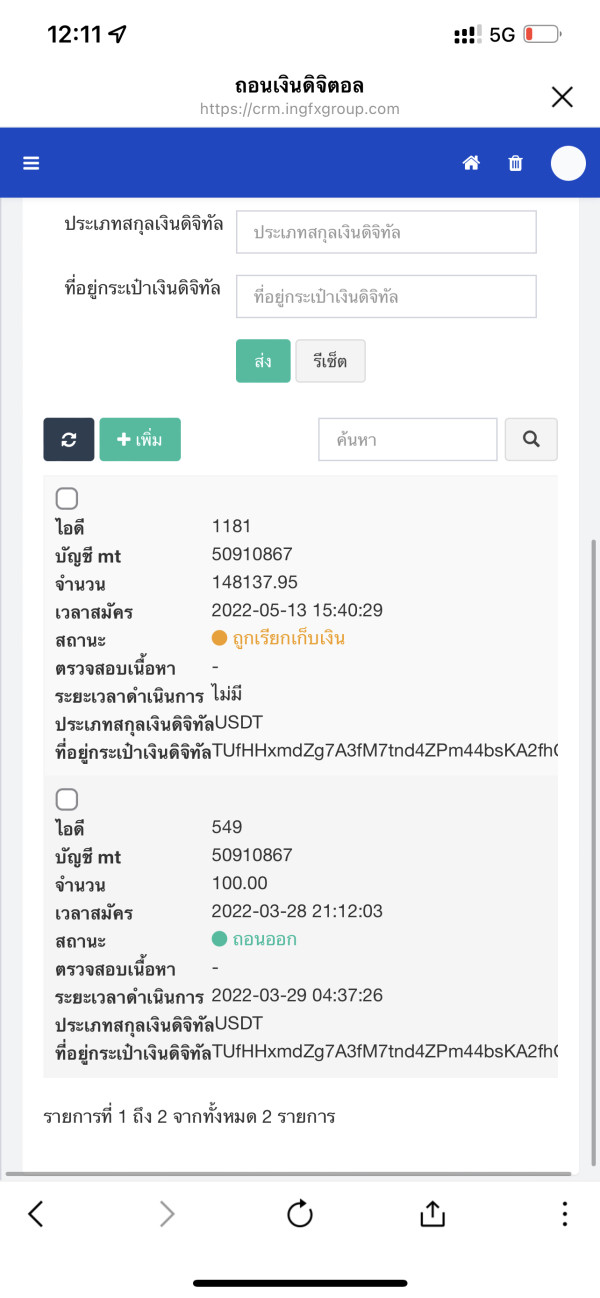

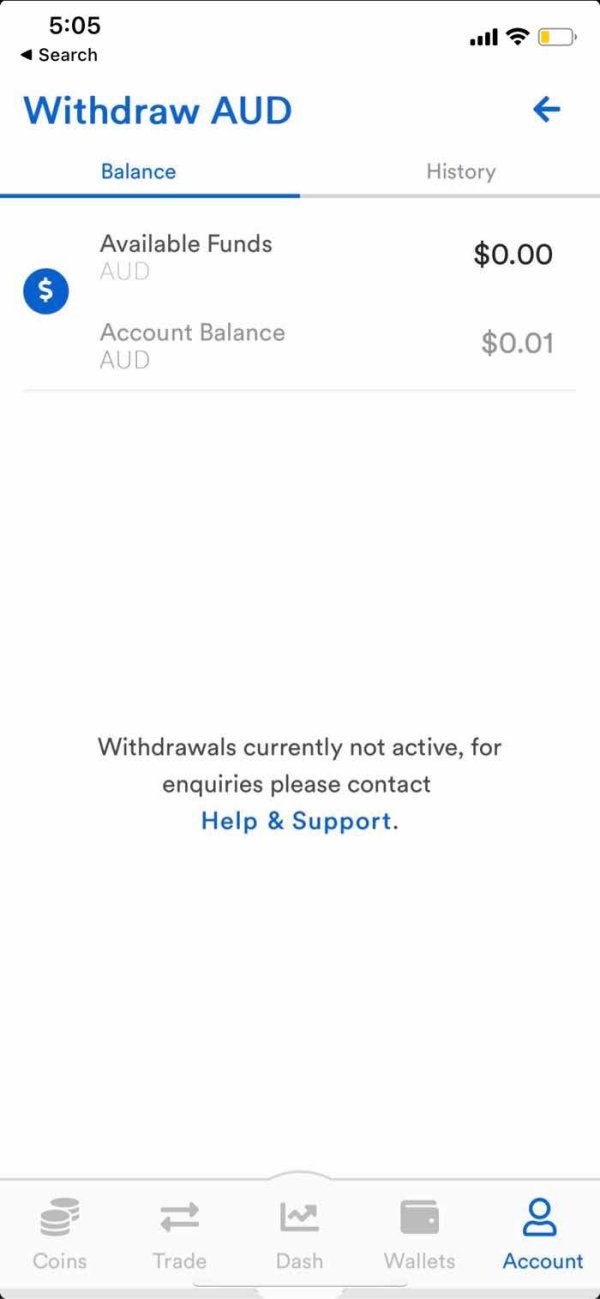

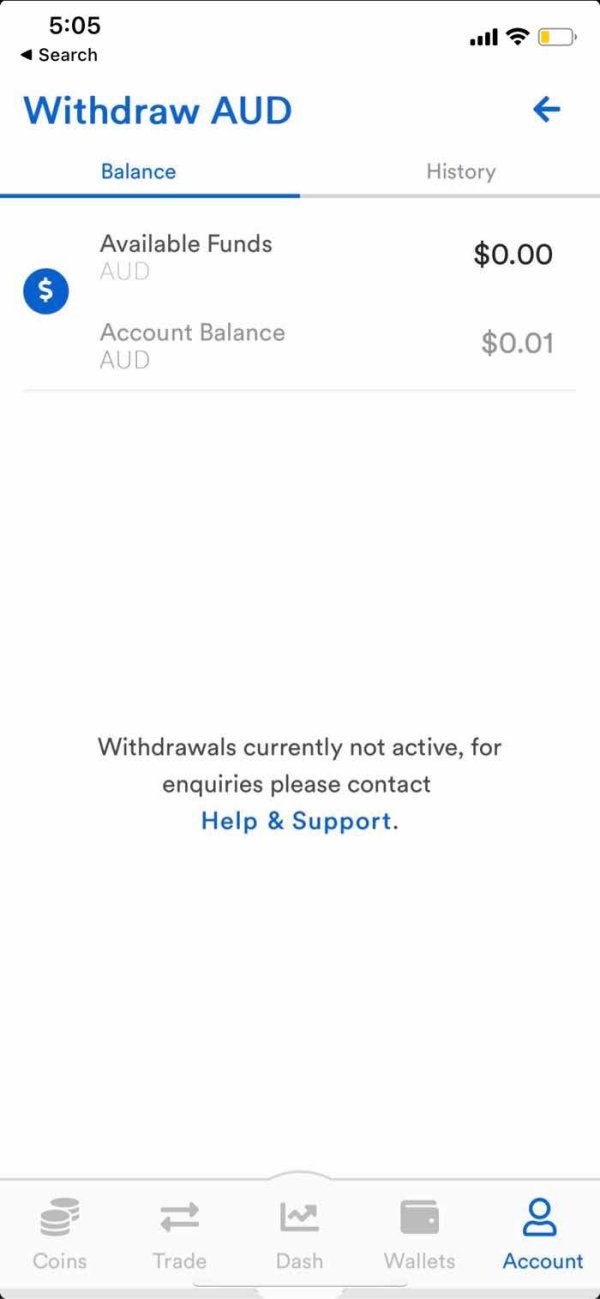

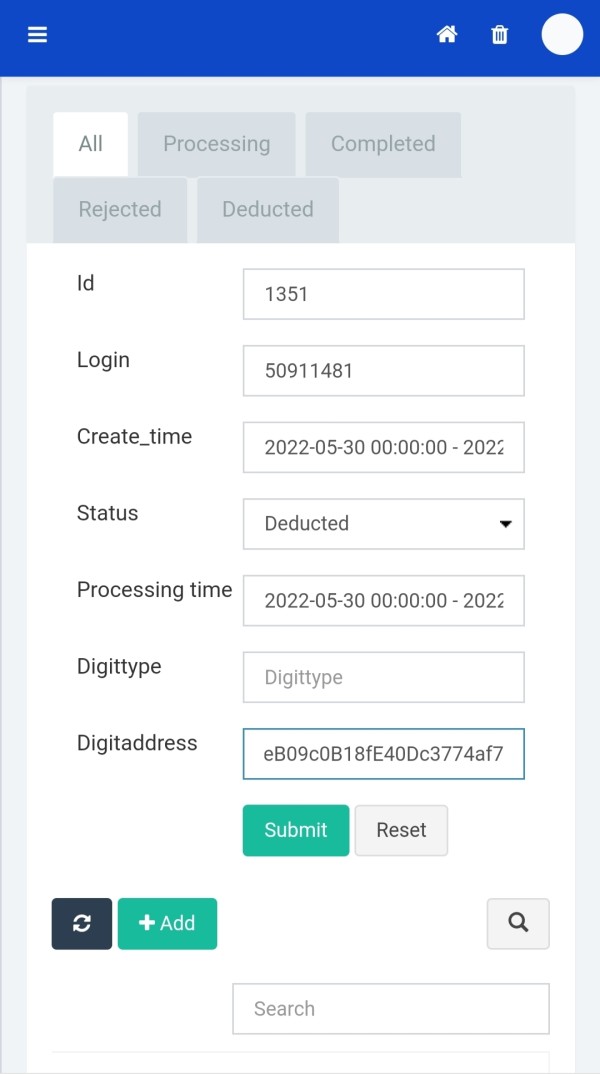

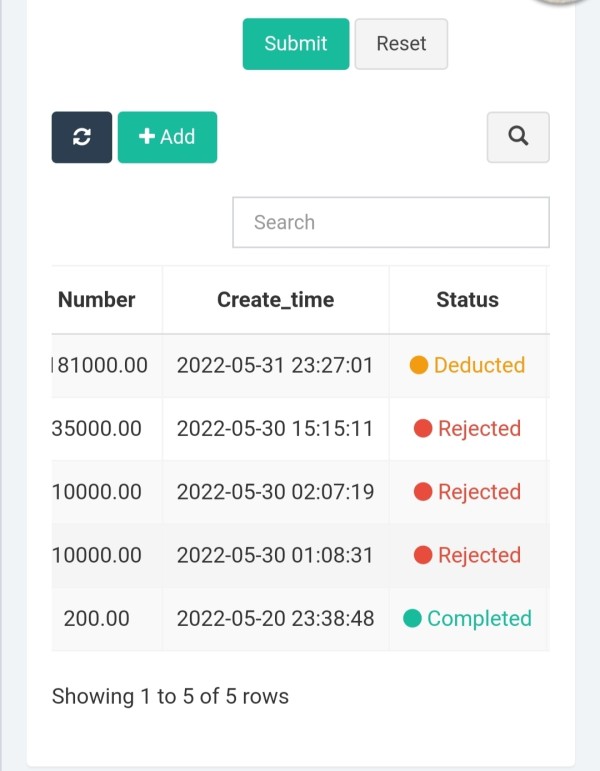

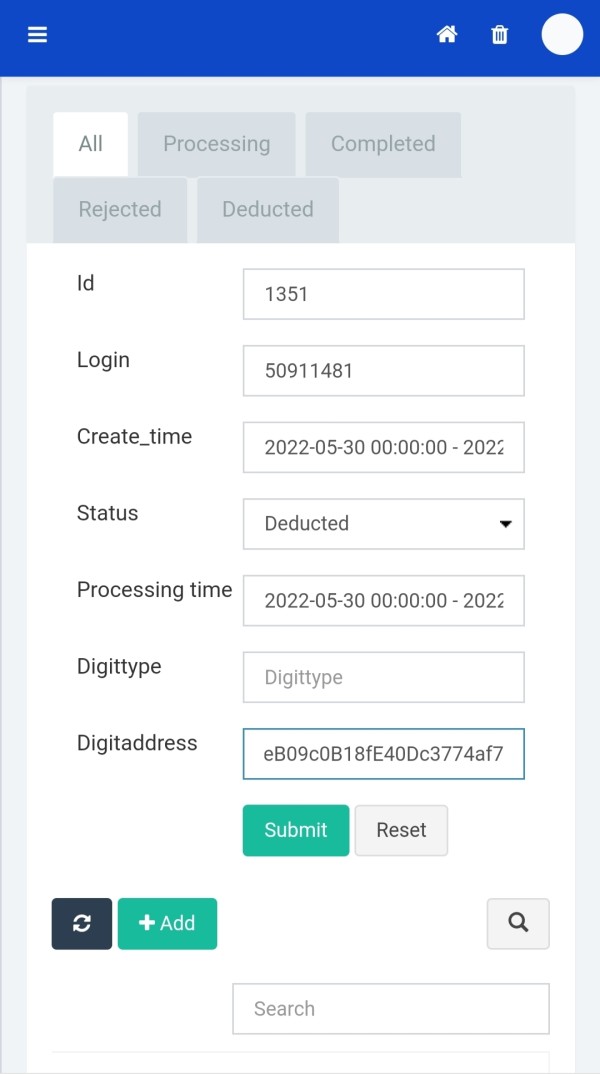

Deposit and Withdrawal Methods: Available information does not specify the deposit and withdrawal methods supported by INGFX. This lack of transparency regarding payment processing is concerning for potential clients who need to understand funding options and withdrawal procedures before opening accounts.

Minimum Deposit Requirements: No specific information about minimum deposit requirements has been disclosed in available sources. The absence of this fundamental account opening information further compounds transparency concerns about INGFX's operating procedures.

Promotional Offers: Current promotional offers, bonus structures, or incentive programs are not detailed in available information. This lack of clarity about promotional terms and conditions prevents proper evaluation of potential benefits and associated risks.

Tradable Assets: INGFX offers over 150 tradable instruments. Specific categorization and detailed asset lists are not comprehensively documented. The range appears to include forex pairs and CFDs across various underlying markets.

Cost Structure: Spreads reportedly start from 0 pips. Commission structures, overnight financing rates, and other trading costs are not clearly specified. This incomplete fee disclosure hampers accurate cost comparison with other brokers.

Leverage Ratios: Maximum leverage reaches 400:1. This represents extremely high risk exposure that requires sophisticated risk management skills and substantial trading experience.

Platform Options: MetaTrader 5 serves as the primary trading platform. It offers professional-grade trading tools and analytical capabilities. However, information about additional platform options or proprietary trading interfaces is not available.

This detailed analysis reveals significant information gaps that impact the overall assessment in this ingfx review, particularly regarding transparency and regulatory compliance.

Account Conditions Analysis

The account conditions evaluation for INGFX reveals substantial transparency deficiencies that significantly impact the broker's credibility assessment. Available information does not specify the types of trading accounts offered, their respective features, or the qualification criteria for different account tiers. This fundamental lack of disclosure prevents potential clients from making informed decisions about account selection and suitability.

Minimum deposit requirements remain undisclosed. This is particularly concerning as this represents basic information that regulated brokers typically provide prominently. Without clear deposit thresholds, traders cannot properly assess the accessibility of different account types or plan their initial funding requirements. The absence of this information suggests either poor disclosure practices or potential variability in requirements that may not be transparent.

