Etore Review 2025: Everything You Need to Know

Executive Summary

This comprehensive Etore review evaluates a broker that has emerged as an innovative player in the social trading space. According to available data from Forbes Advisor UK and Trustpilot, eToro maintains a solid 4.2-star rating based on 27,385 user reviews, demonstrating substantial market presence and user engagement.

Etore distinguishes itself through two key features. First, its innovative social trading platform enables users to follow and copy successful traders' strategies, making it particularly appealing to newcomers seeking guidance from experienced market participants. Second, the broker maintains relatively high user satisfaction scores with consistent positive feedback. This feedback highlights its user-friendly interface and social trading capabilities.

The platform primarily targets beginners interested in social trading and experienced traders looking to share strategies. It also appeals to those seeking to diversify their approach through community-driven insights. This dual appeal makes Etore particularly suitable for traders who value collaborative learning and strategy sharing over traditional isolated trading approaches.

Important Notice

Due to limited specific regulatory information available in current sources, users across different jurisdictions may encounter varying trading conditions and legal protections. Potential clients should verify local regulatory compliance and available protections in their specific region before opening accounts.

This review is based on available user feedback, market analysis, and publicly accessible information. The findings presented here are for informational purposes only and do not constitute specific investment advice. Traders should conduct their own research and consider their risk tolerance before engaging with any forex broker.

Rating Framework

Broker Overview

Etore operates as a social trading-focused broker. Specific founding details and corporate background information are not extensively detailed in currently available sources. The platform appears to leverage eToro's established infrastructure, benefiting from years of development in the social trading sector.

According to Forbes Advisor UK coverage, the broker emphasizes innovative social trading functionality as its primary business model. This allows users to learn from and replicate successful trading strategies within a community-driven environment.

The platform's core strength lies in its social trading ecosystem. Users can observe, follow, and copy trades from successful traders. This approach democratizes access to profitable trading strategies and creates a collaborative environment that benefits both newcomers and experienced traders.

The growing asset lineup mentioned in broker descriptions suggests continuous expansion of trading opportunities. However, specific asset categories require further clarification from official sources.

