FX Fair 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fx fair review examines an offshore broker that operates with limited regulatory transparency and questionable safety credentials. FX Fair positions itself as a forex broker offering multiple account types with varying spread ratios. However, significant concerns arise regarding its regulatory status and overall legitimacy. The broker appears to target international clients through its offshore structure. Specific regulatory information remains notably absent from available documentation.

FX Fair's primary appeal lies in its diverse account offerings and claimed features such as instant withdrawals, stop-out protection, and swap-free trading. However, the lack of clear regulatory oversight raises substantial red flags for potential traders. The broker markets itself with promises of "trade without tradeoffs." It positions features like 30% fewer stop-outs and no overnight fees as competitive advantages.

Given the offshore nature and regulatory uncertainty, FX Fair is only suitable for experienced traders who fully understand the risks associated with unregulated brokers and can afford potential losses. The absence of transparent regulatory information significantly impacts the overall assessment of this broker's credibility and safety for retail traders.

Important Disclaimers

Regional Variations: As an offshore broker, FX Fair's legal status and regulatory compliance may vary significantly across different jurisdictions. Traders should verify the broker's legality in their specific region before engaging in any trading activities.

Review Methodology: This evaluation is based on publicly available information and market feedback. Given the limited transparency from FX Fair regarding regulatory status and operational details, some assessments rely on industry standards. We also use comparative analysis with similar offshore brokers.

Rating Framework

Broker Overview

FX Fair operates as an offshore forex broker with limited publicly available information about its corporate background and establishment history. The broker positions itself in the competitive forex market by targeting international clients who may be seeking alternatives to heavily regulated brokers. However, the absence of clear founding information and corporate transparency raises immediate concerns. These concerns focus on the broker's legitimacy and operational history.

The broker's business model appears focused on providing forex trading services with emphasis on flexible trading conditions. FX Fair markets several distinctive features including instant withdrawal processing, proprietary stop-out protection technology, and swap-free overnight position holding. These features suggest the broker is attempting to differentiate itself in a crowded marketplace. Verification of these claims proves challenging due to limited independent confirmation.

According to available information, FX Fair operates without clear regulatory oversight from major financial authorities. This fx fair review finds that the broker's offshore status places it outside the protective frameworks typically provided by established regulatory bodies. These bodies include the FCA, ASIC, or CySEC. The lack of regulatory transparency significantly impacts the broker's credibility and raises questions about client fund protection and dispute resolution mechanisms.

Regulatory Status: Available information does not specify any major regulatory authority overseeing FX Fair's operations. This absence of regulatory clarity represents a significant risk factor for potential clients.

