CM Globals 2025 Review: Everything You Need to Know

Executive Summary

CM Globals is an Australian-based forex broker. The company has established itself as a regulated financial services provider under the oversight of the Australian Securities and Investments Commission (ASIC). This cm globals review reveals a broker that has garnered positive attention for its high leverage offerings and exceptional customer support services. The company operates across multiple international markets. CM Globals specializes in equities and foreign exchange trading, positioning itself as a viable option for traders seeking substantial leverage opportunities.

The broker has received notable recognition in the industry. These awards include recognition for transparency and customer service excellence. According to available user feedback, CM Globals demonstrates particular strength in providing high maximum leverage ratios. This makes it attractive for traders who aim to maximize their market exposure. The company's commitment to customer support has been consistently highlighted in user reviews. Many traders praise the responsiveness and quality of assistance provided.

CM Globals primarily targets traders who prioritize high leverage trading opportunities. The broker also values superior customer service experiences. The company caters to both novice and experienced traders looking for a regulated environment with competitive trading conditions. However, potential users should be aware that spreads are reported to be on the higher side. This may impact overall trading costs for frequent traders.

Important Disclaimer

CM Globals operates across 12 countries. It's important to note that trading conditions, regulatory frameworks, and available services may vary significantly between different jurisdictions. The regulatory requirements and trading terms applicable in one region may differ substantially from those in another. This could potentially affect account features, leverage limits, and available financial instruments.

This review is based on publicly available information, user feedback, and industry reports available at the time of writing. The analysis aims to provide a comprehensive overview while acknowledging that some specific details may vary depending on the trader's location and account type. Prospective clients should verify current terms and conditions directly with CM Globals for their specific jurisdiction before making any trading decisions.

