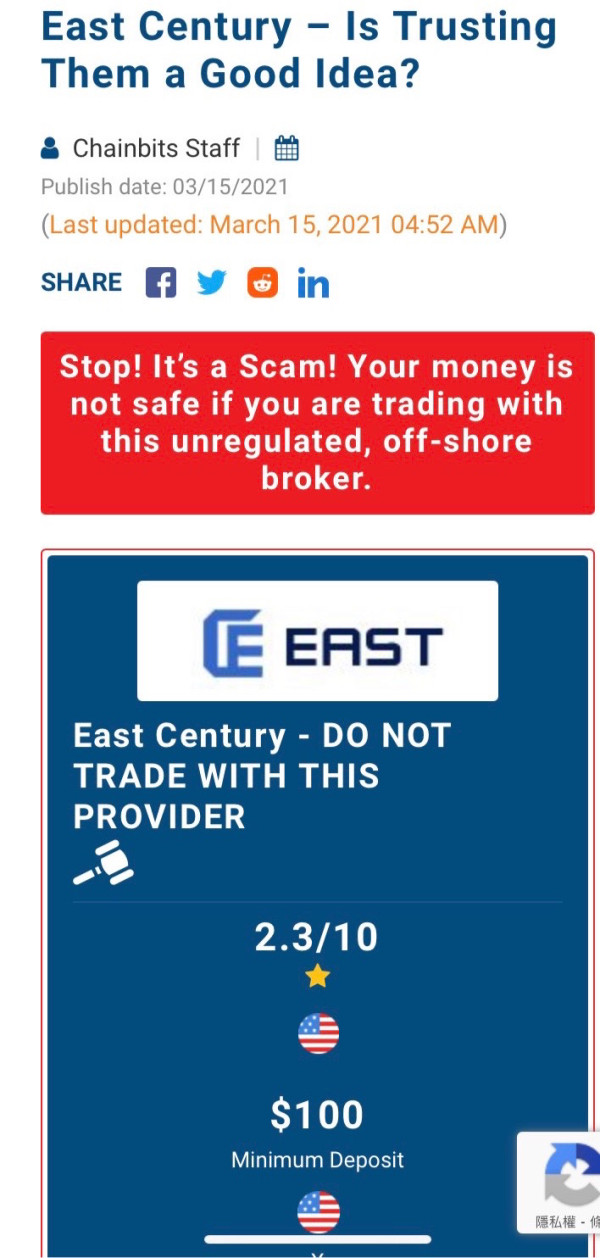

East 2025 Review: Everything You Need to Know

Executive Summary

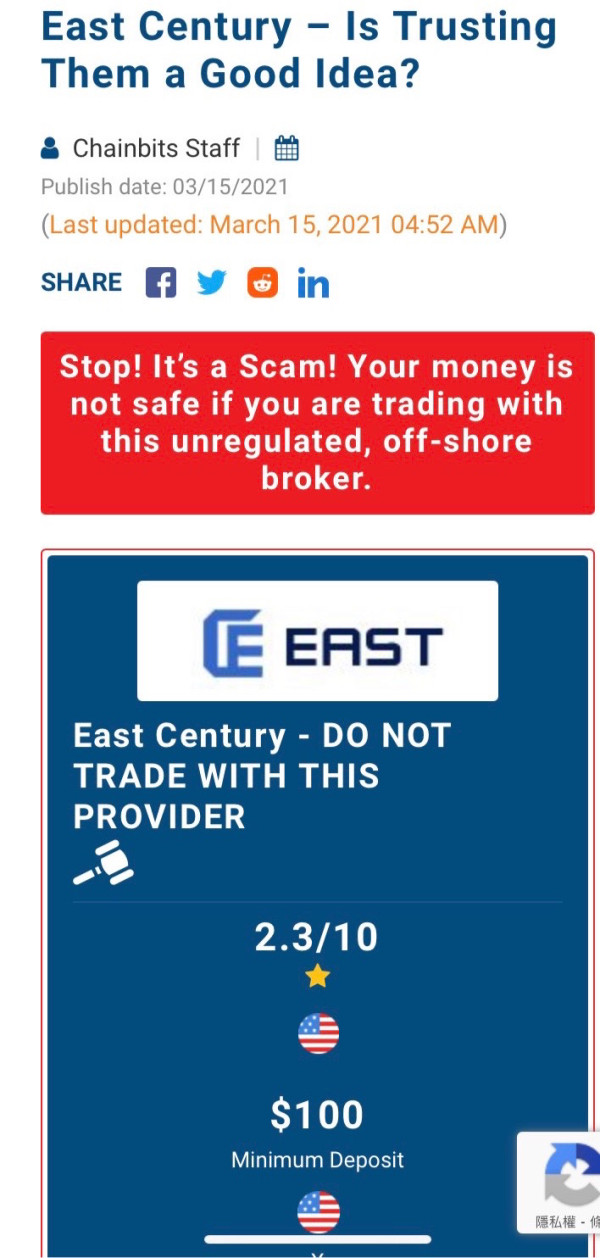

This comprehensive east review examines what appears to be a broker entity that has generated significant discussion in various contexts. Based on available information, East presents itself as a rapidly growing commercial brokerage company primarily active in the New York, Long Island, and Florida regions. However, our analysis reveals substantial gaps in critical information typically expected from regulated financial service providers.

The entity has reportedly experienced record sales growth from 2015 to 2024. It positions itself as a leading commercial broker in its operational territories. Additionally, Food Sales East appears to provide specialized solutions for industry operators, suggesting a focus on retail and food industry segments. Despite these business achievements, the lack of specific trading conditions, regulatory transparency, and detailed service information raises concerns for potential clients seeking comprehensive financial services.

Our evaluation indicates that prospective users should exercise caution and conduct thorough due diligence before engaging with this entity. Fundamental information about trading platforms, regulatory oversight, and customer protection measures remains unclear from available sources.

Important Notice

This east review is based on limited publicly available information. Significant gaps exist in critical areas typically covered in comprehensive broker evaluations. Different regional entities may operate under varying legal and regulatory frameworks, which could substantially impact service delivery and user experience. The absence of clear regulatory information and specific trading conditions makes it challenging to provide definitive recommendations.