Account opening procedures and verification requirements are not detailed in available sources. Regulated brokers typically provide clear information about documentation requirements, verification timelines, and account activation processes. The lack of such information raises questions about INGFX's compliance with standard industry practices and regulatory requirements for client onboarding.

Special account features, such as Islamic accounts, professional trader classifications, or institutional account options, are not mentioned in available materials. This absence of information about specialized account types further limits the assessment of INGFX's service comprehensiveness and regulatory compliance capabilities.

User feedback regarding account conditions includes complaints about lack of transparency and difficulty obtaining clear information about account terms and conditions. These concerns align with the information gaps identified in this ingfx review and reinforce the need for extreme caution when considering account opening with this broker.

INGFX's trading tools and resources evaluation presents a mixed picture with some strengths in platform technology but significant gaps in educational and analytical support. The broker's primary strength lies in its adoption of MetaTrader 5, a globally recognized and professionally respected trading platform that provides comprehensive charting capabilities, technical indicators, and automated trading support through Expert Advisors.

The MetaTrader 5 implementation offers traders access to advanced order types, multiple timeframe analysis, and sophisticated risk management tools. The platform's built-in economic calendar, market news feeds, and technical analysis capabilities provide essential trading support. However, information about platform customization options, additional plugins, or broker-specific enhancements is not available in current sources.

Research and analytical resources appear limited based on available information. Professional brokers typically provide market analysis, economic research, trading signals, or expert commentary to support client decision-making. The absence of detailed information about such resources suggests either limited offerings or poor disclosure of available analytical support services.

Educational resources, including webinars, tutorials, trading guides, or market education materials, are not documented in available sources. For a broker targeting experienced traders, the lack of continuing education and skill development resources represents a significant service gap that may impact long-term client relationships and trading success.