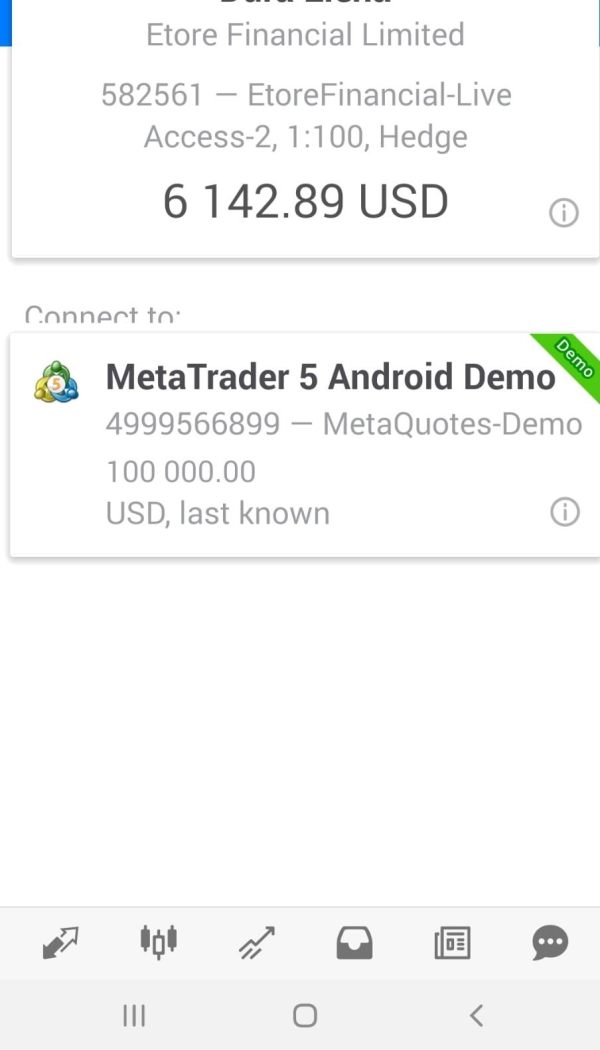

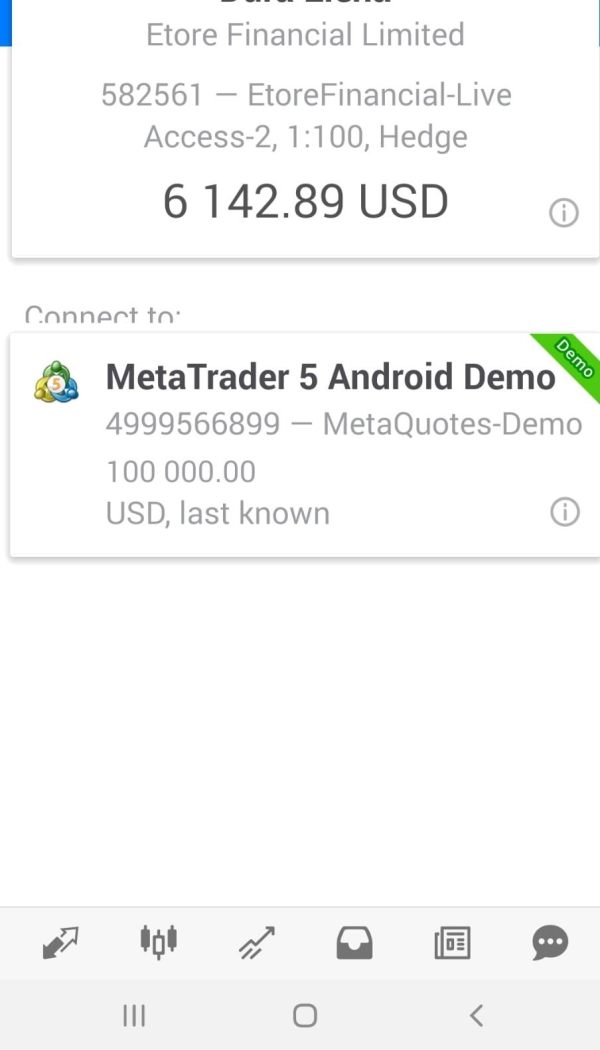

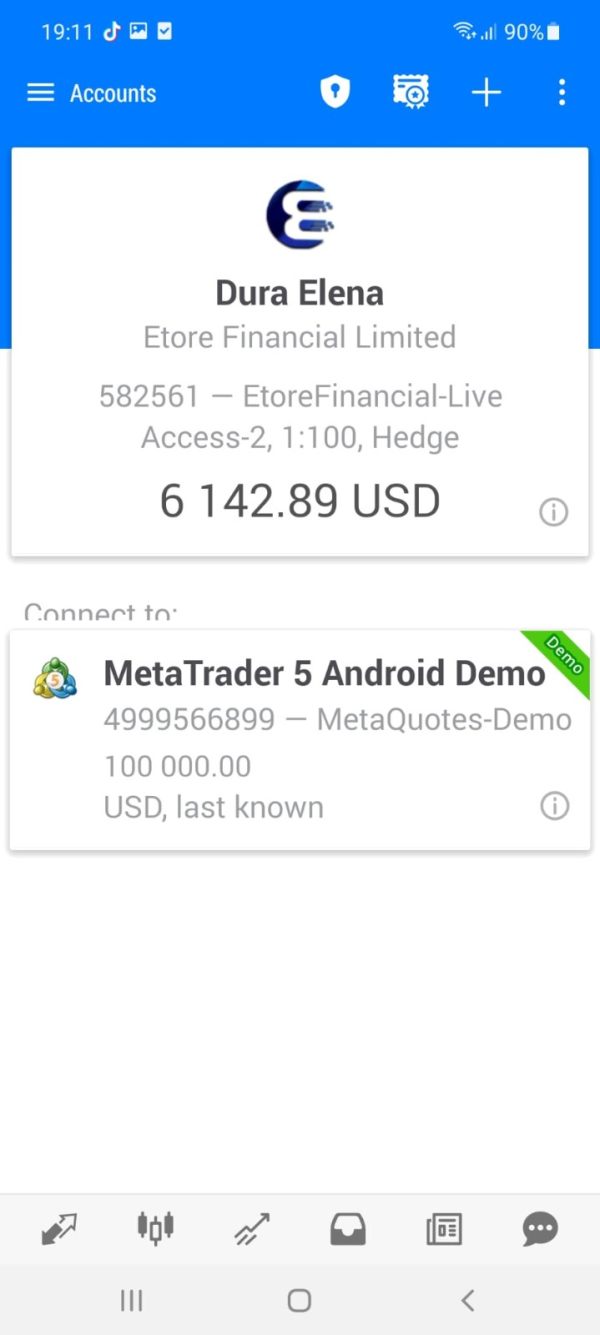

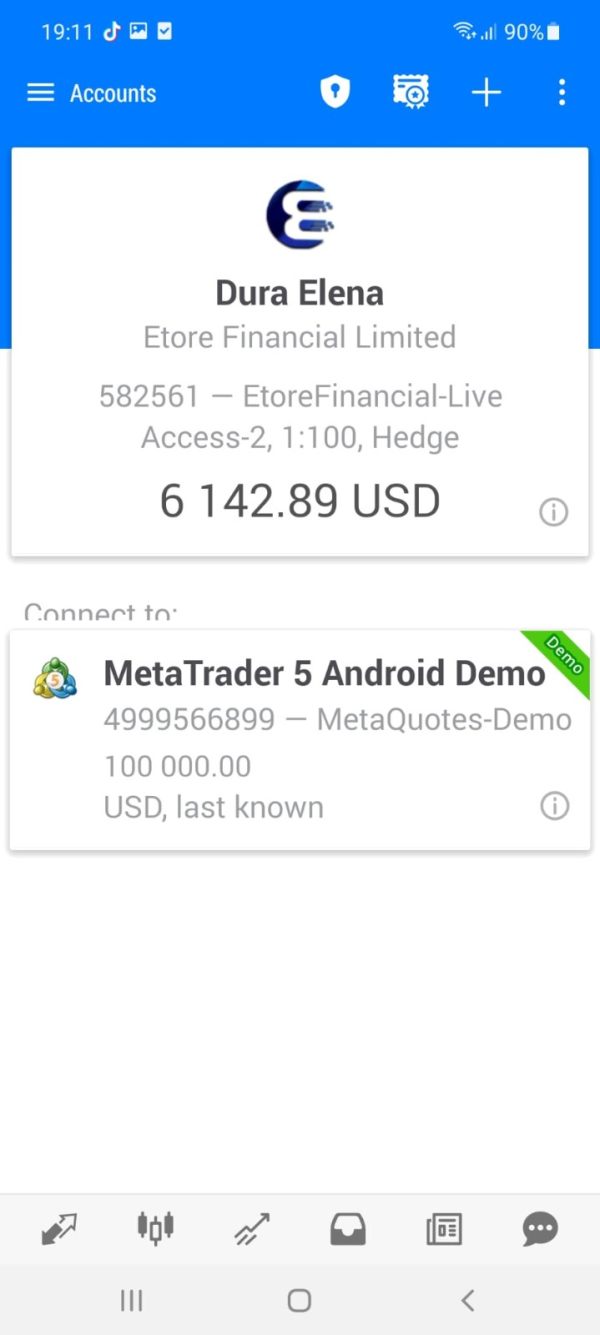

Regarding regulatory oversight and platform specifications, detailed information about primary regulatory jurisdictions is not comprehensively covered in available materials. The trading platform utilizes eToro's established technology infrastructure, providing users with access to social trading tools and community features. These features distinguish it from traditional forex brokers. This Etore review finds that while specific regulatory details need clarification, the platform's association with eToro's proven technology provides a foundation for reliable trading operations.

Regulatory Jurisdictions: Specific regulatory oversight details are not comprehensively outlined in available sources. Potential users must verify regulatory status in their jurisdiction.

