Is FTT Markets safe?

Business

License

Is FTT Markets Safe or Scam?

Introduction

FTT Markets is a relatively new player in the forex trading arena, positioning itself as a platform for traders seeking access to various financial instruments. As with any trading platform, its crucial for traders to exercise caution and conduct thorough evaluations before committing their capital. The forex market is notorious for its volatility and the presence of unscrupulous brokers, making it imperative for traders to assess the legitimacy and safety of their chosen broker. This article investigates whether FTT Markets is a safe option for traders or if it falls into the category of scams. The findings are based on a comprehensive analysis of online reviews, regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory status of a trading platform is a fundamental aspect of its legitimacy. A broker that operates under strict regulatory oversight is generally considered safer for traders, as regulations are designed to protect investors and ensure fair trading practices. Unfortunately, FTT Markets lacks clear regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders have no legal recourse should issues arise, such as withdrawal problems or disputes over trades. Additionally, FTT Markets has been reported to have a history of operating without valid regulatory licenses, which is a significant red flag. This lack of oversight can lead to questionable practices, making it vital for traders to approach this broker with caution. The quality of regulation is paramount; brokers regulated by top-tier authorities (such as the FCA in the UK or ASIC in Australia) are typically subject to rigorous standards that ensure the safety of client funds and fair trading conditions.

Company Background Investigation

FTT Markets is operated by FT Worldwide Holdings Limited, a company with limited transparency regarding its ownership and management structure. The companys history is relatively short, having been established in recent years, which may not provide enough track record to instill confidence among potential traders.

The management team behind FTT Markets has not been publicly disclosed, which raises questions about their expertise and experience in the financial industry. A lack of transparency in ownership and management can often indicate potential risks for traders, as it becomes challenging to hold the firm accountable in the event of issues. Furthermore, the company does not provide sufficient information regarding its operational practices or financial health, which is critical for assessing its reliability.

In terms of transparency, FTT Markets does not publish regular updates or reports that would typically be expected from a reputable broker. This lack of information can lead to uncertainty and mistrust among potential clients, further emphasizing the need for cautious evaluation when considering whether FTT Markets is safe.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. FTT Markets presents a range of trading options, but its fee structure is concerning. Traders have reported hidden fees and unfavorable trading conditions that deviate from industry norms.

| Fee Type | FTT Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | Varies | Standardized |

Reports indicate that the spreads on major currency pairs are significantly higher than the industry average, which can erode potential profits for traders. Additionally, the lack of clarity in commission structures raises questions about the overall cost of trading with FTT Markets. Traders should be wary of any fees that are not explicitly disclosed, as these can lead to unexpected costs that diminish overall returns.

Moreover, the presence of unusual fees, such as withdrawal fees that are disproportionately high, can further complicate the trading experience. Such practices are often indicative of brokers that may not prioritize the best interests of their clients, leading to the conclusion that FTT Markets may not be a safe choice for traders.

Client Funds Security

The safety of client funds is a primary concern for any trader. FTT Markets has not provided clear information regarding its security measures for client funds. The absence of fund segregation, investor protection mechanisms, and negative balance protection policies are significant red flags.

Traders need to be aware that without proper segregation of funds, their capital may be at risk in the event of the broker facing financial difficulties. Additionally, the lack of investor protection means that traders have no safety net should the broker become insolvent. Historical issues with fund security at FTT Markets have been reported, including difficulty in withdrawing funds and unclear policies regarding fund handling.

In light of these factors, it is evident that FTT Markets does not prioritize the safety of client funds, which raises serious concerns about whether it is safe to trade with them. Traders should always seek brokers that have robust security measures in place to protect their investments.

Customer Experience and Complaints

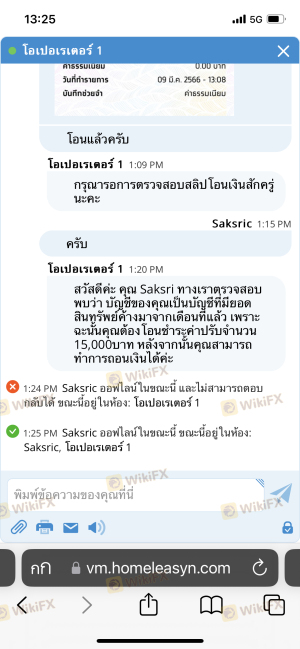

Analyzing customer feedback is crucial in determining the reliability of a broker. FTT Markets has garnered a significant number of negative reviews from users, with common complaints revolving around withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Many users have reported difficulties in withdrawing their funds, often citing excessive fees and delays. The lack of effective customer support has further exacerbated these issues, leaving traders feeling frustrated and helpless. In some cases, traders have reported that their inquiries went unanswered, indicating a lack of commitment to customer service.

Typical case studies reveal that clients who attempted to withdraw their profits faced numerous obstacles, including unexpected fees and prolonged processing times. These experiences suggest that FTT Markets may not be prioritizing customer satisfaction, further supporting the notion that it may not be a safe broker for trading.

Platform and Execution

The trading platform offered by FTT Markets is another critical factor to consider. Users have reported mixed experiences regarding the platform's performance, with issues related to stability, execution quality, and order handling.

Traders have noted instances of slippage and order rejections, which can significantly impact trading outcomes. Such issues raise concerns about the broker's reliability and the potential for platform manipulation. The absence of a well-established trading platform can lead to a frustrating trading experience, making it essential for traders to evaluate whether FTT Markets is safe in this regard.

Risk Assessment

Using FTT Markets presents several risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Stability Risk | High | Lack of transparency regarding finances. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

| Withdrawal Risk | High | Difficulties reported in accessing funds. |

The overall risk associated with trading with FTT Markets is high, primarily due to its unregulated status and numerous complaints regarding fund withdrawals and customer service. Traders should approach this broker with caution and consider the potential for significant losses.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that FTT Markets exhibits several characteristics commonly associated with scam brokers. The lack of regulation, poor customer feedback, and questionable trading conditions raise significant concerns about its safety and legitimacy.

Traders are advised to exercise extreme caution when considering FTT Markets as a trading option. For those seeking reliable alternatives, it is recommended to explore brokers that are well-regulated, have transparent fee structures, and demonstrate a commitment to customer service. By prioritizing safety and due diligence, traders can better protect their investments in the volatile forex market.

Ultimately, the question of "Is FTT Markets safe?" leans heavily towards "no," and potential clients should be wary of engaging with this broker without thorough consideration of the associated risks.

Is FTT Markets a scam, or is it legit?

The latest exposure and evaluation content of FTT Markets brokers.

FTT Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FTT Markets latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.