Automated trading support through MetaTrader 5's Expert Advisor functionality provides some technical capability for algorithmic trading strategies. However, information about broker-specific automated trading services, copy trading options, or signal services is not available, limiting the assessment of comprehensive automated trading support.

User feedback includes positive comments about the MetaTrader 5 platform's functionality and reliability. Some users note limitations in additional tools and resources compared to other brokers in the market.

Customer Service Analysis

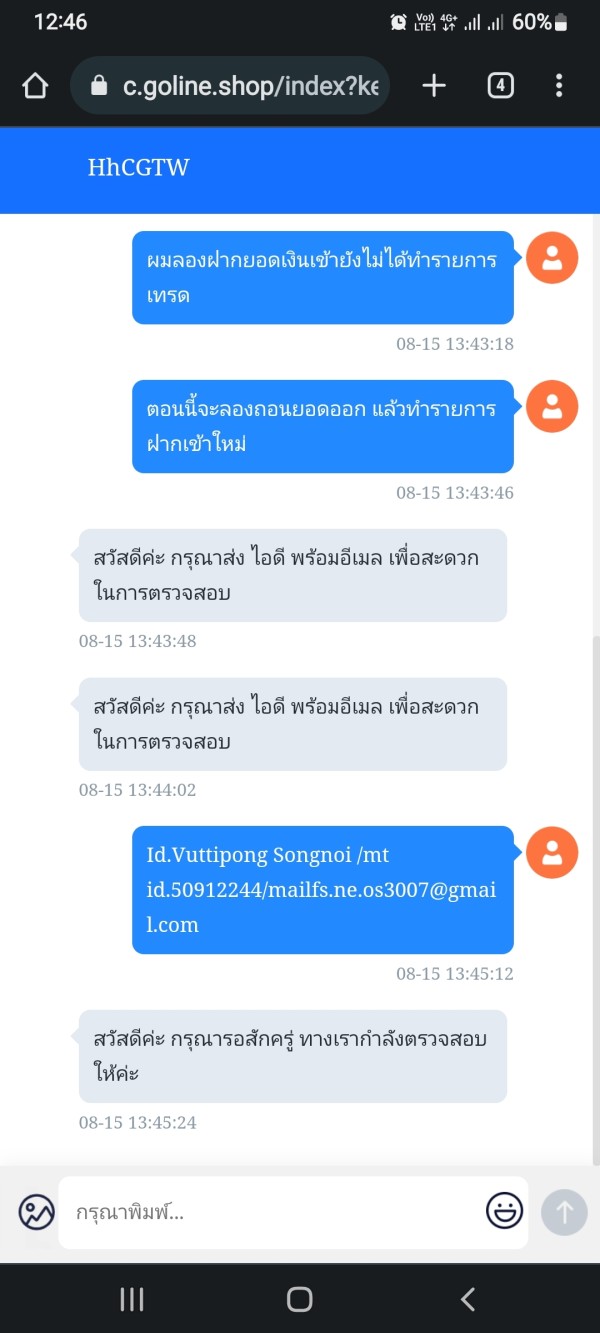

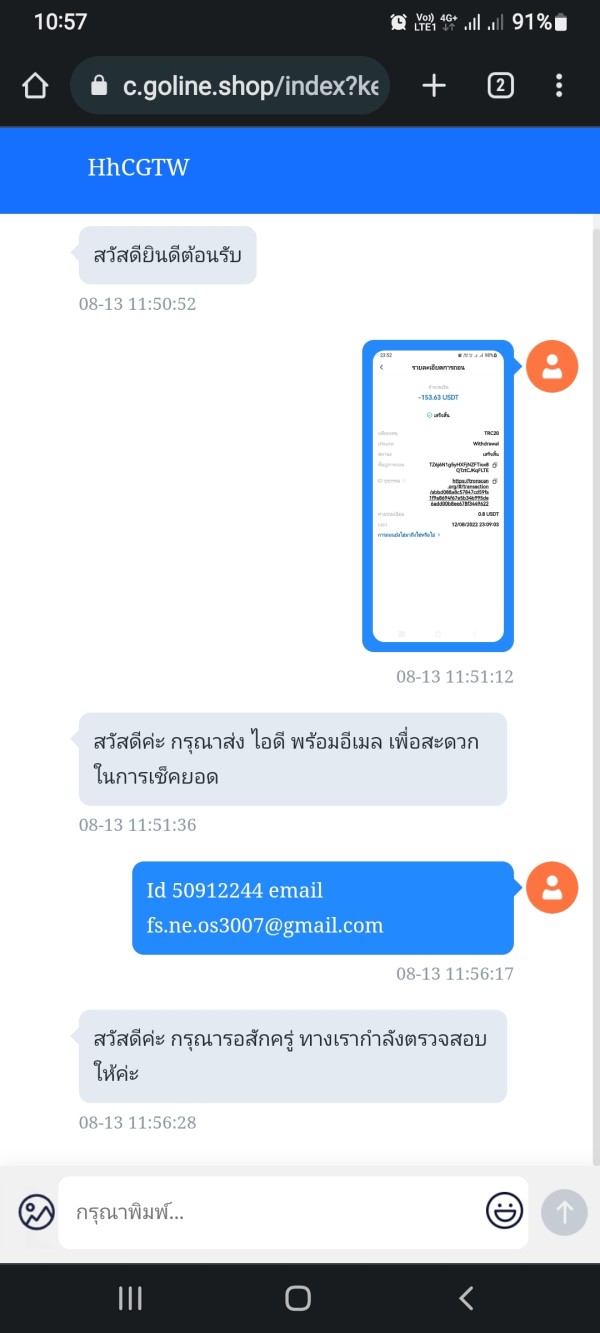

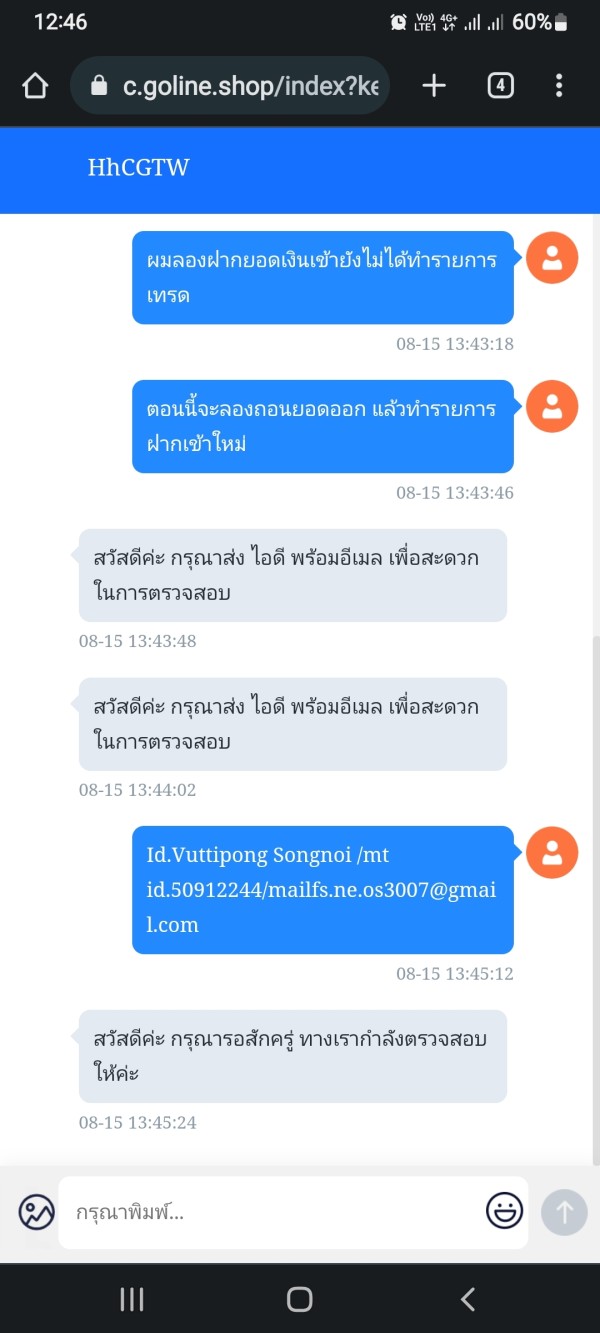

Customer service evaluation reveals concerning patterns in user feedback and significant gaps in service transparency that impact INGFX's overall reliability assessment. Available user reviews indicate mixed experiences with customer support, including complaints about response times, service quality, and problem resolution effectiveness.

Service channel availability and accessibility are not clearly documented in available sources. Professional brokers typically provide multiple contact methods including phone support, live chat, email assistance, and comprehensive FAQ sections. The lack of clear information about available support channels raises concerns about client service accessibility and commitment to customer care.