Rating Framework

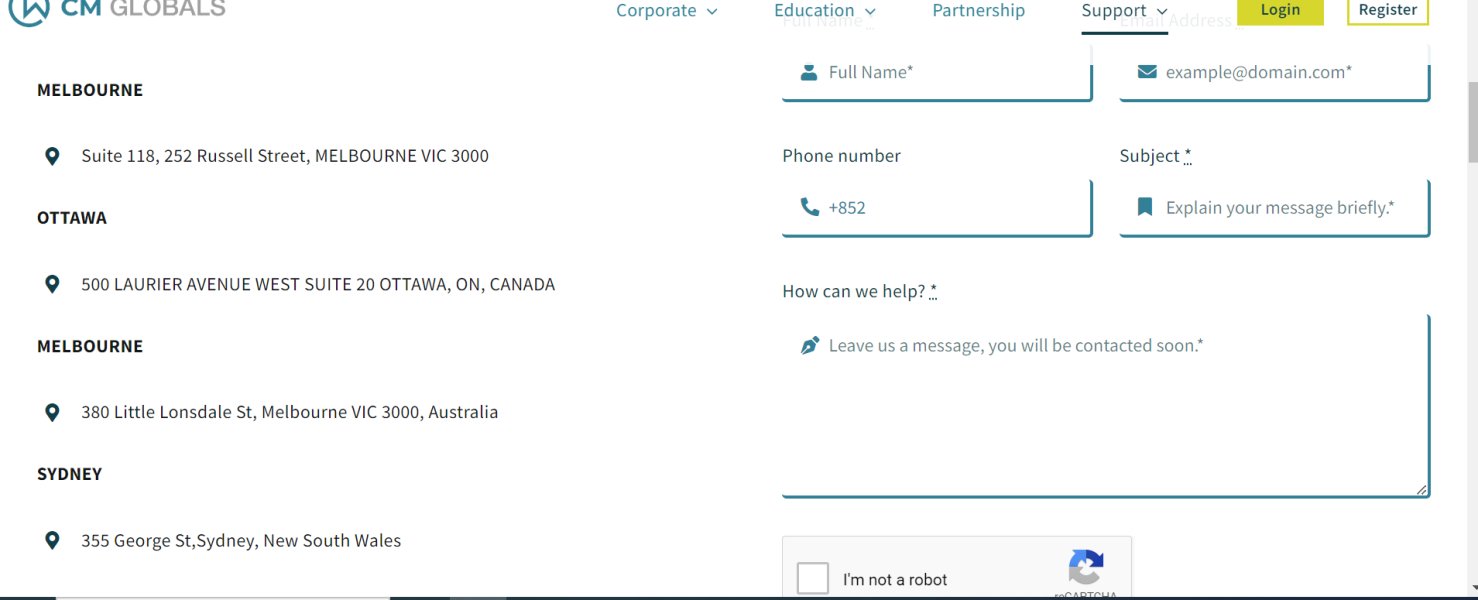

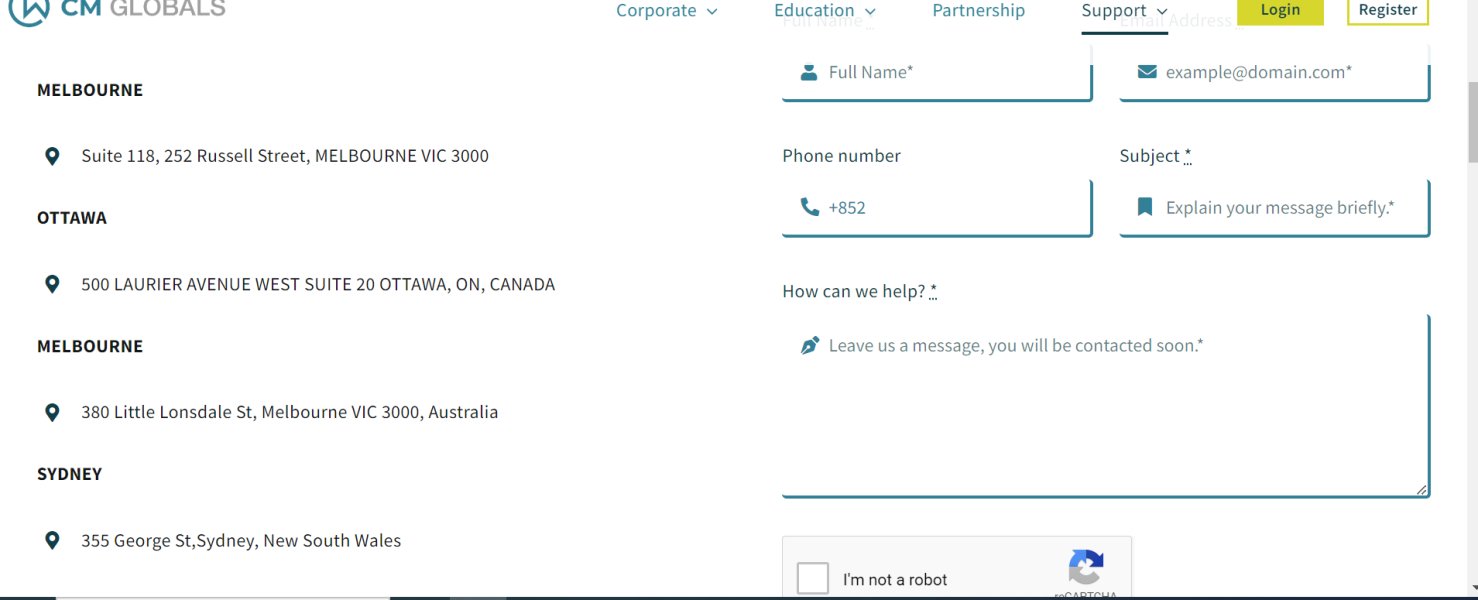

Broker Overview

CM Globals operates as an Australian-headquartered financial services provider. The company specializes in foreign exchange and equity market trading. The company has positioned itself within the competitive forex brokerage landscape by focusing on delivering high leverage trading opportunities combined with superior customer service standards. While specific founding details are not extensively documented in available sources, the broker has established a presence across multiple international markets. This demonstrates its commitment to global expansion.

The company's business model centers around providing access to various financial instruments. These include forex pairs, individual stocks, options contracts, and cryptocurrency trading opportunities. CM Globals has built its reputation on offering traders the flexibility to engage with diverse asset classes while maintaining regulatory compliance standards that meet international requirements.

From a regulatory perspective, CM Globals operates under the supervision of the Australian Securities and Investments Commission (ASIC). The company holds license number 665491663. This regulatory framework provides traders with important protections and ensures that the broker adheres to strict financial conduct standards. The company has also received industry recognition, notably being awarded the title of "Most Transparent Broker" in 2022 and receiving accolades for best customer service. This underscores its commitment to operational transparency and client satisfaction. This cm globals review confirms that the broker's regulatory standing contributes significantly to its overall credibility in the marketplace.