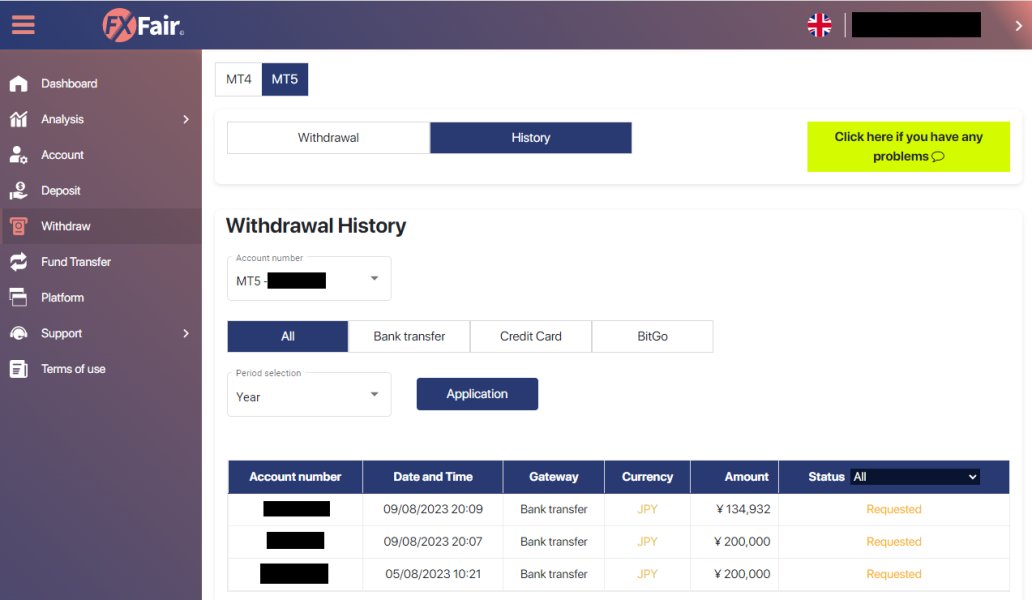

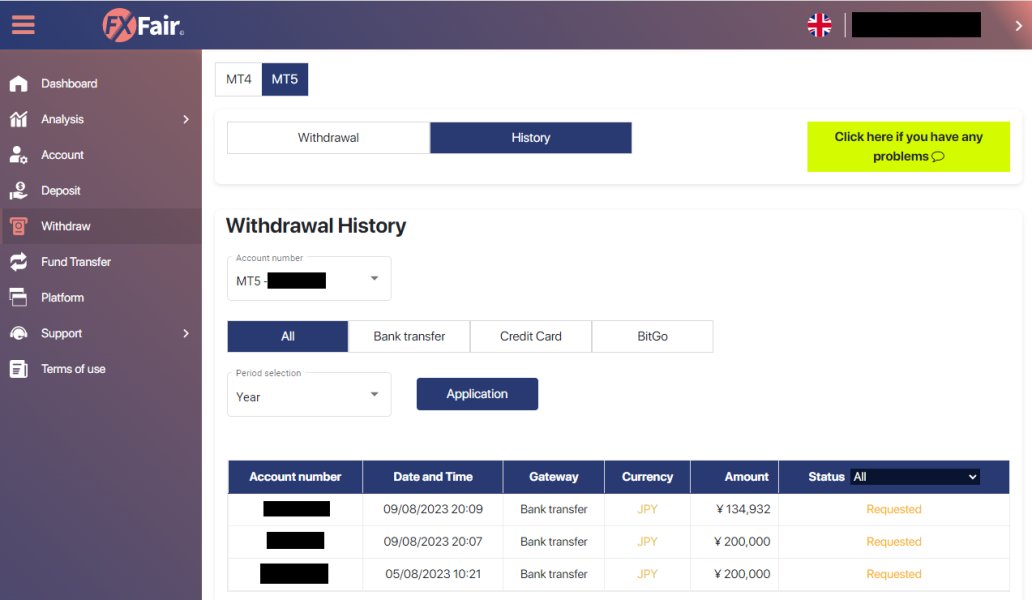

Deposit and Withdrawal Methods: Specific information about accepted payment methods is not detailed in available sources. The broker advertises "instant withdrawals" as a key feature. However, verification processes and actual processing times remain unspecified.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not clearly specified in available documentation. This makes it difficult for potential traders to assess entry barriers.

Promotions and Bonuses: Current promotional offerings and bonus structures are not detailed in available sources. Offshore brokers typically offer various incentives to attract new clients.

Trading Assets: FX Fair focuses primarily on forex markets. The complete range of available currency pairs and other tradable instruments requires further clarification from the broker directly.

Cost Structure: The broker mentions providing "multiple account types with various spread ratios," indicating differentiated pricing structures. However, specific spread ranges, commission rates, and fee schedules are not transparently disclosed in this fx fair review.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available information. This represents a significant information gap for potential traders.

Platform Selection: Specific trading platform details are not clearly documented in available sources. This includes whether the broker uses MetaTrader, proprietary software, or other solutions.

Geographic Restrictions: As an offshore broker, regional availability may vary. Specific restricted jurisdictions are not detailed in available information.

Customer Support Languages: Multi-language support capabilities are not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

FX Fair's account structure centers around multiple account types designed to accommodate different trading preferences and capital levels. According to available information, the broker offers "multiple account types with various spread ratios." This suggests a tiered approach to client categorization. However, the lack of specific details about minimum deposit requirements, commission structures, and account benefits significantly hampers a comprehensive evaluation.

The broker's marketing emphasizes features like instant withdrawals and no overnight fees, which could represent valuable account benefits for active traders. The advertised "30% fewer stop-outs" through proprietary protection technology, if genuine, could provide meaningful risk management advantages. However, without detailed terms and conditions or independent verification, these claims remain difficult to substantiate.

Account opening procedures and verification requirements are not clearly outlined in available sources. This lack of transparency regarding onboarding processes, documentation requirements, and approval timeframes creates uncertainty for potential clients. The absence of clear account tier benefits and upgrade criteria further complicates the assessment of FX Fair's account offerings.

This fx fair review notes that while the concept of multiple account types suggests flexibility, the implementation details remain insufficiently documented for thorough evaluation.

Available information provides limited insight into FX Fair's trading tools and analytical resources. The broker's marketing materials do not detail specific charting capabilities, technical indicators, or analytical tools available to traders. This absence of information about platform functionality represents a significant gap in evaluating the broker's technological offerings.

Research and market analysis resources are not mentioned in available documentation. Professional traders typically require access to economic calendars, market news, research reports, and analytical insights. Yet FX Fair's provision of such resources remains unclear. The lack of educational materials or trading guides further limits the broker's appeal to developing traders who require learning support.