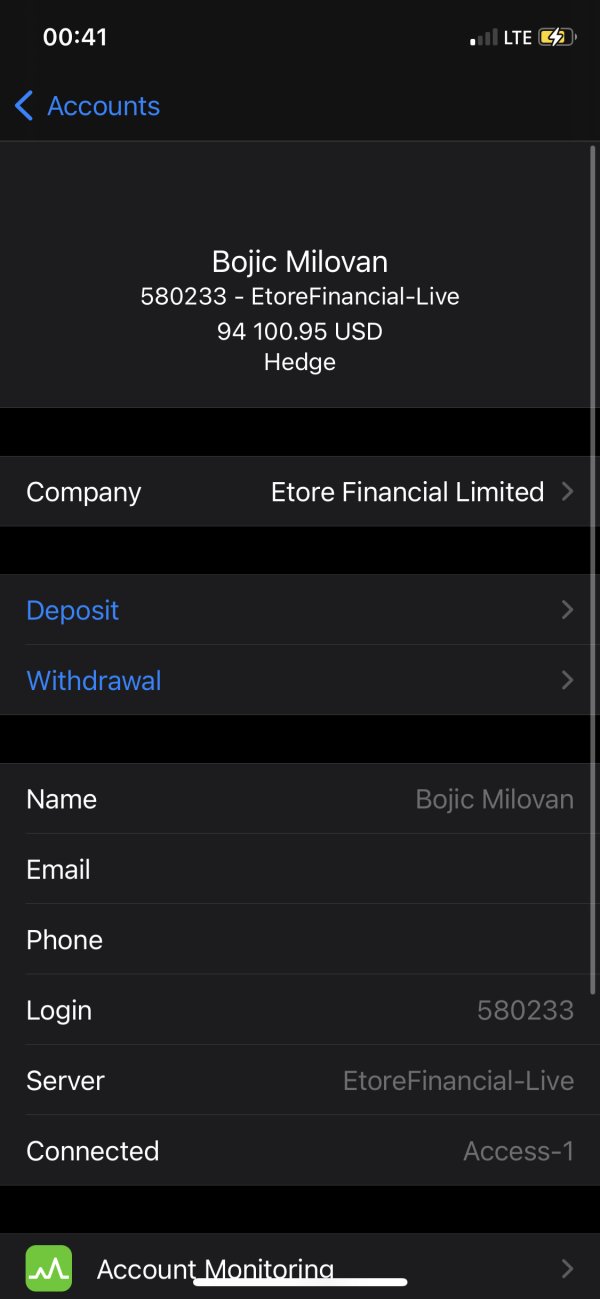

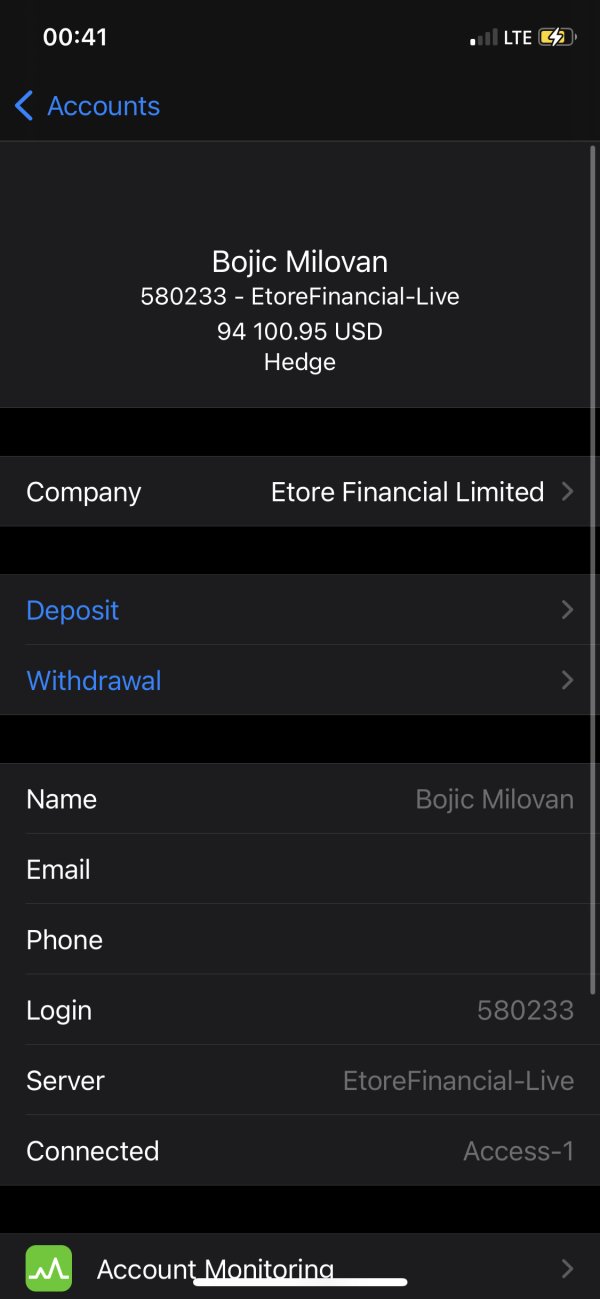

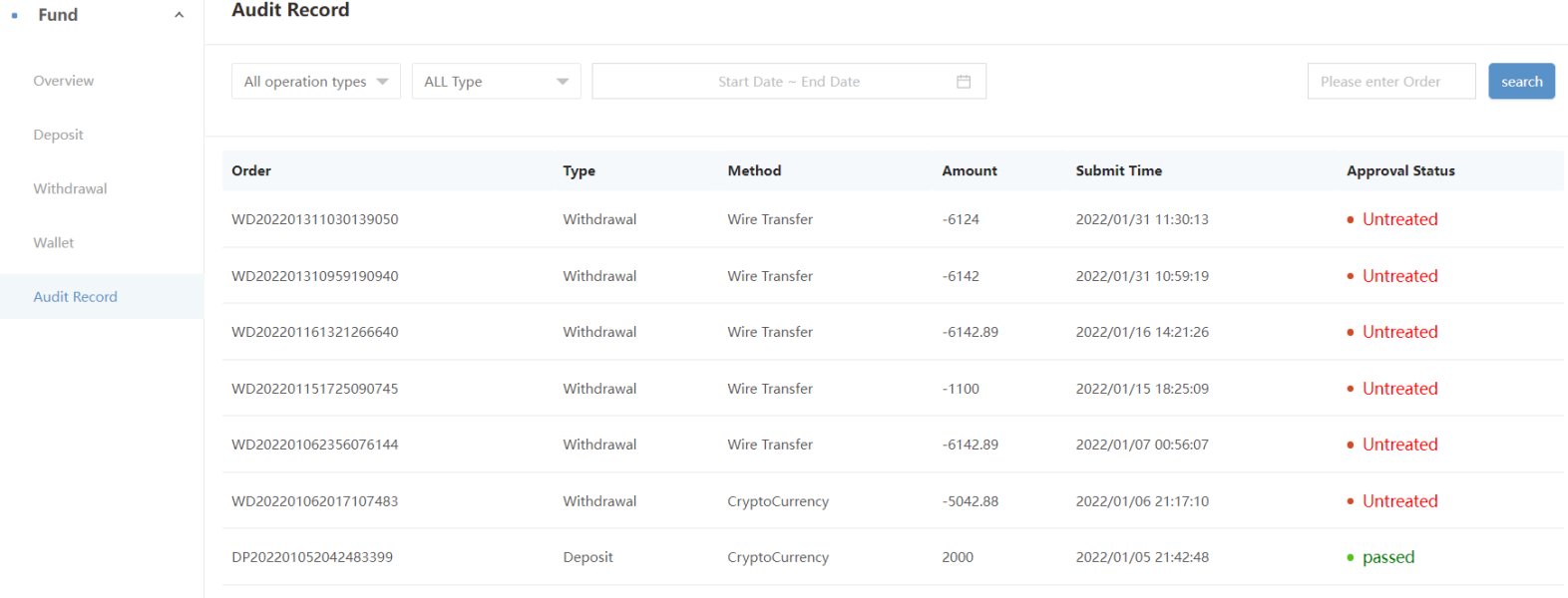

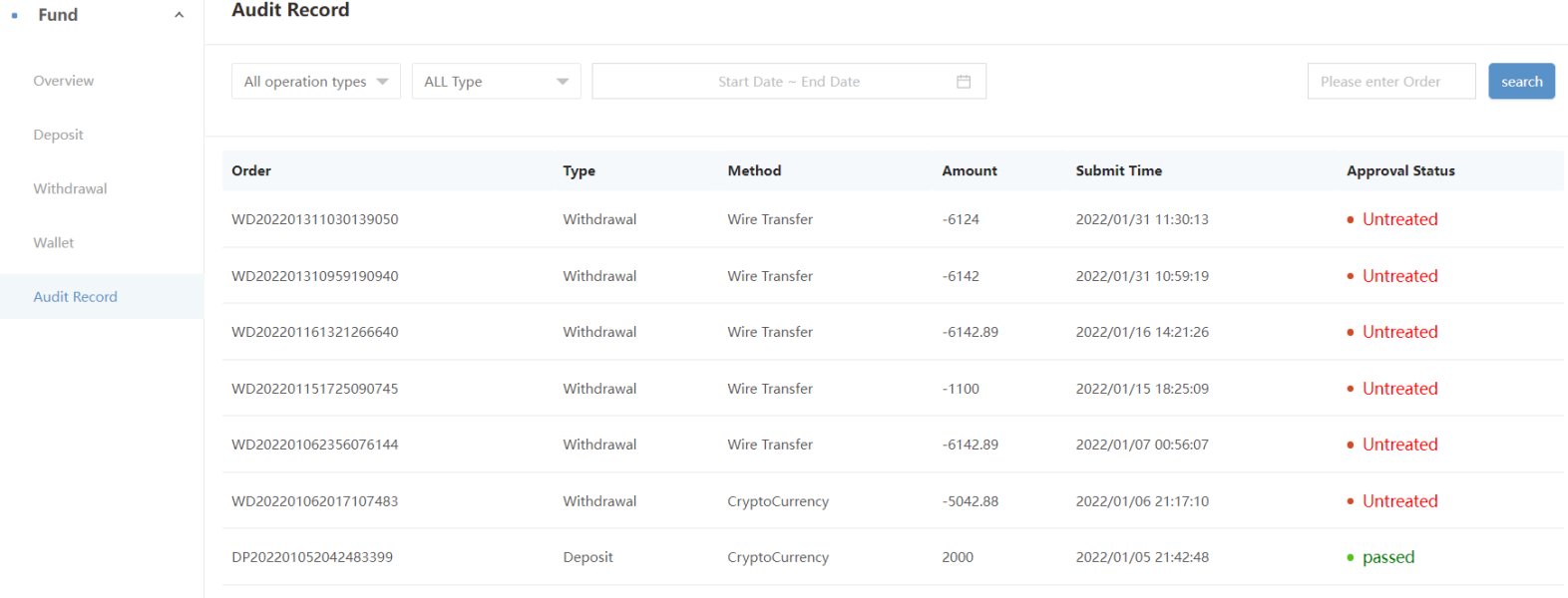

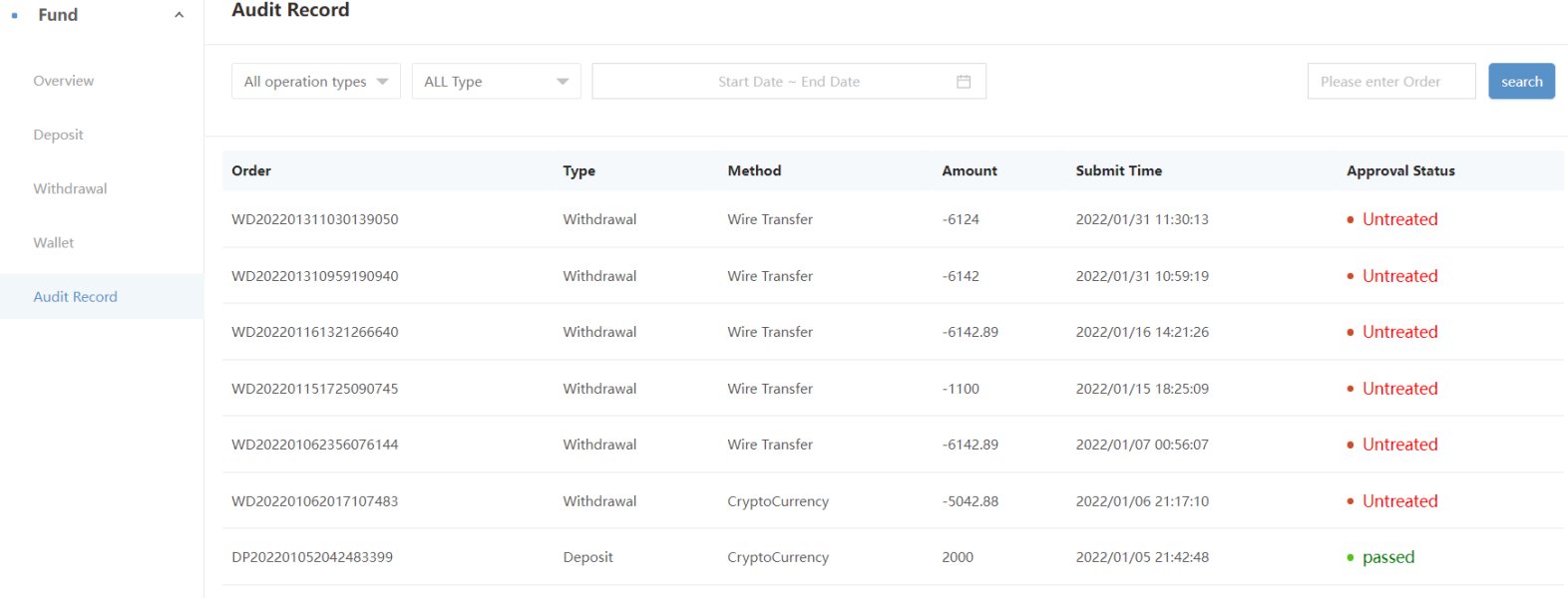

