Gkg 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Gkg review examines Global Kapital Group. GKG is a financial services company that has been operating since 2010, building its reputation over more than a decade in the industry. Based on available user feedback and company information, GKG presents a mixed picture in the financial services landscape with both strengths and areas of concern.

The company has established itself as an international holding company operating across 17 jurisdictions. Their core activities span real estate, entertainment, and financial services, creating a diversified business portfolio. However, user satisfaction appears to be a significant challenge that potential clients should carefully consider.

The company has been recognized as a "Best Practices Agency" for 16 consecutive years according to industry reports. This recognition indicates some level of operational excellence and industry acknowledgment. However, limited user feedback data suggests that customer experience may not align with this recognition, creating a disconnect between industry awards and client satisfaction.

GKG's business model encompasses digital banking, brokerage, and credit services. The company positions itself as a comprehensive financial services provider rather than focusing solely on trading services. This broad approach may appeal to clients seeking multiple financial solutions from a single provider.

For potential clients considering GKG's services, it's important to note that the company operates across multiple jurisdictions. This international structure may result in varying service levels and regulatory protections depending on your location and the specific entity serving your region. The lack of detailed user reviews and transparent operational information makes it challenging to provide a definitive assessment of their trading services quality.

Important Notice

Regional Entity Differences: GKG operates as an international holding company across 17 different jurisdictions. This complex multi-jurisdictional structure means that services, regulations, and trading conditions may vary significantly depending on your location and the specific GKG entity serving your region, which could impact your overall experience. Potential clients should verify which entity they would be dealing with and understand the applicable regulatory framework before proceeding.

Review Methodology: This evaluation is based on limited available information from company sources and industry reports. Due to the scarcity of detailed user feedback and operational data, some assessments rely on general industry standards and company representations rather than comprehensive user experience data, which may limit the accuracy of certain conclusions.

Rating Framework

Broker Overview

Global Kapital Group was established in 2010 in the United Kingdom. The company has evolved into an international financial holding company based in the United States, demonstrating significant growth and expansion over its operational history. GKG operates across 17 jurisdictions, demonstrating a significant global presence in the financial services sector that spans multiple continents and regulatory environments.

According to LinkedIn data, GKG employs between 51-200 people. The company has attracted over 30,000 followers on the platform, indicating a substantial corporate presence and professional network within the financial services industry. This social media following suggests active engagement with the professional community and potential clients.

The company's business model focuses on three core areas: digital banking, brokerage services, and credit solutions. This diversified approach positions GKG as a comprehensive financial services provider rather than a specialized trading platform, which may appeal to clients seeking integrated financial solutions. The company emphasizes diversity and inclusion within its operations, promoting what they describe as celebrating unique contributions from team members across their global operations.

GKG's multi-jurisdictional structure suggests a complex operational framework that spans various regulatory environments. While this global reach may offer advantages in terms of service availability, it also raises questions about regulatory consistency and client protection standards across different regions, which potential clients should carefully consider. The company's longevity in the market, operating for over a decade, indicates some level of business sustainability and ability to navigate various economic conditions.

Regulatory Status: Specific regulatory information is not clearly detailed in available sources. Given the company's operation across 17 jurisdictions, regulatory oversight likely varies by region, but comprehensive regulatory details are not readily available for verification, which may concern potential clients.