Response time performance appears problematic based on user feedback. Several reports indicate delayed responses to client inquiries and support requests. Effective customer service requires prompt response times, particularly for trading-related issues that may impact client positions and financial outcomes. The reported delays suggest inadequate staffing or poor service prioritization.

Service quality concerns emerge from user feedback highlighting unsatisfactory problem resolution and perceived lack of expertise among support staff. Professional trading support requires knowledgeable representatives who understand trading platforms, market conditions, and regulatory requirements. User reports suggesting inadequate support quality raise serious concerns about INGFX's operational capabilities.

Multilingual support capabilities are not specified in available information. This may limit service accessibility for international clients. Global brokers typically provide support in multiple languages to serve diverse client bases effectively.

Operating hours for customer service are not clearly documented. This prevents assessment of service availability across different time zones. Trading markets operate globally, requiring customer support that can address client needs during active trading sessions.

User feedback compilation reveals a pattern of negative experiences with customer service, including reports of unresponsive support and inadequate problem resolution, which significantly impacts the broker's reliability assessment.

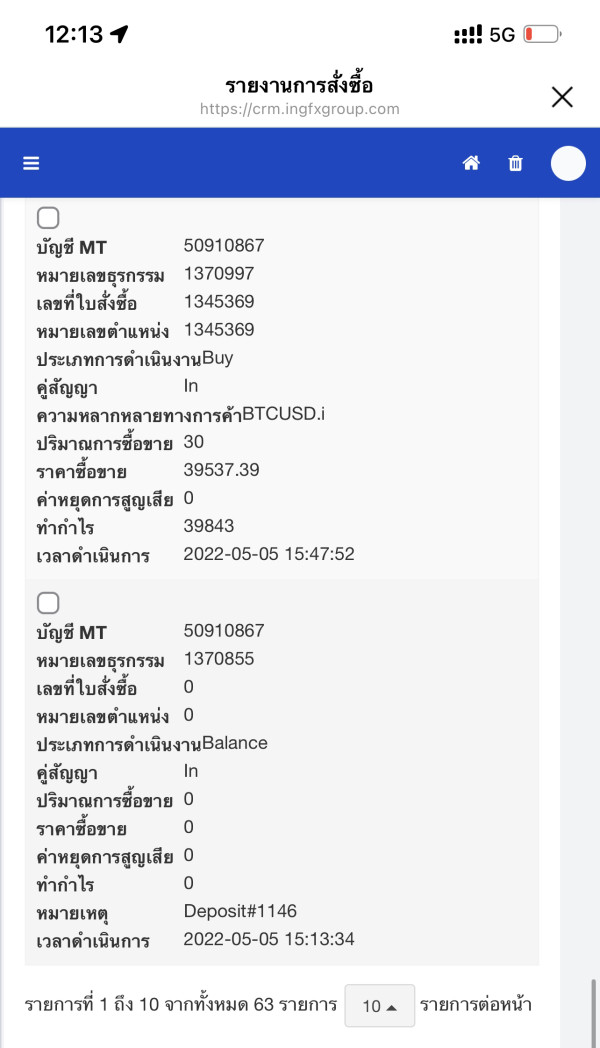

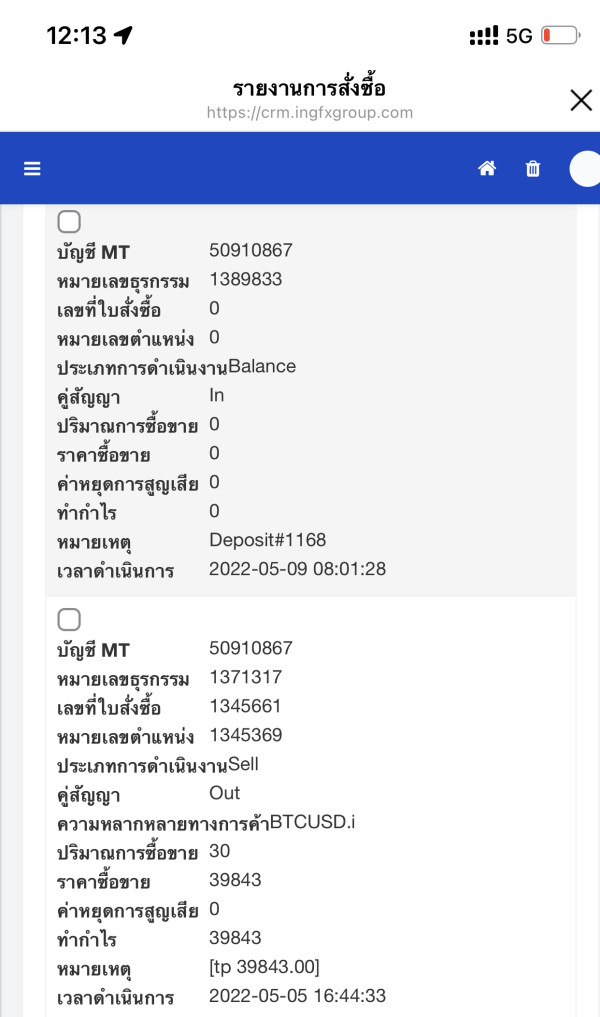

Trading Experience Analysis

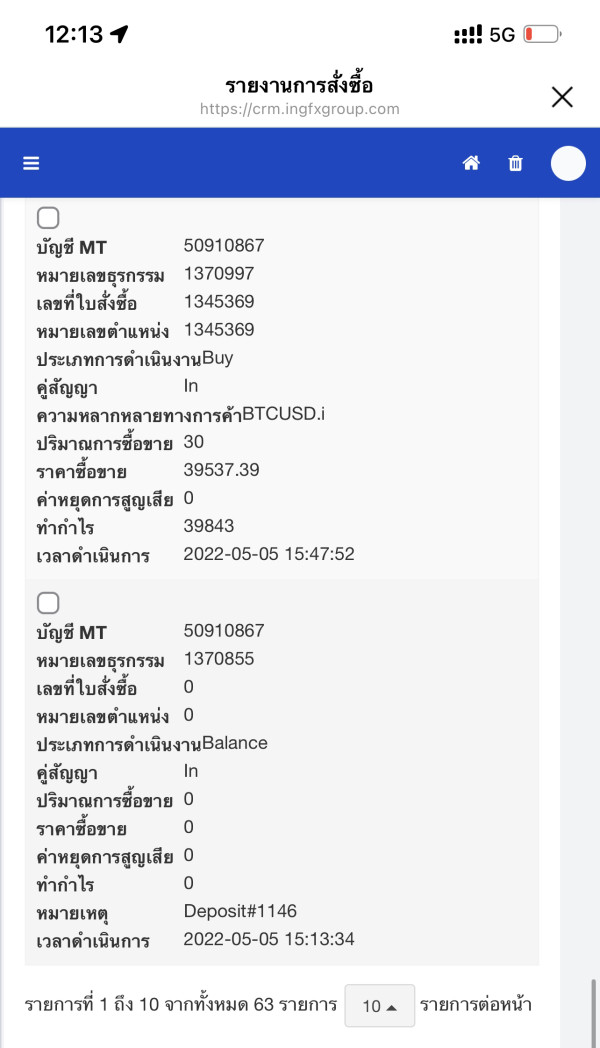

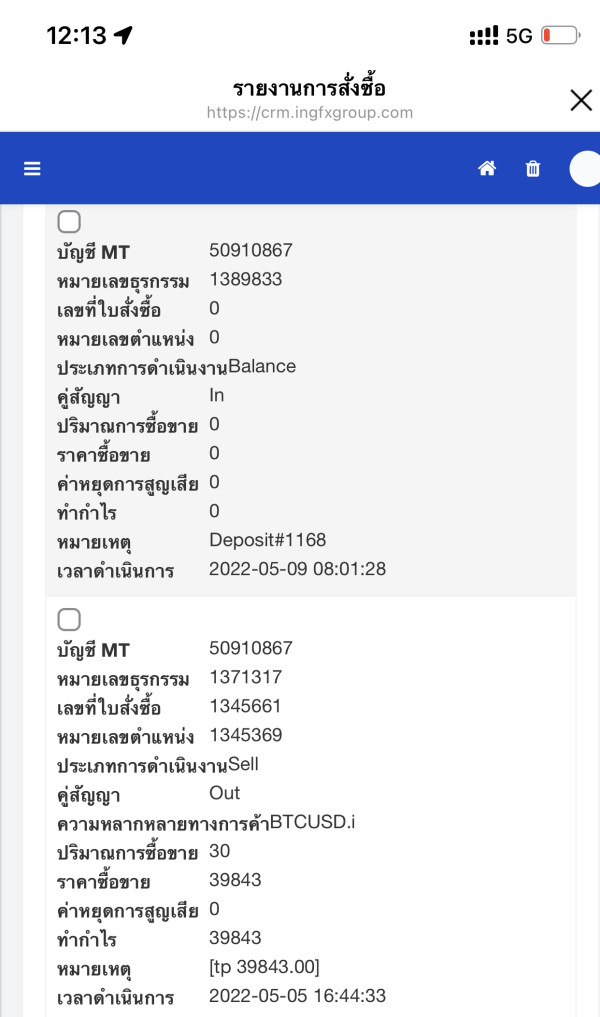

The trading experience evaluation for INGFX reveals both technical strengths and significant concerns that impact overall platform assessment. The broker reports an average execution speed of 0ms, which suggests efficient order processing and minimal latency in trade execution. This technical performance metric indicates potentially competitive execution quality, though independent verification of these claims is not available.

