Is frmarkets safe?

Business

License

Is frmarkets A Scam?

Introduction

Frmarkets is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer a wide range of financial instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to attract traders worldwide, it becomes increasingly important for individuals to assess the legitimacy and reliability of brokers before committing their funds. This article aims to provide an objective and comprehensive evaluation of frmarkets, examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The findings are based on a thorough investigation of available data, user reviews, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its reliability. Frmarkets claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Mauritius Financial Services Commission (FSC). However, the credibility of these claims requires careful scrutiny. Below is a summary of the regulatory information for frmarkets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Not Available | Australia | Unverified |

| FSC | GB21026295 | Mauritius | Verified |

While ASIC is considered a top-tier regulator known for its stringent oversight, the verification status of frmarkets under ASIC raises concerns. Reports suggest that the broker may not be fully compliant with regulatory requirements, which could jeopardize client funds. Conversely, the FSC, while providing some level of oversight, is often viewed as less stringent than ASIC. The lack of a valid regulatory license from a recognized authority like ASIC significantly impacts the trustworthiness of frmarkets, making it essential for potential clients to exercise caution.

Company Background Investigation

Frmarkets operates under the ownership of Trive Financial Services, based in Mauritius. Founded in 2020, the broker's relatively short history raises questions about its stability and long-term viability in the market. The management teams background is also critical; however, detailed information about the individuals behind frmarkets is scarce, leading to concerns about transparency.

The company's operational history has not been devoid of controversy. Reports indicate that frmarkets has faced multiple complaints regarding withdrawal issues and lack of communication with clients. This lack of transparency in ownership and management can be a red flag for potential investors, as it may indicate an attempt to obscure the broker's true intentions. In an industry where trust is paramount, the absence of clear information about the company's leadership and operational practices could deter potential clients from engaging with frmarkets.

Trading Conditions Analysis

When evaluating a broker, understanding their trading conditions is crucial. Frmarkets offers various account types, including standard and raw accounts, with a minimum deposit requirement of just $1, which is attractive for new traders. However, the overall cost structure and fee transparency are areas of concern. Below is a comparison of key trading costs:

| Fee Type | frmarkets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.2 - 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by frmarkets are competitive, the absence of clear information regarding commissions and other fees may lead to unexpected trading costs. Additionally, traders have reported experiencing significant slippage and widening spreads during volatile market conditions, which could impact trading performance. This lack of clarity and potential for hidden fees necessitates careful consideration by traders looking to engage with frmarkets.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. Frmarkets claims to implement various safety measures, including segregating client funds from operational funds. However, the effectiveness of these measures is questionable given the broker's regulatory status. The absence of an investor protection scheme, such as those offered by top-tier regulators, raises concerns about the safety of deposits.

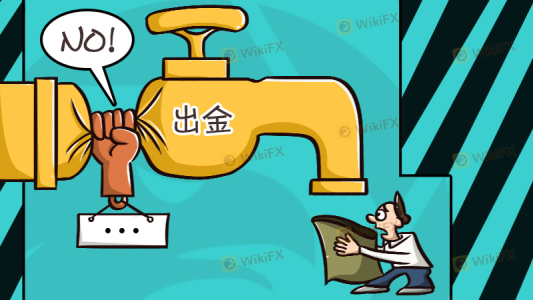

Reports of withdrawal difficulties have emerged, with clients expressing frustration over delayed or denied requests. These issues highlight potential risks associated with trading with frmarkets, as the lack of a robust regulatory framework may leave clients vulnerable in the event of financial disputes or broker insolvency. It is essential for traders to thoroughly evaluate the fund safety measures in place before engaging with frmarkets.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Reviews of frmarkets reveal a mixed bag of experiences, with some users reporting satisfactory trading conditions, while others have expressed severe dissatisfaction. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Slippage Issues | High | Average |

One notable case involved a trader who faced significant delays in withdrawing funds, leading to frustration and eventual abandonment of the trading platform. Despite multiple attempts to contact customer support, the trader reported a lack of timely responses and resolution. This pattern of complaints suggests that while some traders may have positive experiences, the overall customer service and support provided by frmarkets may not meet expectations.

Platform and Trade Execution

The trading platform offered by frmarkets is primarily the widely-used MetaTrader 4 and MetaTrader 5. While these platforms are known for their reliability and user-friendly interfaces, the performance of frmarkets' execution quality has come under scrutiny. Users have reported issues with slippage and order rejections, particularly during high volatility periods.

Moreover, any signs of platform manipulation or discrepancies in execution can significantly impact a trader's profitability. The lack of transparency regarding execution practices and any potential conflicts of interest raises concerns about the integrity of the trading environment provided by frmarkets.

Risk Assessment

Engaging with frmarkets entails several risks that potential clients should be aware of. Below is a summary of the key risk categories associated with trading with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of valid regulation raises concerns. |

| Fund Safety | High | Reports of withdrawal issues and lack of protection. |

| Customer Support Reliability | Medium | Mixed reviews regarding response times and effectiveness. |

| Trading Conditions | Medium | Potential for hidden fees and slippage. |

To mitigate these risks, it is advisable for traders to conduct thorough research, consider starting with a demo account, and only invest what they can afford to lose.

Conclusion and Recommendations

In conclusion, the investigation into frmarkets raises significant concerns regarding its legitimacy and reliability. The lack of robust regulatory oversight, coupled with reports of withdrawal difficulties and mixed customer experiences, suggests that potential traders should approach this broker with caution.

While frmarkets may appeal to some due to its low minimum deposit and competitive spreads, the risks associated with trading with an unregulated broker are substantial. For traders seeking a safer environment, it is advisable to consider alternative brokers that are regulated by reputable authorities, such as ASIC or FCA, which provide better protection for client funds and a more transparent trading experience.

Is frmarkets a scam, or is it legit?

The latest exposure and evaluation content of frmarkets brokers.

frmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

frmarkets latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.