Is Txv safe?

Pros

Cons

Is TXV Safe or Scam?

Introduction

TXV is a forex broker established in 2020, operating out of the United Kingdom. It positions itself as a platform catering to a diverse range of traders, including those interested in forex trading, commodities, and indices. However, the forex market is notorious for its risks and potential scams, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. With numerous reports of fraudulent activities and unregulated entities in the market, understanding the legitimacy of a broker like TXV is crucial for protecting ones investments. This article employs a comprehensive evaluation framework, analyzing TXV's regulatory status, company background, trading conditions, client experiences, and security measures to determine whether it is safe or potentially a scam.

Regulatory and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. Regulation provides a layer of protection for traders, ensuring that brokers adhere to specific standards and practices. In the case of TXV, it is concerning to note that there is no regulatory oversight from any recognized financial authority. This lack of regulation raises red flags, as unregulated brokers can often operate with impunity, making it difficult for traders to seek recourse in case of disputes or fraud.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of a regulatory framework means that traders using TXV do not have the protections typically offered by licensed brokers. This includes safeguards against fraud, requirements for financial disclosures, and mechanisms for resolving disputes. Furthermore, the WikiFX score for TXV is alarmingly low at 1.42 out of 10, indicating a high risk associated with this broker. This score is derived from user complaints and the broker's lack of regulatory compliance. Traders should be particularly cautious when dealing with brokers that operate without oversight, as they often pose a higher risk of becoming victims of scams.

Company Background Investigation

TXV operates under the name Tix Investment Management Limited and was founded in 2020. The company claims to provide a platform for trading various financial instruments, but there is limited information available regarding its ownership structure or the backgrounds of its management team. The lack of transparency surrounding these aspects is concerning, as it makes it difficult for potential clients to assess the credibility of the individuals running the broker.

In terms of management experience, there is little publicly available data to indicate the qualifications or track records of those at the helm of TXV. This lack of information can be a significant deterrent for traders who rely on the expertise and integrity of a broker's management team to safeguard their investments. Transparency in company operations, including clear communication regarding ownership and management, is crucial for building trust with clients. Without this transparency, it is challenging to ascertain whether TXV is a legitimate broker or a potential scam.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. TXV claims to provide competitive trading fees, but the specifics of these costs are not readily available on their website. This lack of clarity can be problematic, as traders need to be aware of all potential costs associated with their trading activities.

| Fee Type | TXV | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Unknown | 1.0 - 2.0 pips |

| Commission Structure | Unknown | Varies widely |

| Overnight Interest Range | Unknown | 0.5% - 2.0% |

The absence of detailed information on spreads, commissions, and overnight interest rates raises concerns about potential hidden fees that could significantly impact trading profitability. Traders should be wary of brokers that do not provide clear and transparent information regarding their fee structures. This lack of transparency could indicate that TXV may impose costs that are not immediately obvious, further complicating the decision to trade with them.

Client Funds Security

The security of client funds is paramount when selecting a forex broker. TXV's lack of regulation means that there are no established protocols for safeguarding client deposits. Typically, regulated brokers are required to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This segregation protects traders in the event of the broker's insolvency.

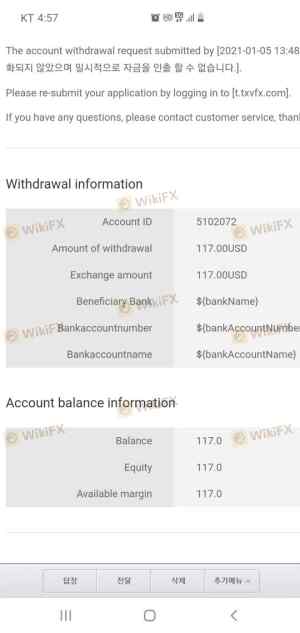

Furthermore, the absence of investor protection schemes, which are often mandated by regulatory authorities, means that traders using TXV may not have any recourse to recover their funds in case of fraud or mismanagement. The risks associated with trading through unregulated brokers can lead to significant financial losses, as clients may find it challenging to reclaim their investments. Historical data on TXV indicates that there have been multiple complaints regarding withdrawal issues and allegations of scams, further highlighting the potential risks involved.

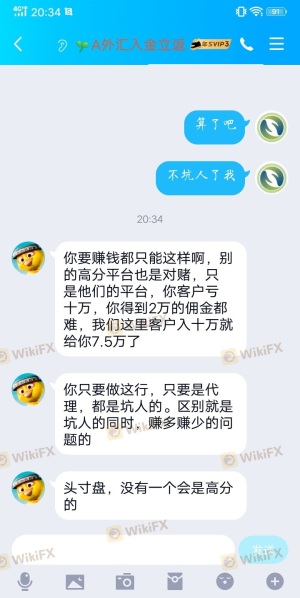

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. In the case of TXV, user reviews and complaints reveal a concerning pattern. Many users have reported difficulties in withdrawing funds, with some alleging that they were misled about the terms of their investments. The following table summarizes the types of complaints received regarding TXV:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Information | Medium | Unresponsive |

| Customer Service Complaints | Medium | Slow Response |

Several users have expressed frustration over TXV's customer service, reporting long wait times and inadequate support when attempting to resolve issues. The lack of effective communication and resolution mechanisms can significantly diminish the overall trading experience and raise concerns about the broker's commitment to client satisfaction. One typical case involved a trader who deposited funds but was unable to withdraw their earnings, leading to accusations of fraudulent practices.

Platform and Execution Quality

The performance of a trading platform is critical for a seamless trading experience. TXV claims to offer a user-friendly platform, but there is limited information available regarding its technology and execution capabilities. Traders should be cautious of platforms that lack transparency about their infrastructure, as this can lead to issues such as slippage, order rejections, and overall poor execution quality.

Without concrete data on execution speeds and slippage rates, it is difficult to assess whether TXV provides a reliable trading environment. Traders should be particularly vigilant about any signs of platform manipulation, which can severely impact trading outcomes.

Risk Assessment

Using TXV poses several risks, primarily due to its unregulated status and lack of transparency. The following risk assessment summarizes the key risk areas associated with trading with TXV:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Financial Risk | High | Potential loss of funds due to mismanagement. |

| Operational Risk | Medium | Lack of transparency regarding trading conditions. |

| Customer Service Risk | Medium | Poor response times and unresolved complaints. |

To mitigate these risks, traders should consider conducting thorough research before engaging with TXV. It is advisable to start with a minimal investment or to explore alternative, regulated brokers that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that TXV raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, transparency issues, and numerous user complaints indicate that traders should exercise extreme caution when considering this broker. While TXV may offer trading opportunities, the associated risks could outweigh the potential benefits.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities such as the FCA or ASIC, which provide essential protections and transparent trading conditions. Some recommended brokers include [Broker A], [Broker B], and [Broker C], all of which have established reputations for reliability and customer service. Ultimately, ensuring a safe trading environment is paramount, and traders should prioritize brokers that can demonstrate a commitment to regulatory compliance and client protection.

Is Txv a scam, or is it legit?

The latest exposure and evaluation content of Txv brokers.

Txv Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Txv latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.