Platform stability and functionality benefit from the MetaTrader 5 implementation. This provides professional-grade trading capabilities including advanced charting, technical analysis tools, and comprehensive order management features. The platform's proven reliability in global markets offers some confidence in core trading functionality, though broker-specific customizations and server performance may vary.

Order execution quality assessment is limited by the lack of independent verification data regarding slippage rates, requotes frequency, and execution transparency during volatile market conditions. Professional traders require consistent execution quality with minimal slippage and transparent pricing, but available information does not provide sufficient detail for comprehensive assessment.

Trading environment conditions include spreads starting from 0 pips. This appears competitive for certain instruments. However, the lack of detailed commission structures, overnight financing rates, and comprehensive pricing transparency prevents accurate cost assessment and comparison with industry standards.

Mobile trading experience information is not available in current sources. This represents a significant gap given the importance of mobile accessibility in modern trading. Professional traders require reliable mobile platforms for position monitoring and trade management while away from desktop systems.

User feedback regarding trading experience includes positive comments about platform functionality and execution speed. Some users report concerns about overall platform reliability and transparency. The mixed feedback pattern suggests variable user experiences that may depend on individual trading requirements and market conditions.

This ingfx review identifies trading experience as an area with both potential strengths and significant information gaps that impact comprehensive assessment.

