Is Etore safe?

Pros

Cons

Is eToro A Scam?

Introduction

eToro is a prominent online trading platform known for its innovative social trading features, allowing users to mimic the trades of experienced investors. Founded in 2007, eToro has gained significant traction in the forex and cryptocurrency markets, boasting over 30 million registered users across more than 140 countries. However, as with any financial service, it's crucial for traders to carefully evaluate the credibility and safety of eToro before committing their funds. The rise of online trading has also brought with it a plethora of scams, making it imperative for traders to conduct thorough research. This article aims to provide an objective assessment of eToro's legitimacy by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of any trading platform's credibility. eToro operates under multiple regulatory jurisdictions, which is a positive indicator of its legitimacy. The following table summarizes the key regulatory information for eToro:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 109/10 | Cyprus | Verified |

| Financial Conduct Authority (FCA) | 583263 | United Kingdom | Verified |

| Australian Securities and Investments Commission (ASIC) | 491139 | Australia | Verified |

| Financial Crimes Enforcement Network (FinCEN) | N/A | United States | Verified |

eToro is regulated by reputable authorities such as the FCA and ASIC, which impose strict compliance requirements and investor protection measures. This regulatory framework is essential for safeguarding client funds and ensuring fair trading practices. eToro has maintained a solid compliance history, with no significant breaches reported, further enhancing its credibility.

Company Background Investigation

Established in Israel, eToro has evolved from a forex trading platform to a multi-asset brokerage offering a wide range of financial instruments, including stocks, cryptocurrencies, and ETFs. The company's founders, Yoni Assia and Ronen Assia, along with David Ring, have extensive backgrounds in finance and technology, contributing to eToro's innovative approach to trading. eToro's ownership structure is transparent, and it operates under multiple entities across various jurisdictions, ensuring compliance with local regulations.

The management team's experience is noteworthy, as they have successfully navigated the complexities of the financial markets while continuously adapting to regulatory changes. eToro's commitment to transparency is evident in its clear communication of trading conditions and fees, as well as its regular updates on platform developments.

Trading Conditions Analysis

eToro's trading conditions are a critical aspect of its appeal. The platform operates on a commission-free model for stocks and ETFs, but it does charge a spread on trades. Below is a comparison of core trading costs:

| Fee Type | eToro | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.0 pips | 0.5-1.0 pips |

| Commission Model | None for stocks/ETFs | Varies (0-0.5%) |

| Overnight Interest Range | Varies by asset | Varies (0.1-0.3%) |

While eToro's spreads are competitive, the platform has faced criticism for its withdrawal fees and inactivity charges. The $5 withdrawal fee and $10 inactivity fee after 12 months of no activity can be seen as drawbacks, especially for traders who prefer to keep their accounts active with small balances. These fees may deter some users, particularly those who engage in infrequent trading.

Client Fund Security

The security of client funds is paramount when evaluating any trading platform. eToro employs several measures to ensure the safety of its users' investments. Client funds are kept in segregated accounts with top-tier banks, which protects them in the event of insolvency. Additionally, eToro offers negative balance protection, ensuring that users cannot lose more than their deposited amount.

The platform is also a member of the Securities Investor Protection Corporation (SIPC) in the United States, which provides additional protection for securities and cash holdings. However, it is important to note that cryptocurrencies held on eToro are not covered by the same protections, as they fall outside traditional regulatory frameworks.

Customer Experience and Complaints

User feedback is a valuable source of insight when assessing a trading platform's reliability. eToro has garnered a mix of positive and negative reviews. Common complaints include slow customer service response times and issues with account verification. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Slow Customer Service | Moderate | Mixed |

| Withdrawal Delays | High | Slow |

| Account Verification Issues | Moderate | Slow |

Many users have reported frustration with the time taken to resolve issues, particularly during peak trading periods. However, eToro has made strides in improving its customer support infrastructure, although some users still find the ticket-based system lacking in efficiency.

Platform and Trade Execution

eToro's trading platform is designed to be user-friendly, catering to both novice and experienced traders. The platform's performance has been generally stable, but some users have reported instances of slippage and order execution delays, particularly during high volatility periods. Such occurrences raise concerns about the platform's reliability during critical trading moments.

