Is Quantum Trade safe?

Pros

Cons

Is Quantum Trade Safe or a Scam?

Introduction

Quantum Trade positions itself as an innovative player in the forex market, offering a platform for trading various financial instruments. As with any financial service, especially in the volatile realm of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The past has shown that many traders fall victim to scams, leading to significant financial losses. Therefore, assessing the legitimacy and reliability of brokers like Quantum Trade is paramount. This article aims to provide an objective analysis of Quantum Trade, utilizing a variety of sources and evaluations to determine if it is a safe option for traders or a potential scam.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in assessing its safety. A well-regulated broker typically adheres to strict guidelines that protect traders' interests and ensure fair trading practices. Unfortunately, Quantum Trade operates without any recognized regulatory oversight. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation raises significant concerns about the safety of funds and the overall integrity of the trading environment. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US, impose strict requirements on brokers, including capital adequacy, regular audits, and investor protection schemes. Quantum Trade has not demonstrated compliance with such standards, leaving traders vulnerable to potential fraud. Moreover, warnings from financial authorities, including the Ontario Securities Commission (OSC), label Quantum Trade as a scam, further solidifying concerns about its legitimacy.

Company Background Investigation

Quantum Trade claims to be a subsidiary of Quantum Global Trading, a company purportedly registered in Dubai. However, upon closer examination, the validity of this claim is questionable. The companys history, ownership structure, and operational transparency are shrouded in ambiguity. There is little publicly available information regarding the management team or their qualifications, which is a red flag for potential investors.

The lack of transparency in company operations often suggests a higher risk of fraudulent activities. A legitimate broker typically provides clear information about its leadership, including professional backgrounds and industry experience. In Quantum Trades case, the absence of such information raises doubts about the broker's credibility. Furthermore, the company's website does not offer adequate disclosures regarding its operational practices or financial standing, which is essential for ensuring trustworthiness in the financial services sector.

Trading Conditions Analysis

An essential aspect of evaluating any trading platform is understanding its fee structure and trading conditions. Quantum Trade advertises competitive spreads and no commission on trades, which can be appealing to potential clients. However, the specifics of its fee structure are often obscured, leading to potential hidden costs that could affect traders' profitability.

Heres a comparative overview of the core trading costs associated with Quantum Trade:

| Fee Type | Quantum Trade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Structure | None | $5 per lot |

| Overnight Interest Range | N/A | 0.5% - 1.0% |

The comparison indicates that while Quantum Trade claims to have no commissions, the spreads are higher than the industry average, potentially leading to higher trading costs in the long run. Additionally, the lack of transparency regarding overnight interest charges raises concerns about unexpected expenses that could arise while holding positions overnight.

Client Funds Safety

The safety of client funds is a paramount concern when choosing a forex broker. Quantum Trade's website does not provide clear information on its fund safety measures, which is alarming. A reliable broker typically segregates client funds from its operational funds, ensuring that traders' money is protected in the event of bankruptcy or financial mismanagement.

Moreover, the absence of investor protection schemes, such as those offered by regulatory bodies, leaves traders vulnerable to losing their entire investment. Historical data on Quantum Trade reveals no significant incidents of fund security breaches, but the lack of regulatory oversight means that the broker is not held accountable for its practices. Without robust measures in place, traders must exercise extreme caution when considering depositing funds with Quantum Trade.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability. In the case of Quantum Trade, numerous complaints have surfaced regarding withdrawal issues and unresponsive customer service. Common patterns in complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

| Misleading Information | High | No acknowledgment |

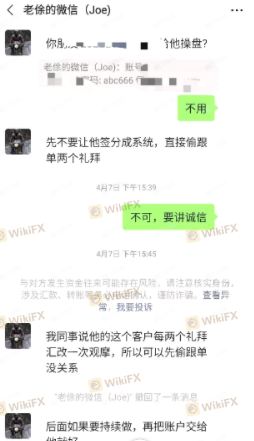

Real user experiences indicate that many clients struggle to withdraw their funds, often facing excessive delays or outright refusals. One case involved a trader who reported being unable to access their account for several weeks after requesting a withdrawal, only to receive vague responses from customer support. This pattern of behavior is typical of many fraudulent brokers, where the goal is to delay withdrawals in hopes that clients will give up or continue trading with the broker.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Quantum Trade offers a web-based trading platform, which is often criticized for its lack of advanced features compared to industry-standard platforms like MetaTrader 4 or 5. Traders have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

In addition, the platforms stability is questionable, with users experiencing frequent downtime and slow response times. These factors not only hinder trading efficiency but also raise concerns about potential market manipulation. A reliable trading platform should provide fast execution speeds and minimal slippage, ensuring that traders can capitalize on market opportunities without unnecessary delays.

Risk Assessment

Using Quantum Trade entails several risks that potential traders should be aware of. The lack of regulation, coupled with numerous complaints regarding withdrawals and customer support, positions Quantum Trade as a high-risk broker. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, high potential for fraud. |

| Financial Risk | High | Funds not protected or segregated, increasing exposure to loss. |

| Operational Risk | Medium | Platform stability issues may affect trading performance. |

| Customer Support Risk | High | Poor response to complaints and withdrawal requests. |

Traders should consider these risks carefully and only invest what they can afford to lose. It is advisable to seek alternatives with better regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Quantum Trade is not a safe option for traders. The lack of regulation, combined with a history of customer complaints and questionable trading practices, raises significant concerns about its legitimacy. Traders should be particularly wary of the potential for fraud and the risks associated with investing funds in an unregulated environment.

For those considering trading, it is recommended to explore alternative brokers that are well-regulated and have positive customer feedback. Brokers such as OANDA, IG, or Forex.com are known for their reliability and strong regulatory frameworks. Ultimately, conducting thorough research and prioritizing safety can help traders avoid the pitfalls associated with dubious platforms like Quantum Trade.

Is Quantum Trade a scam, or is it legit?

The latest exposure and evaluation content of Quantum Trade brokers.

Quantum Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Quantum Trade latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.