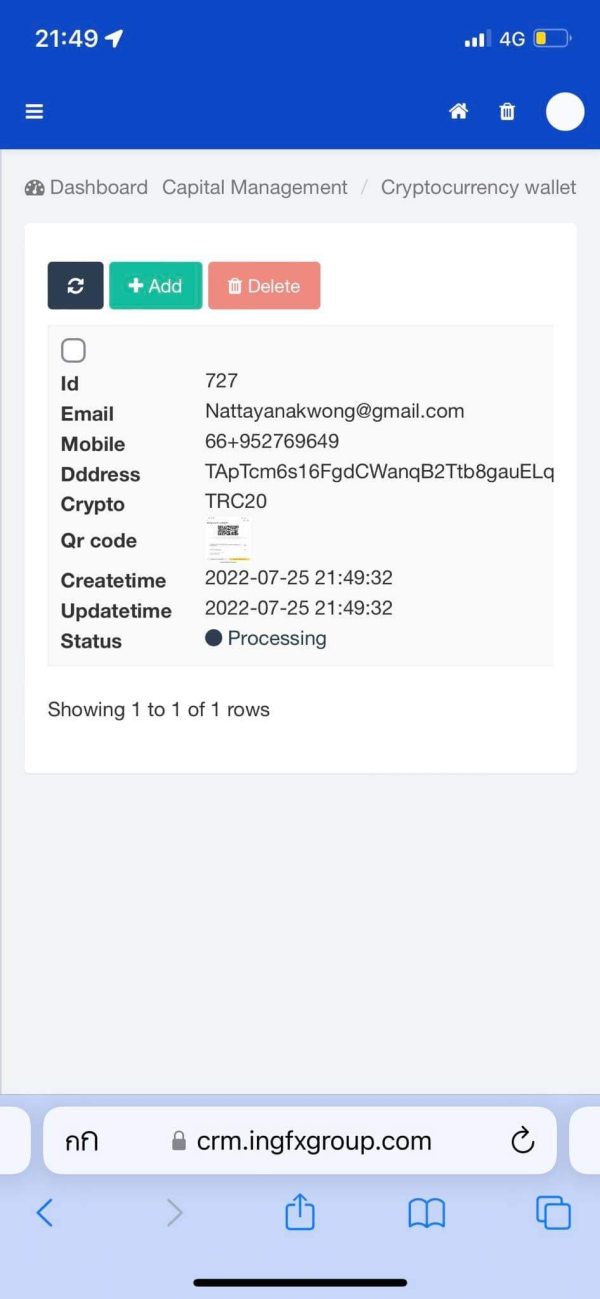

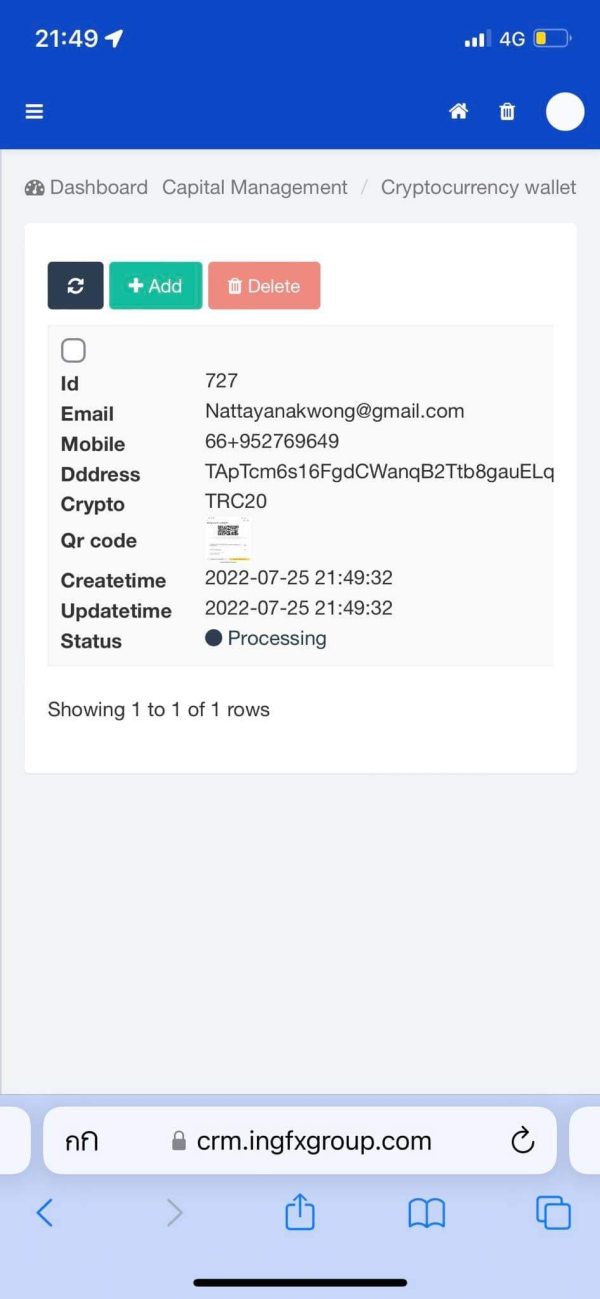

Trust and Safety Analysis

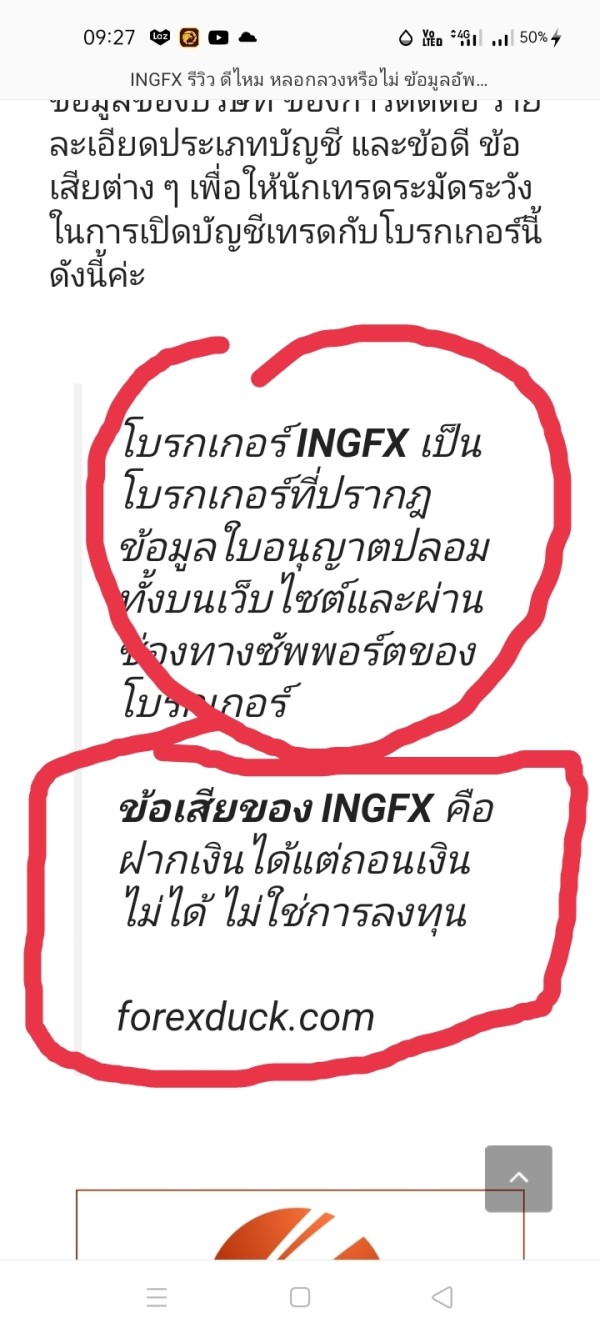

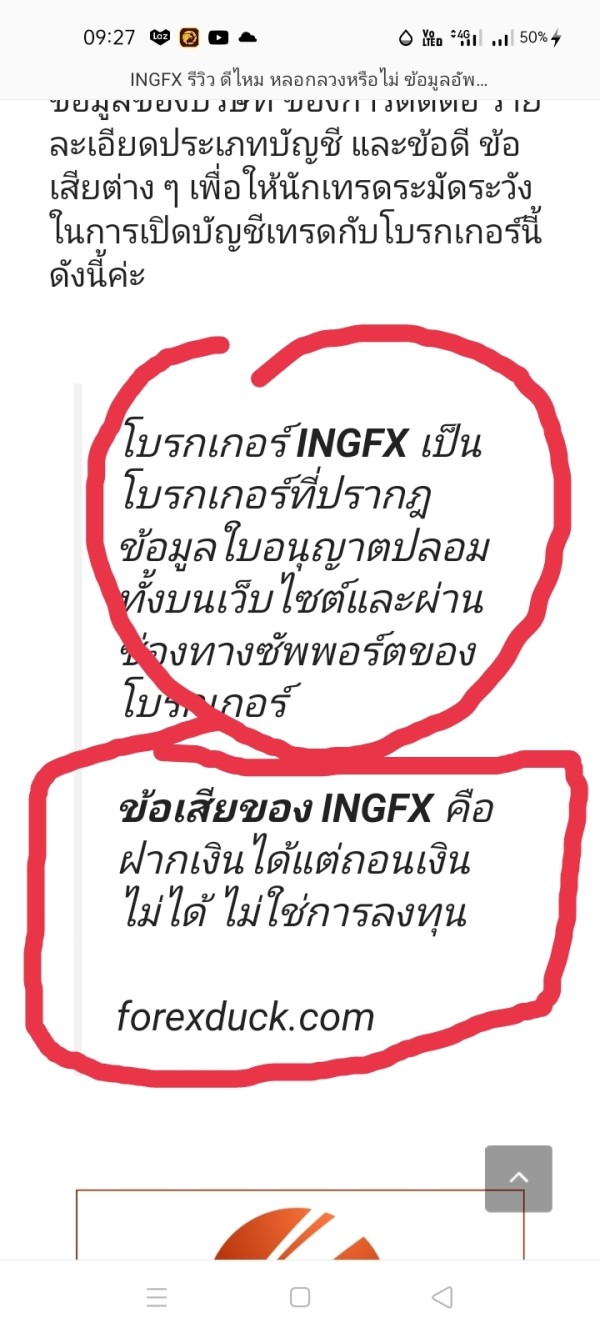

Trust and safety evaluation reveals the most significant concerns in this comprehensive assessment of INGFX. The broker's regulatory claims present immediate red flags that seriously impact credibility and client protection assessment. While INGFX claims regulation under ASIC, independent verification through official regulatory databases has failed to confirm this regulatory status.

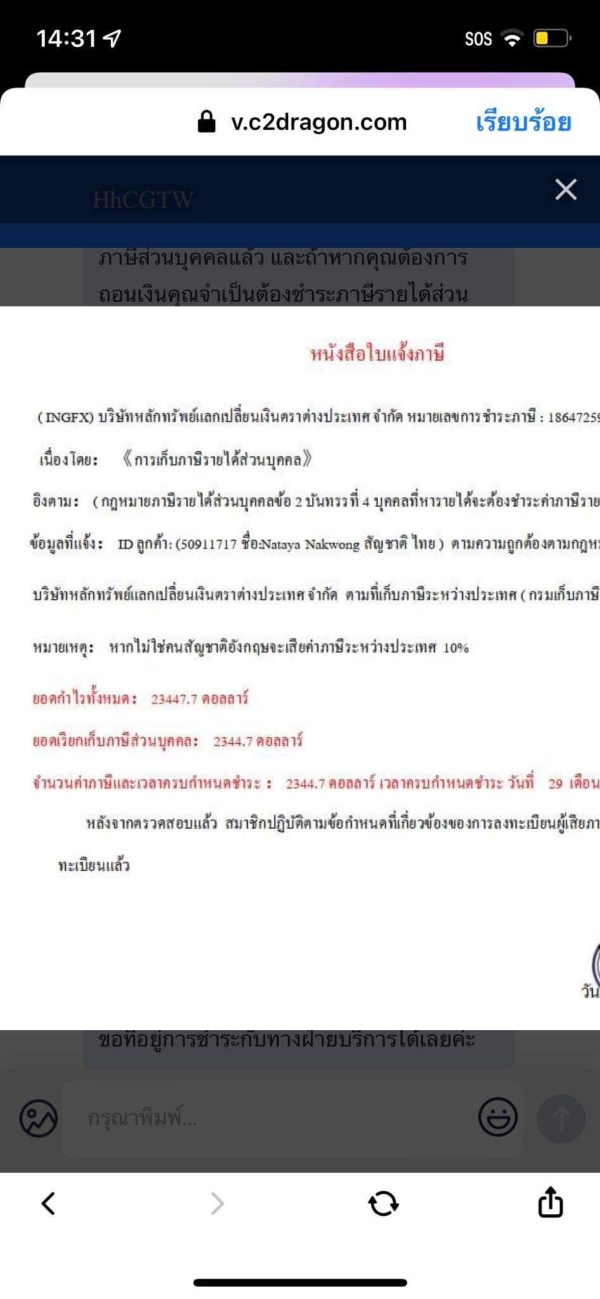

Regulatory compliance verification is fundamental to broker assessment. Proper regulation provides essential client protections including segregated fund requirements, dispute resolution procedures, and compensation schemes. The inability to verify INGFX's claimed regulatory status suggests either misrepresentation or significant gaps in regulatory compliance, both of which pose substantial risks to potential clients.

Fund safety measures and client money protection protocols are not clearly documented in available sources. Regulated brokers typically provide detailed information about client fund segregation, bank partnerships, and protection schemes. The absence of such information raises serious concerns about fund security and client asset protection.

Company transparency issues extend beyond regulatory verification to include limited disclosure about corporate structure, management team, operational history, and business relationships. Professional brokers typically provide comprehensive company information to build client confidence and demonstrate operational legitimacy.