Our assessment methodology relies on available market information and public records. Potential clients should independently verify all claims and regulatory status before making any financial commitments. This review should not be considered as investment advice or a recommendation to engage with any specific financial service provider.

Rating Framework

The inability to assign meaningful scores across all dimensions highlights the fundamental challenge in evaluating this entity based on available information.

Broker Overview

East Coast Commercial Brokerage Company has established itself as a prominent and rapidly expanding commercial brokerage firm. It primarily serves the New York, Long Island, and Florida markets. According to available reports, the company has demonstrated consistent growth trajectory, with record-breaking sales figures reported from 2015 through 2024. This performance suggests strong market positioning within its operational territories and indicates successful business development strategies.

The company's focus appears to center on commercial brokerage services. However, the specific nature of these services and their relevance to retail forex trading remains unclear from available documentation. The geographical concentration in major East Coast markets potentially provides advantages in terms of market access and client proximity, particularly for businesses operating in these high-value commercial real estate markets.

However, this east review must note significant information gaps regarding traditional forex brokerage services. Critical details about trading platforms, asset classes, and regulatory oversight are not clearly documented in available sources. The absence of information about established financial regulatory frameworks raises questions about the entity's positioning within the traditional forex brokerage landscape that most traders would expect to encounter.

Regulatory Framework: Current available sources do not provide specific information about regulatory oversight by recognized financial authorities. These would include the CFTC, NFA, or other major regulatory bodies typically associated with forex brokerage services.