Risk Assessment

Using eToro comes with inherent risks, as with any trading platform. Below is a summary of key risk areas associated with trading on eToro:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Subject to regulatory changes affecting operations. |

| Market Risk | High | Exposure to volatile markets, particularly in cryptocurrencies. |

| Customer Service Risk | Medium | Potential delays in support response times. |

To mitigate these risks, traders should employ sound risk management strategies, including setting stop-loss orders and diversifying their investments.

Conclusion and Recommendations

In conclusion, eToro is not a scam; it is a legitimate trading platform with a solid regulatory framework and a significant user base. However, potential users should remain vigilant and aware of the associated risks, particularly regarding customer service and trading costs. While eToro offers unique features such as social trading and copy trading, it may not be suitable as the sole platform for serious investors.

For those new to trading or interested in social investing, eToro can be a valuable tool. However, experienced traders may want to explore additional platforms that offer more comprehensive trading features and lower fees. Alternatives such as Interactive Brokers or TD Ameritrade may provide a more robust trading experience for serious investors.

In summary, while eToro is generally considered safe, users should conduct their due diligence and consider their trading goals and risk tolerance before committing their funds.

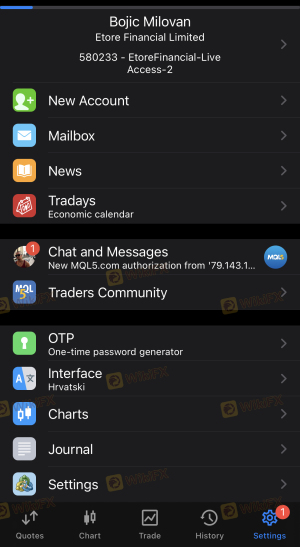

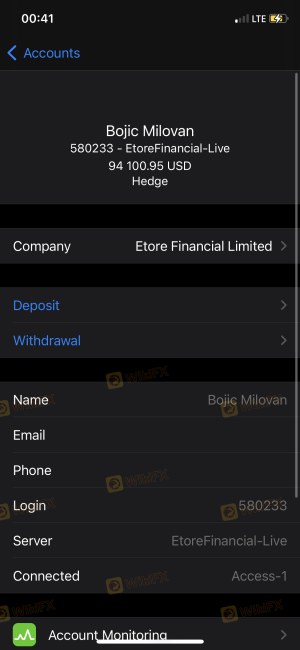

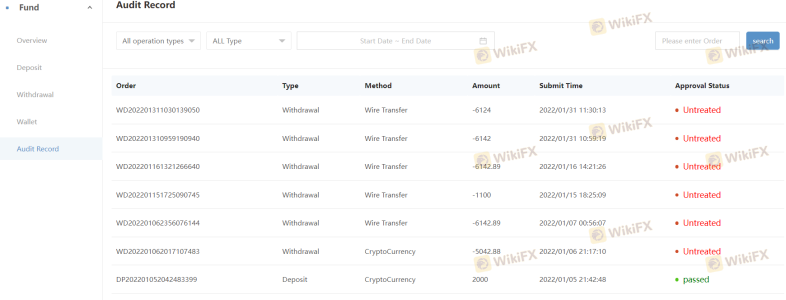

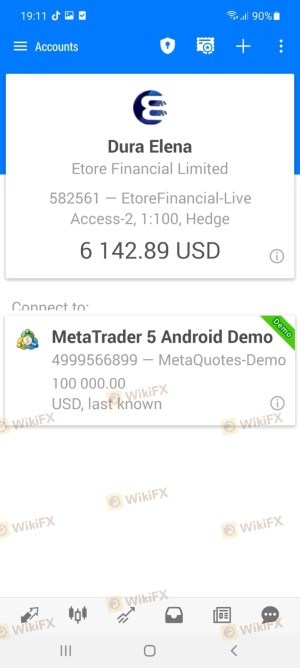

Is Etore a scam, or is it legit?

The latest exposure and evaluation content of Etore brokers.

Etore Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Etore latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.