Is HTCF safe?

Pros

Cons

Is Htcf Safe or a Scam?

Introduction

In the fast-paced world of forex trading, brokers play a crucial role in facilitating trades and providing necessary tools for traders. One such broker is Htcf, which positions itself as a provider of various trading opportunities within the forex market. Established in 2010 and registered in the Cayman Islands, Htcf offers a range of assets including forex, commodities, indices, and shares. However, with the allure of high leverage and competitive spreads, it is vital for traders to approach Htcf with caution. This article aims to critically assess whether Htcf is a safe trading platform or a potential scam. Our evaluation is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and risk factors, drawing insights from various credible sources.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that traders must scrutinize, as it directly impacts the safety of their investments. Htcf's lack of explicit regulatory oversight raises significant concerns. Currently, Htcf operates without a recognized license, which is a red flag in the trading community. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Cayman Islands | Not Verified |

The absence of regulation means that Htcf is not subject to the stringent oversight that reputable financial authorities enforce. Unregulated brokers often lack the necessary safeguards to protect client funds, leading to potential risks such as withdrawal issues and loss of investment. Traders should be particularly wary of brokers that do not provide transparent information about their regulatory status. This lack of clarity regarding Htcf's oversight raises questions about its legitimacy and operational integrity, making it essential for potential clients to conduct thorough due diligence before engaging with the platform.

Company Background Investigation

Understanding the company behind the broker is crucial in assessing its reliability. Htcf, officially known as Hang Tung International Wealth, has a history dating back to 2010. However, the details surrounding its ownership structure and management team remain largely opaque. The absence of publicly available information on the company's leadership and their qualifications can be concerning for traders seeking transparency. Furthermore, the companys registration in the Cayman Islands, a jurisdiction known for its lenient regulatory environment, adds to the skepticism surrounding its operations.

Traders often benefit from knowing the management team‘s background, as experienced professionals are more likely to ensure a broker's reliability and compliance with industry standards. Unfortunately, Htcf does not provide adequate information about its management, which can hinder traders' ability to trust the platform. Transparency in operations and clear communication about the company’s history are critical factors that influence a trader's decision-making process. Given these factors, it is essential for potential clients to weigh the risks associated with Htcf carefully.

Trading Conditions Analysis

The trading conditions offered by Htcf are another critical aspect to consider when evaluating its safety. Htcf claims to provide competitive trading conditions, including leverage of up to 1:500 and spreads as low as 0.7 pips. However, traders must be cautious, as high leverage can amplify both potential profits and losses. Below is a comparison of Htcf's trading costs against industry averages:

| Cost Type | Htcf | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 1.0 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads appear attractive, the lack of clarity regarding commissions and overnight interest raises questions about the overall cost structure. Traders should be aware of any hidden fees that might not be immediately apparent. Furthermore, the potential for slippage and execution issues should also be considered, especially in volatile market conditions. Understanding these costs is vital for traders to assess whether Htcf offers a truly competitive trading environment or if there are underlying issues that could impact their trading experience.

Customer Funds Security

The security of customer funds is paramount when selecting a forex broker. Htcf's lack of regulatory oversight raises significant concerns about the safety measures in place to protect client deposits. It is essential to evaluate whether Htcf implements fund segregation, investor protection mechanisms, and negative balance protection policies. Unfortunately, there is little information available regarding Htcf's practices in these areas. Traders should be cautious, as unregulated brokers often do not have the same level of investor protection as those under stringent regulatory frameworks.

Historically, many unregulated brokers have faced issues related to fund mismanagement and withdrawal problems, leading to significant losses for traders. Without proper oversight, there are no guarantees that Htcf will manage client funds responsibly. Therefore, potential clients must consider the risks associated with entrusting their capital to a broker with such ambiguous safety measures. Ensuring the security of funds is a fundamental aspect of any trading relationship, and traders should prioritize this when evaluating Htcf.

Customer Experience and Complaints

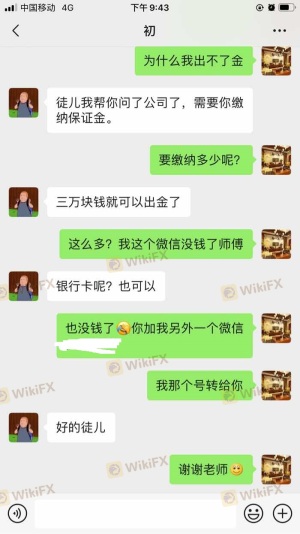

Analyzing customer feedback is crucial in understanding the overall experience with Htcf. Various reviews indicate a mixed reception, with some users praising the platform's features, while others have raised serious concerns. Common complaints include withdrawal issues, lack of customer support responsiveness, and difficulties in accessing funds. Below is an overview of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresolved |

| Platform Instability | High | Minimal feedback |

Several users have reported challenges in withdrawing their funds, which can be a significant red flag for any potential trader. A broker's ability to provide timely and effective support is crucial for maintaining a positive trading experience. The lack of proactive responses from Htcf in addressing these complaints further exacerbates concerns about its reliability. Traders should take these factors into account before deciding to engage with Htcf, as a broker's reputation is often built on its ability to handle customer issues effectively.

Platform and Trade Execution

The performance of a trading platform is another critical aspect that traders must consider. Htcf offers access to popular trading platforms such as MetaTrader 4 and MetaTrader 5, which are known for their robust features and user-friendly interfaces. However, the quality of order execution, including slippage and rejection rates, can significantly impact a trader's experience. Unfortunately, there are limited reports available regarding Htcf's execution quality, making it difficult to assess whether the platform meets industry standards.

Traders should be wary of any signs of platform manipulation, which can include unusual price movements or execution delays. The integrity of a trading platform is essential for ensuring fair and transparent trading conditions. Therefore, potential clients must consider the risks associated with Htcf's platform performance before committing their capital.

Risk Assessment

When evaluating Htcf, it is essential to consider the overall risk associated with using the broker. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of investor protection measures |

| Customer Service Risk | Medium | Slow response to complaints |

| Execution Risk | Medium | Limited information on execution quality |

Given the high risks associated with regulatory and fund security issues, traders must exercise caution when considering Htcf as a trading option. It is advisable to implement risk management strategies, such as limiting the amount of capital invested and conducting thorough research before trading.

Conclusion and Recommendations

In conclusion, the analysis suggests that Htcf may not be a safe trading option for most traders. The absence of regulatory oversight, combined with potential risks related to fund security and customer service, raises significant concerns. While Htcf offers competitive trading conditions, the overall lack of transparency and historical issues reported by users warrant caution.

Traders seeking a reliable forex broker should consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as OANDA, IG, or Forex.com offer robust regulatory frameworks and transparent trading conditions, making them safer options for traders. Ultimately, it is crucial for traders to conduct thorough research and consider their risk tolerance before engaging with any broker, particularly one like Htcf, which presents several warning signs.

Is HTCF a scam, or is it legit?

The latest exposure and evaluation content of HTCF brokers.

HTCF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HTCF latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.