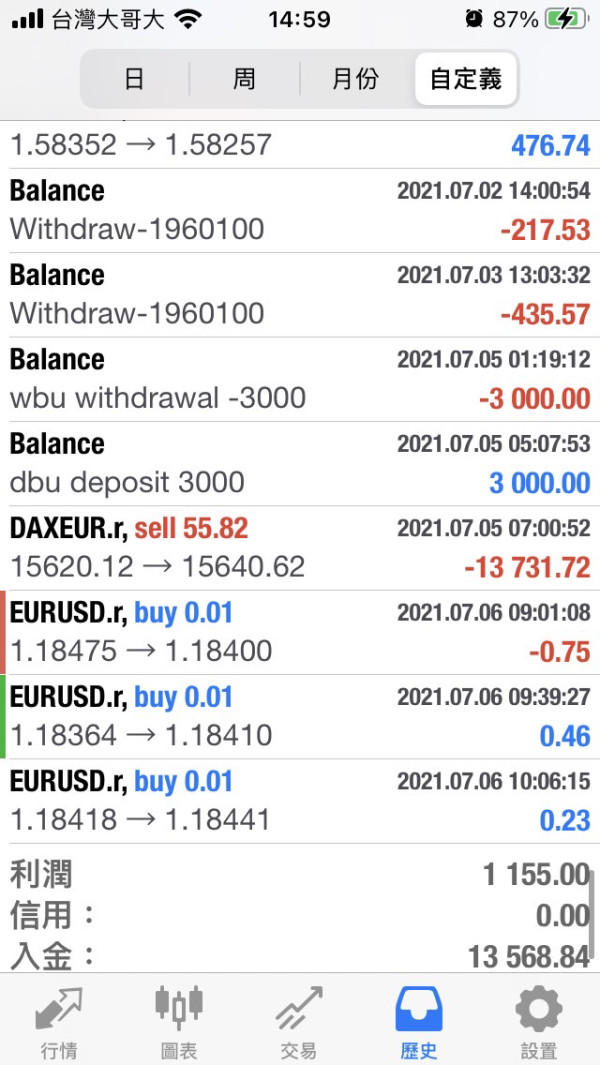

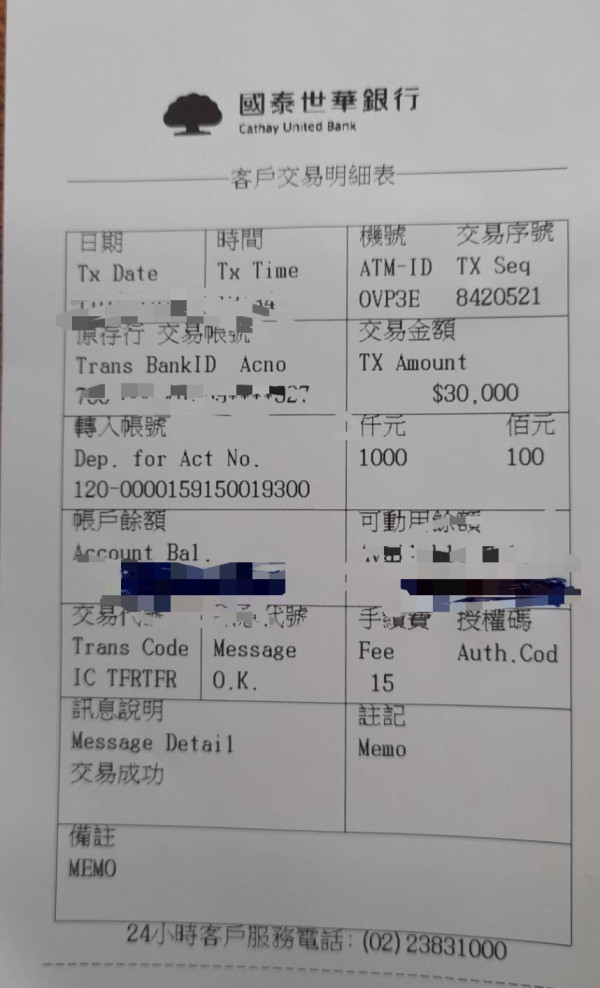

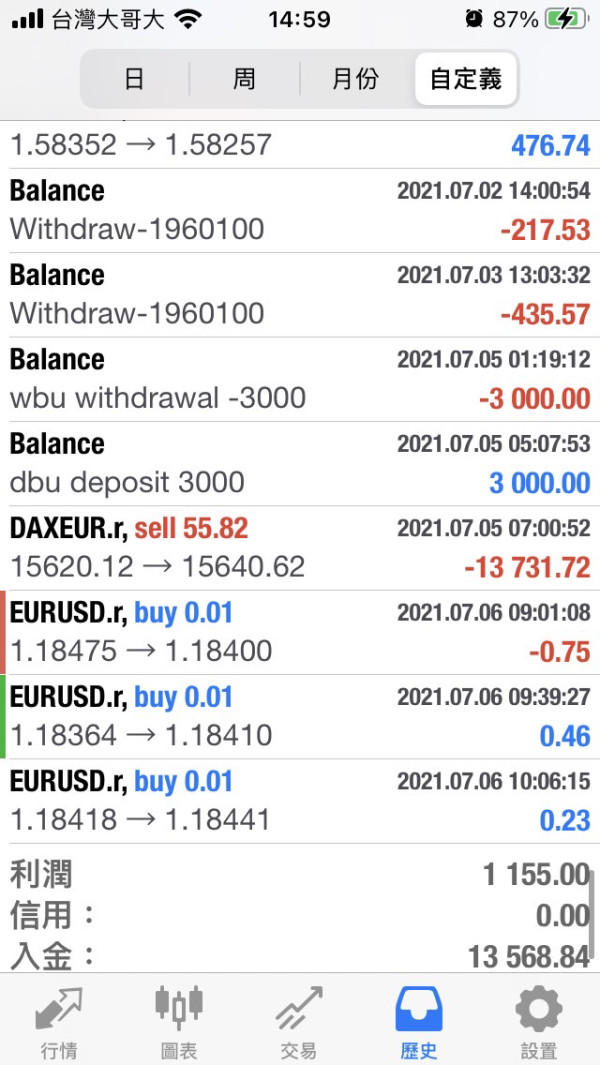

Deposit and Withdrawal Methods: Specific information about funding mechanisms, supported payment methods, and withdrawal procedures is not detailed in available documentation.

Minimum Deposit Requirements: No clear minimum deposit thresholds or account funding requirements are specified in current sources.

Promotional Offerings: Information about welcome bonuses, trading incentives, or promotional campaigns is not available in reviewed materials.