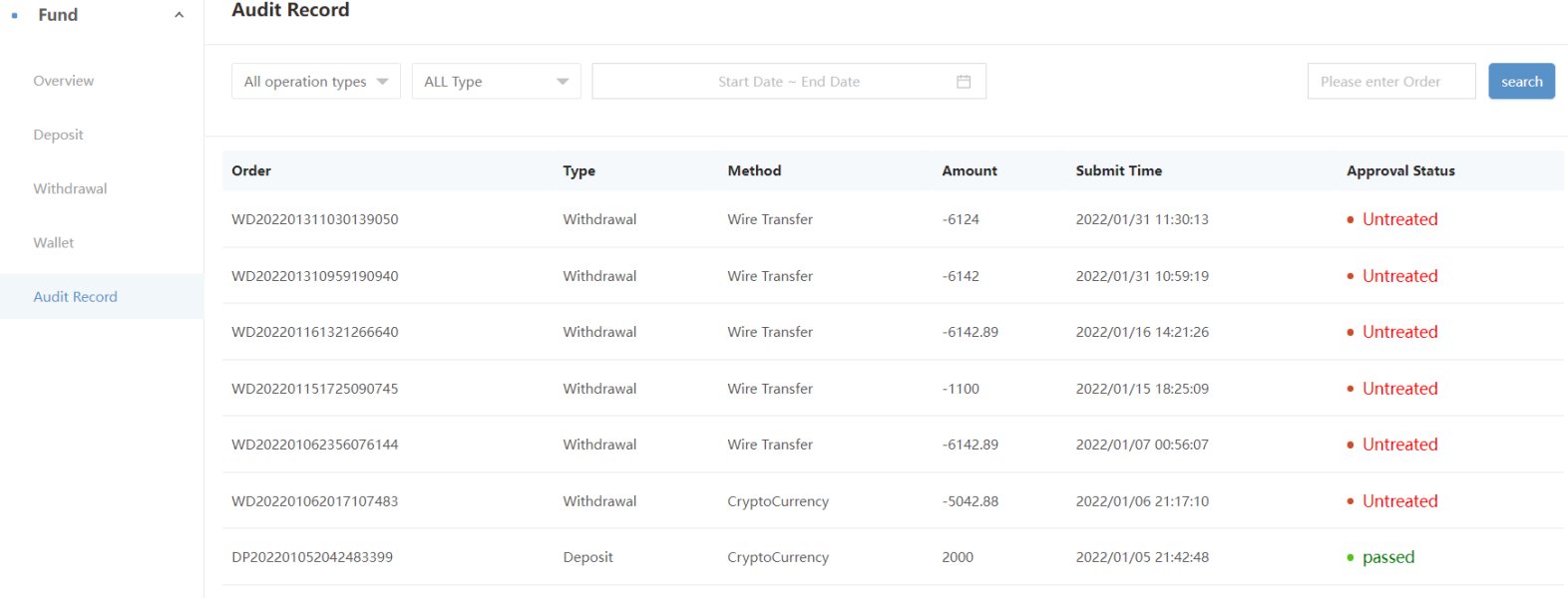

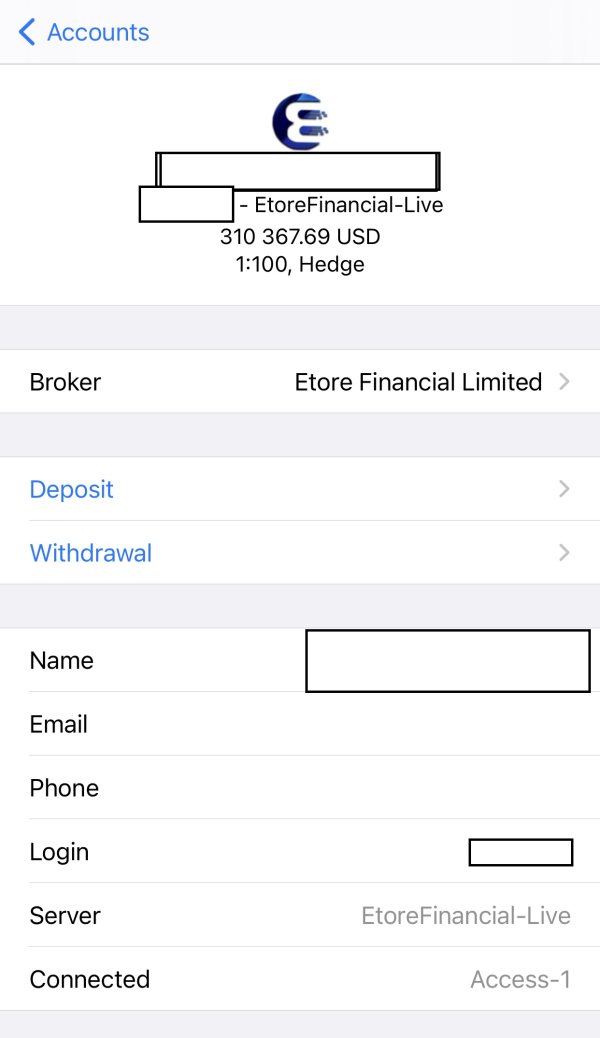

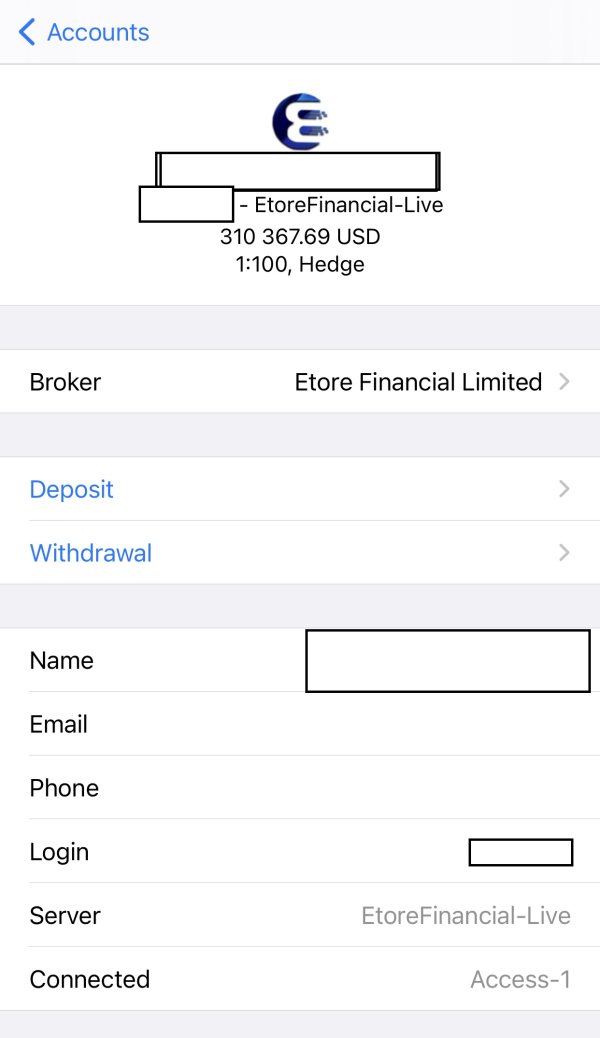

Deposit and Withdrawal Methods: Current materials do not specify available funding methods, processing times, or associated fees for deposits and withdrawals.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not detailed in reviewed sources.