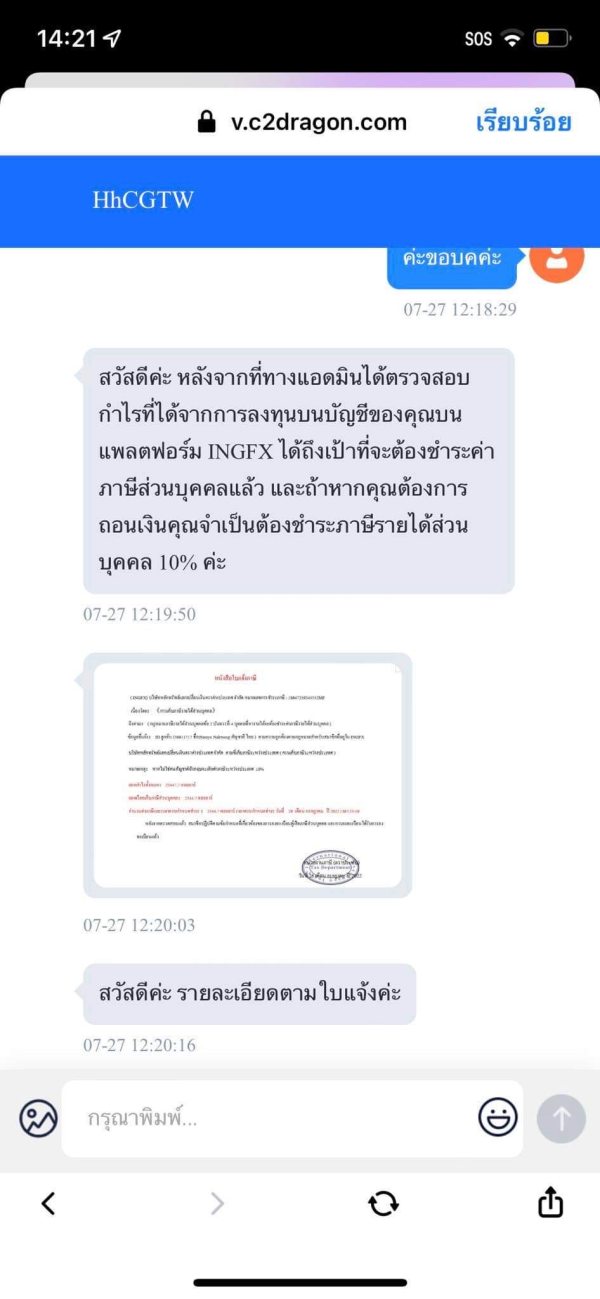

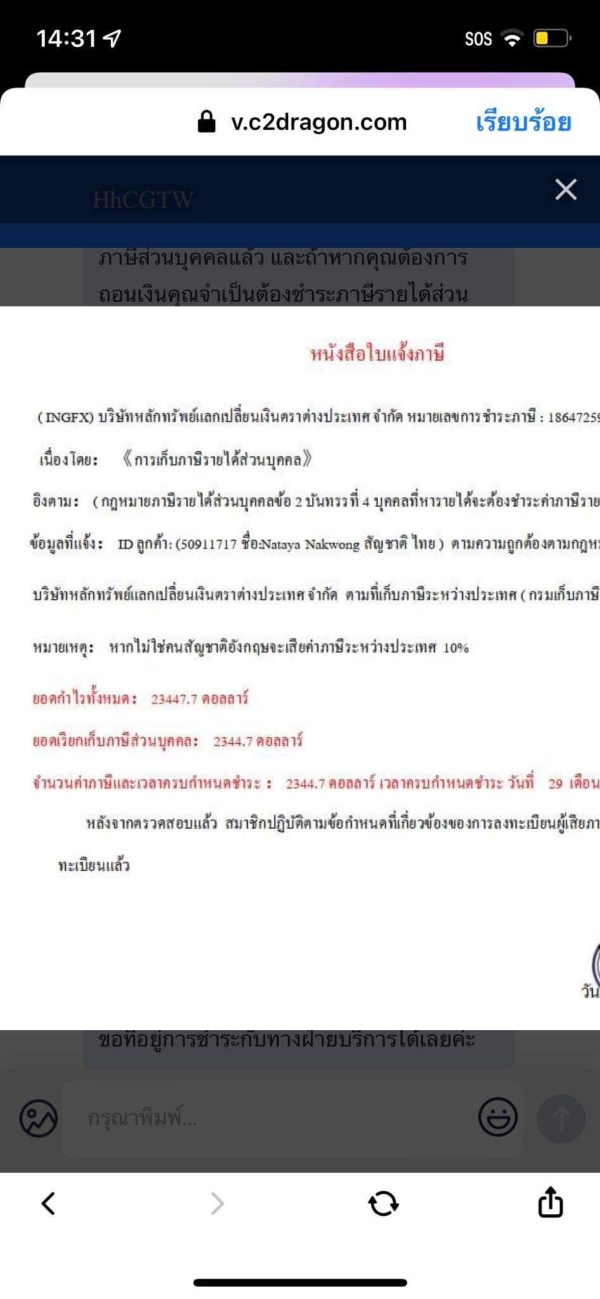

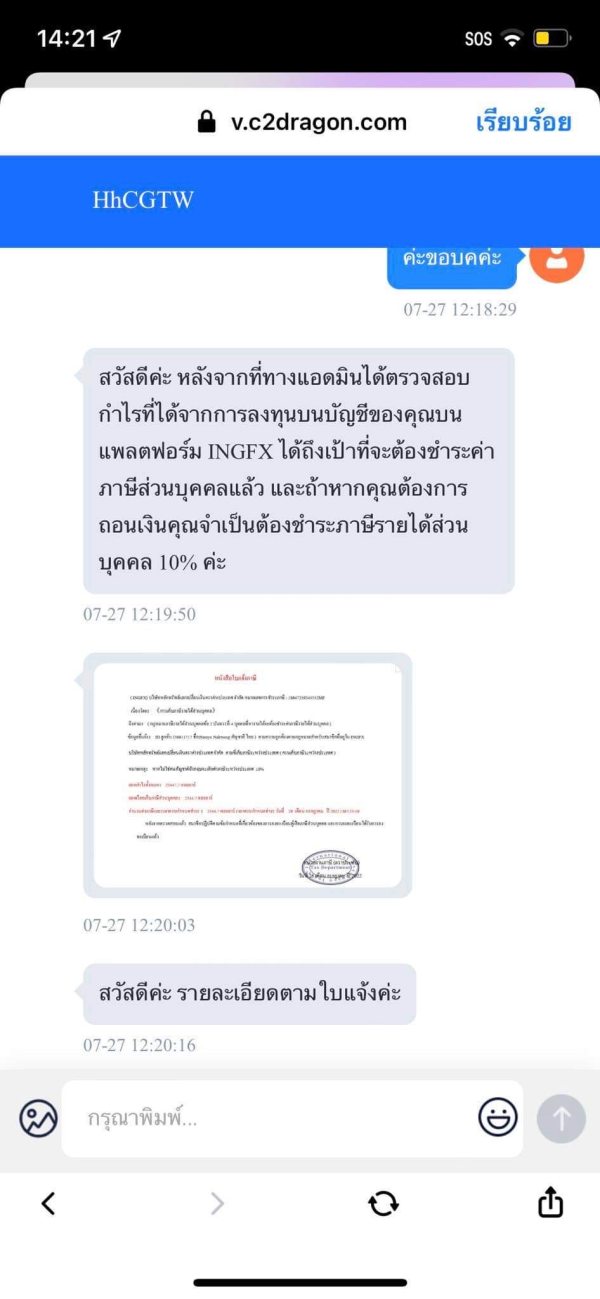

Industry reputation assessment reveals concerning patterns. Multiple sources identify INGFX as potentially unregulated or problematic. User feedback includes serious allegations about potential fraudulent activities and safety concerns that align with the regulatory verification failures identified in this analysis.

Negative incident handling and crisis management capabilities cannot be assessed due to limited operational history and transparency. However, user reports suggest inadequate response to client concerns and potential safety issues, which further undermines trust and confidence.

Third-party verification and industry recognition are notably absent. There is no evidence of positive assessments from reputable industry organizations or independent verification services.

User Experience Analysis

User experience assessment reveals a complex pattern of mixed feedback that reflects both platform capabilities and serious underlying concerns about INGFX's operations. Overall user satisfaction appears highly variable, with experiences ranging from positive technical feedback to serious concerns about safety and reliability.

Positive user feedback typically focuses on MetaTrader 5 platform functionality, execution speed, and technical trading capabilities. Users appreciate the professional-grade charting tools, automated trading support, and comprehensive technical analysis features available through the platform implementation. These positive aspects suggest that the core trading technology meets basic professional requirements.

However, negative feedback patterns reveal more serious concerns about overall broker reliability, transparency, and safety. Users report difficulties obtaining clear information about account terms, withdrawal procedures, and regulatory status. These transparency concerns align with the information gaps identified throughout this assessment and reinforce credibility concerns.

Interface design and usability benefit from MetaTrader 5's proven design and functionality. Broker-specific customizations and additional interface options are not documented. The platform's intuitive design and comprehensive feature set provide a solid foundation for trading activities.

Registration and account verification processes are not clearly documented. This prevents assessment of user onboarding experience. Professional brokers typically provide streamlined yet secure account opening procedures with clear documentation requirements and reasonable processing timelines.