Automated trading capabilities are not specified in available sources. This includes Expert Advisor support or algorithmic trading features. Given the importance of automated trading in modern forex markets, this information gap significantly impacts the broker's competitiveness assessment.

The absence of detailed platform specifications, third-party integrations, or advanced trading tools suggests either limited technological investment or poor marketing communication. Either scenario raises concerns about the broker's commitment to providing comprehensive trading infrastructure.

Customer Service and Support Analysis (3/10)

FX Fair's customer service infrastructure lacks detailed documentation in available sources. Essential information about support channels is not readily accessible. This includes phone numbers, email addresses, live chat availability, and support hours. This absence of contact information raises immediate concerns about client support accessibility and responsiveness.

Response time commitments and service level agreements are not specified, making it impossible to assess the broker's customer service standards. Professional brokers typically provide clear expectations about support response times and escalation procedures. Yet FX Fair's documentation lacks such transparency.

Multi-language support capabilities remain unspecified, which could limit the broker's accessibility for international clients. Given the offshore nature of the operation, comprehensive language support would be expected. Yet confirmation of such services is not available.

The lack of documented customer service policies, complaint procedures, or dispute resolution mechanisms represents a significant concern for potential clients. Without clear support structures, traders may face difficulties in resolving issues or accessing assistance when needed.

Trading Experience Analysis (6/10)

FX Fair markets several features that could enhance the trading experience, including instant withdrawals, stop-out protection, and swap-free trading. The broker's claim of "30% fewer stop-outs" through proprietary technology, if accurate, could provide meaningful risk management benefits for leveraged trading. However, independent verification of these performance claims is not available.

The advertised instant withdrawal feature addresses a common concern among forex traders regarding fund accessibility. If implemented effectively, this could represent a significant competitive advantage over brokers with lengthy withdrawal processing times. However, specific implementation details and any associated conditions are not clearly documented.

Platform stability and execution quality cannot be assessed based on available information, as specific platform details and performance metrics are not provided. Order execution speeds, slippage rates, and platform uptime statistics would be essential for evaluating trading experience quality.

This fx fair review acknowledges that while the marketed features appear attractive, the lack of detailed implementation information and independent verification limits the assessment of actual trading experience quality.

Trust and Safety Analysis (2/10)

The most significant concern regarding FX Fair centers on regulatory transparency and client fund protection. Available information does not identify any major financial regulatory authority overseeing the broker's operations. This regulatory absence represents a fundamental safety concern for potential clients. Regulatory oversight typically provides essential protections including segregated client funds, compensation schemes, and dispute resolution mechanisms.

The offshore operational structure, while not inherently problematic, requires enhanced due diligence from potential clients. Without regulatory oversight, traders must rely entirely on the broker's self-imposed standards and policies. These may not provide adequate protection in case of operational difficulties or disputes.

Client fund segregation policies, insurance coverage, and financial reporting transparency are not documented in available sources. These elements are crucial for assessing broker trustworthiness and client protection levels. The absence of such information significantly impacts the broker's credibility assessment.

Third-party audits, financial statements, or independent verification of the broker's operational claims are not referenced in available documentation. This lack of external validation further compounds trust and safety concerns for potential clients.

User Experience Analysis (4/10)

User experience assessment proves challenging due to limited available feedback and documentation about FX Fair's platform functionality. The broker's marketing emphasizes user-friendly features like instant withdrawals and simplified trading conditions. However, actual user testimonials or independent reviews are not readily available for verification.

Interface design and platform usability cannot be evaluated based on available information, as specific platform screenshots or detailed functionality descriptions are not provided. Modern traders expect intuitive interfaces, customizable layouts, and efficient navigation. Yet FX Fair's platform capabilities remain unclear.

Registration and account verification processes are not detailed in available sources, making it impossible to assess the user onboarding experience. Streamlined account opening procedures are essential for positive user experience, particularly in competitive forex markets.

The absence of user feedback, testimonials, or independent platform reviews significantly limits the assessment of actual user satisfaction levels. Without such feedback, potential clients cannot gauge the practical experience of trading with FX Fair.

Conclusion

This fx fair review reveals significant concerns about the broker's regulatory status and operational transparency that overshadow its marketed features. While FX Fair advertises attractive trading conditions including instant withdrawals and stop-out protection, the absence of regulatory oversight and limited operational transparency create substantial risks for potential clients.

FX Fair may appeal to experienced traders who understand offshore broker risks and prioritize specific features like swap-free trading or flexible account conditions. However, the broker is unsuitable for traders seeking regulatory protection, transparent operations, or comprehensive support infrastructure.

The primary advantages include multiple account types and advertised trading features, while significant disadvantages encompass regulatory uncertainty, limited transparency, and insufficient documentation of operational policies. Potential clients should conduct thorough due diligence and consider regulated alternatives before engaging with this offshore broker.