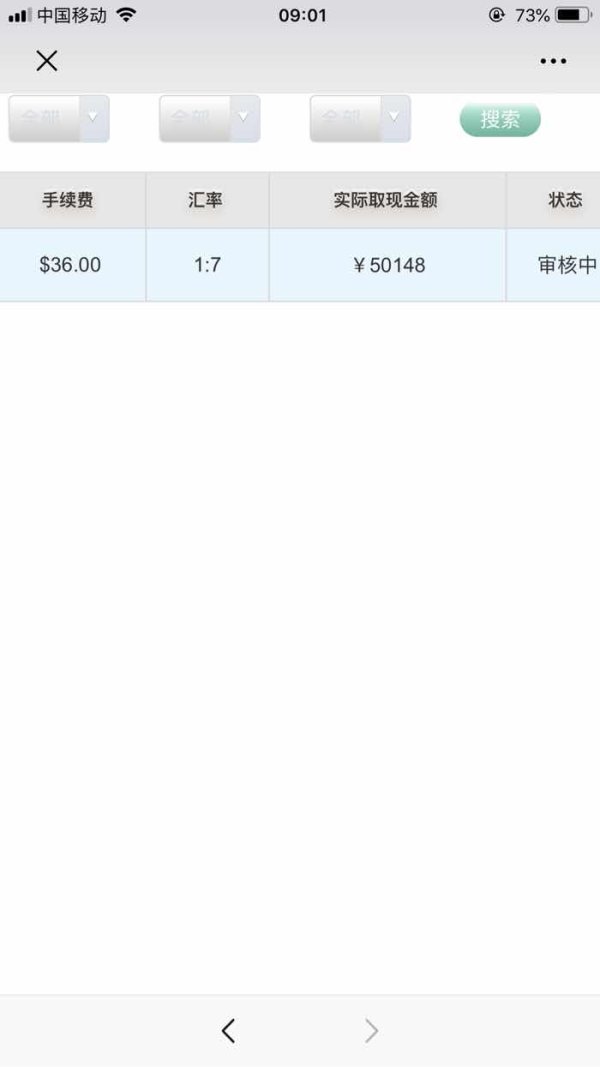

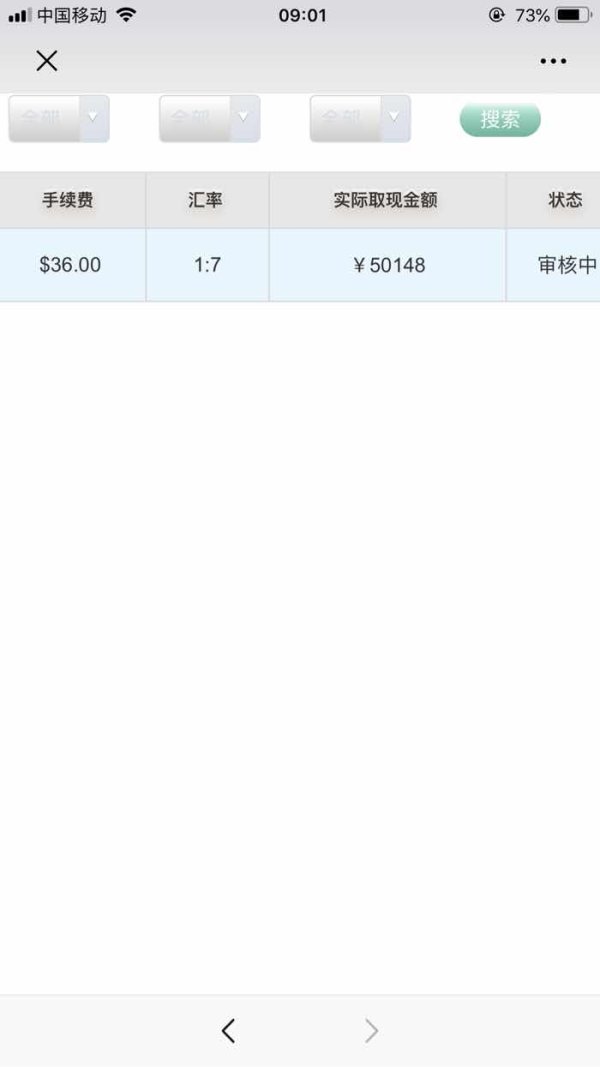

Deposit and Withdrawal Methods: Available sources do not provide specific information about supported payment methods. Processing times and associated fees for deposits and withdrawals remain unclear, making it difficult for potential clients to plan their financial transactions.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in the available company information. This lack of transparency makes it difficult to assess accessibility for different trader categories and budget levels.

