Is Finatics safe?

Pros

Cons

Is Finatics A Scam?

Introduction

Finatics is a forex trading platform that has recently gained attention in the global financial markets. Operating primarily online, it claims to offer various trading services, including forex, commodities, and CFDs. However, the growing number of concerns regarding its legitimacy has prompted traders to exercise caution. As the forex market is rife with potential scams, it is crucial for traders to conduct thorough evaluations of any broker before committing their funds. This article aims to provide an objective analysis of Finatics' credibility, utilizing a comprehensive investigative approach that includes regulatory status, company background, trading conditions, safety of client funds, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical aspects that determine its trustworthiness. A well-regulated broker is typically required to adhere to strict guidelines, ensuring the safety of client funds and ethical business practices. Unfortunately, Finatics does not hold any licenses from reputable regulatory bodies, which raises significant red flags regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Finatics operates without oversight, leaving clients vulnerable to potential fraud and mismanagement. Regulatory authorities, such as the Cyprus Securities and Exchange Commission (CySEC), have issued warnings against Finatics, indicating that it is not authorized to provide investment services. This lack of regulatory compliance suggests that traders should be extremely cautious when considering whether Finatics is safe.

Additionally, the quality of regulation is paramount. Brokers regulated in jurisdictions with strict requirements, such as the UK or the US, typically offer higher levels of client protection. In contrast, Finatics operates in a region where regulatory oversight is minimal, which could lead to issues such as fund misappropriation or lack of transparency.

Company Background Investigation

Understanding the history and ownership structure of a broker is essential for assessing its credibility. Unfortunately, detailed information about Finatics' management team and ownership is scarce. The company claims to be based in Cyprus, but there is little transparency regarding its operational history or the identities of its key personnel.

The lack of publicly available information raises concerns about the company's accountability and trustworthiness. A reputable broker would typically provide clear information about its founders, management team, and any relevant professional qualifications. In Finatics' case, the absence of such details may indicate a lack of legitimacy. Furthermore, the company's website does not offer sufficient insights into its operational framework or business model, further compounding concerns about whether Finatics is safe.

Given the lack of transparency and the dubious nature of its claims, potential clients are advised to approach this broker with caution. A broker that is unwilling to disclose essential information about its operations is often a significant red flag.

Trading Conditions Analysis

When evaluating a trading platform, it's essential to consider its trading conditions, including fees and spreads. Finatics claims to offer competitive trading conditions; however, the absence of clear information on its website raises questions about its pricing structure.

| Fee Type | Finatics | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The lack of specific data regarding spreads and commissions makes it difficult for traders to assess the overall cost of trading with Finatics. Furthermore, reports suggest that clients may encounter hidden fees or unfavorable terms when attempting to withdraw funds. This lack of transparency in fee structures can lead to unexpected costs, making it essential for traders to consider whether Finatics is safe before engaging with the platform.

Moreover, the presence of high leverage ratios, such as 1:400, is concerning, as it exceeds the limits imposed by many reputable regulatory bodies. High leverage can amplify both profits and losses, increasing the overall risk for traders. Such practices are often associated with unregulated brokers and may indicate a potential scam.

Client Funds Security

The safety of client funds is paramount when selecting a trading platform. Regulated brokers are typically required to keep client funds in segregated accounts, ensuring that they are protected in the event of the broker's insolvency. Unfortunately, Finatics does not provide any information regarding its fund security measures, which raises serious concerns about the safety of clients' investments.

The absence of investor protection mechanisms, such as negative balance protection or participation in compensation schemes, further exacerbates the risk. If Finatics were to become insolvent, clients could potentially lose their entire investment without any recourse. This lack of security measures is a significant red flag and raises the question of whether Finatics is safe for traders.

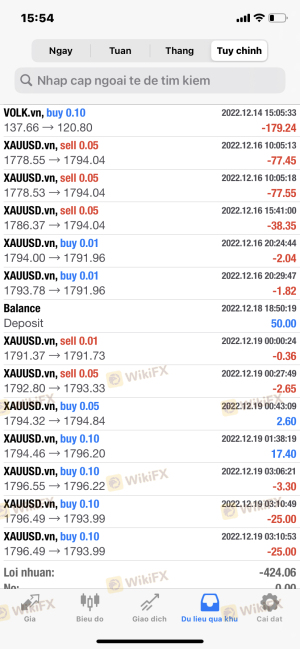

Additionally, there have been reports of clients facing difficulties when attempting to withdraw their funds, a common tactic employed by fraudulent brokers to retain client money. The lack of transparency regarding withdrawal policies and potential fees only adds to the uncertainty surrounding the safety of funds held with Finatics.

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability. Unfortunately, Finatics has received numerous negative reviews and complaints from users, indicating a pattern of dissatisfaction among clients. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and misleading advertising practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Practices | High | Non-responsive |

For instance, several clients have reported being unable to withdraw their funds after making deposits, with the broker citing various reasons for the delays. This pattern of complaints raises significant concerns about the overall trustworthiness of Finatics and whether Finatics is safe for potential investors.

Furthermore, the company's response to complaints has been less than satisfactory, with many clients reporting that their inquiries go unanswered. This lack of effective communication can be indicative of a broker that is not genuinely concerned about its clients' well-being.

Platform and Execution

The trading platform's performance is another critical factor to consider. Finatics claims to offer a robust trading platform, but user experiences vary significantly. Some users have reported issues with order execution, including slippage and rejections, which can severely impact trading outcomes.

Moreover, concerns about potential platform manipulation have surfaced, with some clients alleging that the broker may engage in practices that disadvantage traders. Such claims warrant further investigation, as they can significantly affect the perception of whether Finatics is safe.

The quality of the trading experience is paramount for traders, and any indications of manipulation or poor execution can lead to substantial financial losses. Therefore, potential clients should carefully consider the reports and reviews regarding the platform's performance before engaging with Finatics.

Risk Assessment

Engaging with Finatics presents several risks that traders should be aware of. The combination of its unregulated status, lack of transparency, and negative customer feedback creates a precarious environment for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation |

| Fund Safety | High | No investor protection |

| Withdrawal Issues | High | Frequent complaints |

| Transparency | High | Lack of information |

To mitigate these risks, traders should consider the following recommendations:

- Avoid depositing significant funds until more information becomes available regarding the broker's legitimacy.

- Conduct thorough research and seek out reviews from independent sources to gain a clearer understanding of the broker's reputation.

- Consider alternative, regulated brokers that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Finatics poses significant risks to traders. The absence of regulation, coupled with a lack of transparency and numerous negative reviews, raises serious concerns about whether Finatics is safe for trading. Potential clients should exercise extreme caution and consider these factors before engaging with the platform.

For those looking to invest in the forex market, it is advisable to seek out regulated brokers with a proven track record of reliability and customer satisfaction. Brokers that are overseen by reputable regulatory bodies can provide essential protections for client funds and ensure a more trustworthy trading environment.

Is Finatics a scam, or is it legit?

The latest exposure and evaluation content of Finatics brokers.

Finatics Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finatics latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.