Tradeable Assets: The range of available trading instruments is not clearly documented. This includes forex pairs, commodities, indices, or other financial products.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not specified in available sources. This makes cost comparison impossible.

Leverage Options: Maximum leverage ratios and margin requirements are not disclosed in current documentation.

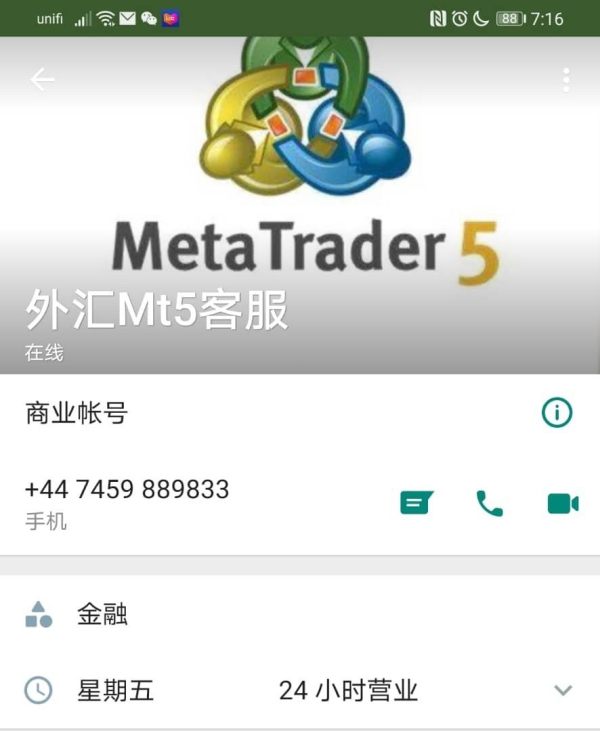

Platform Selection: Information about trading platform options is not provided. This includes MetaTrader availability or proprietary platform features.