Bonuses and Promotions: No information about current promotional offers, welcome bonuses, or ongoing incentive programs is available in the reviewed sources. Potential clients cannot evaluate potential cost savings or additional benefits that might be available.

Trading Assets: While the company operates in financial services including brokerage, specific details about available trading instruments remain unclear. Asset classes and market coverage are not detailed in accessible materials, limiting client understanding of available opportunities.

Cost Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs is not available in the reviewed sources. This transparency gap makes cost comparison challenging for potential clients evaluating different broker options.

Leverage Options: Specific leverage ratios offered to clients are not mentioned in available company documentation. This information is crucial for traders who rely on leverage for their trading strategies.

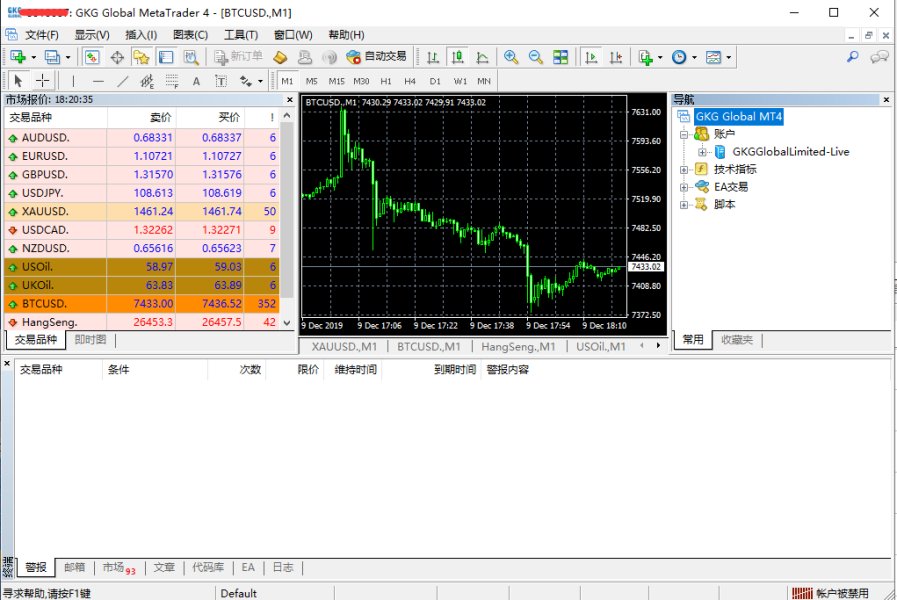

Platform Options: Details about trading platforms are not specified in accessible sources. Whether GKG offers proprietary solutions or third-party platforms like MetaTrader remains unclear to potential clients.

Geographic Restrictions: While operating globally across 17 jurisdictions, specific information about restricted countries or regions is not available. Potential clients from certain locations may face unexpected limitations or restrictions.

Customer Support Languages: Multi-language support details are not specified in available materials. International clients cannot determine whether support will be available in their preferred language.

This Gkg review highlights the significant information gaps that potential clients may encounter when researching the company's services.

