Is GFS Partner safe?

Business

License

Is GFS Partner Safe or a Scam?

Introduction

GFS Partner is an online forex broker that positions itself in the highly competitive trading market by offering a range of trading instruments and services. However, the world of forex trading is fraught with risks, and traders must exercise caution when evaluating brokers. The integrity and safety of a broker can significantly impact a trader's financial security. This article aims to provide a comprehensive analysis of whether GFS Partner is safe or a potential scam. Our investigation is based on a thorough review of available online resources, including regulatory information, customer feedback, and trading conditions.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy. GFS Partner claims to operate under the ownership of GFS Partner Ltd., but it lacks proper regulation from recognized financial authorities. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns about the broker's reliability. Regulated brokers are typically required to adhere to strict guidelines that protect client funds and ensure fair trading practices. GFS Partner's lack of regulation places it in a high-risk category, indicating that it may not offer the same level of protection as its regulated counterparts. This unregulated status is a major red flag for potential traders, as it suggests that GFS Partner may not be held accountable for its actions or any potential misconduct.

Company Background Investigation

GFS Partner's company background is shrouded in ambiguity. There is limited information available about its history, ownership structure, and management team. The lack of transparency regarding the company's operations is concerning. A reputable broker typically provides clear details about its founders, management team, and operational history.

The absence of such information raises questions about the broker's legitimacy and trustworthiness. Furthermore, the unclear ownership structure suggests that there may be a lack of accountability. Traders should be wary of engaging with a broker that does not provide sufficient information about its management and operational practices, as this could indicate potential risks associated with their investments.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for any trader. GFS Partner claims to offer competitive trading conditions, but the lack of clear information on fees and spreads complicates the evaluation process. Below is a comparison of the core trading costs associated with GFS Partner:

| Fee Type | GFS Partner | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific details on spreads, commissions, and overnight fees makes it difficult to assess the overall cost of trading with GFS Partner. Traders may encounter unexpected fees or unfavorable trading conditions, which could lead to significant losses. The lack of transparency in the fee structure further emphasizes the need for caution when considering this broker.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. GFS Partner does not provide adequate information regarding its security measures. Key aspects such as fund segregation, investor protection, and negative balance protection are critical for safeguarding traders' investments.

Without clear policies in place, traders may be at risk of losing their funds without any recourse. Historical issues related to fund safety or disputes have not been disclosed by GFS Partner, which is another indicator of potential risks associated with this broker. The absence of these safety measures poses a significant concern for traders considering GFS Partner as their trading platform.

Customer Experience and Complaints

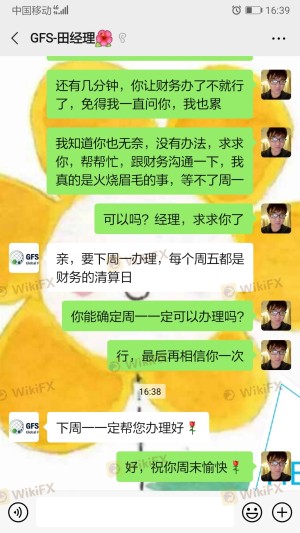

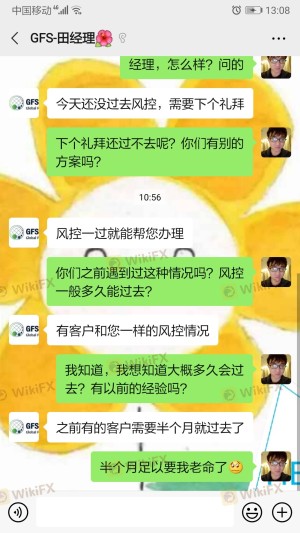

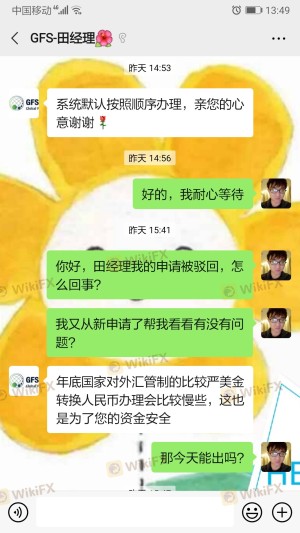

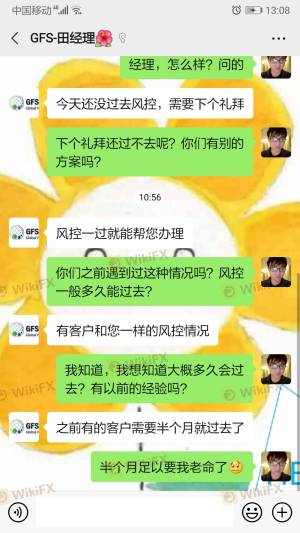

Customer feedback is an essential component in assessing a broker's reliability. A review of user experiences with GFS Partner reveals recurring complaints regarding withdrawal difficulties and poor customer service. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency Concerns | High | Poor |

Many customers report that they faced challenges when attempting to withdraw their funds, often citing unresponsive customer service. The repeated issues with withdrawals raise serious concerns about the broker's practices and its commitment to client satisfaction. Typical cases involve clients who deposited substantial amounts, only to find themselves unable to access their funds, leading to frustration and financial loss.

Platform and Trade Execution

The trading platform offered by GFS Partner is a critical aspect of the overall trading experience. Users have noted that while the platform may provide basic functionalities, there are concerns regarding its stability and performance. Issues such as slippage and order rejections can significantly impact trading results.

Traders have reported instances of delayed order execution, which can lead to unfavorable trading outcomes, especially in volatile market conditions. The potential for platform manipulation further exacerbates the risks associated with trading through GFS Partner. Traders should be cautious and consider the platform's reliability before committing their funds.

Risk Assessment

Engaging with GFS Partner presents various risks that potential traders should carefully consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Financial Risk | High | Lack of transparency in fees and withdrawal issues. |

| Operational Risk | Medium | Platform performance issues may affect trading outcomes. |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and start with small investments to test the platform's reliability.

Conclusion and Recommendations

In conclusion, the analysis indicates that GFS Partner is not a safe trading option. The lack of regulation, transparency issues, and numerous customer complaints suggest that traders should exercise extreme caution. There are significant red flags indicating potential fraudulent practices, and the overall risk associated with this broker is high.

For traders seeking reliable alternatives, it is advisable to consider brokers with strong regulatory oversight, transparent fee structures, and positive user feedback. Brokers such as [insert reputable brokers] may offer safer trading environments and better customer support. In summary, potential traders should prioritize their financial security and carefully evaluate their options before making any commitments.

Is GFS Partner a scam, or is it legit?

The latest exposure and evaluation content of GFS Partner brokers.

GFS Partner Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GFS Partner latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.