Geographic Restrictions: Operations appear focused on East Coast regions. However, specific country restrictions or regulatory limitations are not clearly outlined.

Customer Service Languages: Available customer support languages and communication channels are not specified in reviewed materials.

This east review emphasizes that the absence of such fundamental information represents a significant concern for potential clients seeking transparent and comprehensive brokerage services.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions proves challenging due to the complete absence of specific information about account types, structures, and requirements in available sources. Traditional forex brokers typically offer multiple account tiers, such as standard, premium, and VIP accounts. Each tier has distinct features, minimum deposit requirements, and trading conditions. However, no such information is available for this entity.

Account opening procedures, verification requirements, and documentation standards remain unspecified. The lack of information about Islamic account options complicates the assessment further. These options are crucial for traders requiring Sharia-compliant trading conditions. Additionally, details about account maintenance fees, inactivity charges, or minimum balance requirements are not documented.

Without concrete information about account conditions, potential clients cannot make informed decisions about suitability for their trading needs. The absence of transparent account structure information raises questions about the entity's commitment to standard industry practices and regulatory compliance expectations.

This east review cannot provide meaningful evaluation of account conditions due to insufficient available data. This highlights the need for enhanced transparency in this critical area.

The assessment of trading tools and resources faces significant limitations due to the absence of detailed information about available trading instruments, analytical tools, and educational resources. Professional forex brokers typically provide comprehensive suites of trading tools. These include advanced charting capabilities, technical indicators, economic calendars, and market analysis resources.

Research and analysis resources are fundamental for informed trading decisions but are not documented in available sources. The availability of third-party research, market commentary, or proprietary analysis remains unclear. Educational resources help traders develop their skills but are not mentioned in current documentation. These include webinars, tutorials, and trading guides.

Automated trading support cannot be evaluated due to lack of information. This includes Expert Advisor compatibility, algorithmic trading capabilities, and copy trading features. These tools are increasingly important for modern traders seeking to implement sophisticated trading strategies or benefit from automated execution systems.

The absence of information about mobile trading applications, cross-platform synchronization, and real-time data feeds further complicates the evaluation of technological capabilities and resource availability.

Customer Service and Support Analysis

Evaluating customer service quality and support infrastructure proves impossible due to the complete absence of information about customer support channels, availability, and service standards. Professional brokers typically maintain multiple communication channels. These include live chat, telephone support, email assistance, and comprehensive FAQ sections.

Response time expectations are crucial for traders requiring timely assistance during market hours but are not specified in available documentation. The quality of support staff training, problem resolution procedures, and escalation processes remain unknown factors that could significantly impact user experience.

Multilingual support capabilities are essential for international client bases but are not documented. The availability of 24/7 support is particularly important in the global forex market that operates across multiple time zones. However, this cannot be confirmed from available sources.

Customer service case studies, user testimonials about support experiences, and documented problem resolution examples are absent from available materials. This lack of transparency about customer service capabilities represents a significant gap in the evaluation process.

Trading Experience Analysis

The analysis of trading experience quality faces substantial challenges due to the absence of information about platform stability, execution speeds, and overall trading environment quality. Professional trading platforms typically provide real-time execution, minimal slippage, and robust technical infrastructure. These systems are capable of handling high-volume trading periods.

Order execution quality cannot be evaluated from available sources. This includes fill rates, slippage statistics, and execution speed metrics. These factors are crucial for traders, particularly those employing scalping strategies or trading during high-volatility periods where execution quality directly impacts profitability.

Platform functionality assessment is impossible without information about available order types, risk management tools, and advanced trading features. Mobile trading experience has become essential for modern traders requiring flexibility and constant market access. However, it cannot be evaluated due to lack of documentation.