Detailed Rating Analysis

Account Conditions Analysis

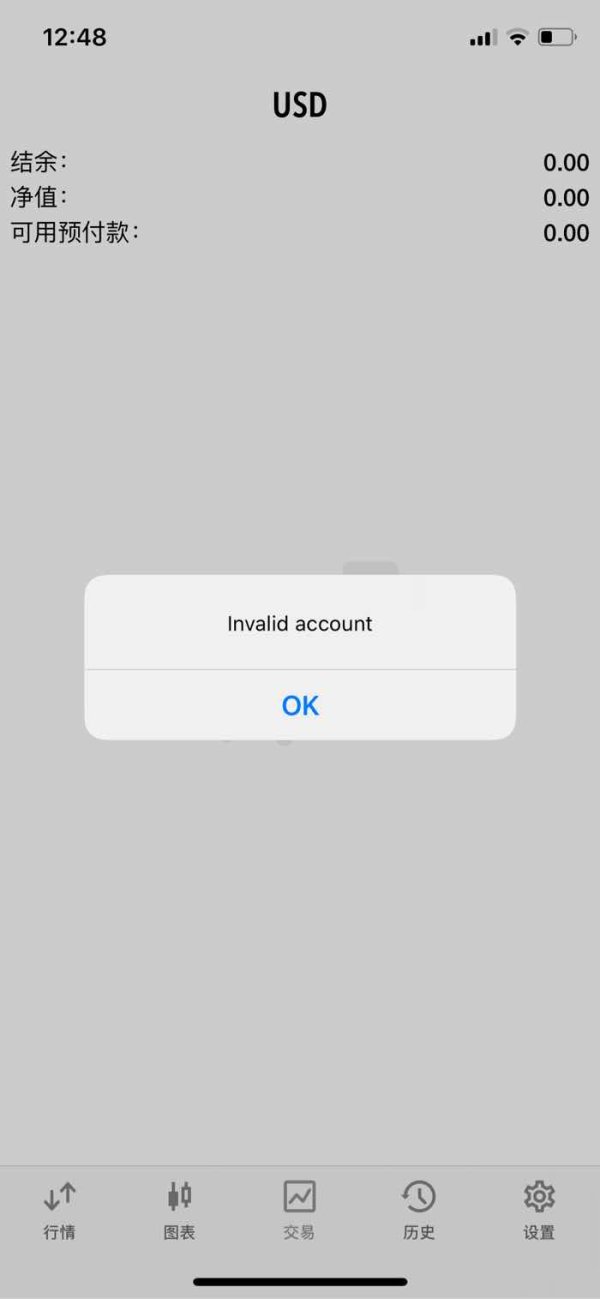

The assessment of GKG's account conditions proves challenging due to limited publicly available information. Unlike many established brokers who provide comprehensive details about their account types, minimum deposits, and trading conditions, GKG's online presence lacks these crucial details that clients need to make informed decisions. This transparency gap makes it difficult for potential clients to understand what to expect when opening an account.

Industry standards typically include multiple account tiers catering to different trader experience levels and capital requirements. However, without specific information about GKG's account structure, it's impossible to determine whether they follow this standard practice or offer customized solutions. The absence of clear information about account opening requirements, verification processes, and available account features raises concerns about operational transparency.

For traders considering GKG's services, the lack of detailed account condition information represents a significant barrier to informed decision-making. Most professional traders require clear understanding of account specifications before committing to a broker relationship. The limited available information suggests that potential clients would need to contact the company directly to obtain basic account details.

This approach is not ideal in today's competitive brokerage environment where transparency is expected. This Gkg review notes that the absence of readily available account information may indicate either limited retail trading focus or insufficient marketing transparency, both of which could impact client acquisition and satisfaction levels.

The evaluation of GKG's trading tools and resources faces similar challenges due to information scarcity. Modern forex and financial services brokers typically offer comprehensive trading platforms, analytical tools, market research, and educational resources to support client success. However, GKG's public-facing materials do not provide detailed information about their technological offerings or analytical capabilities.

Industry-leading brokers usually feature advanced charting tools, technical indicators, automated trading capabilities, and real-time market data feeds. Without specific information about GKG's platform capabilities, it's difficult to assess whether they meet contemporary trading standards or lag behind industry expectations. The absence of platform screenshots, feature lists, or technology partnerships in available materials suggests either limited platform development or poor marketing communication.

Educational resources and market analysis are crucial components of modern brokerage services, particularly for retail traders who rely on broker guidance. The lack of visible educational content, market commentary, or research publications in GKG's online presence raises questions about their commitment to client education and market insight provision. Professional traders increasingly expect comprehensive analytical tools and market intelligence as standard broker offerings.

The limited information about trading tools and resources suggests that GKG may focus more on institutional or high-net-worth clients. These client segments typically rely less on broker-provided analytical tools, though this remains speculative without concrete confirmation from the company.

