Is Fxminin safe?

Business

License

Is Fxminin Safe or a Scam?

Introduction

Fxminin is a relatively new player in the forex market, positioning itself as an investment platform that offers access to forex, CFDs, and cryptocurrency trading. With the allure of high returns and a user-friendly interface, Fxminin has attracted the attention of many traders, particularly those looking for alternative investment opportunities. However, the increasing prevalence of scams in the forex industry necessitates that traders conduct thorough due diligence before engaging with any broker. This article aims to provide a comprehensive evaluation of Fxminin by analyzing its regulatory status, company background, trading conditions, customer experiences, and more. Our investigative approach combines qualitative assessments with quantitative data drawn from online reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its legitimacy. Fxminin operates under the entity name FX Consultants Ltd., which claims to be based in the United Kingdom. However, it is essential to note that Fxminin is not regulated by any recognized financial authority. This lack of regulation raises significant concerns regarding investor protection and operational transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that traders using Fxminin are exposed to higher risks, including the potential for fraud and the inability to seek recourse in the event of disputes. A regulated broker is required to adhere to strict guidelines that protect clients, including maintaining segregated accounts and ensuring fair trading practices. The lack of such oversight at Fxminin suggests that it may not have the necessary frameworks in place to safeguard client funds, making it crucial for traders to exercise caution.

Company Background Investigation

Fxminin is owned by FX Consultants Ltd., which claims to be a UK-registered company. However, many reviews and analyses indicate that the company may not be operating from the stated location, as the provided address appears to be fabricated. The absence of verifiable information regarding the company's history and ownership structure raises red flags about its credibility.

Furthermore, the management team behind Fxminin lacks publicly available profiles or professional backgrounds that can be assessed for credibility. This lack of transparency is concerning, as it makes it difficult for potential investors to gauge the expertise and reliability of the individuals managing their funds. Without a solid foundation of trust and transparency, it becomes increasingly challenging to ascertain whether Fxminin is a safe option for trading or if it operates with ulterior motives.

Trading Conditions Analysis

When evaluating whether Fxminin is safe, it is crucial to analyze the trading conditions it offers. Fxminin claims to provide competitive spreads and various investment plans, but the specifics of its fee structure are often unclear. The company promotes high returns on investments, with some plans suggesting returns of up to 200% within a month, which are unrealistic and indicative of potential scams.

| Fee Type | Fxminin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (not disclosed) | 1-3 pips |

| Commission Model | Not specified | $5-$10 per lot |

| Overnight Interest Range | Not disclosed | 0.5%-2% |

The lack of clarity in the fee structure can lead to unexpected costs for traders, and the absence of detailed information about spreads and commissions is concerning. Traders should be wary of any broker that does not provide transparent information about its fees, as hidden costs can significantly impact profitability. This ambiguity further fuels the question: Is Fxminin safe?

Customer Funds Security

The safety of customer funds is paramount when considering a trading platform. Fxminin does not provide clear information about its security measures, such as whether client funds are kept in segregated accounts or if there are any investor protection policies in place. The absence of such safeguards suggests that traders could be at risk of losing their investments without any recourse.

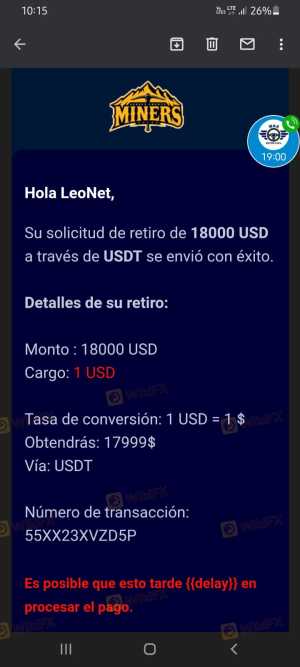

Moreover, there have been reports of clients experiencing difficulties when attempting to withdraw their funds, which is a common issue with unregulated brokers. Historical data indicates that platforms lacking proper regulatory oversight often face allegations of mishandling customer funds. This raises serious concerns about whether Fxminin is a safe platform for trading.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of any trading platform. Reviews of Fxminin reveal a troubling pattern of complaints regarding withdrawal issues, lack of support, and overall dissatisfaction with the service provided.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Misleading Information | High | Ignored |

Typical complaints include clients reporting that they were unable to withdraw their funds after making deposits, a situation that often escalates into frustration and allegations of fraud. The company's response to these complaints has been described as inadequate, with many users feeling ignored or dismissed. This lack of effective communication and resolution further questions the integrity of Fxminin and whether it is a safe option for traders.

Platform and Trade Execution

The performance of a trading platform can significantly influence a trader's experience. Reviews of Fxminin suggest that while the platform may be user-friendly, there are concerns regarding order execution quality, including instances of slippage and rejected orders.

Traders have reported experiencing difficulties in executing trades at desired prices, which can be detrimental in a volatile market. Such issues raise questions about whether Fxminin employs fair trading practices or if there are signs of platform manipulation. The combination of these factors contributes to the overarching concern: Is Fxminin safe?

Risk Assessment

Engaging with Fxminin presents several risks that potential investors should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker, no protection for clients. |

| Financial Risk | High | Lack of transparency in fees and withdrawal issues. |

| Operational Risk | Medium | Platform performance concerns, including slippage. |

Given these risks, it is imperative for traders to approach Fxminin with caution. It is advisable to seek out regulated brokers with proven track records and transparent fee structures to mitigate these risks effectively.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Fxminin is not a safe trading platform. The lack of regulation, transparency, and consistent customer complaints indicate that traders could be exposing themselves to significant risks. The unrealistic promises of high returns combined with poor customer service and withdrawal issues further reinforce the notion that Fxminin is not a trustworthy option.

For traders seeking reliable alternatives, it is recommended to consider well-regulated brokers with a solid reputation in the industry. Options such as IG, OANDA, and Forex.com provide robust regulatory oversight and transparent trading conditions, making them safer choices for traders. As always, thorough research and due diligence are essential to ensure a secure trading experience.

Is Fxminin a scam, or is it legit?

The latest exposure and evaluation content of Fxminin brokers.

Fxminin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fxminin latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.