Regulatory Jurisdiction: CM Globals operates under Australian Securities and Investments Commission (ASIC) regulation with license number 665491663. This regulatory framework ensures compliance with Australian financial services standards and provides client protection measures consistent with developed market requirements.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in available sources. This requires direct verification with the broker for current payment processing capabilities and associated timeframes.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in accessible documentation. This indicates that prospective clients should contact CM Globals directly for current account opening requirements.

Bonus and Promotional Offers: Available sources do not provide specific information about current promotional campaigns, welcome bonuses, or ongoing incentive programs. These may be available to new or existing clients.

Tradeable Assets: CM Globals offers access to multiple asset categories including foreign exchange currency pairs, individual equity stocks, options contracts, and cryptocurrency instruments. This diversified offering allows traders to build varied portfolios across different market sectors.

Cost Structure: According to available information, CM Globals implements relatively high spread structures compared to some competitors. However, specific commission rates, overnight financing charges, and other fee details are not comprehensively documented in public sources. This requires direct inquiry for complete cost analysis.

Leverage Ratios: The broker is noted for providing high leverage opportunities. This has been highlighted as a key attraction for traders seeking amplified market exposure. However, specific maximum leverage ratios are not detailed in available documentation.

Platform Options: Available information indicates that CM Globals does not support MetaTrader 4 or MetaTrader 5 platforms. The specific proprietary or alternative trading platforms offered are not detailed in accessible sources.

Geographic Restrictions: While CM Globals operates in 12 countries, specific geographic limitations or restricted territories are not clearly outlined in available documentation.

Customer Service Languages: Information regarding the range of languages supported by customer service teams is not specified in accessible sources. This cm globals review notes this as an area requiring direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions offered by CM Globals present a mixed picture based on available information. While the broker operates under proper ASIC regulation, which provides a solid foundation for account security and regulatory compliance, specific details about account types, minimum deposit requirements, and account-specific features remain unclear in publicly available documentation.

The lack of detailed information about different account tiers, their respective benefits, and specific requirements represents a significant limitation. This affects potential clients trying to evaluate whether CM Globals meets their trading needs. Without clear documentation of account opening procedures, verification requirements, or special account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions, it becomes challenging to provide a comprehensive assessment.

User feedback suggests that the broker does offer competitive trading conditions, particularly regarding leverage availability. However, the absence of transparent information about account structures, minimum balance requirements, and account maintenance fees creates uncertainty. This cm globals review finds that while the regulatory framework provides confidence, the limited transparency regarding account conditions prevents a higher rating in this category.

The broker would benefit from providing more detailed and accessible information about its account offerings. This should include fee structures and specific terms and conditions to help potential clients make informed decisions about account selection and trading requirements.

The evaluation of CM Globals' trading tools and resources reveals significant information gaps that impact the overall assessment. Available sources do not provide detailed information about the specific trading platforms offered, analytical tools available to clients, or the range of research resources that support trading decisions.

The absence of MetaTrader 4 and MetaTrader 5 platform support, as noted in available documentation, may be a limiting factor. This affects traders who prefer these widely-used industry-standard platforms. Without specific information about alternative proprietary platforms or third-party solutions offered by CM Globals, it's difficult to assess the quality and functionality of the trading environment provided to clients.

Educational resources, market analysis tools, economic calendars, and automated trading capabilities are not detailed in accessible sources. These elements are increasingly important for modern forex trading, particularly for newer traders who rely on educational content and analytical tools to develop their trading strategies and market understanding.

The lack of information about mobile trading applications, charting capabilities, technical indicators, and research reports suggests either limited offerings in these areas or insufficient transparency. This impacts the broker's ability to attract traders who prioritize comprehensive analytical tools and educational support in their trading decisions.

Customer Service and Support Analysis (Score: 8/10)

Customer service represents one of CM Globals' strongest attributes based on available user feedback and industry recognition. The broker has received awards for customer service excellence, and user reviews consistently highlight the quality and responsiveness of the support team as a significant positive factor in their trading experience.

According to user feedback documented in various sources, CM Globals demonstrates exceptional customer support capabilities. These set it apart from many competitors in the forex brokerage space. Traders have specifically praised the broker for providing timely responses to inquiries and effective problem resolution, which contributes significantly to overall client satisfaction.

The broker's recognition as a recipient of best customer service awards indicates a systematic commitment to maintaining high support standards. This suggests more than sporadic good service. This suggests that CM Globals has invested in proper training, adequate staffing, and efficient support systems to ensure consistent service quality across its client base.

