Regarding the legitimacy of HENGTAI FUTURES CO.,LTD. forex brokers, it provides CFFEX and WikiBit, .

Is HENGTAI FUTURES CO.,LTD. safe?

Risk Control

Software Index

Is HENGTAI FUTURES CO.,LTD. markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

恒泰期货股份有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Hengtai Futures Safe or Scam?

Introduction

Hengtai Futures, a player in the forex market, has garnered attention from traders seeking opportunities in currency and commodity trading. As with any trading platform, it is essential for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with both legitimate brokers and potential scams, making it crucial for investors to discern the differences. In this article, we will investigate whether Hengtai Futures is a safe trading option or a potential scam. Our analysis will leverage data from various credible sources, including user reviews, regulatory information, and company background, to provide a comprehensive assessment.

Regulation and Legitimacy

The regulatory landscape is one of the most critical aspects to consider when evaluating a forex broker. Regulation helps ensure that brokers adhere to specific standards and practices, providing a level of security for investors. Hengtai Futures claims to be regulated by the China Financial Futures Exchange (CFFEX). However, the quality of this regulation is often questioned, as it may not provide the same level of investor protection as regulations from top-tier authorities like the FCA or ASIC.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | Not specified | China | Regulated |

While being regulated is a positive sign, it is essential to scrutinize the regulatory authority's reputation. CFFEX, while legitimate, may not offer the same level of oversight as more recognized global regulators. Additionally, there have been reports of issues related to fund withdrawals and customer service, raising concerns about the broker's compliance with regulatory standards.

Company Background Investigation

Hengtai Futures operates under the umbrella of Hengtai Securities Co., Ltd., which has a history dating back several years. The company primarily focuses on futures and options trading, but its foray into forex trading has raised eyebrows among seasoned traders. The ownership structure appears to be consolidated under a few key individuals, which may lead to concerns regarding transparency and governance.

The management team comprises individuals with backgrounds in finance and trading, but the lack of detailed information about their professional experience makes it difficult to assess their expertise. Transparency in operations is crucial for building trust with clients, and Hengtai Futures has room for improvement in this area. The companys website does not provide comprehensive information about its leadership or operational history, which can be a red flag for potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by Hengtai Futures is vital for assessing its credibility. The broker provides various trading instruments, including major currency pairs, commodities, and indices. However, the fee structure is somewhat opaque, with reports of unexpected charges and unclear commission policies.

| Fee Type | Hengtai Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Not specified | 0.1 - 0.3% |

| Overnight Interest Range | High | Low to Moderate |

The lack of clarity regarding the commission model and spread can lead to confusion among traders. Additionally, some users have reported experiencing high overnight interest rates, which can significantly impact trading profitability. Such discrepancies in fee structures warrant a cautious approach when considering Hengtai Futures as a trading platform.

Client Fund Security

Client fund security is a paramount concern for any trader. Hengtai Futures claims to implement various measures to protect client funds, including segregated accounts and potential investor protection schemes. However, the specifics of these measures are not clearly outlined on their website.

The absence of detailed information on fund segregation and negative balance protection raises concerns about the safety of client deposits. Historical complaints regarding fund withdrawal issues further exacerbate these concerns. Traders must be vigilant and consider the potential risks associated with depositing funds with Hengtai Futures.

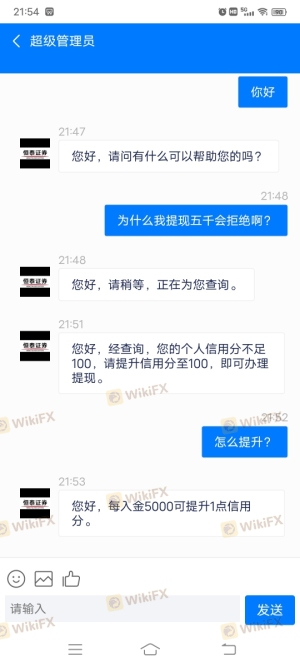

Customer Experience and Complaints

Customer feedback plays a crucial role in evaluating the reliability of a broker. Reviews of Hengtai Futures reveal a mixed bag of experiences. While some users report satisfactory trading conditions, others highlight significant issues, particularly related to withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Inconsistent |

| Fees and Charges | Medium | Unclear |

Common complaints include difficulties in withdrawing funds and slow customer service responses. These issues can severely impact a trader's experience and trust in the broker. A closer examination of individual cases reveals that while some clients received resolutions, others were left frustrated, indicating a need for improved customer support.

Platform and Execution

The trading platform offered by Hengtai Futures is another critical aspect to consider. A reliable platform should provide a stable trading environment with minimal downtime. User experiences indicate that while the platform is generally functional, there have been reports of slippage and execution delays during high volatility periods.

The potential for platform manipulation is also a concern among users, with some traders alleging that their orders were not executed at the expected prices. Such practices, if true, could indicate a lack of integrity in the broker's operations, further questioning whether Hengtai Futures is safe for traders.

Risk Assessment

When assessing the overall risk associated with Hengtai Futures, several factors come into play. The combination of regulatory concerns, customer complaints, and platform reliability contribute to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Questions about regulatory oversight |

| Fund Security | High | Withdrawal issues and unclear policies |

| Customer Support | Medium | Inconsistent response times |

To mitigate these risks, potential traders should consider starting with a small investment or exploring alternative brokers with stronger regulatory backgrounds and better customer feedback.

Conclusion and Recommendations

In conclusion, the investigation into whether Hengtai Futures is safe or a scam reveals a broker with several concerning attributes. While it is regulated, the quality of that regulation, combined with numerous customer complaints and issues related to fund withdrawals, raises significant red flags.

Traders should proceed with caution when considering Hengtai Futures, especially those who value strong regulatory oversight and reliable customer service. For those seeking alternative options, brokers with top-tier regulation and positive customer reviews may be more suitable choices. Always ensure to conduct thorough research and consider your risk tolerance before engaging with any trading platform.

Is HENGTAI FUTURES CO.,LTD. a scam, or is it legit?

The latest exposure and evaluation content of HENGTAI FUTURES CO.,LTD. brokers.

HENGTAI FUTURES CO.,LTD. Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HENGTAI FUTURES CO.,LTD. latest industry rating score is 7.75, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.75 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.