Is Texas safe?

Pros

Cons

Is Texas Safe or Scam?

Introduction

In the dynamic world of forex trading, selecting a reliable broker is crucial for both new and experienced traders. One such broker is Texas, which has garnered attention in recent years for its offerings in the foreign exchange market. With a plethora of options available, traders must exercise caution and conduct thorough evaluations to avoid potential pitfalls. The legitimacy and safety of a broker can directly impact traders' investments and financial security. This article aims to provide a comprehensive analysis of whether Texas is a safe trading platform or a potential scam. To achieve this, we will examine the broker's regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulatory and Legitimacy

The regulatory framework surrounding forex brokers is essential in determining their credibility. Legitimate brokers are typically registered with recognized regulatory bodies that enforce strict compliance standards. In the case of Texas, we must assess its regulatory status to understand its legitimacy in the forex market.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Texas State Securities Board | Not Applicable | Texas, USA | Unverified |

As seen in the table above, Texas does not appear to be registered with any major regulatory authority. This absence of regulation raises significant red flags for potential traders. Operating without oversight can lead to a lack of accountability, making it difficult for clients to seek recourse in case of disputes or financial losses. Furthermore, unregulated brokers are often associated with higher risks of fraud and malpractice.

The quality of regulation is paramount. A well-regulated broker is subject to regular audits, ensuring that they adhere to ethical practices and maintain transparent operations. In contrast, the lack of regulation for Texas suggests that traders may face increased risks. Historical compliance issues within the industry further underscore the importance of selecting a broker that is not only licensed but also has a proven track record of adhering to regulatory standards.

Company Background Investigation

To assess the safety of Texas as a forex broker, it is essential to delve into its company background. Understanding the history, ownership structure, and transparency levels can provide valuable insights into the broker's reliability. Texas was established in [Year], and since then, it has aimed to position itself as a competitive player in the forex market. However, the lack of detailed information regarding its ownership and management team raises concerns.

The management teams background and professional experience are critical factors in evaluating a broker's trustworthiness. A seasoned team with a strong reputation in the financial sector can inspire confidence among traders. Unfortunately, Texas has not provided sufficient information regarding its management, leaving potential clients in the dark about who is behind the operations.

Transparency is another crucial aspect of a broker's credibility. A reputable broker typically discloses comprehensive information about its services, fees, and trading conditions. However, Texas's limited information availability may indicate a lack of transparency, which can be a warning sign for traders seeking a safe environment to invest their funds.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience and profitability. Texas, like many brokers, has its own fee structure and trading costs that potential clients should understand before committing their capital. A thorough examination of its fees is necessary to determine whether they align with industry standards.

| Fee Type | Texas | Industry Average |

|---|---|---|

| Major Currency Pair Spread | [Spread] | [Average Spread] |

| Commission Model | [Commission Type] | [Average Commission] |

| Overnight Interest Range | [Interest Rate] | [Average Rate] |

The table above outlines the core trading costs associated with Texas. It is essential for traders to compare these costs with industry averages to assess their competitiveness. Unusual or excessively high fees can indicate potential red flags, suggesting that the broker may not prioritize traders' interests.

Additionally, traders should be aware of any hidden fees or charges that may arise during the trading process. A broker that lacks transparency in its fee structure may be attempting to exploit traders, making it crucial for potential clients to conduct thorough research before proceeding.

Customer Funds Security

The security of customer funds is paramount when evaluating a forex broker. Traders need assurance that their investments are safe from potential fraud or mismanagement. Texas's approach to fund security and investor protection measures should be scrutinized to determine its reliability.

Texas claims to implement various safety measures for customer funds, including fund segregation, investor protection policies, and negative balance protection. However, the effectiveness of these measures remains questionable without proper regulatory oversight. Traders should be cautious and consider the potential risks associated with entrusting their funds to a broker that lacks robust regulatory backing.

Furthermore, any historical issues related to fund security or disputes should be examined. A broker with a track record of mishandling client funds or failing to address security concerns should raise significant alarms for potential traders.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Analyzing real user experiences can provide insights into the overall quality of service provided by Texas. Common complaint patterns and the company's responsiveness to issues should be carefully scrutinized.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

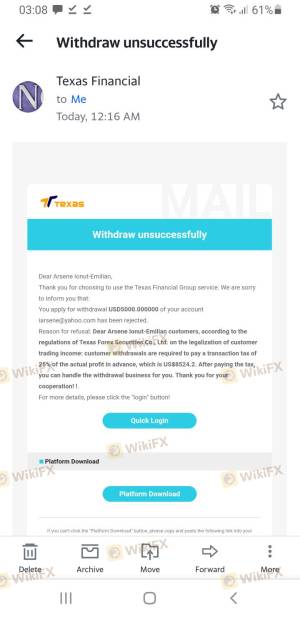

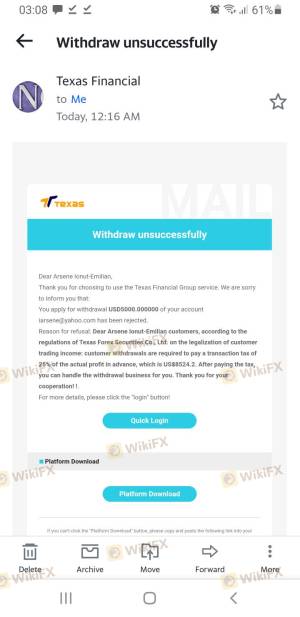

| Withdrawal Delays | High | [Response Quality] |

| Account Freezes | Medium | [Response Quality] |

| Poor Customer Support | High | [Response Quality] |

The table above categorizes the primary complaints associated with Texas, highlighting the severity of each issue and the company's response quality. High-severity complaints, particularly those related to withdrawal delays or account freezes, should be taken seriously, as they can significantly impact traders' experiences.

One or two case studies illustrating typical complaints can further elucidate the challenges faced by clients. For instance, a trader may have reported difficulties in withdrawing funds, leading to frustration and concerns about the broker's reliability. Such instances can undermine trust and raise questions about the safety of trading with Texas.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors that can influence traders' success. A thorough evaluation of Texas's platform stability, order execution quality, and user experience is necessary to determine its suitability for forex trading.

Traders should assess whether the platform provides a seamless experience, including quick order execution, minimal slippage, and an intuitive interface. Any indications of platform manipulation or issues with order execution should be carefully considered, as they can have a direct impact on trading outcomes.

Risk Assessment

Using Texas as a forex broker involves inherent risks that potential traders must evaluate. Understanding the comprehensive risk landscape can help traders make informed decisions about their investments.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Fund Security Risk | Medium | Lack of transparency in fund protection |

| Customer Service Risk | High | High severity complaints indicate issues |

The risk assessment table summarizes key risk areas associated with Texas. Traders should be aware of these risks and consider implementing mitigation strategies, such as diversifying their investments and utilizing risk management tools.

Conclusion and Recommendations

In conclusion, the investigation into Texas reveals several concerning factors that may indicate potential risks for traders. The absence of robust regulatory oversight, coupled with a lack of transparency and high-severity customer complaints, suggests that traders should exercise caution when considering Texas as their forex broker.

While some traders may find value in the services offered, it is essential to remain vigilant and informed. For those seeking safer alternatives, it may be advisable to explore brokers with established regulatory frameworks and positive customer reviews. By prioritizing safety and due diligence, traders can navigate the forex market with greater confidence and security.

Ultimately, the question of whether Texas is safe or a scam hinges on individual risk tolerance and the importance placed on regulatory compliance.

Is Texas a scam, or is it legit?

The latest exposure and evaluation content of Texas brokers.

Texas Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Texas latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.