Is Finle safe?

Pros

Cons

Is Finle Safe or a Scam?

Introduction

Finle is a forex broker that has recently garnered attention in the trading community. Operating primarily in the foreign exchange market, it positions itself as a platform for trading various currency pairs, commodities, and indices. However, as with any financial service, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with a broker. The forex market is known for its volatility and risks, making it essential for traders to evaluate the legitimacy and reliability of the brokers they choose to work with.

This article aims to provide an objective and comprehensive analysis of Finle, exploring its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks. The evaluation is based on a review of various credible sources, including regulatory databases, user reviews, and expert assessments.

Regulation and Legitimacy

The regulatory environment is a critical aspect of any forex broker, as it ensures adherence to industry standards and offers some level of protection to traders. Finle operates as an unregulated broker, which raises significant concerns regarding its legitimacy and investor safety. The absence of regulatory oversight means that traders may not have access to the protections typically afforded by regulated brokers, such as compensation schemes and transparent operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a valid license from a recognized financial authority such as the FCA (UK), ASIC (Australia), or SEC (USA) indicates that Finle does not comply with the stringent requirements that ensure fair trading practices. This unregulated status can lead to concerns about transparency, customer protection, and potential fraudulent activities. Historical compliance records are absent, further emphasizing the risks associated with trading through such a broker.

Company Background Investigation

Finle's company history and ownership structure are essential factors in assessing its credibility. The broker is registered in China and has been operational for several years, but specific details about its founding, ownership, and management team are scarce. This lack of transparency can be a red flag for potential investors, as it raises questions about the broker's accountability and operational integrity.

The management team's expertise and professional backgrounds are also vital in evaluating Finle's reliability. However, the information available on the key personnel is limited, making it difficult to ascertain their qualifications and experience in the financial services industry. A transparent company usually provides detailed information about its team, including their qualifications and previous roles in the financial sector. The absence of this information could indicate a lack of commitment to transparency and professionalism.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and costs, is crucial. Finle offers competitive spreads on major currency pairs, with average spreads ranging from 0.5 pips for EUR/USD to 2 pips for exotic pairs. However, the broker's fee structure is not clearly defined, which can lead to confusion for traders.

| Fee Type | Finle | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 - 2 pips | 1 - 3 pips |

| Commission Model | Commission-free | Varies |

| Overnight Interest Range | Not specified | Varies |

While the competitive spreads may seem attractive, the lack of clarity regarding other fees, such as overnight interest rates and withdrawal fees, raises concerns. Traders should be wary of brokers that do not provide comprehensive information about their fee structures, as hidden costs can significantly impact overall profitability.

Customer Fund Safety

The safety of client funds is paramount when selecting a broker. Finle's unregulated status poses significant risks regarding the security of traders' capital. The broker reportedly does not implement robust measures for fund segregation, investor protection, or negative balance protection. This lack of security measures can expose traders to considerable financial risks, especially in volatile market conditions.

Historical issues related to fund safety have been reported, including allegations of fraudulent activities associated with the broker. These incidents highlight the potential dangers of engaging with an unregulated entity, underscoring the importance of choosing a broker with a solid reputation for safeguarding client funds.

Customer Experience and Complaints

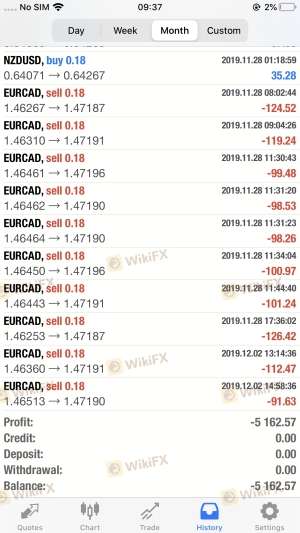

Analyzing customer feedback is essential for understanding the overall experience with a broker. Reviews of Finle indicate a mix of positive and negative experiences, with many users expressing concerns about the broker's customer service and responsiveness. Common complaints include difficulties in withdrawing funds, lack of educational resources, and inadequate support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Lack of Educational Resources | High | No resources provided |

Several users have reported challenges in accessing their funds, which raises significant concerns about the broker's operational integrity. The slow response times and limited support options further exacerbate these issues, making it difficult for traders to resolve their concerns in a timely manner.

Platform and Execution

The trading platform offered by Finle, primarily based on MetaTrader 5 (MT5), provides a user-friendly interface and advanced trading features. However, the performance and stability of the platform have been questioned, with users reporting instances of slippage and order rejections.

Traders should be cautious of any signs of platform manipulation, as this could indicate unethical practices by the broker. A reliable broker typically ensures high execution quality, minimal slippage, and transparent operations.

Risk Assessment

Engaging with Finle presents several risks that potential traders should consider. The lack of regulation, combined with reported issues regarding fund safety and customer service, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Safety Risk | High | Lack of security measures for client funds. |

| Customer Support Risk | Medium | Reports of inadequate support and responsiveness. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with robust regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, is Finle safe or a scam? The evidence suggests that Finle operates with significant risks that potential traders should carefully consider. The broker's unregulated status, lack of transparency, and historical issues with fund safety raise red flags about its legitimacy.

For traders looking to engage in forex trading, it is advisable to seek out regulated brokers that offer comprehensive protections and transparent operations. Alternatives with strong reputations, such as brokers regulated by top-tier authorities, should be prioritized to ensure a safer trading environment.

In summary, while Finle may present itself as a viable trading option, the associated risks and concerns warrant caution. Traders should approach with skepticism and consider more reputable alternatives to safeguard their investments.

Is Finle a scam, or is it legit?

The latest exposure and evaluation content of Finle brokers.

Finle Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finle latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.