Bonus and Promotional Offers: Information regarding welcome bonuses, promotional campaigns, or loyalty programs is not available in current materials.

Available Trading Assets: Sources mention a "growing asset lineup" but do not specify exact categories. These might include forex pairs, commodities, indices, or cryptocurrencies available for trading.

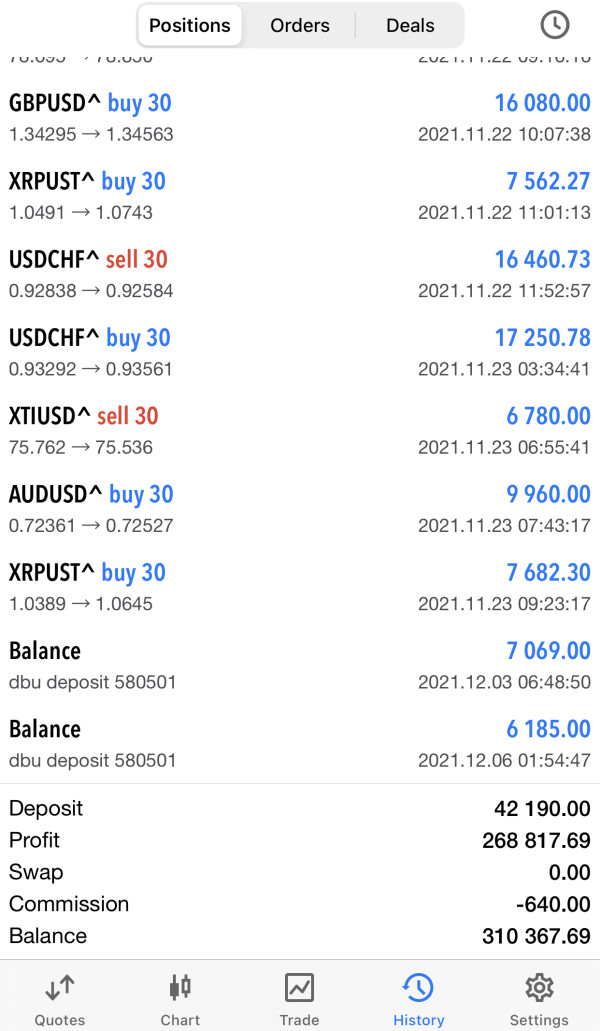

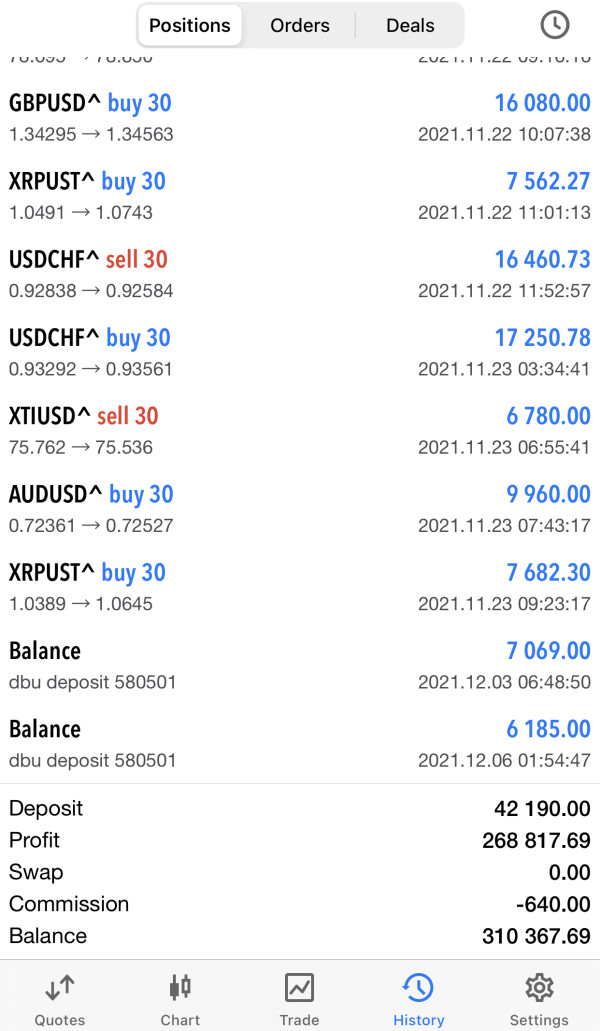

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available materials. Direct verification with the broker is required.

Leverage Ratios: Maximum leverage offerings for different asset classes and account types are not specified in reviewed sources.

Platform Options: The broker utilizes eToro's trading platform technology. This provides access to social trading features and community-driven tools.

Geographic Restrictions: Specific countries or regions where services are restricted are not detailed in current materials.

Customer Support Languages: Available support languages are not specified in reviewed sources.

This Etore review notes that many operational details require direct verification with the broker. Comprehensive information is not available in current public sources.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Etore's account conditions faces limitations due to insufficient detailed information in available sources. While the broker appears to offer social trading-focused accounts, specific account types, their features, and associated requirements are not comprehensively outlined in current materials.

This lack of transparency regarding account structures makes it challenging for potential clients to assess which account type might best suit their trading needs and experience level. Minimum deposit requirements, which significantly impact accessibility for retail traders, are not specified in reviewed sources.

This information gap is concerning as deposit requirements often determine whether a broker is suitable for beginners or primarily targets more substantial investors. Additionally, the account opening process, including required documentation and verification procedures, lacks detailed coverage in available materials.

The absence of information about special account features, such as Islamic accounts for Muslim traders or professional accounts for qualified investors, further limits the assessment of Etore's account offerings. Without clear details about leverage options, margin requirements, or account-specific benefits, potential clients cannot make informed decisions about account selection.

This Etore review emphasizes that prospective clients should directly contact the broker to obtain comprehensive account condition details. Publicly available information does not provide sufficient depth for thorough evaluation. The lack of transparent account information represents a significant limitation in assessing the broker's overall value proposition.

Assessing Etore's trading tools and educational resources proves challenging due to limited specific information in available sources. While the broker emphasizes social trading capabilities as a primary tool, detailed descriptions of analytical tools, charting packages, or technical indicators are not comprehensively covered in current materials.

