Is East safe?

Business

License

Is East Safe or Scam?

Introduction

In the ever-evolving world of Forex trading, the choice of a broker can significantly impact a trader's success. East, a broker that has garnered attention in the Forex market, positions itself as a platform for traders seeking opportunities in currency exchange. However, with the rise of unregulated and potentially fraudulent brokers, it is essential for traders to exercise caution and conduct thorough assessments before entrusting their funds. This article aims to explore whether East is a safe trading option or a potential scam. The investigation will consider regulatory status, company background, trading conditions, customer feedback, and overall risk assessment, using a combination of narrative and structured information to provide a comprehensive overview.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining a broker's legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' interests. In the case of East, our investigation revealed that it operates without any recognized regulatory oversight. This lack of regulation raises significant concerns about the safety of funds and the broker's accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory body overseeing East is a major red flag. Regulatory agencies like the FCA (Financial Conduct Authority) in the UK, ASIC (Australian Securities and Investments Commission), and CySEC (Cyprus Securities and Exchange Commission) play vital roles in protecting traders by enforcing strict guidelines. Brokers under their jurisdiction must adhere to rigorous standards, including maintaining client funds in segregated accounts and providing transparency in operations. Without such oversight, traders using East may find themselves vulnerable to fraudulent practices, making it imperative to question whether East is indeed safe.

Company Background Investigation

Understanding the companys history and ownership structure provides insight into its credibility. East has not disclosed substantial information about its founding, operational history, or ownership, which contributes to a lack of transparency. A reputable broker typically shares details about its management team and their qualifications, which enhances trust among potential clients.

The management teams background is crucial in assessing the broker's reliability. Unfortunately, information regarding the key personnel at East is scarce, raising concerns about their expertise and commitment to ethical trading practices. Transparency in operations and clear communication about the company's structure are essential for building trust. The absence of such information about East further underscores the need for caution when considering this broker.

Trading Conditions Analysis

An essential aspect of any broker evaluation is the analysis of trading conditions, including fees and spreads. East claims to offer competitive trading conditions, but without regulatory oversight, these claims should be approached with skepticism. Traders should be particularly wary of any unusual fee structures that may not align with industry standards.

| Fee Type | East | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | None | $5 per trade |

| Overnight Interest Range | 2% | 1.5% |

The above table illustrates that East may impose higher spreads compared to industry averages, which could erode potential profits for traders. Additionally, the lack of a clear commission structure raises questions about hidden fees that may be levied on traders. Such practices often indicate a broker's intention to exploit clients, reinforcing the need for traders to consider whether East is a safe option.

Customer Funds Security

The security of customer funds is paramount in the Forex trading environment. A trustworthy broker should implement robust measures to protect clients' investments. Unfortunately, East has not provided clear information regarding its fund security protocols, such as whether client funds are held in segregated accounts or if there are any investor protection schemes in place.

Without adequate measures, traders using East risk losing their funds in the event of a financial crisis or broker insolvency. Historical incidents involving unregulated brokers often reveal a pattern of fund mismanagement and inadequate security measures, leading to significant losses for traders. Therefore, the lack of transparency and information regarding East's fund security raises serious concerns about whether it is a safe broker.

Customer Experience and Complaints

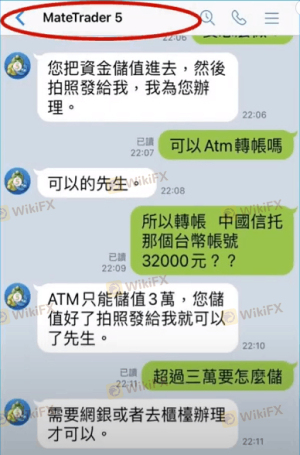

Customer feedback provides valuable insights into a broker's operations and service quality. Reviews and complaints about East indicate a concerning trend of negative experiences among users. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with trade execution.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Trade Execution | High | Unresponsive |

Several users have reported being unable to withdraw their funds, which is a critical concern that suggests a lack of integrity on the part of East. When traders encounter such issues, it often leads to frustration and financial loss. The poor response from the company to these complaints further exacerbates the situation, indicating a disregard for customer welfare. Such patterns of behavior contribute to the perception that East may not be a safe trading environment.

Platform and Trade Execution

The performance of a trading platform significantly impacts the trading experience. A reliable platform should offer stability, fast execution, and minimal slippage. However, users have reported issues with East's platform, including slow execution speeds and instances of slippage that can affect trading outcomes.

Traders have expressed concerns about the potential for platform manipulation, where brokers may interfere with trade execution to benefit themselves. The lack of transparency regarding the platform's operations and the absence of regulatory oversight amplify these concerns. Therefore, the question remains: is East truly safe, or does it pose risks to traders' investments?

Risk Assessment

Engaging with East presents several risks that traders must consider. The lack of regulation, transparency issues, and negative customer feedback collectively contribute to a high-risk environment. Traders should be aware of the following risks:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight available. |

| Fund Security Risk | High | Lack of clear fund protection measures. |

| Operational Risk | Medium | Negative feedback on trade execution and customer service. |

To mitigate these risks, traders should conduct thorough research before engaging with East. Utilizing demo accounts, seeking regulated alternatives, and being cautious with fund deposits can help protect against potential losses.

Conclusion and Recommendations

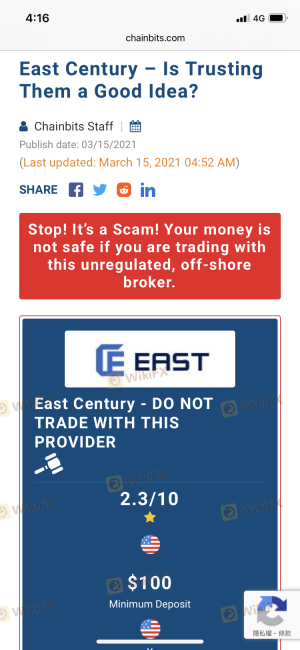

In conclusion, the investigation into East raises significant concerns regarding its safety and legitimacy as a Forex broker. The lack of regulatory oversight, transparency issues, and negative customer experiences suggest that East may not be a safe option for traders. It is crucial for potential clients to approach this broker with caution and consider the risks involved.

For traders seeking reliable alternatives, it is advisable to explore brokers that are regulated by reputable authorities, have transparent operations, and maintain positive customer feedback. By prioritizing safety and due diligence, traders can enhance their chances of success in the Forex market. Ultimately, the question remains: is East safe? The evidence suggests that caution is warranted when considering this broker.

Is East a scam, or is it legit?

The latest exposure and evaluation content of East brokers.

East Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

East latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.