Trading environment factors remain unknown variables that significantly impact the overall trading experience. These include server stability during major market events, platform uptime statistics, and technical support for platform-related issues.

This east review cannot provide meaningful assessment of trading experience quality due to insufficient available information about these critical operational aspects.

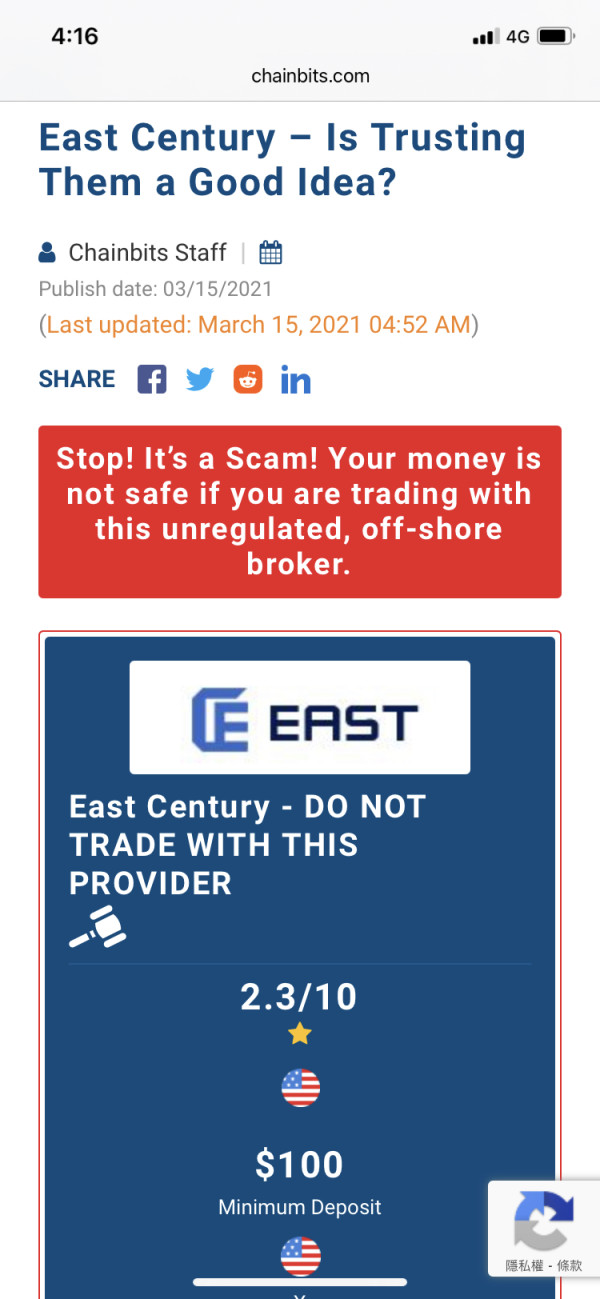

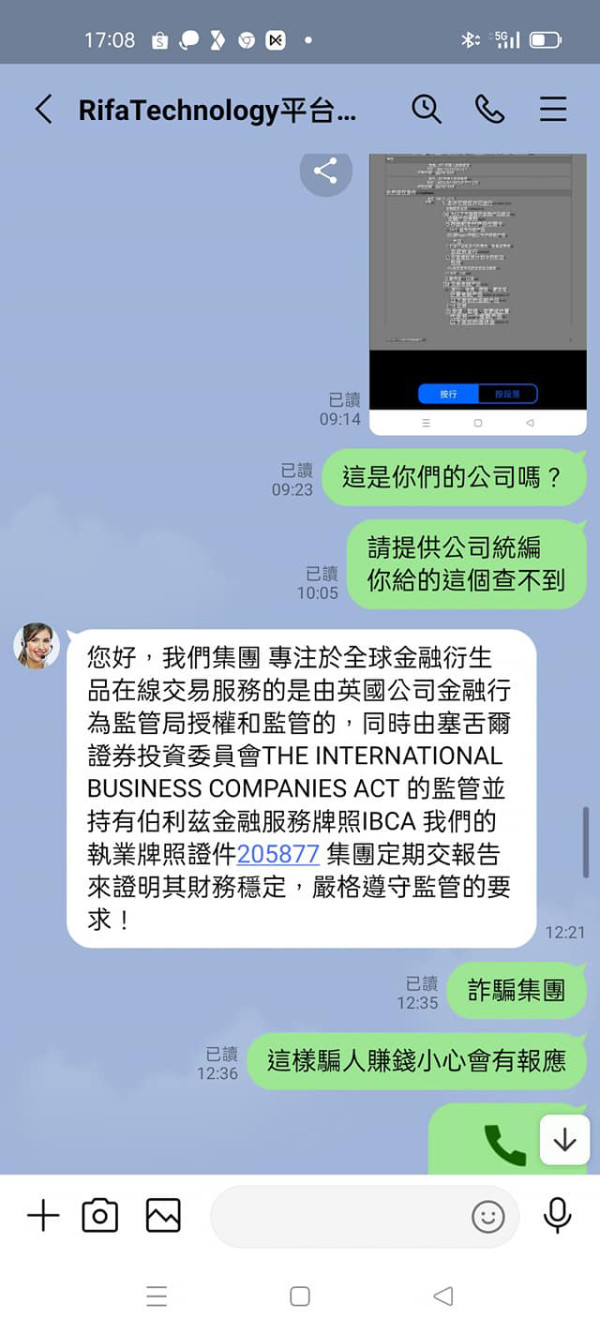

Trust and Regulation Analysis

The evaluation of trustworthiness and regulatory compliance presents the most significant concerns in this assessment. Regulatory oversight by recognized financial authorities is fundamental to broker credibility and client protection. Yet specific regulatory information is not available in current sources.

Fund safety measures are not documented. These include segregated account policies, deposit insurance coverage, and client fund protection protocols. These safeguards are essential for client confidence and are typically mandated by major regulatory frameworks.

Company transparency cannot be assessed due to lack of available information. This is demonstrated through public financial reporting, regulatory filing compliance, and clear ownership structure disclosure. Industry reputation factors are not evident in reviewed materials. These include awards, recognition by financial publications, and peer acknowledgment.

The handling of negative events, regulatory actions, or client disputes cannot be evaluated without access to regulatory records or documented case histories. This absence of transparency about regulatory standing and compliance history represents a fundamental concern for potential clients seeking reliable and trustworthy brokerage services.

User Experience Analysis

Overall user satisfaction assessment proves challenging without access to user reviews, testimonials, or documented client feedback. Professional brokers typically maintain strong online presence with verifiable user reviews across multiple platforms. These provide prospective clients with insights into actual user experiences.

