Is DIOPTION safe?

Business

License

Is Dioption Safe or a Scam?

Introduction

Dioption is a relatively new player in the forex market, positioning itself as a platform that offers trading services to both novice and experienced traders. In an industry where trust is paramount, it is crucial for traders to thoroughly evaluate the credibility and reliability of their chosen brokers. The forex market, while lucrative, is also rife with scams and unscrupulous practices, making it essential for traders to conduct careful due diligence. This article aims to investigate whether Dioption is safe or if it raises any red flags that could indicate fraudulent activity. Our assessment will be based on regulatory compliance, company background, trading conditions, customer feedback, and overall risk factors.

Regulation and Legitimacy

When evaluating the safety of any trading platform, regulatory oversight is a critical factor. A regulated broker is generally held to higher standards and is subject to regular audits, which can provide a layer of security for traders. Dioption's regulatory status is a key element of our investigation.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

Currently, Dioption appears to lack regulation from any prominent financial authority. This absence of oversight is concerning, as it suggests that the broker may not adhere to the strict compliance standards set by recognized regulatory bodies. The lack of a regulatory license raises questions about the broker's legitimacy and operational practices. Traders are advised to exercise caution when dealing with unregulated brokers, as they may be more susceptible to unethical practices, including the misappropriation of funds and lack of transparency.

Company Background Investigation

Understanding the history and ownership structure of Dioption is vital for assessing its credibility. The company claims to offer a user-friendly trading platform with a variety of financial instruments. However, information regarding its establishment, ownership, and management team is sparse.

Dioption's website does not provide detailed information about its founding date, the individuals behind the company, or their professional backgrounds. This lack of transparency can be a red flag, as reputable brokers typically provide comprehensive information about their team and corporate structure. Without knowing who manages the firm and their qualifications, traders may find it challenging to trust the broker fully. A transparent company is generally more likely to be accountable to its clients, while a lack of information can be indicative of potential issues.

Trading Conditions Analysis

The trading conditions offered by Dioption are another critical area to examine. Understanding the fee structure and trading costs can help traders make informed decisions. Dioption advertises competitive spreads and commissions, but it is essential to scrutinize these claims.

| Fee Type | Dioption | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.0-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 1.5% | 0.5-1.0% |

While Dioption claims to offer no commission on trades, the spread on major currency pairs is significantly higher than the industry average. This discrepancy could lead to higher trading costs for clients, which may not be immediately apparent. Additionally, the overnight interest rate charged by Dioption is also above average, which could affect long-term traders negatively. Traders should be aware of these hidden costs, as they can erode profits over time.

Client Fund Security

The safety of client funds is of utmost importance when assessing whether Dioption is safe. A trustworthy broker should have robust measures in place to protect client deposits, including segregated accounts and investor protection schemes. Unfortunately, Dioption does not provide clear information regarding its fund security practices.

Traders should be concerned if a broker does not offer details about how client funds are managed. The absence of segregated accounts means that client funds could potentially be mixed with the broker's operational funds, increasing the risk of loss in the event of financial difficulties. Furthermore, without investor protection schemes, such as those offered by regulatory bodies, traders could face significant risks.

Customer Experience and Complaints

Customer feedback often provides valuable insights into a broker's reliability. Analyzing user experiences can reveal common issues and the company's responsiveness to complaints. In the case of Dioption, customer reviews are mixed, with some users expressing satisfaction with the platform's features, while others have reported significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inadequate |

| Misleading Information | High | Unresolved |

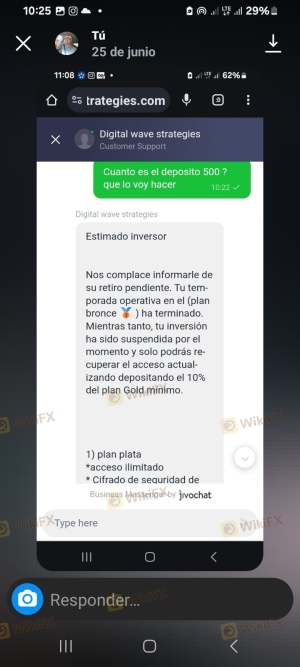

Many complaints revolve around difficulties in withdrawing funds, which is a common issue with potentially untrustworthy brokers. Slow response times from customer support have also been reported, indicating a lack of adequate service. These issues can create a frustrating trading experience and may lead to financial losses for traders trying to access their funds.

Platform and Execution

The performance and reliability of the trading platform are essential for any trader. Dioption claims to offer a user-friendly interface and efficient execution, but user experiences suggest otherwise. Reports of slippage and rejected orders have surfaced, raising concerns about the platform's overall reliability.

Traders need to be cautious of platforms that exhibit signs of manipulation or poor execution quality. If a broker's platform consistently results in unfavorable trading conditions, it can significantly impact a trader's profitability and overall experience.

Risk Assessment

Using Dioption involves several risks that traders should be aware of. Understanding these risks can help traders make informed decisions regarding their investments.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases vulnerability. |

| Financial Risk | Medium | High spreads and fees can erode profits. |

| Operational Risk | High | Platform reliability issues may affect trades. |

Traders should consider these risks seriously. To mitigate potential issues, it is advisable to start with a small deposit, thoroughly research the broker's practices, and be prepared for possible challenges in fund withdrawals or customer service interactions.

Conclusion and Recommendations

In conclusion, the investigation suggests that Dioption raises several red flags that may indicate it is not a safe choice for traders. The lack of regulatory oversight, insufficient company transparency, high trading costs, and numerous customer complaints all contribute to a concerning picture.

For traders seeking reliable options in the forex market, it is advisable to consider well-regulated brokers with established reputations, such as those overseen by top-tier regulatory bodies. Alternatives like Fidelity, Charles Schwab, and Interactive Brokers often provide more robust protections and better overall trading conditions.

In summary, while Dioption may offer certain appealing features, the potential risks and lack of transparency suggest that traders should proceed with caution or look for more reputable alternatives.

Is DIOPTION a scam, or is it legit?

The latest exposure and evaluation content of DIOPTION brokers.

DIOPTION Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DIOPTION latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.