Is KSD safe?

Pros

Cons

Is KSD Safe or Scam?

Introduction

KSD, or Keston International, is a forex broker that has positioned itself in the competitive landscape of online trading since its establishment in 2018. Operating out of the United Kingdom, KSD offers trading services primarily through the MetaTrader 5 platform, catering to a diverse clientele across various financial markets. However, as with any broker, traders must exercise caution and conduct thorough due diligence before committing their funds. The forex market is rife with potential pitfalls, including unregulated brokers and scams that can lead to significant financial losses. Therefore, understanding the regulatory environment, the broker's reputation, and user experiences is crucial for making informed trading decisions. This article aims to provide an objective analysis of KSD, exploring its regulatory status, company background, trading conditions, and customer experiences to determine whether KSD is a safe choice for traders or potentially a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in assessing its legitimacy. KSD claims to be registered with the National Futures Association (NFA) under license number 0520672. However, it is essential to note that this license is considered unauthorized, raising questions about the broker's regulatory compliance. The absence of credible regulation can expose traders to various risks, including the potential for fraud and the inability to recover funds in case of disputes.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0520672 | United Kingdom | Unauthorized |

The quality of regulation is paramount in ensuring the safety of traders' investments. A broker operating without proper licensing may not adhere to industry standards, which can result in a lack of accountability and protection for clients. Moreover, KSD's low score of 1.94 on WikiFX indicates a concerning level of exposure and potential risk. This information suggests that traders should approach KSD with caution and consider the implications of trading with an unregulated broker.

Company Background Investigation

KSD was founded in 2018, and while it has made strides in establishing itself within the forex market, its relatively short history raises questions about its stability and reliability. The ownership structure of KSD is not transparently disclosed, which can be a red flag for potential investors. A lack of transparency regarding ownership and management can lead to skepticism about the broker's intentions and operational practices.

The management team of KSD has not been extensively detailed in available resources, leaving traders with limited information about their expertise and experience in the financial sector. A strong management team with a proven track record is often indicative of a broker's reliability and commitment to customer service. The absence of such information may lead to concerns about the broker's operational integrity.

Furthermore, KSD's transparency in terms of information disclosure is questionable. Reliable brokers typically provide comprehensive details about their services, fees, and operational procedures, fostering trust with their clients. However, KSD's lack of detailed information could hinder traders' ability to make informed decisions.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is crucial to assess the overall cost structure and any potential hidden fees. KSD offers a variety of trading instruments, but the specifics of its fee structure are not readily available. This lack of clarity can be problematic for traders seeking to understand the true cost of trading.

| Fee Type | KSD | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The absence of specific data regarding spreads, commissions, and overnight interest rates makes it challenging to compare KSD's trading conditions with industry standards. Traders should be wary of brokers that do not provide clear and comprehensive information about their fee structures, as this can lead to unexpected costs and diminished profitability.

Additionally, if KSD employs unusual or problematic fee policies, it could indicate a lack of transparency and fairness in its trading practices. Traders are advised to scrutinize any broker's fee structure to ensure they are not subject to hidden charges that could erode their trading capital.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. KSD's approach to fund security is crucial in determining whether it is a safe broker. Industry-standard practices include segregating client funds from the broker's operational funds and offering investor protection measures. However, there is limited information available about KSD's specific security measures.

Traders should inquire whether KSD implements fund segregation, which helps protect clients' investments in case of the broker's insolvency. Furthermore, understanding whether KSD offers negative balance protection is essential for assessing the risks involved in trading with this broker. The absence of such protections can expose traders to significant financial risks, especially in volatile market conditions.

Historically, KSD has faced complaints regarding withdrawal issues, with users claiming that they were unable to access their funds. Such incidents raise concerns about the broker's financial practices and reliability. Any history of fund safety issues should be taken seriously, as it can indicate deeper systemic problems within the brokerage.

Customer Experience and Complaints

Analyzing customer feedback and experiences is essential in assessing the overall reliability of a broker. KSD has received various complaints, particularly regarding withdrawal difficulties. These issues have been highlighted by users who reported being unable to access their funds after requesting withdrawals, raising significant red flags about the broker's operations.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

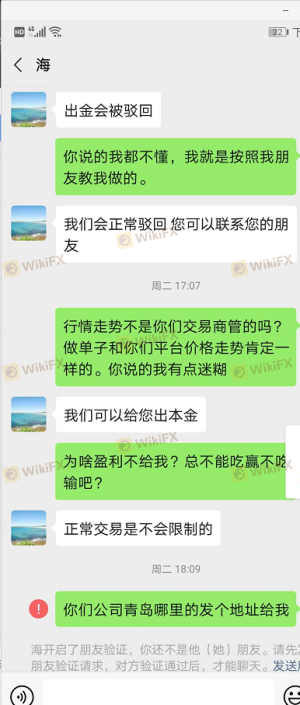

The common complaint pattern indicates that traders have experienced significant challenges when attempting to withdraw their funds. In some cases, users reported that customer service representatives claimed they had violated trading rules, leading to account restrictions. Such experiences can be indicative of a broker that may not prioritize customer satisfaction or transparency.

Two notable cases involved users who reported being unable to withdraw their funds after multiple attempts. In one instance, a trader was told they had violated trading rules without any clear explanation, resulting in frustration and distrust. These complaints highlight the importance of evaluating a broker's responsiveness and accountability when issues arise.

Platform and Trade Execution

The performance and stability of a trading platform are crucial for a successful trading experience. KSD utilizes the MetaTrader 5 platform, which is known for its user-friendly interface and robust features. However, the overall performance and execution quality of KSD's platform have not been extensively reviewed.

Traders should assess the order execution quality, including the presence of slippage and order rejection rates. If a broker exhibits signs of platform manipulation or poor execution quality, it can significantly impact a trader's profitability. A reliable broker should ensure that orders are executed promptly and at the best available prices without undue delays.

Risk Assessment

Using KSD as a trading platform involves various risks that traders must consider. The overall risk profile of KSD can be summarized in the following risk assessment table:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unauthorized NFA registration raises concerns. |

| Fund Safety Risk | High | History of withdrawal issues and lack of transparency. |

| Customer Service Risk | Medium | Complaints about delayed responses and unresolved issues. |

To mitigate these risks, traders should conduct thorough research before engaging with KSD. It is advisable to start with a small investment and monitor the broker's performance closely. Additionally, seeking alternative brokers with established reputations and regulatory oversight may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the investigation into KSD raises significant concerns regarding its safety and legitimacy. The unauthorized regulatory status, coupled with a history of customer complaints and withdrawal issues, suggests that KSD may not be a safe option for traders. The lack of transparency in its operations and fee structures further compounds these concerns.

Traders should approach KSD with caution and consider the potential risks involved. For those seeking reliable alternatives, brokers with robust regulatory oversight, transparent fee structures, and positive customer feedback should be prioritized. Ultimately, conducting thorough research and due diligence is essential for ensuring a safe and successful trading experience in the forex market.

Is KSD safe? Based on the evidence presented, it appears that traders should be wary of this broker and consider more reputable options for their trading needs.

Is KSD a scam, or is it legit?

The latest exposure and evaluation content of KSD brokers.

KSD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KSD latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.