Is Helius Capital safe?

Business

License

Is Helius Capital Safe or Scam?

Introduction

Helius Capital, a forex broker established in 2021 and based in Singapore, has garnered attention within the online trading community. Positioned as a platform for trading various financial instruments, it appeals to both novice and experienced traders. However, with the rise of online trading platforms, the need for traders to carefully evaluate their choices has never been more critical. The forex market is rife with potential pitfalls, including scams and unregulated brokers, making due diligence essential. This article aims to provide a comprehensive analysis of Helius Capital, assessing its safety and legitimacy through an examination of its regulatory status, company background, trading conditions, customer experiences, and overall risks.

Regulation and Legitimacy

The regulatory status of a forex broker is a pivotal factor in determining its safety. A well-regulated broker typically adheres to stringent guidelines that protect investors, while an unregulated broker may expose traders to significant risks. Helius Capital claims to be regulated by the National Futures Association (NFA), yet various reviews indicate discrepancies regarding its licensing status.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0549867 | USA | Suspicious/Unverified |

The absence of valid regulatory oversight raises serious concerns about Helius Capital's operations. Reports suggest that the NFA license number provided by Helius Capital does not exist in the official records, which casts doubt on the broker's legitimacy. Furthermore, the lack of transparency regarding its regulatory status can be alarming for potential investors. Without proper oversight, traders are at risk of losing their funds without any recourse.

In summary, the regulatory quality of Helius Capital is questionable, and its historical compliance appears to be non-existent, making it imperative for traders to exercise caution when considering this broker.

Company Background Investigation

Helius Capital was founded in 2021, but its relatively short history raises questions about its stability and credibility in the forex market. The company claims to have a team of experienced professionals; however, detailed information about its ownership structure and management team is scarce. This lack of transparency can be a red flag for potential investors.

The absence of publicly available information regarding the company's founders and their professional backgrounds further complicates the assessment of Helius Capital's reliability. A reputable broker typically provides detailed information about its management team, including their qualifications and industry experience. This transparency instills confidence in potential clients and demonstrates the broker's commitment to ethical practices.

Given the limited information available, traders are left to speculate about the company's operations and intentions. The opacity surrounding Helius Capital's ownership and management is a significant concern, as it may indicate a lack of accountability and a potential for unethical behavior.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall value. Helius Capital claims to provide competitive trading conditions; however, several reports indicate that its fee structure may not be as favorable as advertised.

| Fee Type | Helius Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | Unspecified | Specified |

The trading costs associated with Helius Capital appear to be on the higher end, particularly concerning spreads on major currency pairs. Additionally, the lack of clarity regarding commission structures and overnight interest rates can lead to unexpected costs for traders. A transparent fee structure is essential for traders to accurately assess their potential profits and losses.

Moreover, reports of excessive fees and unclear withdrawal policies have surfaced, suggesting that traders may face challenges when trying to access their funds. Such practices can be indicative of a broker that prioritizes profit over client satisfaction, further raising concerns about Helius Capital's legitimacy.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Helius Capital's measures for safeguarding client investments remain unclear. Key aspects to consider include the segregation of client accounts, investor protection policies, and negative balance protection.

Unfortunately, Helius Capital has not provided sufficient information regarding these critical safety measures. The absence of detailed disclosures about how client funds are managed and protected can lead to significant risks for traders.

Furthermore, historical complaints regarding difficulties in fund withdrawals raise alarms about the broker's commitment to client fund safety. Reports of clients being unable to withdraw their funds and facing additional charges to access their accounts are particularly concerning. Such practices suggest a lack of transparency and accountability, which can jeopardize the financial security of traders.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. Reviews of Helius Capital reveal a troubling pattern of complaints, particularly concerning fund withdrawals and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

Many users have reported that they encountered significant challenges when attempting to withdraw their funds, with some claiming that their accounts were frozen or that they were pressured to deposit more money to facilitate withdrawals. The company's response to these complaints has often been inadequate, exacerbating the frustration of affected clients.

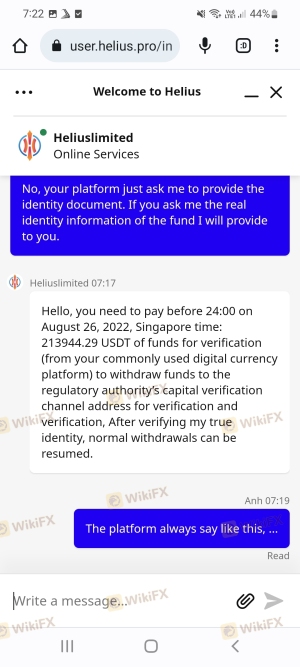

For instance, one user recounted a harrowing experience where their account balance was manipulated, leading to a loss of significant funds. They were subsequently asked to pay additional "verification" fees to access their money. Such practices are alarming and indicative of a potentially fraudulent operation.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for traders. Helius Capital utilizes the MetaTrader 5 (MT5) platform, which is generally well-regarded in the industry for its functionality and user experience. However, concerns about order execution quality and potential manipulation have been raised.

Traders have reported issues with slippage and rejected orders, which can severely impact trading outcomes. The platform's stability is also in question, with users experiencing downtime and technical glitches that hinder their ability to trade effectively.

The lack of transparency regarding the broker's operational practices raises concerns about potential market manipulation. Traders should be wary of platforms that do not provide clear evidence of their order execution processes and underlying market mechanisms.

Risk Assessment

Engaging with Helius Capital carries inherent risks that potential investors must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Complaints about fund withdrawals and fees. |

| Operational Risk | Medium | Issues with platform stability and execution. |

The high regulatory and financial risks associated with Helius Capital make it a precarious choice for traders. To mitigate these risks, it is crucial for potential clients to conduct thorough research and consider alternative brokers with better regulatory oversight and transparent practices.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Helius Capital exhibits several concerning traits that warrant caution. The lack of credible regulatory oversight, coupled with numerous complaints regarding fund withdrawals and customer service, indicates potential risks for traders. The absence of transparency in its operations and fee structures further complicates the assessment of this broker's legitimacy.

For traders considering Helius Capital, it is advisable to proceed with extreme caution. Those seeking a reliable trading experience may want to explore alternatives with established reputations and robust regulatory frameworks. Brokers such as [Alternative Broker 1] and [Alternative Broker 2] offer more transparent operations and better protections for client funds.

Ultimately, the question remains: Is Helius Capital safe? Based on the findings, it is prudent for traders to be wary and thoroughly evaluate their options before engaging with this broker.

Is Helius Capital a scam, or is it legit?

The latest exposure and evaluation content of Helius Capital brokers.

Helius Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Helius Capital latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.