However, specific details about support channels (phone, email, live chat), availability hours, response time guarantees, and multilingual support capabilities are not detailed in available sources. While the overall quality appears high based on user feedback, the lack of specific operational details about support services prevents a perfect score in this category.

Trading Experience Analysis (Score: 7/10)

The trading experience offered by CM Globals receives generally positive feedback from users. This occurs despite limited detailed information about platform specifications and technical performance metrics. User reviews suggest that traders find the overall trading environment satisfactory, with particular appreciation for the high leverage opportunities available.

Platform stability and execution quality are crucial factors in trading experience. However, specific data about order execution speeds, slippage rates, or platform uptime statistics are not available in accessible sources. This makes it challenging to provide a comprehensive technical assessment of the trading infrastructure's performance under various market conditions.

The reported high spreads represent a potential drawback for the trading experience. This is particularly true for frequent traders or those employing scalping strategies where tight spreads are crucial for profitability. However, user feedback suggests that despite higher spreads, traders find value in other aspects of the trading environment that compensate for this limitation.

Mobile trading capabilities, platform customization options, and advanced order types are not detailed in available information. This limits the ability to assess how well CM Globals serves different trading styles and preferences. This cm globals review notes that while user sentiment appears generally positive, more specific technical information would strengthen confidence in the trading experience quality.

Trust and Regulation Analysis (Score: 9/10)

CM Globals demonstrates strong credentials in terms of regulatory compliance and industry recognition. The broker earns one of the highest scores in this evaluation. The broker operates under Australian Securities and Investments Commission (ASIC) regulation with license number 665491663, providing clients with significant regulatory protections and oversight from a well-respected financial regulatory authority.

The ASIC regulatory framework ensures that CM Globals must adhere to strict capital adequacy requirements, client fund segregation protocols, and operational transparency standards. This regulatory environment provides substantial protection for client funds and ensures that the broker operates according to established international best practices for financial services providers.

Industry recognition further strengthens the trust profile. CM Globals has received awards including "Most Transparent Broker 2022" and recognition for customer service excellence. These accolades suggest peer and industry acknowledgment of the broker's commitment to operational transparency and client service standards.

The broker's operation across 12 countries indicates successful navigation of multiple regulatory environments. This suggests robust compliance capabilities. However, specific information about additional regulatory licenses, client fund insurance arrangements, or detailed risk management procedures is not extensively documented in available sources, preventing a perfect score despite the strong foundation provided by ASIC regulation.

User Experience Analysis (Score: 6/10)

The user experience assessment for CM Globals reveals a mixed picture with some positive elements but limited comprehensive feedback data. Available user reviews suggest generally satisfactory experiences, particularly regarding customer service interactions and leverage availability. However, broader user experience factors remain unclear.

Account opening and verification processes are not detailed in accessible sources. This makes it difficult to assess the convenience and efficiency of getting started with CM Globals. Modern traders increasingly value streamlined onboarding processes, and the lack of specific information about these procedures represents a gap in the user experience evaluation.

Interface design, platform usability, and navigation efficiency are not documented in available sources. These factors significantly impact daily trading activities and overall satisfaction, particularly for traders who spend considerable time analyzing markets and executing trades through the broker's platforms.

User feedback regarding deposit and withdrawal processes, including processing times, fees, and ease of use, is not comprehensively available. These operational aspects directly affect user satisfaction and confidence in the broker's services. Their absence is notable in the overall user experience assessment.

The limited scope of available user feedback and the absence of detailed information about common user complaints or areas for improvement suggest either a relatively small user base or limited transparency. Both factors impact the ability to provide a comprehensive assessment.

Conclusion

CM Globals emerges as a regulated forex broker with notable strengths in customer service and regulatory compliance. However, this cm globals review reveals significant information gaps that limit comprehensive evaluation. The broker's ASIC regulation and industry awards for transparency and customer service provide a solid foundation for trader confidence, while the emphasis on high leverage trading appeals to traders seeking amplified market exposure.

The broker appears most suitable for traders who prioritize regulatory security and exceptional customer support. This is particularly true over detailed platform specifications or extensive educational resources. Traders comfortable with higher spreads in exchange for reliable service and strong regulatory oversight may find CM Globals a viable option for their trading activities.

However, the main limitations include insufficient transparency regarding account conditions, trading platforms, and specific cost structures. Prospective clients should conduct direct inquiries with CM Globals to obtain detailed information about trading conditions, platform capabilities, and account requirements before making trading decisions. The broker would benefit from providing more comprehensive public information about its services to enable better-informed client evaluations.