Interface design and usability evaluation cannot be conducted without access to platform demonstrations or user interface documentation. Registration and verification process efficiency significantly impacts initial user experience but remains undocumented in available sources.

Fund operation experience cannot be assessed from current information. This includes deposit processing times, withdrawal procedures, and payment method reliability. These operational aspects directly impact user satisfaction and are critical factors in broker selection decisions.

Common user complaints or recurring issues that might affect user experience are not documented in available sources. The absence of user feedback mechanisms, satisfaction surveys, or public review platforms further complicates the assessment of actual user experience quality.

Conclusion

This east review reveals significant challenges in providing a comprehensive evaluation due to substantial information gaps across all critical assessment areas. While the entity appears to have achieved commercial success in specific regional markets, the absence of fundamental information about trading conditions, regulatory oversight, and service standards prevents meaningful evaluation for potential forex trading clients.

The lack of transparency regarding regulatory compliance, trading platforms, and customer protection measures raises important questions about suitability for traders seeking reliable and regulated brokerage services. Potential clients should exercise extreme caution and conduct thorough independent research before considering any engagement with this entity.

Based on available information, this entity may not align with expectations for professional forex brokerage services. Prospective users should consider well-established, transparently regulated alternatives that provide comprehensive information about their services, regulatory status, and trading conditions.