Is GMI Securities safe?

Business

License

Is GMI Securities Safe or a Scam?

Introduction

GMI Securities, a trading name for Global Market Index Limited, is an online forex and CFD broker that has been operating since 2009. Headquartered in the United Kingdom, GMI has expanded its reach with offices in several financial hubs, including Vanuatu and Mauritius. As the forex market continues to grow, traders are increasingly drawn to various brokers offering competitive trading conditions. However, with the rise of online trading, it is crucial for traders to exercise caution and perform thorough evaluations of forex brokers. This article aims to provide a comprehensive analysis of GMI Securities, focusing on its regulatory status, company background, trading conditions, and overall safety for traders. Our evaluation will be based on a detailed examination of available data, user reviews, and regulatory information.

Regulation and Legitimacy

Regulation is a critical aspect of any trading broker, as it ensures that the broker adheres to specific standards and practices designed to protect clients. GMI Securities claims to be regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK and the Financial Services Commission (FSC) in Mauritius. The presence of these regulatory licenses adds a layer of trustworthiness to the broker. However, it is essential to scrutinize the quality of these regulations and the broker's compliance history.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 677530 | United Kingdom | Verified |

| FSC | C118023454 | Mauritius | Verified |

| VFSC | 14646 | Vanuatu | Verified |

While GMI is regulated by the FCA, which is known for its stringent oversight, the other licenses, particularly from offshore jurisdictions, may not offer the same level of protection. Traders should be aware that even with regulatory oversight, risks still exist, as regulations do not guarantee the safety of funds. Therefore, it is vital to assess GMI's compliance history and any past regulatory issues.

Company Background Investigation

GMI Securities has a relatively short history in the financial services industry, having been established in 2009. The company operates under the ownership of Global Market Index Limited, which has expanded its operations across different jurisdictions. The management team comprises experienced professionals from the financial sector, which can be a positive indicator for potential clients. However, the level of transparency regarding the company's ownership structure and management backgrounds is somewhat limited.

The availability of information about GMI's operational practices and financial health is crucial for potential traders. A broker that lacks transparency can raise red flags, leading to concerns about its legitimacy. The company's website does provide some details about its services and offerings, but there is a noticeable absence of in-depth information regarding its financial performance and operational strategies.

Trading Conditions Analysis

When evaluating whether GMI Securities is safe, it is essential to analyze its trading conditions, including fees, spreads, and commissions. GMI offers various account types, including Standard, ECN, and Cent accounts, catering to different trading styles. The overall fee structure appears competitive, with spreads starting from 0.0 pips for ECN accounts. However, the minimum deposit requirements vary significantly across account types, which may be a barrier for some traders.

| Fee Type | GMI Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 0.5 pips |

| Commission Model | $4 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads are attractive, it is essential to note that GMI imposes a quarterly inactivity fee of $50 for dormant accounts, which can deter some traders. Additionally, the lack of clarity regarding other potential fees, such as withdrawal fees or additional charges, raises questions about the overall cost of trading with GMI.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. GMI Securities claims to implement several measures to protect client funds, including the segregation of client accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing a level of security in the event of insolvency.

However, the effectiveness of these measures can vary depending on the regulatory environment in which the broker operates. While the FCA provides strong protections, the oversight in offshore jurisdictions may not be as robust. It is also essential to investigate any historical issues related to fund security or client complaints regarding withdrawals, as these can be indicative of a broker's reliability.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing whether GMI Securities is safe. User reviews reveal a mixed bag of experiences, with some traders praising the broker's trading conditions and platform performance, while others express frustration over withdrawal delays and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Limited options |

| Inactivity Fees | Low | Standard policy |

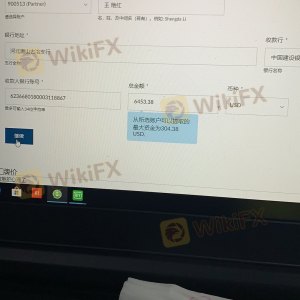

One notable case involved a trader who reported difficulties withdrawing funds, citing a lack of communication from customer support. This pattern of complaints can be concerning for potential clients, as it raises questions about the broker's commitment to customer service and satisfaction.

Platform and Trade Execution

The trading platform used by GMI Securities is another critical factor in evaluating its safety. GMI offers the popular MetaTrader 4 (MT4) platform, known for its reliability and user-friendly interface. However, the performance of the platform, including execution quality, slippage, and rejection rates, is crucial for traders.

Traders have reported mixed experiences with order execution quality, with some noting instances of slippage during high volatility periods. While GMI claims to provide a stable trading environment, any signs of platform manipulation or execution issues can severely impact a trader's experience and profitability.

Risk Assessment

Using GMI Securities carries inherent risks that traders should be aware of. The combination of offshore regulation, mixed customer feedback, and potential issues with fund withdrawals creates a complex risk landscape for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack robustness. |

| Fund Safety | Medium | Segregated accounts in some jurisdictions. |

| Customer Service | Medium | Mixed feedback on responsiveness and support. |

To mitigate these risks, traders should conduct thorough research, consider starting with a small investment, and remain vigilant regarding any changes in the broker's practices or regulatory status.

Conclusion and Recommendations

Based on the analysis presented, GMI Securities shows both positive attributes and concerning factors. While the broker is regulated by the FCA, which adds a layer of safety, the presence of offshore entities raises questions about the overall security of client funds. Additionally, customer feedback indicates potential issues with withdrawals and customer service responsiveness.

For traders considering GMI Securities, it is essential to weigh the benefits of competitive trading conditions against the potential risks associated with using an offshore broker. Traders looking for a safer alternative may want to explore brokers with more robust regulatory frameworks and comprehensive customer support options.

In summary, while GMI Securities is not outright a scam, potential clients should approach with caution and conduct their due diligence before making any investment decisions.

Is GMI Securities a scam, or is it legit?

The latest exposure and evaluation content of GMI Securities brokers.

GMI Securities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GMI Securities latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.