Customer Service and Support Analysis

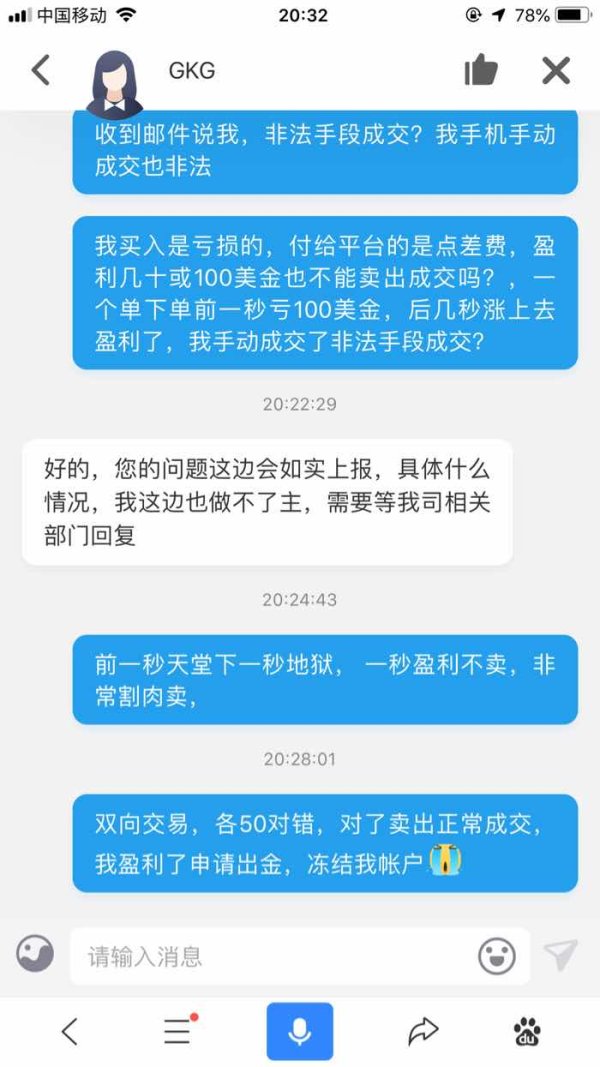

Customer service evaluation for GKG is significantly hampered by the absence of user feedback and detailed service information. Quality customer support is fundamental to successful broker-client relationships, particularly in financial services where timely assistance can impact trading outcomes and financial security. The lack of available information makes it impossible to assess GKG's commitment to client support.

Industry standards for broker customer service typically include multiple contact channels such as phone, email, and live chat. Extended service hours to accommodate global markets and multilingual support for international clients are also expected features. However, available sources do not provide specific information about GKG's customer service infrastructure, response times, or service quality metrics.

The lack of user reviews specifically addressing customer service experiences makes it impossible to assess real-world support quality. In today's digital environment, satisfied clients typically leave positive feedback about responsive customer service, while dissatisfied clients often share negative experiences online. The absence of such feedback could indicate either very limited client interaction or insufficient online presence management.

For a company operating across 17 jurisdictions, effective customer service coordination across different time zones and regulatory environments would be particularly challenging. Without specific information about GKG's approach to international customer support, potential clients cannot assess whether the company can provide adequate assistance for their geographic location and service needs.

Trading Experience Analysis

Assessing GKG's trading experience requires evaluation of platform stability, execution quality, order processing speed, and overall trading environment. Unfortunately, the available information does not provide insights into these critical aspects of broker performance that directly impact client success. Modern trading platforms must offer reliable connectivity, fast order execution, minimal slippage, and comprehensive order types to meet professional trading standards.

The absence of technical specifications, performance metrics, or user testimonials about trading experience makes it impossible to evaluate whether GKG meets these requirements. Traders need confidence in platform reliability and execution quality before committing capital to any broker relationship. Mobile trading capabilities have become essential for contemporary traders who need market access across devices and locations.

Without information about GKG's mobile platform offerings or cross-device synchronization capabilities, potential clients cannot assess the flexibility of their trading infrastructure. Modern traders expect seamless transitions between desktop and mobile platforms with synchronized data and order management. Market access and liquidity provision are crucial factors affecting trading experience quality.