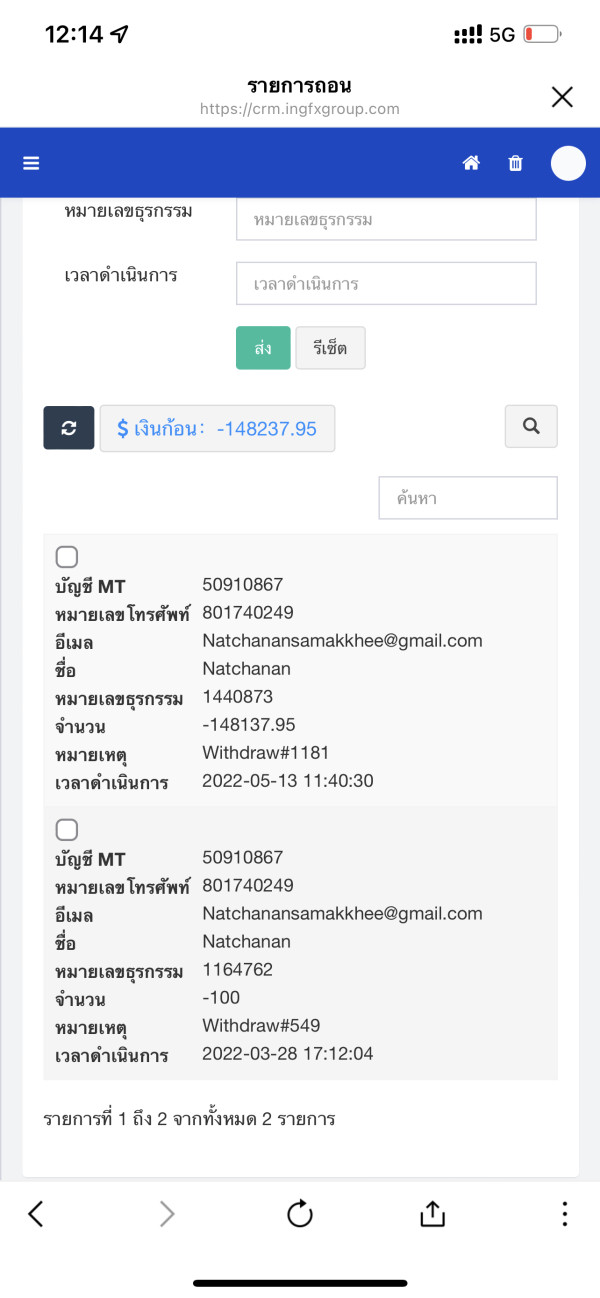

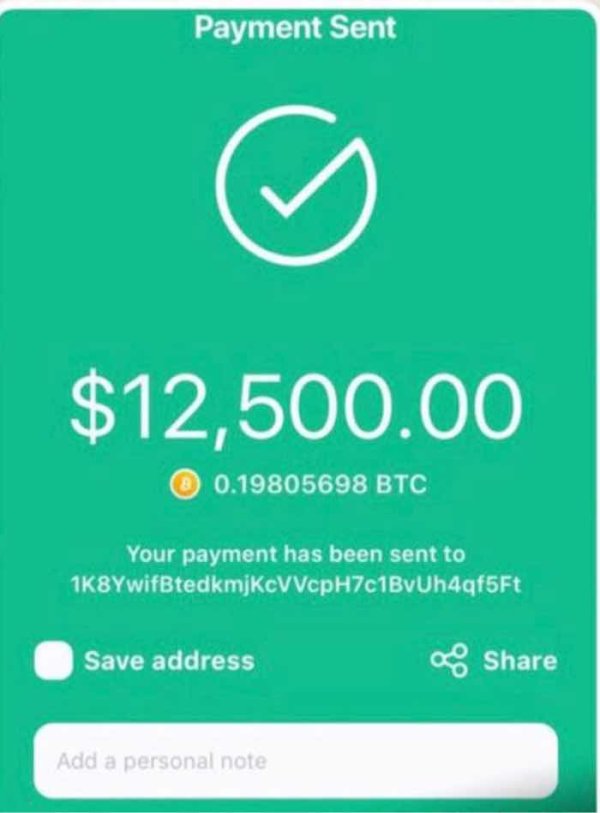

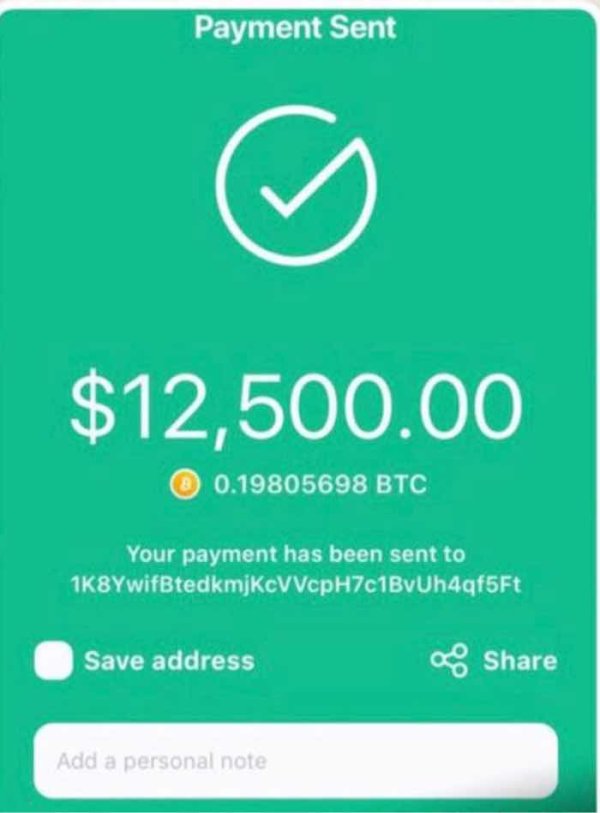

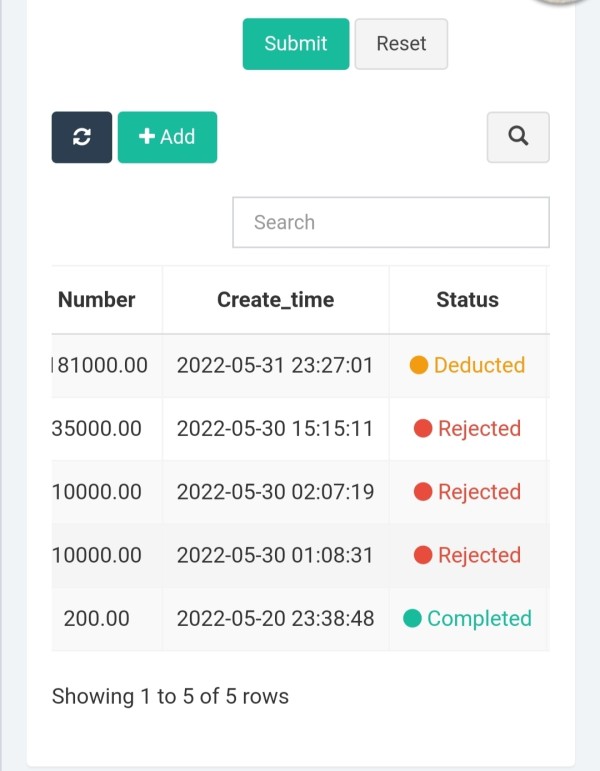

Fund operation experiences appear problematic based on user feedback. Users report difficulties in withdrawal processing and unclear fee structures. These concerns about fund accessibility and transparency represent serious operational issues that impact overall user experience and safety.

Common user complaints focus on transparency issues, customer service quality, and concerns about regulatory compliance. The pattern of negative feedback regarding fundamental operational aspects suggests systemic issues that extend beyond isolated incidents.

User demographic analysis suggests INGFX may attract traders seeking high leverage and technical trading capabilities. However, the overall user experience assessment reveals significant concerns that outweigh potential technical benefits.

Conclusion

This comprehensive ingfx review reveals substantial concerns that significantly outweigh any potential benefits offered by the broker. The inability to verify INGFX's claimed ASIC regulation represents a fundamental trust issue that should disqualify the broker from consideration by prudent traders. Combined with transparency deficiencies regarding account conditions, fee structures, and operational procedures, these regulatory concerns create an unacceptable risk profile for potential clients.

While INGFX offers some attractive technical features including MetaTrader 5 platform access, high leverage up to 400:1, competitive spreads starting from 0 pips, and fast execution speeds, these benefits are overshadowed by serious credibility and safety concerns. The mixed user feedback pattern, with particular emphasis on negative experiences regarding transparency and customer service, reinforces the assessment that INGFX presents significant risks to trader funds and interests.

The broker may initially appear suitable for experienced traders seeking high-leverage opportunities and professional trading tools. However, the fundamental trust and regulatory issues make it unsuitable for any trader regardless of experience level. Professional traders require reliable regulatory protection, transparent operations, and trustworthy business practices that INGFX fails to demonstrate convincingly.

Potential traders should prioritize regulated brokers with verified credentials, transparent operations, and positive industry reputations over platforms offering attractive technical features without proper regulatory foundation and operational transparency.