Is Coinsoft safe?

Business

License

Is Coinsoft A Scam?

Introduction

Coinsoft is an online forex and cryptocurrency broker that claims to provide access to over 200 trading instruments, including currencies, commodities, stocks, and indices. Operating from Saint Vincent and the Grenadines, Coinsoft positions itself in a competitive market, appealing to both novice and experienced traders. However, the lack of regulation and transparency surrounding Coinsoft raises significant concerns for potential investors.

As the forex market is fraught with risks, it is crucial for traders to carefully evaluate any broker before investing their hard-earned money. An unregulated broker can expose traders to various risks, including fraud, loss of funds, and lack of recourse in the event of disputes. This article employs a comprehensive investigative approach, utilizing a variety of sources, including regulatory bodies, user reviews, and financial analysis, to assess the safety and legitimacy of Coinsoft. The evaluation framework focuses on regulation, company background, trading conditions, client safety, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is paramount to ensuring the safety of client funds and the integrity of trading practices. Coinsoft is notably unregulated, lacking oversight from any major financial authority. This absence of regulation is a significant red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The Financial Conduct Authority (FCA) in the UK has issued warnings against Coinsoft, stating that the broker operates without proper authorization. This means that clients do not have access to the Financial Ombudsman Service or the Financial Services Compensation Scheme, which are essential protections for traders in the event of a broker's failure or misconduct. The lack of regulatory oversight raises serious concerns about the legitimacy of Coinsoft and its operations.

Regulatory quality is critical because it ensures that brokers adhere to strict standards of conduct, including capital requirements, segregation of client funds, and transparent reporting practices. Coinsoft's unregulated status indicates a lack of accountability, making it difficult for traders to seek recourse in case of disputes or losses.

Company Background Investigation

Coinsoft is registered under the name VC Management LLC, with an address in Saint Vincent and the Grenadines. This region is notorious for its lenient regulatory framework, often attracting unregulated brokers and scams. The companys ownership structure is vague, with little information available about its management team or operational history.

The absence of transparency regarding the company's background and leadership raises concerns about its legitimacy. A reputable broker typically provides detailed information about its history, ownership, and management team, enabling potential clients to assess its credibility. Unfortunately, Coinsoft falls short in this regard, lacking the necessary disclosures that would instill confidence in its operations.

The lack of a clear management team with verifiable experience in the financial sector further compounds the concerns surrounding Coinsoft. This absence of professional oversight can lead to poor decision-making and unethical practices, putting client funds at risk.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is crucial. Coinsoft offers a minimum deposit requirement of $250, which is slightly above the industry average. The broker provides leverage of up to 1:400, which can amplify both potential gains and losses. However, high leverage is often associated with increased risk, especially for inexperienced traders.

| Fee Type | Coinsoft | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0-1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread for major currency pairs is reported to be around 1.5 pips, which is within the industry standard. However, the lack of transparency regarding commission structures and overnight interest rates raises concerns. Many brokers disclose their fee structures clearly, allowing traders to understand the costs involved in trading. Coinsoft's vague policies may lead to unexpected costs, potentially eroding profits.

Moreover, Coinsoft's terms of service reportedly include clauses that could disadvantage traders, such as withdrawal fees of $30 per transaction and a minimum withdrawal amount of $50. These practices can be seen as predatory, especially in an industry that increasingly emphasizes customer-friendly practices.

Client Funds Safety

The safety of client funds is a critical factor in evaluating any broker. Coinsoft does not provide clear information regarding its fund safety measures. There is no indication of segregated accounts, which are essential for protecting client funds in the event of the broker's insolvency. Furthermore, Coinsoft does not offer negative balance protection, which means traders could potentially lose more than their initial investment.

The absence of a compensation scheme or investor protection measures is a significant concern. Traders using Coinsoft are at risk of losing their entire investment without any recourse. This lack of security measures is a common characteristic of unregulated brokers, further supporting the argument that Coinsoft may not be a safe option for trading.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews and reports from users of Coinsoft indicate a pattern of negative experiences, with many clients expressing frustration over withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Promotions | High | Poor |

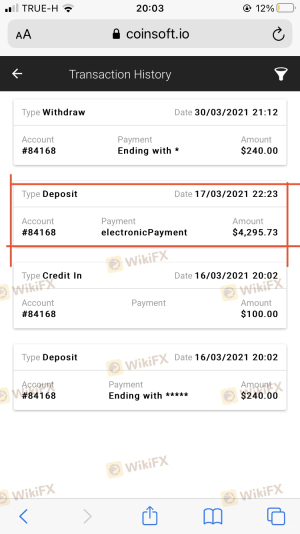

Common complaints include significant delays in processing withdrawal requests, with some users reporting that their requests were ignored or met with unreasonable conditions. This pattern of behavior is alarming and suggests that Coinsoft may not prioritize customer satisfaction or ethical business practices.

For instance, one user reported attempting to withdraw funds only to be told they needed to deposit additional money first, a classic tactic employed by many scam brokers. Such practices raise serious questions about the integrity of Coinsoft and its commitment to its clients.

Platform and Trade Execution

The trading platform offered by Coinsoft is proprietary and lacks the features commonly found in industry-standard platforms like MetaTrader 4 or 5. While the interface may be user-friendly, it reportedly lacks essential functionalities such as automated trading and advanced charting tools.

Concerns about order execution quality have also been raised, with reports of slippage and rejected orders during volatile market conditions. These issues can significantly impact trading performance and profitability, especially for traders who rely on precision and timely execution.

Risk Assessment

Engaging with Coinsoft presents several risks that potential investors should consider. The overall risk assessment indicates a high level of exposure to potential fraud and financial loss.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of segregation and protection |

| Withdrawal Risk | High | Numerous complaints regarding withdrawals |

| Transparency Risk | Medium | Insufficient information about operations |

To mitigate these risks, it is advisable for traders to conduct thorough research before engaging with any broker, especially those with a questionable reputation. Seeking out regulated brokers with a proven track record of reliability and customer service can significantly reduce the risk of financial loss.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Coinsoft is not a safe trading option. The lack of regulation, transparency, and numerous complaints from users indicate that Coinsoft operates in a high-risk environment. Traders should approach this broker with extreme caution, as the potential for fraud and financial loss is significant.

For those seeking reliable trading options, it is advisable to consider regulated brokers with a strong reputation for customer service and fund safety. Some recommended alternatives include brokers regulated by the FCA or ASIC, which provide robust protections for investors. Ultimately, the goal should be to ensure that your trading experience is both profitable and secure.

Is Coinsoft a scam, or is it legit?

The latest exposure and evaluation content of Coinsoft brokers.

Coinsoft Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Coinsoft latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.