This lack of detail makes it difficult to evaluate whether the platform provides sufficient tools for both technical and fundamental analysis. The educational component, crucial for trader development, lacks detailed coverage in available sources.

Information about webinars, tutorials, market analysis, or educational content quality is not specified. For a broker targeting both beginners and experienced traders, comprehensive educational resources are essential, yet current materials do not provide adequate insight into these offerings.

Research and analysis resources, including market reports, economic calendars, or expert analysis, are not detailed in reviewed sources. These tools are fundamental for informed trading decisions, and their absence from available information raises questions about the platform's analytical support capabilities.

Automated trading support, including Expert Advisors or algorithmic trading capabilities, is not mentioned in current materials. This omission is significant as many modern traders rely on automated strategies for consistent execution and risk management. The focus on social trading tools, while innovative, requires more detailed explanation of how these features integrate with traditional trading tools to provide a comprehensive trading environment.

Customer Service and Support Analysis

Evaluating Etore's customer service quality faces significant limitations due to insufficient detailed information in available sources. Customer support channels, availability hours, and response time metrics are not specified in current materials, making it impossible to assess the broker's commitment to client assistance.

This lack of transparency regarding support infrastructure is concerning for potential clients who may require assistance with platform navigation or trading issues. The quality of customer service, including staff expertise and problem-resolution capabilities, cannot be adequately assessed from available information.

User feedback regarding support experiences is not comprehensively covered in reviewed sources, limiting insight into real-world service quality. For a broker emphasizing social trading, where users may need guidance on platform features, robust customer support becomes particularly important.

Multilingual support capabilities, essential for international brokers, are not detailed in current materials. This information gap makes it difficult for non-English speaking traders to assess whether they will receive adequate support in their preferred language.

Additionally, specialized support for different account types or trading issues is not addressed in available sources. The absence of information about customer service training, support ticket systems, or escalation procedures further limits the assessment of Etore's support infrastructure. Without clear metrics or user testimonials regarding support quality, potential clients cannot gauge whether the broker provides reliable assistance when needed. This analysis emphasizes the need for direct verification of customer support capabilities before committing to the platform.

Trading Experience Analysis

The assessment of Etore's trading experience encounters significant limitations due to insufficient technical performance data in available sources. Platform stability, execution speed, and order processing quality metrics are not provided in current materials, making it challenging to evaluate the fundamental aspects of the trading environment.

These technical specifications are crucial for traders who depend on reliable order execution and minimal latency. Order execution quality, including slippage rates, requote frequency, and execution speed during volatile market conditions, lacks detailed coverage in available sources.

This information gap is particularly concerning for active traders who require consistent execution quality. The absence of specific data about execution models further limits understanding of the trading environment.

Platform functionality assessment is hampered by limited detailed descriptions of available features beyond social trading capabilities. Information about charting tools, order types, risk management features, and customization options is not comprehensively covered.

Mobile trading experience, increasingly important for modern traders, also lacks detailed evaluation in current materials. The social trading features, while highlighted as a key differentiator, require more detailed explanation of how they integrate with standard trading functions.

Understanding how copy trading affects execution, whether copied trades experience delays, and how social features impact overall platform performance needs clarification. This Etore review concludes that comprehensive trading experience evaluation requires direct platform testing, as available sources do not provide sufficient technical detail for thorough assessment.

