Is FX Fair safe?

Pros

Cons

Is FX Fair Safe or a Scam?

Introduction

FX Fair is an online forex broker that has positioned itself within the expansive landscape of the foreign exchange market. Established in 2013 and operating from Saint Vincent and the Grenadines, FX Fair claims to offer competitive trading conditions, including high leverage and various account types. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to conduct thorough assessments of brokers before committing their funds. This article aims to evaluate the legitimacy of FX Fair through a comprehensive investigation of its regulatory status, company background, trading conditions, customer fund security, user experiences, and potential risks. The analysis will be based on information gathered from credible sources and user reviews, providing a well-rounded perspective on whether FX Fair is a safe trading option.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation helps ensure that brokers adhere to specific standards, protecting traders from potential fraud and malpractice. Unfortunately, FX Fair operates without any significant regulatory oversight. The broker is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. This lack of regulation raises significant concerns about the safety of traders' funds and the integrity of trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a reputable regulatory body overseeing FX Fair's operations means that traders have limited recourse in the event of disputes or fund recovery. While the broker claims to maintain segregated accounts for client funds, the lack of external oversight diminishes the credibility of these assertions. In contrast, regulated brokers are required to adhere to stringent guidelines, providing a layer of security for traders. Overall, the unregulated status of FX Fair is a significant red flag, leading many to question whether FX Fair is safe to trade with.

Company Background Investigation

FX Fair's history is relatively recent, having been established in 2013. The company operates under the Fair Group and is based in Saint Vincent and the Grenadines. While the broker presents itself as a legitimate trading entity, the lack of transparency regarding its ownership and management structure is concerning. Details about the management team are scarce, making it difficult to assess their qualifications and experience in the financial industry.

Furthermore, the broker's website provides limited information about its operations, which raises questions about its transparency and accountability. A trustworthy broker typically discloses key information about its management team and corporate structure, allowing traders to gauge the firm's credibility. The absence of such information from FX Fair's platform further adds to the skepticism surrounding its legitimacy. Consequently, the lack of transparency and the unregulated status of FX Fair leave potential clients with significant uncertainties about the broker's trustworthiness.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. FX Fair offers various account types, including standard, real ECN, and prime accounts, with leverage options reaching up to 1:1111. While high leverage may attract traders seeking significant returns, it also amplifies the risk of substantial losses. The broker's fee structure includes spreads that vary by account type, with some accounts offering spreads as low as 0.0 pips. However, the lack of clarity regarding potential hidden fees raises concerns.

| Fee Type | FX Fair | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | From 1.0 pips |

| Commission Model | $2 per $100,000 (ECN) | $5 per $100,000 |

| Overnight Interest Range | Varies | Varies |

The comparison of FX Fair's trading costs with industry averages indicates that while the broker may offer competitive spreads, the associated commission fees can add to the overall trading costs. Furthermore, the lack of clarity surrounding overnight interest charges and other potential fees could lead to unexpected costs for traders. Overall, while FX Fair presents attractive trading conditions, the ambiguity surrounding its fee structure and the potential for hidden costs warrant caution among traders.

Customer Fund Security

The security of customer funds is a paramount concern for any trader. FX Fair claims to keep clients' funds in segregated accounts, which is a standard practice among reputable brokers. However, the absence of regulatory oversight raises questions about the effectiveness of these measures. Without a regulatory body enforcing strict guidelines, the assurance of fund safety becomes questionable. Additionally, the broker does not offer negative balance protection, which means that traders could potentially lose more than their initial deposit.

Historically, offshore brokers have been associated with numerous fund security issues, including difficulties in fund recovery and fraudulent activities. Given the lack of investor protection schemes in Saint Vincent and the Grenadines, the risk of losing funds with FX Fair is significantly heightened. Traders should be aware that if any issues arise, the chances of recovering lost funds through legal recourse are minimal. Overall, while FX Fair claims to prioritize fund security, the lack of regulatory oversight and investor protection measures raises serious concerns about whether FX Fair is safe for trading.

Customer Experience and Complaints

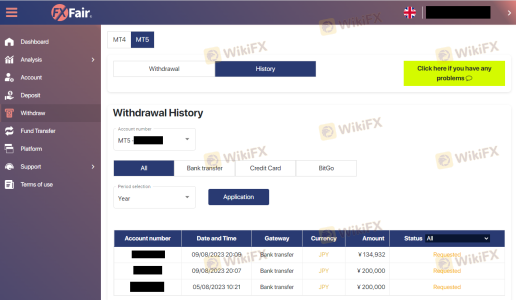

Customer feedback is often a telling indicator of a broker's reliability. Reviews of FX Fair reveal a mixed bag of experiences among users. While some traders report positive experiences, including quick withdrawals and responsive customer support, others express frustration over delayed withdrawals and poor customer service. Common complaints include issues with fund recovery, unresponsive support, and difficulties in executing trades.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Unresponsive |

| Trading Execution Problems | High | No resolution |

Two notable case studies highlight these issues. One trader reported a significant delay in withdrawing funds, leading to frustration and a loss of confidence in the broker. Another user experienced slippage during high volatility periods, resulting in unexpected losses. These complaints indicate a pattern of issues that could deter potential clients from engaging with FX Fair. The inconsistent customer experiences raise questions about the broker's commitment to providing a reliable trading environment.

Platform and Execution

The trading platform is a crucial aspect of any forex broker's offering. FX Fair utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading features. However, some users have reported issues with platform stability and execution quality. Complaints about slippage and order rejections during critical market events suggest that the broker's execution may not always meet traders' expectations.

Additionally, concerns about potential platform manipulation have surfaced, particularly in high-volatility situations. Traders have expressed skepticism about the broker's ability to execute trades fairly, especially when market conditions are turbulent. Overall, while FX Fair provides access to a widely used trading platform, the reported issues with execution and stability raise concerns about whether FX Fair is safe for traders.

Risk Assessment

Using FX Fair involves inherent risks that potential clients should carefully consider. The absence of regulation, coupled with mixed customer feedback and concerns about execution quality, contributes to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of investor protection and negative balance protection. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | Medium | Inconsistent support response times and resolution quality. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform before committing real funds. Additionally, maintaining a cautious approach and not investing more than one can afford to lose is advisable.

Conclusion and Recommendations

In conclusion, while FX Fair presents itself as an appealing option for forex trading, the combination of its unregulated status, mixed customer feedback, and reported execution issues raises significant concerns about its safety. The lack of regulatory oversight means that traders may face heightened risks, including potential fraud and difficulties in fund recovery.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have established a positive reputation in the industry. Brokers regulated by reputable authorities, such as the FCA in the UK or ASIC in Australia, offer a safer trading environment with robust investor protection measures. Ultimately, while FX Fair may offer attractive trading conditions, the potential risks associated with trading with this broker should not be overlooked.

Is FX Fair a scam, or is it legit?

The latest exposure and evaluation content of FX Fair brokers.

FX Fair Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX Fair latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.