Information about GKG's liquidity providers, market depth, or execution models is not available in reviewed sources. This lack of transparency makes it difficult to predict trading conditions that clients might experience during different market conditions. This Gkg review emphasizes that the lack of detailed trading experience information represents a significant gap for traders who need to understand execution quality and platform reliability before committing to a broker relationship.

Trust and Safety Analysis

Trust assessment for GKG reveals mixed indicators that require careful consideration by potential clients. On the positive side, the company has been recognized as a "Best Practices Agency" for 16 consecutive years, according to industry reports, which suggests consistent operational standards. This recognition suggests some level of operational excellence and industry acknowledgment, which contributes positively to credibility assessment and indicates peer recognition within the financial services sector.

However, the specific regulatory framework governing GKG's operations remains unclear despite their multi-jurisdictional presence. Regulatory oversight is crucial for client fund protection and operational standards enforcement, particularly in financial services where client funds are at risk. Without clear information about regulatory licenses, client fund segregation practices, or investor compensation schemes, it's difficult to assess the safety measures protecting client interests.

The company's longevity, operating since 2010, indicates business sustainability and market survival through various economic conditions. This operational history provides some confidence in business continuity and the company's ability to navigate market challenges, though it doesn't guarantee service quality or regulatory compliance standards. For international operations across 17 jurisdictions, regulatory complexity increases significantly with varying requirements and standards.

Different regions have varying investor protection standards, and clients need clarity about which regulatory framework applies to their specific situation. The absence of detailed regulatory information in available sources raises questions about transparency and client protection standards, which are fundamental concerns for potential clients.

User Experience Analysis

User experience evaluation for GKG faces significant limitations due to minimal available feedback from actual clients. Contemporary broker assessment typically relies heavily on user reviews, satisfaction surveys, and community feedback to understand real-world service quality and client satisfaction levels. The scarcity of user testimonials, online reviews, or community discussions about GKG's services makes it challenging to assess client satisfaction levels.

In today's digital environment, successful brokers typically generate substantial user feedback across various review platforms and trading communities. The absence of such feedback raises questions about either client engagement levels or the company's approach to feedback collection and publication. Account opening and verification processes significantly impact initial user experience, but specific information about GKG's onboarding procedures is not available.

Modern clients expect streamlined, digital-first processes with clear timelines and requirements for account setup. Without details about these fundamental user interactions, potential clients cannot anticipate their initial experience quality or prepare for the onboarding process. Platform usability, interface design, and navigation efficiency are crucial components of positive user experience.

The absence of platform demonstrations, user interface screenshots, or usability feedback makes it impossible to evaluate whether GKG's platforms meet contemporary design and functionality standards. Modern traders expect intuitive interfaces and efficient workflows that support their trading activities. The limited user experience information suggests either restricted public access to GKG's services or insufficient focus on retail client feedback collection and publication.

Conclusion

This comprehensive Gkg review reveals a company with significant industry presence but limited transparency regarding specific service offerings and client experience. While GKG's recognition as a "Best Practices Agency" for 16 consecutive years and its multi-jurisdictional operations indicate substantial business credentials, the lack of detailed operational information and user feedback creates uncertainty for potential clients who need clear information to make informed decisions. The disconnect between industry recognition and available client information represents a significant concern for transparency.

GKG may be more suitable for institutional clients or high-net-worth individuals who can conduct direct due diligence rather than retail traders. These client segments typically have resources for independent verification and may not rely on publicly available information for broker selection. The company's diversified business model spanning real estate, entertainment, and financial services suggests a broad corporate focus that may not prioritize retail trading services.

Potential clients should conduct thorough direct communication with GKG to obtain specific information about trading conditions, regulatory protections, and service offerings before making any commitment. The limited public information available makes it difficult to recommend GKG without additional verification of their current service standards and client protection measures, which potential clients should prioritize in their evaluation process.