Trust and Security Analysis

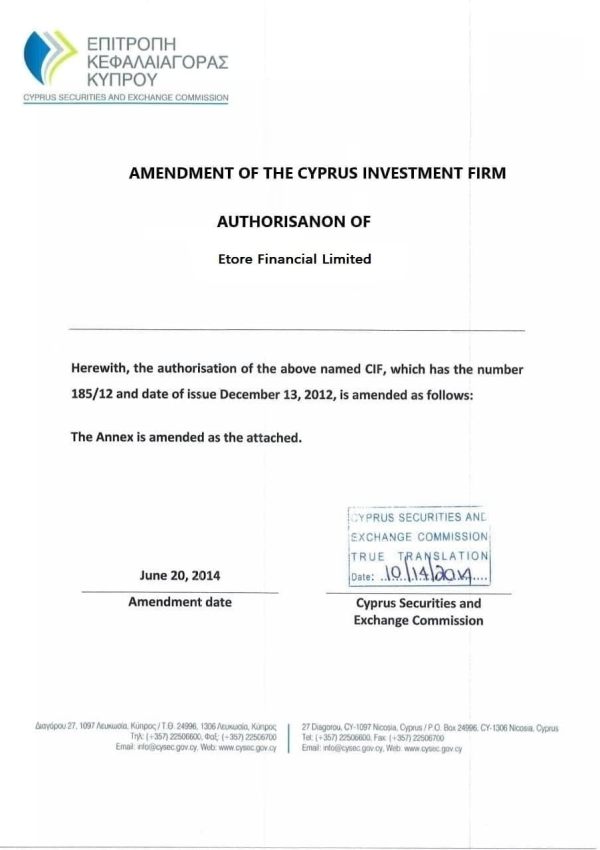

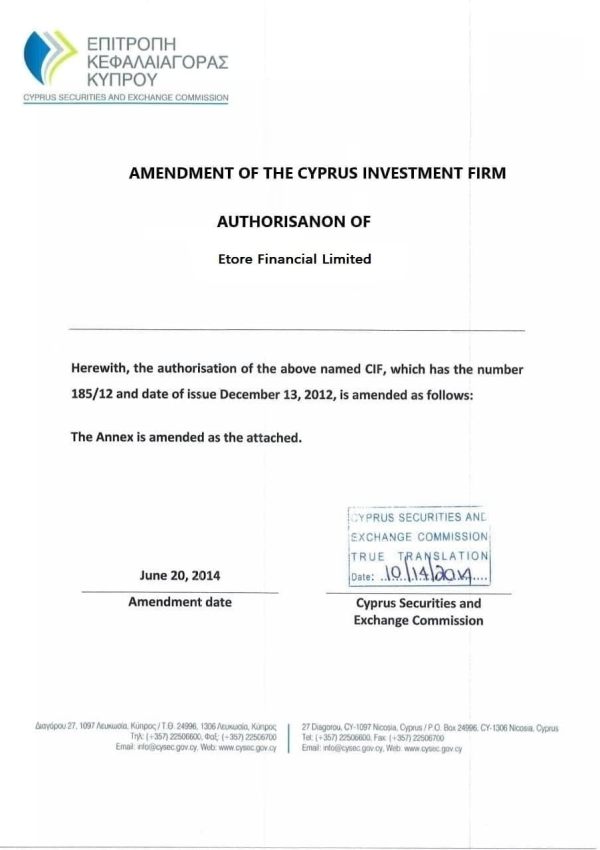

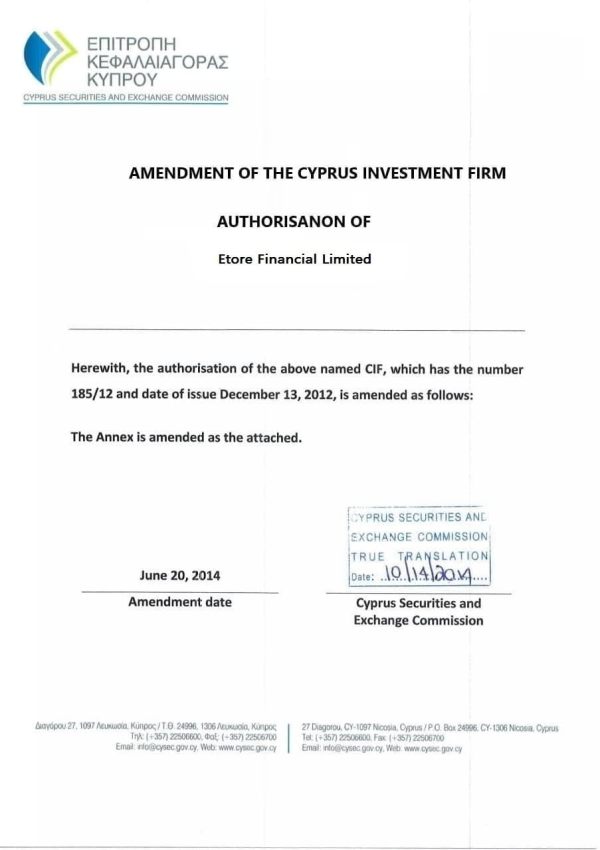

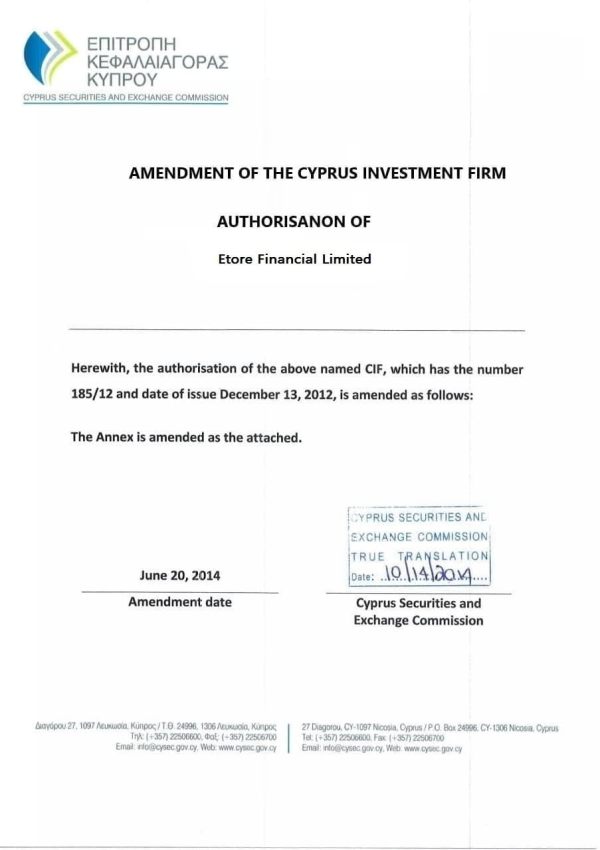

Evaluating Etore's trustworthiness faces substantial challenges due to limited regulatory and security information in available sources. Specific regulatory licenses, oversight jurisdictions, and compliance measures are not comprehensively detailed, creating uncertainty about the broker's legal standing and client protection measures.

This lack of regulatory transparency is concerning for potential clients seeking secure trading environments. Fund security measures, including client money segregation, deposit insurance, and bankruptcy protection, are not specified in current materials.

These protections are fundamental for trader confidence, yet their absence from available information makes it impossible to assess the safety of client funds. The connection to eToro's infrastructure suggests some level of established security, but specific measures require clarification.

Corporate transparency, including ownership structure, financial statements, and business history, lacks detailed coverage in available sources. This information gap makes it difficult to assess the broker's financial stability and long-term viability.

Additionally, information about negative incidents, regulatory actions, or dispute resolution procedures is not provided. The broker's industry reputation, while potentially benefiting from association with eToro's established presence, requires more specific evaluation based on independent regulatory records and industry recognition.

Third-party audits, security certifications, and compliance reports are not mentioned in current materials. Without comprehensive regulatory and security information, potential clients cannot adequately assess the risk level associated with choosing Etore as their trading partner.

User Experience Analysis

User experience evaluation benefits from available rating data, with eToro maintaining a 4.2-star rating from 27,385 Trustpilot reviews, indicating generally positive user satisfaction. This substantial review volume suggests significant user engagement and provides a meaningful sample size for assessing overall satisfaction levels.

The rating indicates that most users find the platform satisfactory, though specific aspects of user experience require deeper analysis. Interface design and usability details are not comprehensively covered in available sources, limiting assessment of platform navigation, visual design, and ease of use for different user types.

The social trading focus suggests emphasis on community features, but specific interface elements and their effectiveness need clarification from direct user feedback. Registration and account verification processes lack detailed description in current materials.

Understanding the complexity, time requirements, and documentation needs for account setup is important for potential users, particularly those new to forex trading. Streamlined onboarding can significantly impact initial user experience.

Fund management experience, including deposit and withdrawal processes, processing times, and associated fees, is not detailed in available sources. These operational aspects significantly impact user satisfaction, as funding difficulties often generate negative reviews and user frustration.

Common user complaints or praise themes are not systematically analyzed in available materials, limiting understanding of recurring issues or particularly valued features. This feedback analysis would provide valuable insights into platform strengths and areas requiring improvement.

Conclusion

This Etore review reveals a broker with promising social trading capabilities and generally positive user feedback, as evidenced by eToro's 4.2-star rating from over 27,000 reviews. The platform's emphasis on innovative social trading features and community-driven strategy sharing creates an appealing proposition for traders seeking collaborative learning opportunities.

However, the evaluation is significantly limited by insufficient detailed information about crucial operational aspects. Etore appears most suitable for traders interested in social trading functionality, particularly beginners who can benefit from following experienced traders and seasoned traders willing to share strategies within a community environment.

The platform's association with eToro's established technology infrastructure suggests reliable technical foundation, though specific performance metrics require verification. The main advantages include innovative social trading features that democratize access to successful strategies and positive user satisfaction indicators.

However, significant disadvantages include lack of transparency regarding regulatory status, account conditions, cost structures, and operational details that are essential for informed broker selection. Potential clients should conduct thorough direct verification of these crucial details before committing to the platform.